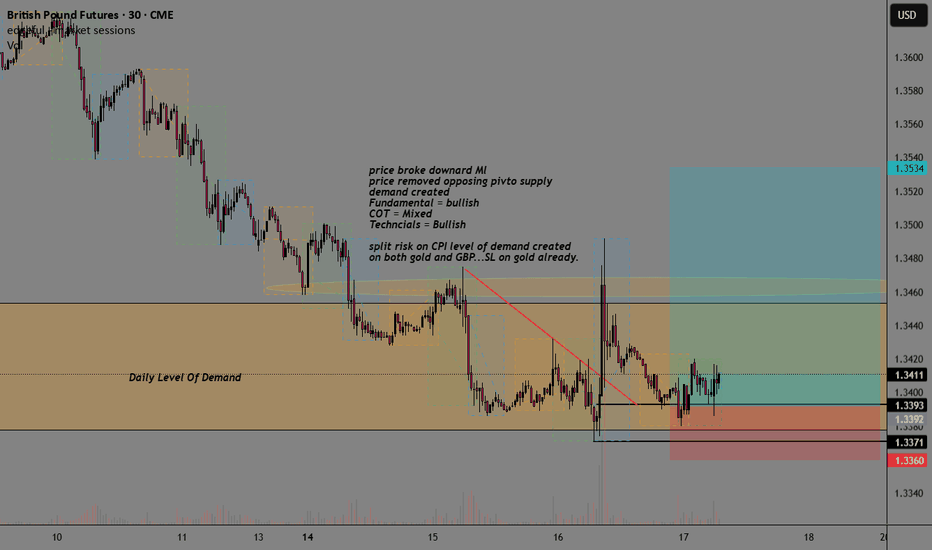

GBP GBPUSD Supply-Demand Long SignalHigher Timeframe Analysis:

- Price inside daily/Weekly level of demand + pivot

- Long term trend = uptrend

- Fundamentals Bullish

- COT Mixed

- Technicals Bullish

Lowertimeframe:

- Price broke downard ML

- Price removed the opposing pivotal level of demand

- DBR Demand created from CPI event

- Split risk on GC + GBP

This is a mix of using Sentiment, technical analysis, and fundamental analysis with supply-demand.

6BU2029 trade ideas

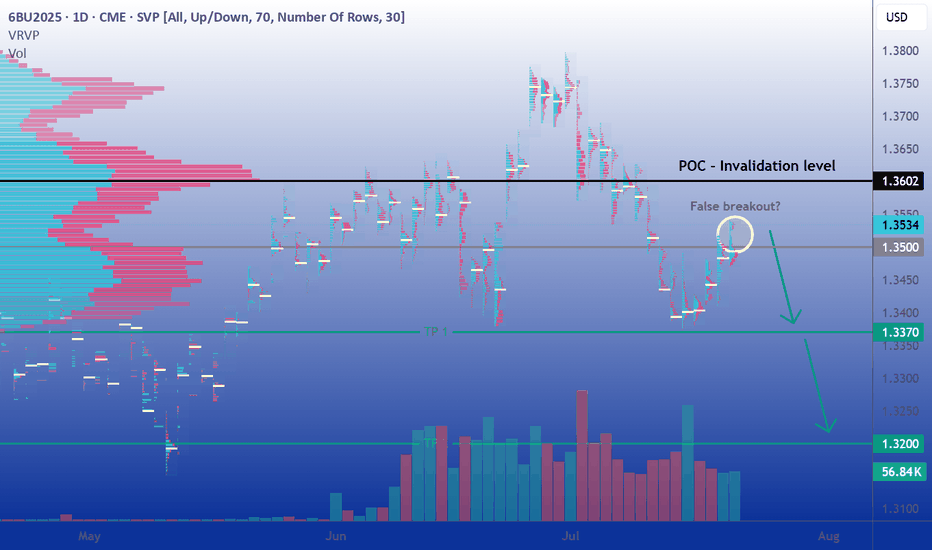

Short the Slip Above 1.3500Fundamental Outlook: A stagflation trap

The UK economy continues to emit worrying signs of stagflation: inflation remains uncomfortably high, growth is weak, and the once-tight labor market is starting to soften. Consumer confidence has deteriorated, and house prices are experiencing record declines, a trend that underscores the fragility of household wealth and future consumption.

In this challenging context, any rally in the pound should be treated with caution. The broader macro backdrop still favors the US dollar, especially if incoming US data continues to support a "soft landing" narrative. In contrast, the UK's trajectory appears more constrained.

On monetary policy, the Bank of England is expected to maintain a predictable, yet clearly dovish, easing cycle through the second half of 2025. Market consensus leans toward a 25 bps cut in August, followed by a pause in September, then another cut in November. This gradual pace of easing may keep the pound under persistent pressure, especially if the Federal Reserve maintains a more stable or data-driven stance.

