6E1! trade ideas

Still waters before ECB waves?This morning, Euro FX futures (June contract 6EM5) are trading around 1.14300, still contained within the upper end of a well-established range between 1.1350 and 1.1450. The volume profile continues to show a heavy concentration of activity around 1.1380, reflecting a neutral stance from market participants as they await the ECB’s policy decision later today.

The macro context is clear: eurozone inflation just came in at 1.9% YoY, a figure already below the ECB’s 2% target, and the consistency of the disinflation trend has shifted expectations. Markets now see today’s 25 basis point rate cut as a near certainty, bringing the deposit rate from 2.40% to 2.15%.

But the real focus lies in the forward guidance. Investors will be watching closely for signals on whether the ECB will continue easing through the summer or adopt a more cautious, data-dependent stance, especially with the Federal Reserve still on hold in a 4.25–4.50% range, and US inflation proving more persistent.

Sentiment remains neutral to slightly bearish: retail traders are still about 60% short, while institutional flows appear more balanced. Implied volatility is low, with EUR/USD vol and the VIX both subdued, creating ideal conditions for range trading, at least on the surface.

With significant open interest sitting at 1.1350 and 1.1400 on the June 6EM5 options board, the market is effectively pinned and in wait mode. Traders will need to stay nimble while the post-decision reaction could break this temporary equilibrium.

Time for perspective: when markets go quiet, let’s get curious

With the market clearly in limbo and no compelling directional trade setup this morning, it’s an ideal opportunity to step back and look deeper at what this range-bound phase might be hiding.

Periods of low volatility and tight consolidation may feel uneventful, but they often precede the most decisive market moves. Traders who understand the structural dynamics behind these calm phases, and why they often lead to sharp breakouts, will be better positioned to react quickly when volatility returns.

So, what exactly makes low volatility environments potentially dangerous? Let’s unpack the mechanics behind the calm-before-the-storm setup.

Why low volatility often precedes an explosive breakout

1. Position buildup and leverage exposure

In range-bound markets, traders tend to build up positions near support and resistance levels, often with excessive leverage. The longer a range holds, the more confident participants become in fading it, creating clusters of stop-loss orders just beyond the boundaries. Once price breaks out, those stops can cascade and generate fast, exaggerated moves in the direction of the breakout. This is particularly relevant in the FX space, where margin and leverage are widely used.

2. Dealer positioning and gamma squeeze risk

Low-volatility regimes are often accompanied by aggressive option selling. Dealers who are short options (typically on both sides) hedge delta exposure daily. As price approaches heavily populated strikes (such as 1.1400), they may be forced to buy or sell futures to remain neutral. If the underlying breaks out beyond a major strike, dealers can become forced buyers or sellers, driving price further in the same direction. This feedback loop is known as a gamma squeeze, and it's a common driver of explosive moves from low-volatility setups.

3. Liquidity compression outside the range

Inside established ranges, liquidity is typically deep. Market makers and passive orders ensure two-sided flow. But once the market breaks out, liquidity can evaporate. With fewer resting orders above resistance or below support, price can jump large distances on relatively light flow. This creates the conditions for quick, directional surges, not because of massive volume, but because of a sudden absence of liquidity.

4. Misleading risk models

Risk systems like Value-at-Risk (VaR) generally rely on recent historical volatility to determine position sizing and exposure. In prolonged calm markets, VaR shrinks and risk budgets expand. Traders and institutions might take on larger positions than they would in more volatile environments, falsely reassured by the quiet. If a breakout suddenly injects volatility into the system, these positions can become excessively risky, triggering a chain of margin calls, forced liquidations, or panic adjustments, all of which further amplify the move.

5. The psychological trap of stability

Perhaps most importantly, low volatility lulls traders into complacency. They shrink their stop losses, stretch their entries, and begin to assume the range will hold “because it has.” But volatility is mean-reverting by nature. When a catalyst appears, be it a surprise from the ECB, geopolitical headlines, or simply a technical breakout, the transition from low to high volatility is often violent and abrupt.

Final thought: expect the unexpected

Traders, especially retail traders, love quiet markets, until they stop being quiet. This morning, the euro is pinned in place, volatility is suppressed, and positioning is relatively balanced. But beneath this apparent calm lies a market ripe for reprice.

The ECB is widely expected to cut rates by 25 basis points today, that much is in the price. What’s not yet priced, however, is the exact message that will accompany the move. If the ECB delivers a dovish tone, the euro is likely to weaken. But if the statement or press conference turns out more hawkish than expected, even slightly, the euro could rally sharply.

When volatility is cheap and expectations are compressed, it takes little to unleash a large move. So while there’s no clear trade to take right now, this is the kind of day that sets the tone for the next few weeks.

When charting futures, the data provided could be delayed. Traders working with the ticker symbols discussed in this idea may prefer to use CME Group real-time data plan on TradingView: tradingview.com/cme/.

This consideration is particularly important for shorter-term traders, whereas it may be less critical for those focused on longer-term trading strategies.

