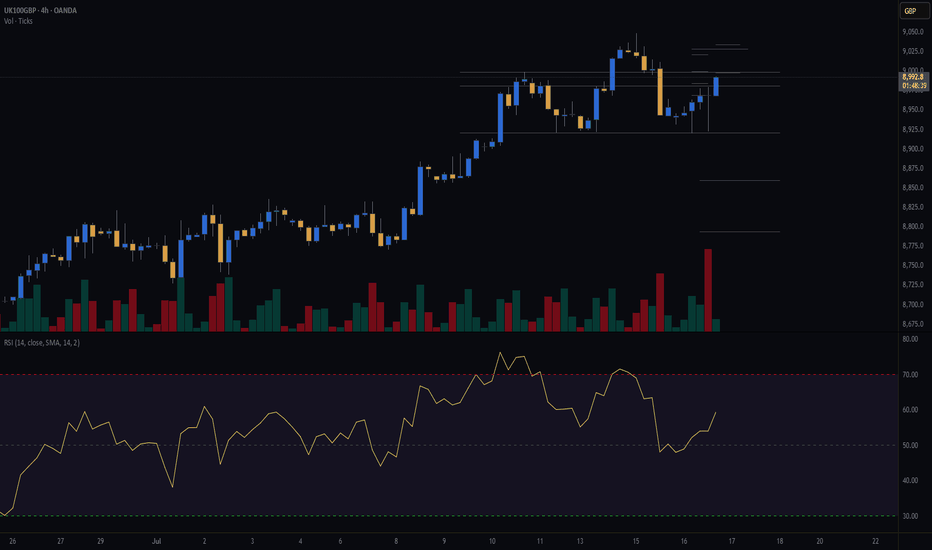

FTSE100 overbought pullback supported at 8880The FTSE remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend.

Support Zone: 8880 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 8880 would confirm ongoing ups

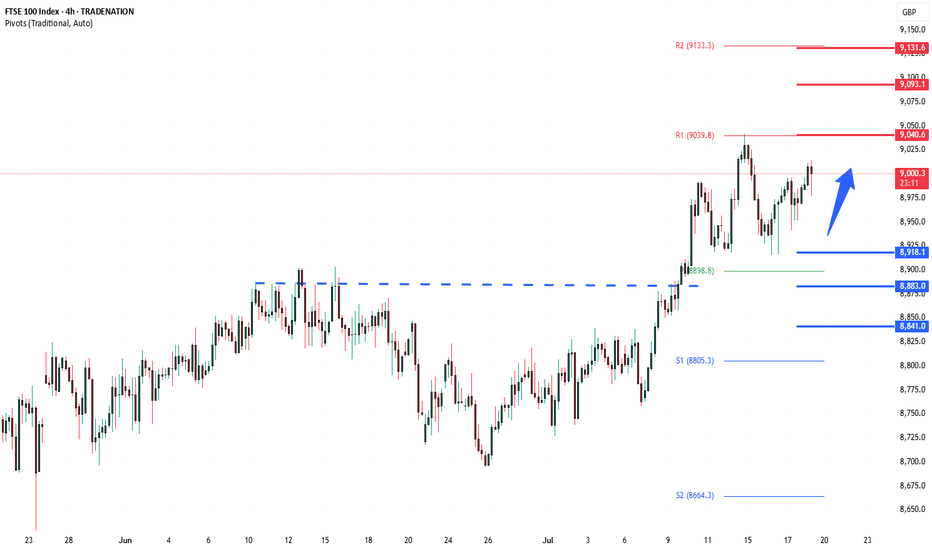

UK100 – Buy the Dip Near Support as Bottom FormsTrade Idea

Type: Buy Limit

Entry: 8,905

Target: 9,015

Stop Loss: 8,867

Duration: Intraday

Expires: 15/07/2025 06:00

Technical Overview

Price action is forming a potential bottom, suggesting that downside momentum is slowing.