On the political front, Trump’s critical remarks toward Powell and evolving UK-US relations represent potential flashpoints. Any surprises here could further erode confidence in the pound.

Technical Analysis: Signs of breakdown below 1.34

The September futures contract (6BU2025) has dropped over 2.5% in a straight line during the first two weeks of July, pressuring the 1.34 USD support zone before rebounding in recent sessions. So far, each rebound attempt has been met with consistent selling, and the brief move above 1.3500 appears fragile, offering a potential short opportunity to re-enter the previous range.

A sustained daily close below 1.3370 would likely pave the way for further downside toward the 1.32 level, which hasn’t been visited since May 13th. Notably, the volume profile reveals a liquidity vacuum in that region, potentially acting as a price magnet.

Overall, the technical setup favors another leg lower, barring the emergence of a strong bullish catalyst capable of reversing the prevailing trend.

Sentiment Analysis: Mixed but fragile

From a positioning standpoint, the CFTC's latest Commitment of Traders (COT) report shows asset managers increasing their bearish exposure. Net short positions grew from 13,154 to 27,611 contracts, hinting at rising institutional pessimism toward the pound.

In the FX/CFD retail segment, positioning remains relatively balanced. However, we notice a pattern: retail traders tend to increase long exposure on dips, profiting from short-term rebounds, a classic contrarian signal that the market may still have room to move lower.

Volatility remains muted, with the VIX trading below 17, close to its annual lows. This low-volatility environment tends to reinforce technical trading patterns and increases the likelihood that price respects key support/resistance zones, unless jolted by surprise macro events.

Options Market: Downside risk priced in

In the listed options market, we see a clear asymmetry in favor of downside protection. Out-of-the-money (OTM) puts trade at higher premiums than equivalent calls, confirming a market pricing greater fear of a GBP decline.

Open interest (OI) is notably concentrated in the 1.34–1.35 strike zone. This suggests potential pinning around these levels near expiry, but also highlights the risk of increased volatility if the spot price deviates sharply. A move away from this cluster could spark rapid adjustments in hedging flows, adding fuel to the next directional move.

Trade Ideas: Two ways to play the bearish bias

1. Classic directional strategy

Entry: Short at current price (around 1.3535)

Stop Loss: Daily close above 1.3602 (Volume Profile Point of Control)

Take Profit 1: 1.3370 (recent support)

Take Profit 2: 1.3200 (liquidity void)

This strategy targets a clean technical setup with clearly defined risk. A break below 1.3370 would confirm downside momentum and offer a high-reward second leg toward the 1.32 region.

2. Alternative strategy: Replace your stop loss with an OTM call option

Rather than exiting prematurely via a hard stop loss in case of a false breakout, consider purchasing an OTM call option as a form of insurance. This allows you to stay in the trade while limiting your maximum loss.

For instance, buying the August 1.355 call, currently trading around 0.0059 on CME (59 ticks), caps your loss in the event of an unexpected breakout above resistance. If the cable squeezes sharply higher, the call option will compensate part or all of the loss on the short position beyond the strike price.

This hybrid approach works particularly well in setups like this one, where fundamentals and sentiment support a bearish outlook, but positioning and low volatility leave room for abrupt technical counter-moves.

Final thoughts

The pound faces an increasingly precarious setup. Fundamental conditions in the UK remain soft, monetary policy is turning more accommodative, and political uncertainty looms large. Meanwhile, technical and sentiment indicators tilt bearish, and the options market reflects elevated downside risk premiums.

In short, while the market may already be pricing in some of this pessimism, the risks of a deeper GBP correction remain high. Traders should watch upcoming catalysts, BoE and Fed meetings, US/UK economic data, and geopolitical signals, and adjust positions accordingly.

Until we see a clear shift in macro data or a breakdown in technical patterns, fading rallies remains a strategy with attractive risk/reward potential.

---

When charting futures, the data provided could be delayed. Traders working with the ticker symbols discussed in this idea may prefer to use CME Group real-time data plan on TradingView: tradingview.com/cme/ .

This consideration is particularly important for shorter-term traders, whereas it may be less critical for those focused on longer-term trading strategies.

General Disclaimer:

The trade ideas presented herein are solely for illustrative purposes forming a part of a case study intended to demonstrate key principles in risk management within the context of the specific market scenarios discussed. These ideas are not to be interpreted as investment recommendations or financial advice. They do not endorse or promote any specific trading strategies, financial products, or services. The information provided is based on data believed to be reliable; however, its accuracy or completeness cannot be guaranteed. Trading in financial markets involves risks, including the potential loss of principal. Each individual should conduct their own research and consult with professional financial advisors before making any investment decisions. The author or publisher of this content bears no responsibility for any actions taken based on the information provided or for any resultant financial or other losses.