General Disclaimer:

The trade ideas presented herein are solely for illustrative purposes forming a part of a case study intended to demonstrate key principles in risk management within the context of the specific market scenarios discussed. These ideas are not to be interpreted as investment recommendations or financial advice. They do not endorse or promote any specific trading strategies, financial products, or services. The information provided is based on data believed to be reliable; however, its accuracy or completeness cannot be guaranteed. Trading in financial markets involves risks, including the potential loss of principal. Each individual should conduct their own research and consult with professional financial advisors before making any investment decisions. The author or publisher of this content bears no responsibility for any actions taken based on the information provided or for any resultant financial or other losses.

6E long position in cup with handle pattern Cup and Handle Pattern:

The chart exhibits a classic "Cup and Handle" formation. The "cup" forms from around July 2024 to March 2025, where the price dips to a low near 1.06250 (around October 2024) and then rises to a high near 1.13660 (March 2025), creating a U-shaped recovery.

The "handle" follows from March 2025 to May 2025, showing a slight consolidation or pullback, with the price dipping to around 1.13115 before breaking out.

Breakout:

The price breaks out of the handle around late May 2025, surpassing the previous high of 1.13660 and reaching approximately 1.14245. This breakout confirms the bullish continuation pattern.

Price Target:

The chart includes a projected price target box ranging from 1.13660 to 1.24815. The height of the cup (from the low of 1.06250 to the high of 1.13660, roughly 0.07410) is added to the breakout point (1.13660), giving a potential target around 1.21070, which aligns with the lower end of the target box.

Trendline and Support:

A descending trendline (drawn in red) from the March 2025 high is broken during the breakout, further confirming the bullish momentum.

The price finds support around the 1.13115 level during the handle formation, which aligns with the breakout confirmation.

Conclusion:

The chart displays a bullish Cup and Handle pattern with a confirmed breakout, suggesting potential upward movement toward the 1.21070–1.24815 range. However, traders should watch for volume confirmation and any macroeconomic factors affecting the Euro FX, as well as monitor for a possible retest of the breakout level around 1.13660.

Mid-Week FOREX Forecast: Will The USD Remain Weak?In this video, we will update Sunday's forecasts mid-week, and look for valid setup for the rest of the week ahead. The following FX markets will be analyzed:

In this video, we will analyze the following FX Majors markets:

USD Index

EUR

GBP

AUD

NZD

CAD

CHF

JPY

The expected short term bearishness in the USD came, but will it continue for the rest of the week? Wait patiently for the market to tip its hand, and trade accordingly. Have a plan in place if the protected low at 99.172 holds or folds.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

EURUSD - double scenario So I develop a strategy on 6E1! that I post to you. I identified a H&S that seems to have broken the neck with a bearish retest in the area of 1.14. Theoretically the daily left shoulder volumes are "decreasing" confirming a potential bearish H&S structure, furthermore we are under the POC bullish leg that was touched with the retest, the short scenario should be confirmed with the break of the micro support (under the retest candle) going to confirm a hypothesis of an ABC retracement of Elliott after an impulse with a target around 1.10, the POC area of the previous accumulation phase. The long scenario instead is more attributable to a triangle pattern with volume compression, any overcoming of the POC and the first resistance area around 1.14 with the break of the descending line should confirm this scenario with a potential target in the upper POC area around 1.20... Thank you in advance for any contribution to this analysis.

BUY The Major FX Pairs vs USD?? This is the FOREX Currency futures outlook for the week of May 12 - 16th.

In this video, we will analyze the following FX Majors markets:

USD Index

EUR

GBP

AUD

NZD

CAD

CHF

JPY

USD Index finally finished the move to the Daily -FVG, as forecasted last week. Now, will the resistance hold, sending prices lower? I thinking so.

Look to buy xxxUSD pairs. Sell USDxxx pairs.

Wait for valid setups. CPI Data on Tuesday, so be careful.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

EURUSD: Potential Bearish Head and Shoulders Pattern FormingOn the daily chart, an interesting potential bearish head and shoulders formation is developing. If confirmed, it could lead to a downward move, completing a minor degree wave iv before resuming the broader uptrend.

I expect prices to retrace towards the 1.1204–1.1105 area.

Targeting 1.185: Strategies for Navigating Euro Volatility!A few thoughts on the results of the analysis of Friday's stock exchange reports on the euro/dollar pair

We noticed a portfolio that has entered the market with a target of 1.185, and only have 12 days until expiration. With the current volatility at 10.23, the future price at expiration is expected to be in the range of 1.0993 to 1.1849 — a 95% probability. Interesting, right?

Now, let’s consider two possible scenarios.

The first option : if the price is rapidly moving towards 1.185, it might be wise to think about selling the asset. Why? Because this price will act as a strong resistance level. Two reasons:

First , the expected price range is based on a mathematical formula and statistical data. Second , using leverage embedded in options that are deep out of the money (i.e., far from the current price) presents an excellent opportunity to create a synthetic short position without any risk, even if the market continues to move upward! Sounds unreal? Start learning about options, and a new world of opportunities will open up for you. Your perspective on risk and opportunities will change dramatically!

