"US30/DJ30" Index CFD Market Heist Plan (Scalping/Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "US30/DJ30" Index CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on!

however I advise to Place sell limit orders within a 15 or 30 minute timeframe most nearest or swing, low or high level.

Stop Loss 🛑: (42200) Thief SL placed at the nearest / swing high level Using the 3H timeframe scalping / day trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 40200

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

"US30/DJ30" Index CFD Market Heist Plan (Scalping/Day Trade) is currently experiencing a bearishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro Economics, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Index-Specific Analysis, Positioning and future trend targets... go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

WALLSTREETCFD trade ideas

US30/DJI "Dow Jones" Index CFD Market Heist Plan (Day or Swing)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the US30/DJI "Dow Jones" Index CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (42200) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

📌I strongly advise you to set an alert on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑:

Thief SL placed at the recent/swing low level Using the 1H timeframe (41400) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 43100 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

US30/DJI "Dow Jones" Index CFD Market Heist Plan (Swing/Day) is currently experiencing a bullishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Index-Specific Analysis, Positioning and future trend targets.. go ahead to check 👉👉👉

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

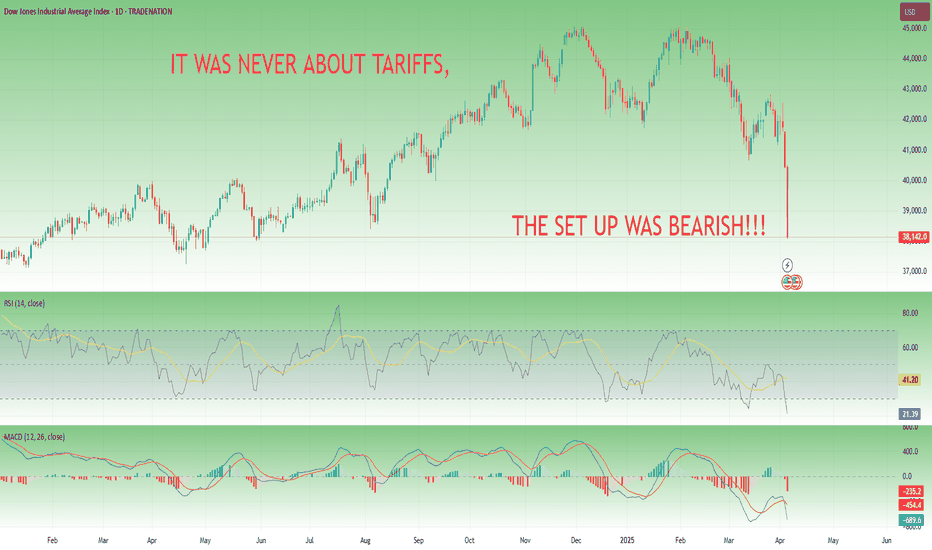

dow jones down 15% -Some time ago, I identified a strong resistance zone near the 45,000 level on the Dow Jones Industrial Average chart, based on historical price action and technical indicators. Since then, the index has experienced a notable correction, declining to approximately 38,314 as of the most recent close — representing a drawdown of nearly 15% from the identified resistance level. This move reinforces the significance of that resistance area and suggests heightened market sensitivity around those levels

Tariffs Didn’t Cause the Correction — It Was Coming Anyway🚩 Intro: Markets Correct — They Don’t Need Permission

Every time the market drops hard, the headlines rush in to explain it. This time, it was President Trump’s dramatic tariff announcement on April 2nd. The media called it a shock.

I didn’t.

I’ve been calling for S&P 500 to drop to 5,200, and NASDAQ-100 to 17,500, since early January.

Not because I predicted tariffs. But because the charts told the story.

The market didn’t fall because of politics — it fell because it had to.

________________________________________

🔥 The Spark: Trump’s “Liberation Day” Tariffs

On April 2, 2025, Trump rolled out an aggressive trade agenda:

• 10% blanket tariff on all imports

• Up to 54% tariffs on Chinese goods

• 25% tariffs on imported cars and parts

• With limited exemptions for USMCA-aligned countries

Markets reacted instantly:

• S&P 500 dropped 4.8% — worst day since 2020

• NASDAQ-100 plunged over 6%

• Tech mega caps lost 5–14% in a day

Sounds like cause and effect, right?

Wrong.

________________________________________

🧠 The Real Cause: A Market That Was Ready to Fall

Let’s talk technicals:

• S&P 500 had printed a textbook double top at the 6100–6150 zone

• NASDAQ-100 had formed a rising wedge, with volume divergence and momentum fading

• RSI divergence was in place since February

• MACD had crossed bearish and also deverging

• Breadth was weakening while indices were still pushing highs

• Sentiment was euphoric, volatility crushed — a classic setup

You didn’t need to guess the news. The structure was screaming reversal.