The primary trend remains bullish, with no clear in

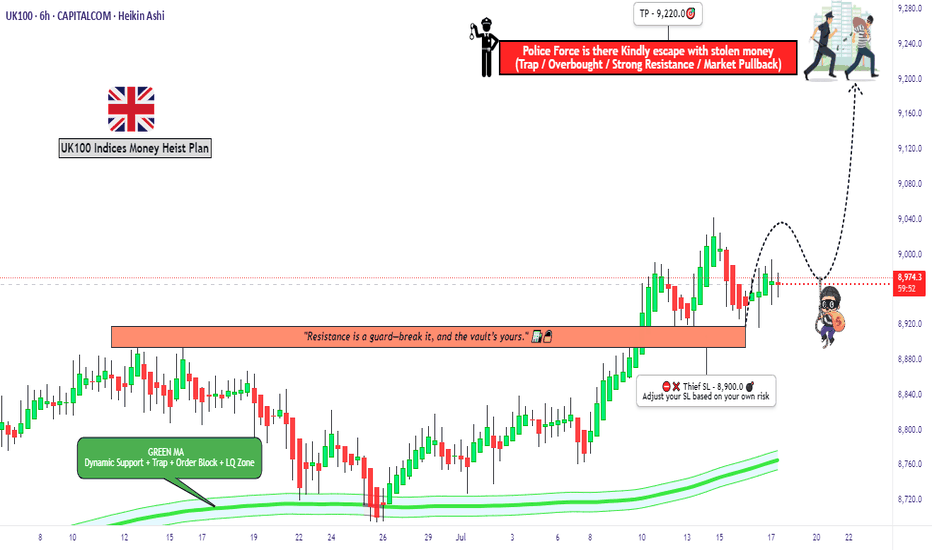

"UK100 Bulls Vault Open! Grab the Loot & Escape Early"🏴☠️💰"UK100 / FTSE100 Market Heist Blueprint" – A Thief Trading Operation for High-Profit Target Extraction 💼📈

🌍 Hola! Hi! Bonjour! Ola! Hallo! Marhaba!

To all the Market Robbers, Smart Thieves, and Strategic Money Makers — welcome to another Thief Trading Heist Plan™.

Ready your gear and charts —

FTSE breaking out?Following a lengthy consolidation, the FTSE appears to be poking its head above the resistance trend of a triangle formation and resistance circa 8830-35 area today, potentially paving the way for a run to a new all-time high.

This comes as markets have taken the latest tariff threats from Trump in

5-Swing Elliott Wave Sequence in FTSE Supports Bullish BiasThe ongoing rally in the FTSE Index, originating from the April 7, 2025 low, continues to unfold as a five-wave impulse structure within the Elliott Wave framework. This signals sustained bullish momentum. From the April 7 low, wave 1 peaked at 7984.19. Wave 2 pullback followed which concluded at 75

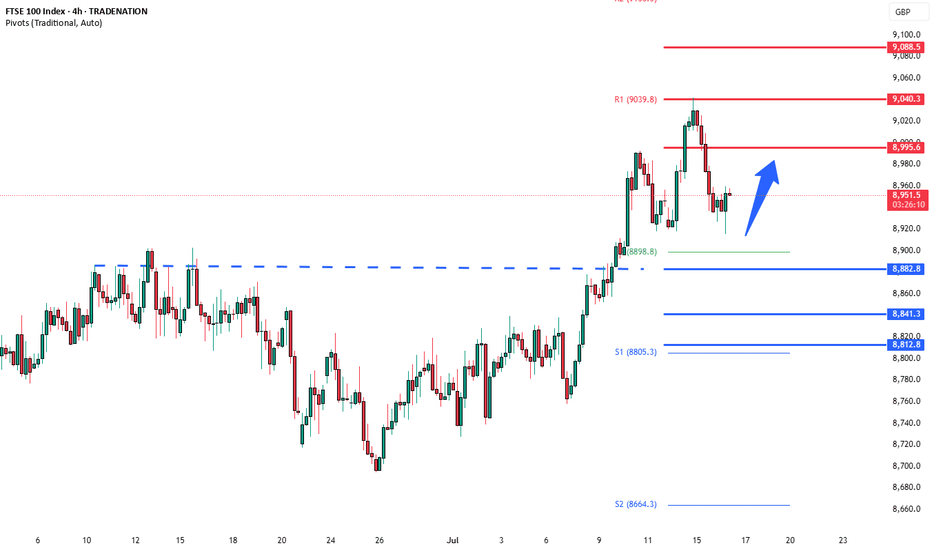

FTSE100 sedeways consolidation supported at 8920The FTSE100 pair price action sentiment appears Bullish, supported by the current rising trend. The recent intraday price action appears to be a sideways consolidation breakout.

The key trading level is at 8920 level, the previous consolidation price range. A corrective pullback from the current l

FTSE100 overbought pullback supported at 8880The FTSE remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend.

Support Zone: 8880 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 8880 would confirm ongoing ups

FTSE INTRADAY continuation pattern breakout. The FTSE remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend.

Support Zone: 8880 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 8880 would confirm ongoing ups

See all ideas

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

UK 100 CFD reached its highest quote on Jul 10, 2025 — 8,992.6 GBP. See more data on the UK 100 CFD chart.

The lowest ever quote of UK 100 CFD is 4,785.5 GBP. It was reached on Mar 23, 2020. See more data on the UK 100 CFD chart.

UK 100 CFD is just a number that lets you track performance of the instruments comprising the index, so you can't invest in it directly. But you can buy UK 100 CFD futures or funds or invest in its components.