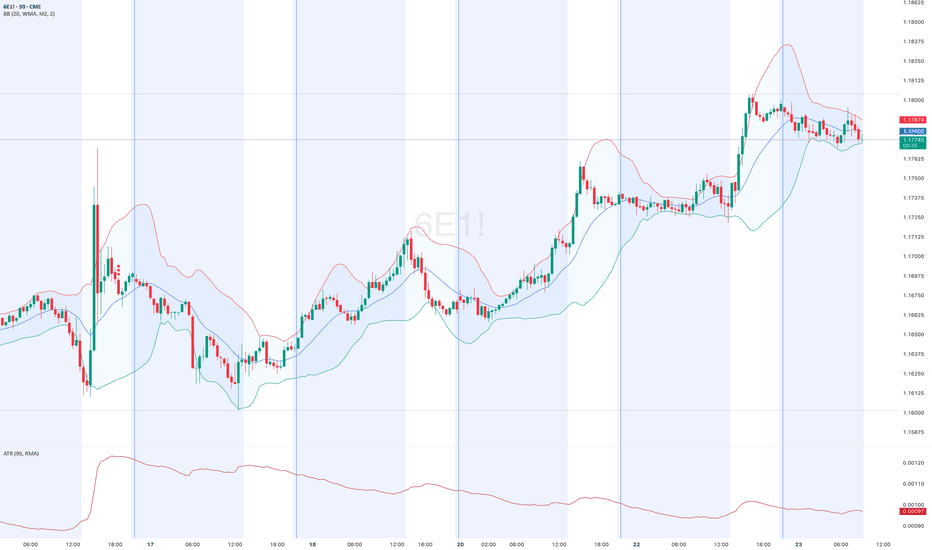

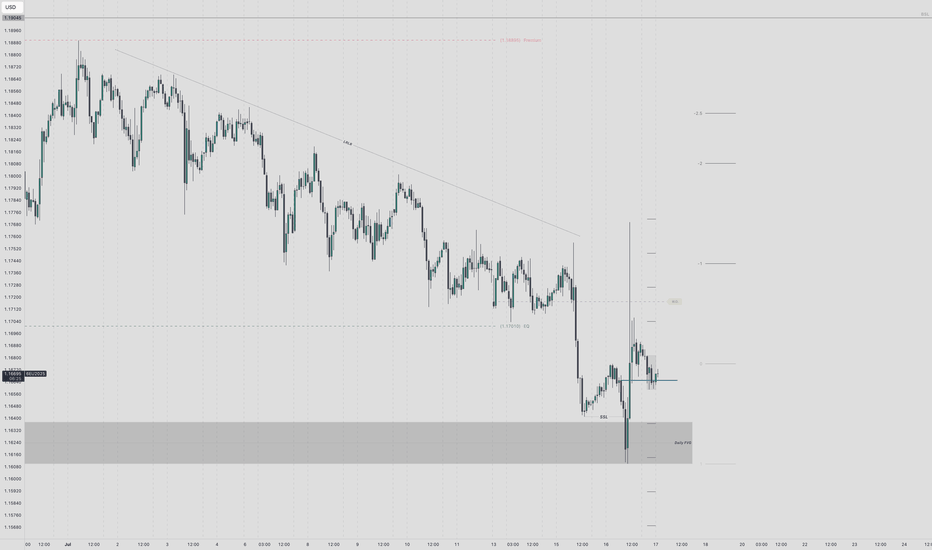

Euro Futures (6E) – Bearish Drift Below ResistanceEuro Futures (6E) appears to be grinding lower showing clear signs of fading bullish momentum.

After a bounce off 1.16160 support on July 17, Euro Futures (6E) made a failed push into 1.17995 resistance on Tuesday, July 22, a level that’s acted as a firm ceiling since June 26.

Since then, price action has been in a descending broadening channel, often a precursor to further downside with expanding volatility as sellers control the tempo.

As of 5:20 AM GMT, the structure points to continued weakness. I expect 6E to settle around 1.17170 – 1.16990 by close of Wednesday, July 23, 2025.

