EURUSD: Potential Bearish Head and Shoulders Pattern FormingOn the daily chart, an interesting potential bearish head and shoulders formation is developing. If confirmed, it could lead to a downward move, completing a minor degree wave iv before resuming the broader uptrend.

I expect prices to retrace towards the 1.1204–1.1105 area.

6E1! trade ideas

Targeting 1.185: Strategies for Navigating Euro Volatility!A few thoughts on the results of the analysis of Friday's stock exchange reports on the euro/dollar pair

We noticed a portfolio that has entered the market with a target of 1.185, and only have 12 days until expiration. With the current volatility at 10.23, the future price at expiration is expected to be in the range of 1.0993 to 1.1849 — a 95% probability. Interesting, right?

Now, let’s consider two possible scenarios.

The first option : if the price is rapidly moving towards 1.185, it might be wise to think about selling the asset. Why? Because this price will act as a strong resistance level. Two reasons:

First , the expected price range is based on a mathematical formula and statistical data. Second , using leverage embedded in options that are deep out of the money (i.e., far from the current price) presents an excellent opportunity to create a synthetic short position without any risk, even if the market continues to move upward! Sounds unreal? Start learning about options, and a new world of opportunities will open up for you. Your perspective on risk and opportunities will change dramatically!

OK, now let's get back to the point of the post. The second option : if the price consolidates above 1.1436 on the futures, this could signal a buying opportunity.

Taking into account other factors (you can dig deeper using our website's data), the current sentiment is quite bullish and the continuation of the uptrend seems more likely than a correction.

Which path will you choose? Share your thoughts in the comments!

That’s where our market research comes in. Think of it as your “bias detector.” We’ve developed and use it daily to get a second opinion on trades. It’s like having a pro trader whisper, “Hey, this isn’t looking good— think twice.”.

P.S. No pressure, just a chance to trade smarter! No Valuable Data, No Edge!

EWTSU 6E1! subminuette wave v developping

Elliott Wave trade analysis

micro wave ((5)) of subminuette wave v developping

look at kennedy channels technique to monitor wave ((5)) of ((v))

confirmation: price break over 1.1470 and rise with a motive 5 waves pattern

invalidation: price break below area 1.1300

SHORT EURO Potential Drop in the Euro

Hello everyone, today I’m sharing my analysis on the Euro (EUR), as I see a potential drop in the short term. Below, I’ll outline the reasons behind my bearish bias and my entry strategy. Let’s dive in!

Why I’m Bearish on the Euro

Institutional and Retail Activity

My indicator shows a short-term increase in long contracts from retail traders, while institutional players are also selling. Although this isn’t an extreme reading, it’s actionable enough to take a position.

Open Interest

My open interest indicator also shows a clear trend of increasing short contracts, which supports my bearish outlook.

Valuation

My valuation indicator indicates a clear overvaluation of the Euro compared to the US Dollar and gold, suggesting a potential correction.

Technical Analysis

I’ve identified a key zone on the weekly timeframe using an indicator that highlights candles I call "Base" in my technical analysis strategy. These candles have a body smaller than 50% of their total range and tend to accumulate orders before an explosive move. Within this zone, I’m looking for an entry to anticipate the drop that my indicators are forecasting.

My Entry Strategy

I’ll be entering a short position in this identified zone, expecting the downward move my indicators are predicting. I’ll keep this idea updated as the price evolves, so stay tuned for more details.

Disclaimer

This is my personal analysis and does not constitute financial advice. Trading carries risks, so always conduct your own research and assess your risk tolerance before making decisions.