SP500 CHART:

NASDAQ CHART:

________________________________________

🧩 Why Tariffs Made a Convenient Narrative

Markets love clean stories. And Trump’s tariffs offered everything:

• Emotional trigger

• Economic fear factor

• Political drama

• Global implications

But smart traders know better: markets correct based on positioning, not politics.

As soon as the wedge broke on NAS100 and SPX broke the double top's neck line the path was clear — risk off.

________________________________________

📉 I Was Calling This Since Q1

The targets were public:

SPX = 5,200. NAS100 = 17,500.

And the logic was simple:

• Overextension in AI-led tech

• Complacent VIX environment

• Crowded long positioning

• Bearish divergences and fading momentum

Double Top and Rising Wedge on SPX and Nas100

We didn’t need a reason to drop. The market had been levitating without support. All we needed was a trigger — and we got one.

________________________________________

🧭 Lesson: Trade the Structure, Not the Story

Here’s what I hope you take away:

✅ Setups come first. News comes later.

✅ If it wasn’t tariffs, it would’ve been CPI, earnings, Fed minutes, or a bird on a wire

✅ Don’t chase headlines. Anticipate setups.

The best trades aren’t reactive. They’re built on structure, sentiment, and timing — not waiting for CNBC to tell them what’s happening.

________________________________________

🔚 Conclusion: It Was Never About Tariffs

Tariffs were the match.

But the market was already soaked in gasoline.

This correction was technical, predictable, and clean.

📝 Post Scriptum — The Setup Shapes the Narrative

Let me be clear:

I’m not a Trump fan. Hoho — not by far.

But I’ll swear this on any chart:

If the setup had been the opposite — double bottom, falling wedge, positive divergences, and improving momentum — these exact same tariffs would’ve been interpreted as “bold leadership,” “pro-growth protectionism,” or “markets pricing in a stronger America.”

That’s how it works.

Price action leads. Narrative follows.

When structure is bullish, traders celebrate even bad news.

When structure is bearish, even good news becomes a reason to sell.

So no — it wasn’t about Trump. It never is. It’s about where the market wants to go. The rest is storytelling.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

Dow Jones INTRADAY key trading levels ahead of US employmentKey Support and Resistance Levels

Resistance Level 1: 40540

Resistance Level 2: 41000

Resistance Level 3: 42000

Support Level 1: 38940

Support Level 2: 38175

Support Level 3: 37320

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

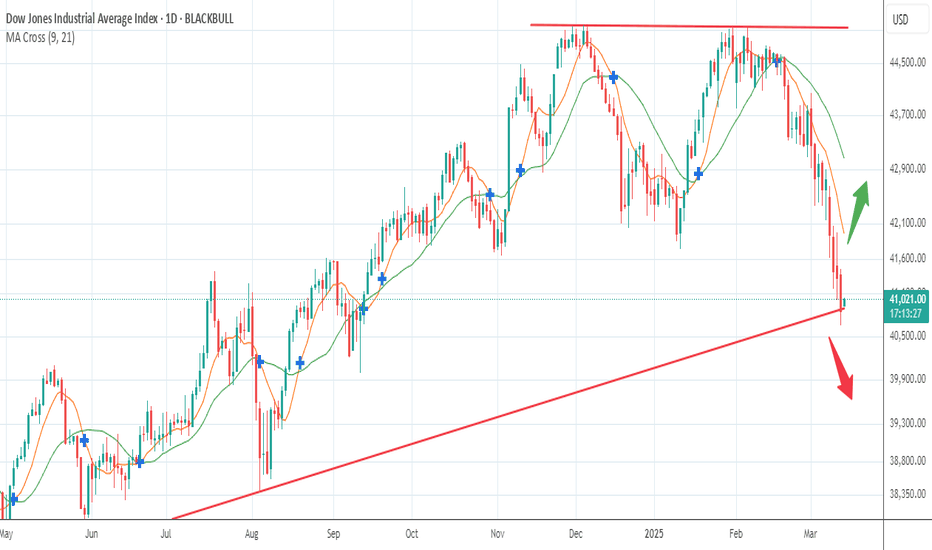

Wall Street - Printing a very Dangerous Move!The Dow Jones (US30) is currently testing a critical level within its long-term ascending channel. The next move depends on whether the price holds or breaks this structure.

🔹 Possible Scenarios:

1️⃣ Bullish Bounce (Channel Holds) ✅

If price finds support within the 38,000 - 36,000 zone, we could see a strong rebound.

A bounce from this level may lead to a retest of 42,000 - 44,000, with potential for another attempt at the upper channel near 46,000+.

Confirmation: Look for bullish price action like long wicks or a bullish engulfing candle.

2️⃣ Bearish Breakdown (Channel Breaks) ❌

If the price breaks below the channel and closes under 36,000, this could signal a trend shift.

A breakdown may accelerate selling, leading to further downside targets at 32,000, then 28,000.

Confirmation: A strong weekly close below support with increased volume and no immediate recovery.