📉 Bias: Bearish

🔍 Pattern: Broadening Descending Channel

🕒 Date: July 23, 2025

6EH2027 trade ideas

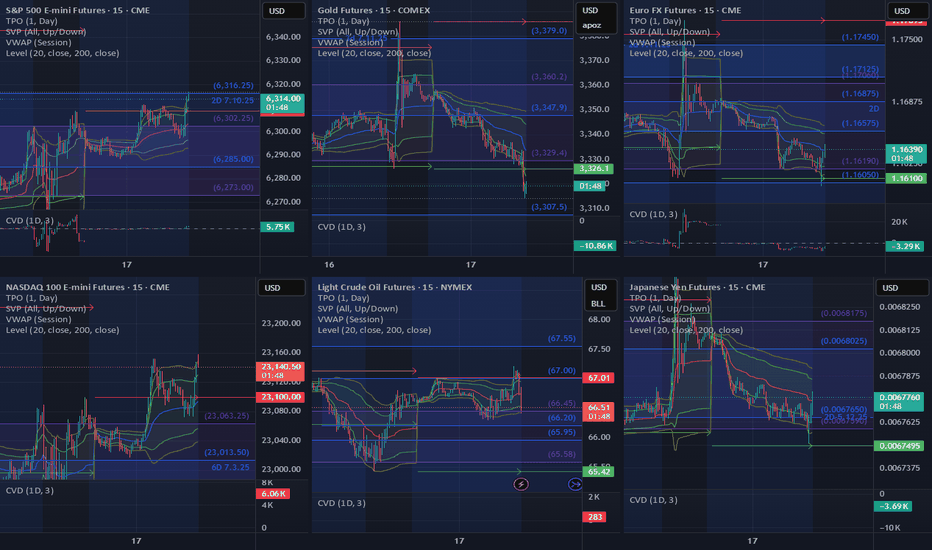

End-of-Session Market ReviewToday was a solid trading day with some interesting moves across the markets:

S&P 500: The market trended upwards from the open, gradually moving into and above the prior day’s value area, closing near the high of that range.

NASDAQ 100: After some initial back-and-forth, it climbed above the prior day’s high and value area, showing strength into the close.

Russell 2000: This market was quite choppy and balanced for a good part of the session, but eventually pushed up to close near the prior value area high.

Gold: It stayed range-bound, moving between the CVA high and the prior day’s value area without breaking out.

Crude Oil: We saw a significant drop right from the start, with prices falling about 1.5 points and ending the day lower, though still within the prior day’s range.

Euro Dollar: It tested the CVA low, dipped below the prior day’s low, and then bounced back to close around that level.

Yen Dollar: It started near the prior value area low, accepted below it by midday, and remained balanced in that lower range.

Aussie Dollar: Initially, it held above the CVA area and tested a higher level before sharply dropping below the prior day’s low and then balancing in that lower area.

In total, I took eight trades today. Two of them were in the Yen, both valid setups that didn’t work out and ended in stop-outs. I also took some long trades in the Aussie Dollar that I probably could have avoided since the market was choppy.

On the positive side, I managed risk well and ended up with two winning trades that put me in the green by about $1,200. Overall, I’d rate today as an A- day. Moving forward, I’ll focus on staying out of choppy markets, paying attention to the developing value area, and possibly using Heikin Ashi bars for better clarity.