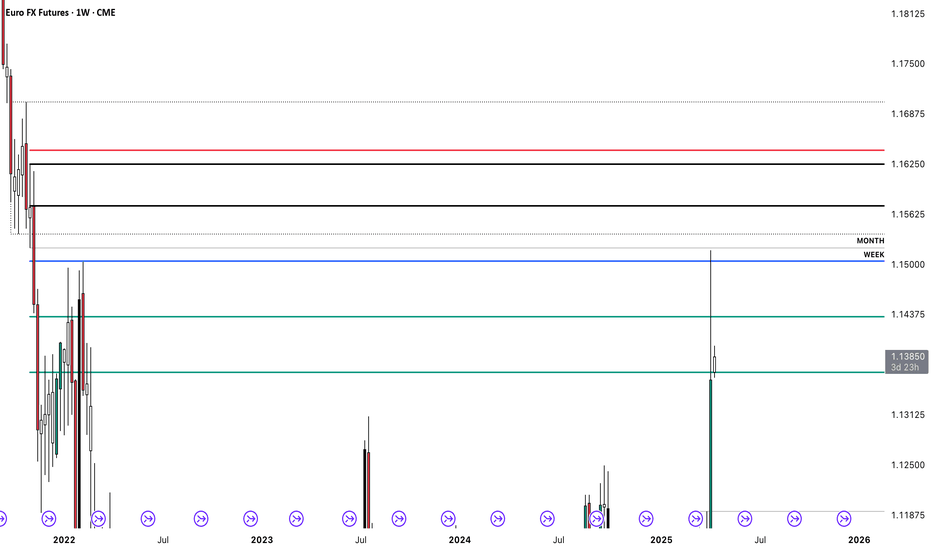

Institutional Supply Zones in Play: Will the Euro FX Rally Hold?Euro FX Futures is currently showing strong bullish momentum on the weekly timeframe, surging toward major supply zones that have historically triggered significant sell-offs. The chart reveals two key supply areas where institutional selling pressure has previously emerged. The first, more immediate zone represents a medium-term supply area that could attract profit-taking or initiate a pause in the current rally. The second, higher zone is a long-term supply area with even greater significance, marking the origin of strong bearish moves in the past. These zones are crucial in the current context, as they highlight potential turning points or consolidation phases as price approaches them.

The overall structure remains bullish, but as the market climbs into these well-defined supply regions, traders should be cautious and watch for any shift in momentum or early signs of distribution. These zones often act as magnets for liquidity and can become battlegrounds between buyers and sellers. Whether this bullish move powers through or reacts with a pullback will depend on how price behaves within these high-supply environments. For now, the market is in a strong phase of upside continuation, but strategic traders will be closely monitoring these zones for potential setups.

EURUSD – 60-Minute Chart AnalysisI'm currently anticipating further strength in the euro against the dollar, with the potential for an impulsive upward move targeting at least the 1.1312 level.

The current wave structure suggests a bullish count is still valid, provided that 1.0528 holds as support. A decisive break below this level would invalidate the bullish scenario, opening the door for renewed downside pressure, potentially driving price back below the 1.0205 area.

📌 Key Levels:

🔹 Bullish Target: 1.1312

🔻 Invalidation Level: 1.0528

⚠️ Bearish Continuation Below: 1.0205

As always, stay disciplined and manage risk accordingly.

EURUSD Weekly FOREX Forecast: BUY IT!In this video, we will analyze EURUSD and EUR Futures for the week of March 31 - April 4th. We'll determine the bias for the upcoming week, and look for the best potential setups.

The bias is bullish for now, but the April 2nd tariffs can flip the markets upside down. Be careful. Let the market tell you which direction it's going, and trade accordingly. Allow the markets to settle on a bias before you jump in.

NFP on Friday, btw.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

Behind the Curtain The Economic Pulse Behind Euro FX1. Introduction

Euro FX Futures (6E), traded on the CME, offer traders exposure to the euro-dollar exchange rate with precision, liquidity, and leverage. Whether hedging European currency risk or speculating on macro shifts, Euro FX contracts remain a vital component of global currency markets.

But what truly moves the euro? Beyond central bank meetings and headlines, the euro reacts sharply to macroeconomic data that signals growth, inflation, or risk appetite. Using a Random Forest Regressor, we explored how economic indicators correlate with Euro FX Futures returns across different timeframes.

In this article, we uncover which metrics drive the euro daily, weekly, and monthly, offering traders a structured, data-backed approach to navigating the Euro FX landscape.

2. Understanding Euro FX Futures Contracts

The CME offers two primary Euro FX Futures products:

o Standard Euro FX Futures (6E):

Contract Size: 125,000 €

Tick Size: 0.000050 per euro = $6.25 per tick per contract

Trading Hours: Nearly 24 hours, Sunday to Friday (US)

o Micro Euro FX Futures (M6E):

Contract Size: 12,500 € (1/10th the size of 6E)

Tick Size: 0.0001 per euro = $1.25 per tick per contract

Accessible to: Smaller accounts, strategy testers, and traders managing precise exposure

o Margins:

6E Initial Margin: ≈ $2,600 per contract (subject to volatility)

M6E Initial Margin: ≈ $260 per contract

Whether trading full-size or micro contracts, Euro FX Futures offer capital-efficient access to one of the most liquid currency pairs globally. Traders benefit from leverage, scalability, and transparent pricing, with the ability to hedge or speculate on Euro FX trends across timeframes.