OK, now let's get back to the point of the post. The second option : if the price consolidates above 1.1436 on the futures, this could signal a buying opportunity.

Taking into account other factors (you can dig deeper using our website's data), the current sentiment is quite bullish and the continuation of the uptrend seems more likely than a correction.

Which path will you choose? Share your thoughts in the comments!

That’s where our market research comes in. Think of it as your “bias detector.” We’ve developed and use it daily to get a second opinion on trades. It’s like having a pro trader whisper, “Hey, this isn’t looking good— think twice.”.

P.S. No pressure, just a chance to trade smarter! No Valuable Data, No Edge!

EWTSU 6E1! subminuette wave v developping

Elliott Wave trade analysis

micro wave ((5)) of subminuette wave v developping

look at kennedy channels technique to monitor wave ((5)) of ((v))

confirmation: price break over 1.1470 and rise with a motive 5 waves pattern

invalidation: price break below area 1.1300

SHORT EURO Potential Drop in the Euro

Hello everyone, today I’m sharing my analysis on the Euro (EUR), as I see a potential drop in the short term. Below, I’ll outline the reasons behind my bearish bias and my entry strategy. Let’s dive in!

Why I’m Bearish on the Euro

Institutional and Retail Activity

My indicator shows a short-term increase in long contracts from retail traders, while institutional players are also selling. Although this isn’t an extreme reading, it’s actionable enough to take a position.

Open Interest

My open interest indicator also shows a clear trend of increasing short contracts, which supports my bearish outlook.

Valuation

My valuation indicator indicates a clear overvaluation of the Euro compared to the US Dollar and gold, suggesting a potential correction.

Technical Analysis

I’ve identified a key zone on the weekly timeframe using an indicator that highlights candles I call "Base" in my technical analysis strategy. These candles have a body smaller than 50% of their total range and tend to accumulate orders before an explosive move. Within this zone, I’m looking for an entry to anticipate the drop that my indicators are forecasting.

My Entry Strategy

I’ll be entering a short position in this identified zone, expecting the downward move my indicators are predicting. I’ll keep this idea updated as the price evolves, so stay tuned for more details.

Disclaimer

This is my personal analysis and does not constitute financial advice. Trading carries risks, so always conduct your own research and assess your risk tolerance before making decisions.

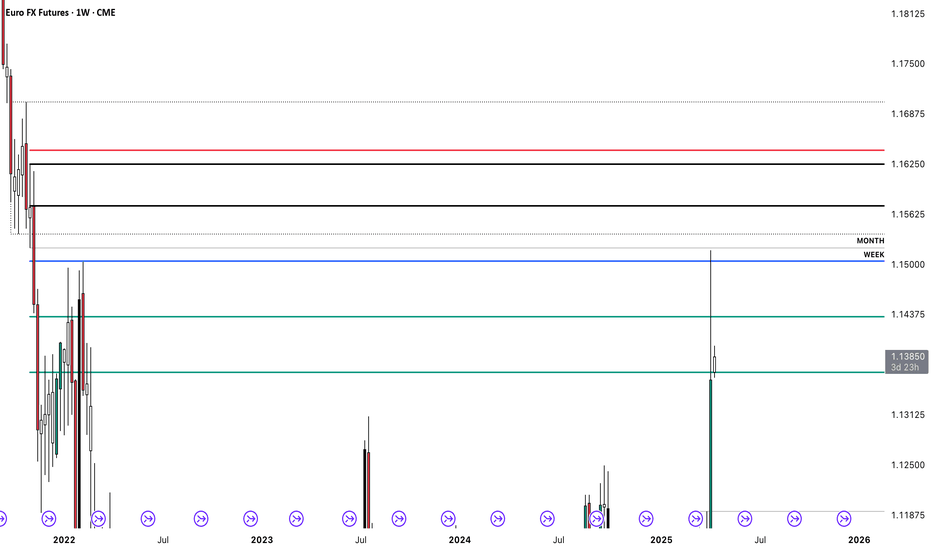

Institutional Supply Zones in Play: Will the Euro FX Rally Hold?Euro FX Futures is currently showing strong bullish momentum on the weekly timeframe, surging toward major supply zones that have historically triggered significant sell-offs. The chart reveals two key supply areas where institutional selling pressure has previously emerged. The first, more immediate zone represents a medium-term supply area that could attract profit-taking or initiate a pause in the current rally. The second, higher zone is a long-term supply area with even greater significance, marking the origin of strong bearish moves in the past. These zones are crucial in the current context, as they highlight potential turning points or consolidation phases as price approaches them.

The overall structure remains bullish, but as the market climbs into these well-defined supply regions, traders should be cautious and watch for any shift in momentum or early signs of distribution. These zones often act as magnets for liquidity and can become battlegrounds between buyers and sellers. Whether this bullish move powers through or reacts with a pullback will depend on how price behaves within these high-supply environments. For now, the market is in a strong phase of upside continuation, but strategic traders will be closely monitoring these zones for potential setups.