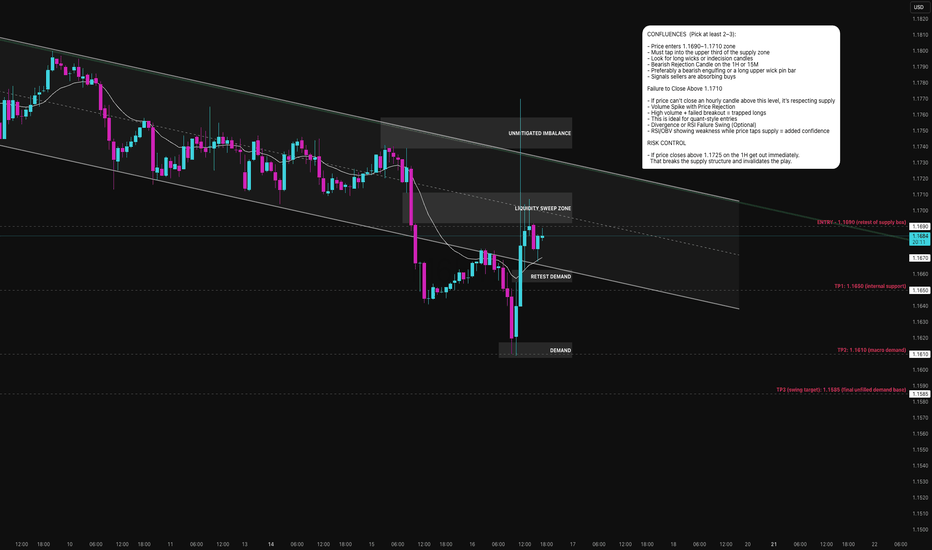

That Wasn’t a Breakout, That Was a Mugging!The Euro thought it could sneak one past the quant crowd. It creeped up into 1.1690–1.1710, broke some weak highs, and even teased a breakout. Then boom! rejected harder than a dodgy NFT pitch in 2024.

We're inside a bearish channel, mid-supply zone, and price just faked out everyone chasing the highs. This is trap territory, and the sellers are circling like vultures.

Why This Zone?

- Bearish channel — structure holding strong

- Liquidity grab — swept the highs, printed a long upper wick

- SMMA resistance — price slammed into the dynamic ceiling

- Wick = trap — always a mood

This is where dumb money gets long. We don’t do that here.

Tap, Trap, Slap Trade Plan (Short Bias)

- Entry: 1.1695 (anywhere inside 1.1690–1.1710)

- Confirmation: 15M/1H bearish engulfing or rejection wick

- Stop Loss: Above 1.1725 (don't give it CPR)

- TP1: 1.1650 – first shelf of support

- TP2: 1.1610 – breakdown level

- TP3 (greedy target): 1.1585 macro demand where bulls reload

Staakd Rating: 7.5/10 Bearish Bias

- Structure

- Volume spike into supply

- Rejection wick

- Bullish continuation? Not yet, brotha!

Invalidation Level

If the 1H candle closes above 1.1725, I'm officially wrong. Close the trade. Don’t beg.

Bonus Stats

Supply rejections like this inside a defined channel with clean liquidity traps? these setups historically resolve short 65–70% of the time, assuming no news nukes the setup.

Are you shorting this trap? Already in from the wick? Or are you waiting for price to cough up another fake out? Let’s hear it. Drop your setups, throw your TPs in the chat, and may your drawdown be nonexistent.

Trading Day SummaryTrading Day Summary

Today wasn’t a winning day on the books, but it was a major win in discipline.

I hit my daily loss limit before 10 AM, stopped live trading, and switched over to paper trades to protect my capital.

The setups I took—especially in Gold and Euro—lacked full confirmation, and one overnight trade didn’t align with my plan.

I experienced around $200 in slippage, which added to the loss.

The bright side? I stayed in control. No revenge trades. No emotional spirals.

My paper trade afterward was textbook—5R+ potential. That tells me the strategy is sound. Execution and timing just need to be sharper.

Bottom line: this is a marathon, not a sprint. I’m proud of the discipline and the mindset. Tomorrow, we reset and refocus.