3. Daily Timeframe: Key Economic Indicators

For day traders, short-term price action in the euro often hinges on rapidly released data that affects market sentiment and intraday flow. According to machine learning results, the top 3 daily drivers are:

Housing Starts: Surging housing starts in the U.S. can signal economic strength and pressure the euro via stronger USD flows. Conversely, weaker construction activity may weaken the dollar and support the euro.

Consumer Sentiment Index: A sentiment-driven metric that reflects household confidence. Optimistic consumers suggest robust consumption and a firm dollar, while pessimism may favor EUR strength on defensive rotation.

Housing Price Index (HPI): Rising home prices can stoke inflation fears and central bank hawkishness, affecting yield differentials between the euro and the dollar. HPI moves often spark short-term FX volatility.

4. Weekly Timeframe: Key Economic Indicators

Swing traders looking for trends spanning several sessions often lean on energy prices and labor data. Weekly insights from our Random Forest model show these three indicators as top drivers:

WTI Crude Oil Prices: Oil prices affect global inflation and trade dynamics. Rising WTI can fuel EUR strength if it leads to USD weakness via inflation concerns or reduced real yields.

Continuing Jobless Claims: An uptick in claims may suggest softening labor conditions in the U.S., potentially bullish for EUR as it implies slower Fed tightening or economic strain.

Brent Crude Oil Prices: As the global benchmark, Brent’s influence on inflation and trade flows is significant. Sustained Brent rallies could create euro tailwinds through weakening dollar momentum.

5. Monthly Timeframe: Key Economic Indicators

Position traders and institutional participants often focus on macroeconomic indicators with structural weight—those that influence monetary policy direction, capital flow, and long-term sentiment. The following three monthly indicators emerged as dominant forces shaping Euro FX Futures:

Industrial Production: A cornerstone of economic output, rising industrial production reflects strong manufacturing activity. Strong U.S. numbers can support the dollar, while a slowdown may benefit the euro. Likewise, weaker European output could undermine EUR demand.

Velocity of Money (M2): This metric reveals how quickly money is circulating in the economy. A rising M2 velocity suggests increased spending and inflationary pressures—potentially positive for the dollar and negative for the euro. Falling velocity signals stagnation and may shift flows into the euro as a lower-yield alternative.

Initial Jobless Claims: While often viewed weekly, the monthly average could reveal structural labor market resilience. A rising trend may weaken the dollar, reinforcing EUR gains as expectations for interest rate cuts grow.

6. Strategy Alignment by Trading Style

Each indicator offers unique insights depending on your approach to market participation:

Day Traders: Focus on the immediacy of daily indicators like Housing Starts, Consumer Sentiment, and Housing Price Index.

Swing Traders: Leverage weekly indicators like Crude Oil Prices and Continuing Claims to ride mid-term moves.

Position Traders: Watch longer-term data such as Industrial Production and M2 Velocity.

7. Risk Management

Currency futures provide access to high leverage and broad macro exposure. With that comes responsibility. Traders must actively manage position sizing, volatility exposure, and stop placement.

Economic indicators inform price movement probabilities—not certainties—making risk protocols just as essential as trade entries.

8. Conclusion

Euro FX Futures are shaped by a deep web of macroeconomic forces. From Consumer Sentiment and Oil Prices to Industrial Production and Money Velocity, each indicator tells part of the story behind Euro FX movement.

Thanks to machine learning, we’ve spotlighted the most impactful data across timeframes, offering traders a framework to align their approach with the heartbeat of the market.

As we continue the "Behind the Curtain" series, stay tuned for future editions uncovering the hidden economic forces behind other major futures markets.

When charting futures, the data provided could be delayed. Traders working with the ticker symbols discussed in this idea may prefer to use CME Group real-time data plan on TradingView: www.tradingview.com - This consideration is particularly important for shorter-term traders, whereas it may be less critical for those focused on longer-term trading strategies.