GBPUSD. 14.07.2025. The plan for the next few days.The nearest interesting resistance zone was already worked out in the morning and gave a good reaction. Let's mark the others where we can expect a reaction. It's not certain that there will be a major reversal, but I think we'll see a correction that can be monetized. We're waiting for a reaction and looking for an entry point.

The post will be adjusted based on any changes.

Don't forget to click on the Rocket! =)

Mid-Session Market ReviewMid-Session Market Review

S&P 500: After some initial volatility from the 8:30 news, the market accepted above the prior day’s levels but has since pulled back within range, consolidating just below the highs.

NASDAQ: The NASDAQ remains above all of yesterday’s levels and is currently balancing between the high of the day and the 23,100 level, showing a rotational pattern.

Russell 2000: This market is rotational within the prior day’s range and has accepted below the CVA and PVA. Potential trade opportunities might come with a pullback to the 2,245 area.

Gold: Gold has accepted below the prior value area and is still rotational within the CVA. Trade opportunities could present themselves near the prior day’s low.

Crude Oil: The market is quite choppy, hovering around the prior day’s low and value area low. Caution is advised, with potential long opportunities on a pullback, as long as conditions align.

Euro Dollar: The Euro is dropping significantly, moving below all key levels without much respect for them. This could provide short opportunities if there’s a pullback.

Yen: Similar to the Euro, the Yen is also pushing below previous levels. It’s getting choppy near the CVA low, so caution is needed until it shows more respect for those levels.

Natural Gas: The market is rotational within the prior day’s range and respecting the CVA high. Long opportunities might be possible if conditions are right.

Aussie Dollar: It’s showing some respect for the CVA low and is still rotational. There could be a potential long setup forming, depending on how it plays out.

British Pound: The Pound has accepted below all key levels, and a pullback to the CVA low might provide short opportunities, though caution is needed around the VWAP.

British Pound Futures (6B1!) Face Supply Area.Pound Futures: 6B1 Area Tests Bearish Resolve

Pound Futures are approaching a critical weekly supply zone (6B1). Today's price action saw a touch and rejection of this level, marked by a bearish candlestick. This suggests a potential for a short-term pullback, and we're eyeing a re-entry opportunity at this level, watching for a drop to the next significant demand zone on our chart.

Further reinforcing the bearish outlook is an intriguing divergence in the Non-Commercial trader positions revealed in the latest Commitment of Traders (COT) report, noticeable on the daily chart. This divergence hints at a possible shift in sentiment, paving the way for a short position. Should the price successfully breach the 6B1 area, our chart indicates another supply zone as the next potential target.

✅ Please share your thoughts about 6B1! in the comments section below and HIT LIKE if you appreciate my analysis. Don't forget to FOLLOW ME; you will help us a lot with this small contribution.

GBP/USD Futures – Short Trade Active📉 GBP/USD Futures – Short Trade Active

🕒 Timeframe: 1H

💼 Instrument: Micro GBP/USD Futures (M6B1!)

📍 Entry: 1.3651

🎯 Target: 1.3614

📊 Analysis:

Price tapped into a clear area of liquidity and resistance at 1.3651, aligning with previous sell pressure. I’ve entered short expecting a rejection and return toward support near 1.3614.

The market just completed a strong leg up — this is a textbook area to fade the strength and catch the retrace.

🎯 Bias: Intraday short

📲 Trade in progress – managing risk actively

#GBPUSD #FuturesTrade #MicroFutures #PriceAction #ShortSetup #CME #FXFutures #SupplyAndDemand #Forex

Game-changing analysis technique that will elevate your strategyAs many of my loyal followers know, my analysis toolkit goes beyond just the standard fare of CME options data and COT reports. I dive deeper, utilizing additional filters like the average long and short positions of retail traders. These insights are publicly available, and while I won’t name specific sources to avoid any hint of hidden promotion, I’ll give you a clue: look for a website with the word "book" in its title. 📚

For years, I’ve relied on this data, and it has proven to be both reliable and insightful. The average positions of market participants serve as both filters and indicators. But what do I mean by indicators?

Let’s break it down. When the price interacts with these levels, it reveals the market sentiment. For instance, if the price is below the average long position and breaks through easily, it’s a bullish sentiment. Conversely, if it hovers below the level and struggles to break through, that’s still bullish, as it indicates buyers are being drawn into profitable territory.

Now, let’s flip the script for the bears: if the price breaks down from above or struggles below the average short position, that’s a bearish sentiment. The price isn’t responding to sellers, dragging them into a profit land.

There’s more. Often, you’ll notice different behaviors near these key levels, allowing you to enter positions with an incredible risk/reward ratio of 3:1, 5:1, or even better! This clarity gives you insight into the current market mood—who’s being punished and who’s favored at that moment.

Now, let’s take a look at the screenshot of the British Pound futures chart. Here’s what you’ll see:

- A green line representing the average long position of retail traders.