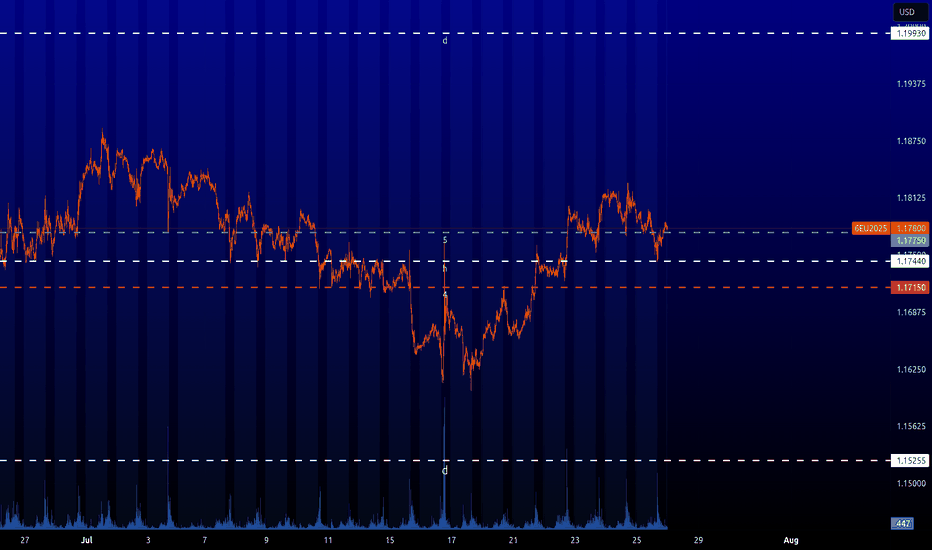

6E : Key levelsHere are the key levels for this instrument.

The nearest interesting level is at 1.17750. It is too early to buy it. The price needs to grow a little more and then it will be possible to buy this level with a limit order.

The other levels are still far away, but they will be interesting for the market.

Please note that I interpret these levels in my own way. I need special conditions to understand when exactly there will be a bounce from the level. Such as the conditions I described from 1.17750. So you should not trade these levels mindlessly, but you can use them in your strategy and using your logic.

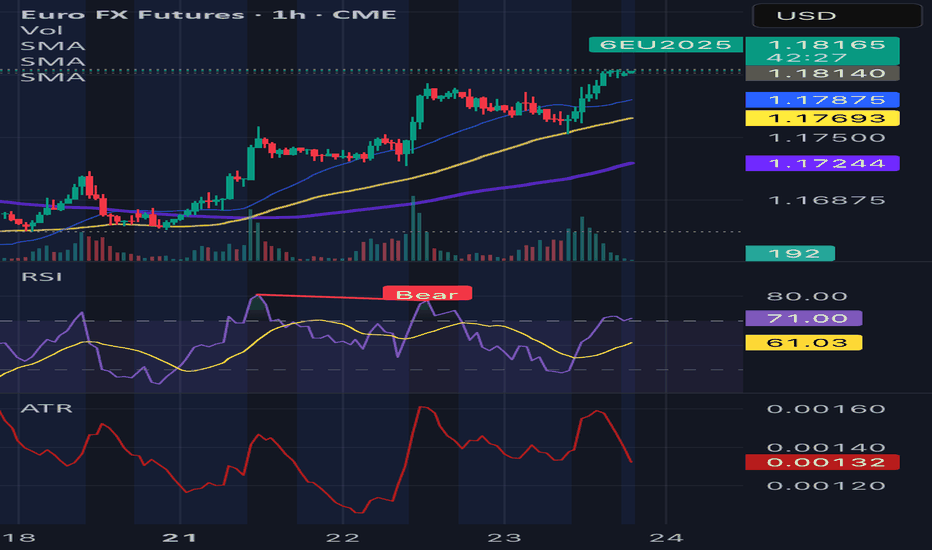

Retrace and get long Current fundamental analysis suggest long euro short dollar options market suggest that people are starting to prefer puts in later expirations but put call ratio still about one cause call premium is up compared to put For September expiration also ecb not expected to cut rates while the fed is anticipated to cut twice by year end. Trend has been respecting the 50 hour sma well and following a pretty solid pattern of retrace and go. Suggest buying pullbacks to 59 hour sma.

Euro LongsI've been waiting for euro to reach discount of its daily range and deliver into a daily BISI.

Mon - Wed trade lower into key arrays. Intraweek reversal confirmed with 4h and 1h CISD. Paired with Pound SMT at the daily lows.

LRLR built up from last weeks pullback. That bsl looks too obvious to me.