📌 Key Takeaway:

Channel intact → Buy dips for potential continuation.

Channel break → Expect deeper correction towards long-term supports.

Let me know your thoughts! Are you bullish or bearish on US30? 🚀📉

If you found this analysis valuable, kindly consider boosting and following for more updates.

Disclaimer: This content is intended for educational purposes only and does not constitute financial advice.

No Signs of the Bull ArmyDow Jones Update : The correction appears likely to continue, testing the 40,045–40,467 range. Subsequently, the index is expected to rebound toward the 40,714–40,945.

Additionally, it is worth noting the gap in the 41,173–41,629 range—perhaps the market may find its way there.

DOW JONES INDEX (US30): Detailed Support & Resistance Analysis

Here is my latest structure analysis for US30 Index.

Resistance 1: 40650 - 40850 area

Resistance 2: 41150 - 41300 area

Resistance 3: 42550 - 42850 area

Support 1: 40000 - 40250 area

Support 2: 39470 - 39650 area

Support 3: 38400 - 38650 area

Consider these structures for pullback/breakout trading.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

US30 Trade Update – 04/04/2025🚨 US30 Trade Update – 04/04/2025 🚨

📉 US30 Sell-Off Intensifies!

The Dow Jones has now broken below 41,000 and is approaching the critical support at 40,063. Bears are in full control, and if this level fails, we could see a test of 39,279 next.

🔍 Key Observations:

✅ Major rejection at 42,359 resistance

✅ Strong bearish momentum breaking 41,000

🔻 Next Major Support: 40,063 → 39,279

🎯 Trade Plan:

🔹 Short below 40,063 → Target 39,279

🔹 Look for bounce signs at 40,063 for potential reversal

🔹 Long only if price reclaims 40,600+

⚠️ Watch for a reaction at 40,063—this level could determine the next major move.

Warning Signs Flashing: Dow Jones Breaks Key SupportThe Dow Jones Index has officially broken its rising trendline support, signaling a possible shift in the medium-term trend. After losing this key ascending structure, price is now hovering near the psychological support zone of 40,000, which has historically acted as both resistance and support.

This level is crucial. If it holds, we could see a temporary bounce or consolidation. However, if the 40K zone fails to provide support, the index may head toward the next major support area around 38,000, aligned with the longer-term trendline support.

Do like and follow us

THANK YOU

Trade Idea : US30 Short ( MARKET )Technical Analysis Overview:

1. Daily Chart:

• The index is in a clear downtrend, with price action breaking below the moving average.

• MACD is deeply negative, with a bearish divergence and downward momentum.

• RSI at 37.28, indicating approaching oversold territory, but not yet reversing.

2. 15-Minute Chart:

• Strong downward momentum with sharp drop visible.

• MACD is heavily negative, confirming bearish momentum.

• RSI is at 32.71, indicating oversold conditions, but no clear sign of reversal yet.

3. 3-Minute Chart:

• Sharp sell-off followed by consolidation.

• MACD is negative but appears to be flattening, suggesting potential for a short-term bounce or continued consolidation before the next move.

• RSI at 44.38, showing mild recovery from previous lows but still below the midpoint (50).

Trade Idea:

• Position: Short (Sell)

• Entry Level: 41,250 (near minor resistance or after a weak bullish retracement)

• Stop Loss (SL): 41,800 (Above recent consolidation zone or resistance)

• Take Profit (TP): 40,400 (Previous support area with good potential for price to test)

FUSIONMARKETS:US30

Do Or Die!The past few weeks have caught out many bulls as Trump tariffs wreck the markets.

41K support today may just be the bottom, this area must hold, otherwise we are heading not just for a correction but a bear market.

The falls have been consistent and steady, no real plunges which points to a correction, although we do have a double top from the Dec highs and early Feb highs.

Gold and silver have been the standout performers, 3000 gold will be blown away.

A mix of Trump threats of tariffs and many beginning to wake up to media attention in PM's....a hedge against turmoil.

Any close below the Dow low is a short, from here bottom fishing just may produce a rally of significance, perhaps a rally to sell.

Appreciate a thumbs up and God Bless you all!

DOW JONES You will regret not taking this buyDow Jones / US30 remains under heavy selling pressure as it has been yet again rejected under the 1week MA50, failing to hold the closings over it of the past 3 candles.

This is the strongest correction of the index since the September 26th 2022 bottom and the start of the Channel Up.

Despite the negatives, the 1week RSI is almost on the 37.50 level, which is where the last higher low of the Channel Up was formed on October 23rd 2023, again under the 1week MA50.

Obviously even though the downside may continue for a few more days, the extent is limited technically, especially since the worst of the tariffs have been priced and only new and more aggressive ones can inflict more non-technical fear on the market.

This is a unique long term buy opportunity, the likes of which saw 2 rallies before of +21.10%.

Even in the event of one more dip, a 48000 target towards the end of the year is very realistic.

Follow us, like the idea and leave a comment below!!