- A red line for the average short position.

- The breakeven point of a put option contract for the June futures expiring on May 22, with 1,320 contracts at a strike of 1.295.

Take a moment to study the chart. What do you observe? 🤓

Ok, breathe in, breathe out. Tomorrow, we’ll dive deeper into this analysis. Don’t forget to subscribe so you won’t miss the continuation of this story! The insights I’ll share are definitely worth your time, as I aim to shift your perspective on the market by demonstrating a clear methodology without relying on indicators or technical patterns.

Stay tuned; it’s going to be incredibly valuable! 🚀✨

The next trade idea for “6B” GBPUSD FX FuturesCME:6B1!

This trade idea is built on very simple premises.

Simplicity in trading is what we all strive for. Where possible, we should aim to simplify our strategies rather than complicate them with excessive information—unless the additional inputs add clear, actionable value to the trade thesis. While that holds true in this analysis, for the sake of clarity and simplicity, we’ve chosen not to include volume profile study or levels derived from volume profiling.

Also, don’t forget to check out how our example trade idea in Crude Oil played out —posted earlier this Tuesday.

6B Weekly Time frame:

Key Levels

Weekly Resistance: 1.3400 – 1.3425

Daily Double Top: 1.3425

April 21 Mid: 1.3350

April 2025 Developing Mid: 1.3067

Scenario 1: Break and Continuation

In this scenario, we anticipate further upside in 6B futures and GBPUSD. A break above the double top at 1.3425 could lead to a push toward 1.3550. Look for confirmation across other FX futures and signs of Dollar weakening to support this thesis.

Example Trade Idea 1:

Entry: 1.3425 (wait for an hourly candle to close above the double top, then enter on the pullback)

Stop: 1.3350

Target: 1.3550

Risk: 75 ticks

Reward: 125 ticks

Risk/Reward Ratio: 1.7 R

Scenario 2: Swing Failure on Weekly Timeframe

Zooming out to the weekly timeframe, 1.3425 aligns with a potential swing failure at prior resistance near 1.3423. A pullback from this level could provide a short opportunity. Watch for Dollar strength and pullbacks in 6E and 6J to further support this thesis.

Example Trade Idea 2:

Entry: 1.3350 (wait for sellers to regain control at Monday’s mid)

Stop: 1.3425

Target: 1.3067

Risk: 75 ticks

Reward: 283 ticks

Risk/Reward Ratio: 3.7 R

Important Notes:

These are example trade ideas provided strictly for educational purposes and should not be considered trade recommendations.

Traders are encouraged to perform their own independent analysis and thorough preparation before entering any positions.

Please note: Stop losses are not guaranteed to execute at specified levels. Actual losses may exceed predetermined stop amounts.

6B Bearish Setup: Watching for Downside ConfirmationPotential bearish setup forming on 6B. Price showing signs of weakness, with key resistance levels in play. Watching for further confirmation and potential downside movement. Keep an eye on momentum and structure for entry triggers. Risk management is crucial.

GBPUSD Weekly FOREX Forecast: Wait for BUYS!In this video, we will analyze GBPUSD and GBP Futures for the week of March 31 - April 4th. We'll determine the bias for the upcoming week, and look for the best potential setups.

The GBP has been a bit stronger than its counterparts, and currently in consolidation. I am waiting for a high probability setup, which would entail as sweep of SSL and a tap of the Weekly +FVG before moving higher.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

GBP/USD (Futures Contract) – Weekly Elliott Wave AnalysisChatGPT ha detto:

GBP/USD (Futures Contract) – Weekly Elliott Wave Analysis

GBP/USD found support around the 1.2097 level, initiating a rally that is currently facing resistance near 1.2900. Based on Elliott Wave structure, this resistance zone is expected to trigger another corrective decline, potentially driving prices toward the 1.1923 - 1.1566 area before the next impulsive bullish leg develops.

The primary count suggests that this decline would complete a corrective structure before resuming the larger-degree uptrend. However, a break above 1.3420 would invalidate this scenario and favor an alternative wave count, indicating that the impulsive bullish movement is already in progress.

Key levels to monitor:

📉 Bearish Target Zone: 1.1923 - 1.1566

📈 Bullish Confirmation Level: 1.3420

Traders should watch for price action signals around these zones to confirm whether the anticipated corrective move plays out or if the alternative bullish scenario takes precedence.

GBPUSD Weekly FOREX Forecast: March 10 - 14th In this video, we will analyze EURUSD and EUR Futures. We'll determine the bias for the upcoming week, and look for the best potential setups.

The GBP has been a bit stronger than its counterparts, and has shown bullish intent in recent days. Friday's candle was very strong, and price is likely to see higher prices over the next week.

A correction to Friday's candle is likely, followed by longer term bullishness.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.