Entering off 1h cisd at 1.16650. Stop at Wednesday low. Targeting manipulation leg STD levels and relative equal highs at 1.19045

If the weekly draw on liquidity is to the upside, this intraweek reversal will hold. I know im wrong on direction if Wednesday low doesnt hold. The framework and logic line up with what I look for. Midweek Reversal daily profile. Thursday continuation in play.

Pre-Market Prep

Today, I'm narrowing down to six key markets. For the S&P, it's all about waiting for a pullback from the prior day's high or a breakout above the CVA. If it dips back inside the range, I'm ready to go short with some scalps.

For the NASDAQ, it's looking strong. I'm thinking about a long position if it pulls back to the prior day's high.

Gold is in a downtrend across all areas, and I'm already in a short position from the CVA low. I'm thinking about adding to that if it pulls back to the prior day's low.

Crude Oil is pretty balanced. I'm looking at the high of the CVA for a short opportunity if it gets there.

For the Yen and Euro, both are rotational. I'm eyeing long opportunities if they show some acceptance and pullbacks from key levels.

That's the vibe for today. Let's trade smart, avoid the chop, and keep it moving. Peace!

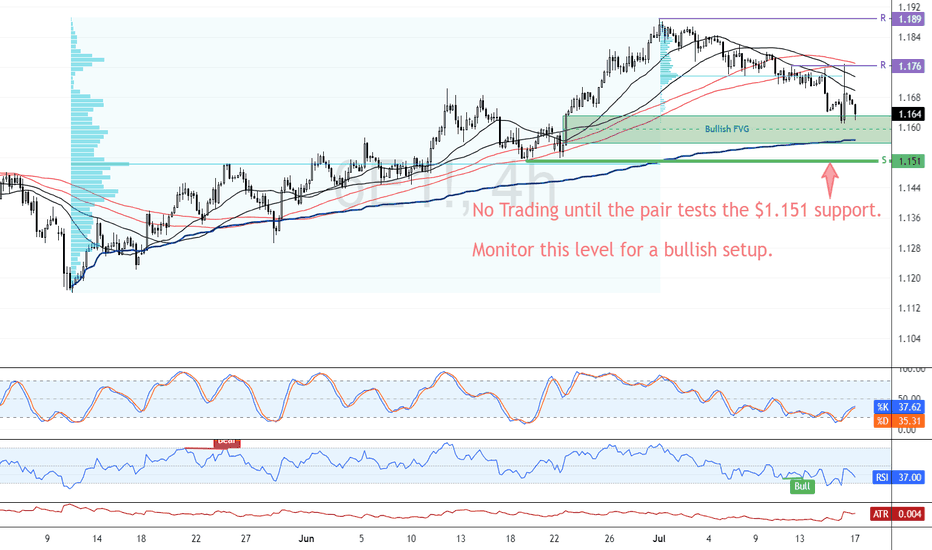

EUR/USD Resumes Bearish Trend Below $1.176FenzoFx—EUR/USD trades bearish, below the 100-SMA, and is currently testing the bullish FVG as support. Yesterday, Euro failed to pass the immediate resistance at $1.176; therefore, we expect the bearish bias to resume.

In this scenario, EUR/USD's downtrend could extend to the next support level at $1.151. Please note that the bearish outlook should be invalidated if Euro closes and stabilizes above $1.176.

Opportunities Arise from Dollar WeaknessSince the dollar peaked in 2022, it has declined by 24%.

Such a decline may not seem significant for a stock, it’s a different story when it comes to currencies, especially a reserve currency for USD. US purchasing power has dropped by a quarter, meaning they will now have to pay 24% more for imports from EU.

However, the decline in the USD also presents opportunities in other markets.

Mirco EUR/USD Futures

Ticker: M6E

Minimum fluctuation:

0.0001 per euro = $1.25

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

CME Real-time Market Data help identify trading set-ups in real-time and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

Sell the EURO vs USD?Welcome back to the Mid-Week Analysis for Wed, July 8th.

In this video, we will analyze the following FX markets:

EURO and USD Index.

The USD is seeing some strength off the tariffs Trump is declaring... and extending the grace period again on. This dragging down the EURO a bit, as it is printing bearish candles for Mond and Tues.

Will Wed print another bearish candle? Are we heading for a full retracement in the EURUSD?

This could be the scenario forming that I eluded to in my Weekly Forecast video: Buy The Dips and Sell The Rips.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

EUR/USD (6E1!) Nears Critical Monthly Supply ZoneThe EUR/USD futures (6E1!) are currently trading at 1.1858, already inside a key monthly supply zone. With price action approaching higher resistance levels, traders should prepare for potential reversals—especially near the 1.20395 – 1.22710 range, where a major bearish reaction could unfold.

Key Technical Levels to Watch

Current Price: 1.1858, testing the lower bounds of a monthly supply zone.

Weekly Supply Areas: Highlighted on the chart, signaling potential selling pressure ahead.

Primary Target Zone for Shorts: 1.21240 – 1.22710 (within the broader 1.20395 – 1.22710 range).

Breakout Scenario: A sustained move above 1.22710 could invalidate the bearish structure, targeting 1.2400+.

COT Report Reveals Market Sentiment Shifts

The latest Commitment of Traders (COT) report shows:

Commercials (Smart Money): Accumulating bearish positions, suggesting institutional hedging at these levels.

Non-Commercials (Large Speculators): Still bullish but stagnant—no major additions or reductions in exposure.

Retail Traders: Remain bullish, often a contrarian signal when Commercials are increasing shorts.

This setup suggests that while momentum is still upward, the lack of new buying from Non-Commercials and Commercials increasing shorts could lead to a reversal.

Euro Futures Test Support at $1.1821 After PullbackEuro futures dipped from 1.189, currently testing the previous day's high at $1.1821 as support.

From a technical perspective, a new bullish wave could be on the horizon if the support holds. Otherwise, a break below this level can result in the price dipping toward the previous week's high at approximately 1.1705.

FX quarter end : a high-probability recurring patternAs we approach the end of June, a well-known phenomenon among FX traders is once again coming into focus: when currencies have diverged significantly over the course of a month or quarter, we often see a technical correction into the final trading session, with partial pullbacks in the pairs that had previously moved the most.

This end-of-month or quarter pattern is not random. It is the predictable result of recurring institutional flows. Recently, the US dollar has notably weakened against most major currencies. As a result, we could anticipate a modest bounce in the dollar to close out the month and start the new week, as various participants are likely to adjust their positions accordingly.

Performance of FX futures contracts from Sunday, June 1 to Friday, June 27:

Swiss Franc +3.71%

Euro +3.61%

British Pound +1.95%

New Zealand Dollar +1.58%

Australian Dollar +1.50%

Canadian Dollar +0.67%

Japanese Yen +0.16%

Performance of FX futures contracts from Tuesday, April 1 to Friday, June 27:

Swiss Franc +10.73%

Euro +8.40%

New Zealand Dollar +6.90%

British Pound +6.26%

Canadian Dollar +5.23%

Australian Dollar +4.80%

Japanese Yen +3.68%

These figures illustrate a broad-based decline in the dollar during June and over the entire second quarter. Historically, such imbalances open the door to late-stage adjustments, with currencies that have risen sharply often seeing modest technical pullbacks. This is a setup closely monitored by FX traders, who view it as a high-probability opportunity based on a pattern that is rare, but remarkably consistent.

FX rebalancing: mechanics and market players

At the heart of these adjustments lies one key concept: rebalancing. This is the process by which institutional players, pension funds, insurers, central banks, passive managers, bond funds, corporates adjust their FX exposures to stay in line with the targets defined in their mandates.

Every month, the value of their assets (equities, bonds, alternatives) and currency holdings fluctuate. If a currency appreciates sharply, its weight in the portfolio may become too high. Conversely, if a currency weakens, exposure might fall below target. Rebalancing involves buying or selling FX to return to those target allocations.

This process is recurring, predictable, and usually concentrated in a narrow window, the final hours of the trading month, just before the London 4pm fix. Quarter-ends tend to be even more pronounced, as many investors revisit long-term strategic allocations at that time.

Many of these adjustments are driven by systematic models using fixed thresholds, which adds to the consistency and timing of these flows.

Ideal setup: low volatility, high impact

June 2025 ends in a particularly calm environment: equity markets are stable or even rising, and the VIX is trading near its yearly lows, signs of a quiet and balanced market that favors more technical trading. This context is favorable for strategies aiming to take advantage of rebalancing effects, as in the absence of new announcements or unexpected events, these adjustments are likely to have a tangible impact on prices.

Conversely, in a more volatile market environment, such adjustments could be drowned out by larger flows (such as a flight to quality), thus having a reduced or even negligible impact.

FX options: another layer of flows

Another important factor on Monday, June 30: a large number of FX options expire at 10am New York (3pm London). These expiries cover several major pairs, with significant notional amounts concentrated near current spot levels.

According to what is currently being whispered on trading desk chat rooms, we expect the following large expiries:

EUR/USD: €3.0bn at 1.1650 (below spot)

USD/JPY: $1.6bn at 145.50 (above spot)

USD/CHF: $1.8bn at 0.8000 (above spot)

GBP/USD: £1.0bn at 1.3600 (below spot)

AUD/USD: A$1.1bn at 0.6425 (below spot)

When spot approaches these strikes, option holders or sellers may intervene to "pin" prices, based on their delta exposure. This behavior can amplify technical price movements in the hours before expiration.

When these heavy expirations align with month/quarter end rebalancing flows in a quiet, low-volatility market, it creates a strong potential cocktail for tactical moves, conducive to a dollar rebound into the fix.

How to trade the pattern effectively

Here’s a simplified roadmap to navigate this recurring pattern:

Identify monthly or quarterly extremes: look for the currencies that gained or lost the most over the period;

Assess the market environment: a low VIX, no major data or central bank events, meaningful trends, and significant options expiries are ideal conditions;

Use liquid and transparent instruments: Sep 2025 FX futures (standard, e-mini or micro) are currently the most suitable products for active positioning

Set realistic expectations: aim for a 0.5% to 1.0% pullback, not a full-blown trend reversal

Manage risk properly: as with any strategy, always use a stop-loss. This is quantitative trading, not fortune-telling. If the USD continues to weaken despite the setup, be ready to exit swiftly.

In short...

Quarter/month end FX rebalancing is one of the few market events where anticipated institutional flows can create repeatable, high-probability trading opportunities. These flows stem from real portfolio needs and systematic re-hedging, and are often amplified by option expiries and technical positioning.

This setup provides a great educational case study for any trader seeking to better understand hidden FX dynamics. There’s no secret indicator or crystal ball here, just a solid grasp of structural flows and timing.

From a personal standpoint, after over 20 years trading currencies, this strategy remains one of my favorites: simple, effective, and highly instructive. I encourage you to study it closely, and observe its behavior during upcoming month-end windows.

---

When charting futures, the data provided could be delayed. Traders working with the ticker symbols discussed in this idea may prefer to use CME Group real-time data plan on TradingView: tradingview.com/cme/ .

This consideration is particularly important for shorter-term traders, whereas it may be less critical for those focused on longer-term trading strategies.

General Disclaimer:

The trade ideas presented herein are solely for illustrative purposes forming a part of a case study intended to demonstrate key principles in risk management within the context of the specific market scenarios discussed. These ideas are not to be interpreted as investment recommendations or financial advice. They do not endorse or promote any specific trading strategies, financial products, or services. The information provided is based on data believed to be reliable; however, its accuracy or completeness cannot be guaranteed. Trading in financial markets involves risks, including the potential loss of principal. Each individual should conduct their own research and consult with professional financial advisors before making any investment decisions. The author or publisher of this content bears no responsibility for any actions taken based on the information provided or for any resultant financial or other losses.

Weekly FOREX Forecast: When Missiles Fly, So Does The US Dollar This is the FOREX futures outlook for the week of Jun 16-20th.

In this video, we will analyze the following FX markets:

USD Index, EUR, GBP, AUD, NZD, CAD, CHF, and JPY.

Middle East tensions are high, missiles flying.... and so will the USD. Look for the USD to

out perform its counterparts during precarious period.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.