General Disclaimer:

The trade ideas presented herein are solely for illustrative purposes forming a part of a case study intended to demonstrate key principles in risk management within the context of the specific market scenarios discussed. These ideas are not to be interpreted as investment recommendations or financial advice. They do not endorse or promote any specific trading strategies, financial products, or services. The information provided is based on data believed to be reliable; however, its accuracy or completeness cannot be guaranteed. Trading in financial markets involves risks, including the potential loss of principal. Each individual should conduct their own research and consult with professional financial advisors before making any investment decisions. The author or publisher of this content bears no responsibility for any actions taken based on the information provided or for any resultant financial or other losses.

Technical set-up: EUR/USDEUR/USD has strengthened materially following news of EU plans to increase defence spending. This has resulted in yields across Europe rising sharply and, more importantly, spreads widening against US Treasuries.

At the same time, US rates have fallen materially as growth fears take hold due to the Trump administration’s new tariff plans. When comparing the chart of 10-year rates between Germany and the US with EUR/USD, it becomes clear that the expansion of these spreads is driving the euro’s strength. Should this trend continue, EUR/USD could rise further.

EUR/USD has cleared some significant levels of support, breaking above $1.05 and then moving above $1.06, which has allowed it to extend beyond $1.08. The currency pair is trading above the upper Bollinger Band and the relative strength index (RSI) is above 70, suggesting that the pair may be overbought. This suggests that EUR/USD could consolidate by trading sideways or testing support at $1.075 soon. A break of support at $1.075 would be bearish and could send EUR/USD back to $1.058.

However, if support holds, EUR/USD could trade higher, especially if the spreads between Germany and the US continue to expand, with the next level of resistance at $1.095. A breakout above $1.095 could lead the EUR/USD to rise to $1.12, the highs last seen in late September.

Written by Michael J Kramer, founder of Mott Capital Management

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only and does not take into account your personal circumstances or objectives. Nothing in this material is (or should considered to be) financial, investment or other advice on which reliance should be placed.

No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

EURUSD Weekly FOREX Forecast: March 10 - 14thIn this video, we will analyze EURUSD and EUR Futures. We'll determine the bias for the upcoming week, and look for the best potential setups.

While the USD is bearish, the EUR is finding strength to the upside. This is noted in the very strong Friday candle. Meh NFP numbers, tariffs and trade wars are pulling the USD down, allowing the EUR and the other majors to move higher.

Look for a retracement to the +FVG in the beginning of the week. This could potentially set up the higher probability buy setup that potentially forms there.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

EUR/USD: Bullish Momentum in PlayThe Euro is gaining strength against the U.S. Dollar, and the technical structure on the weekly chart suggests a strong impulsive wave to the upside 📊.

🔍 Key Elliott Wave Perspective:

The current bullish move appears to be part of a larger impulse wave, targeting the 1.2573 - 1.2977 zone 🎯. However, this bullish outlook remains valid as long as the market holds above the critical support level of 1.0205.

📊 Technical Confluence Supporting the Uptrend:

✅ Major Weekly Resistance: 1.0907, where prices will face the 200 EMA, a key trend-defining level.

✅ RSI & MACD: Both indicators are well-aligned with the bullish trend, confirming strength in momentum.

✅ Wave Structure: As long as price remains above 1.0205, the Elliott Wave count remains intact for further upside expansion.

🔹 Break & Hold Above 1.0907? Expect acceleration towards 1.2573 – 1.2977 📈.

🔹 Failure to Hold Above Support? A deeper retracement could reset the bullish wave structure.

⚡ Traders & Investors: Keep an eye on price action near 1.0907—a rejection or breakout here will be decisive!

Fading the 6E1! Gap With the price showing signs of exhaustion and resistance forming around the gap's high, a short entry could be ideal as momentum fades. A move back towards the gap’s origin and potential support levels would be the target, with careful risk management in place. If the market continues to show weakness, this gap-up move could quickly reverse, offering a solid opportunity to take advantage of the pullback.

Reversal in the Euro FuturesThe Euro Futures market is showing signs of a potential bullish reversal after a period of bearish selling pressure. Price action suggests that support is holding strong, and we might be on the verge of a shift in momentum. A break above recent resistance could signal the start of a new uptrend.

Bullish Euro Trade IdeaThe Euro has been showing strong bullish momentum in recent sessions, breaking key resistance levels and maintaining a steady uptrend. The market is currently testing a critical level that could lead to further upside if broken. A successful breakout above this level could signal continuation towards higher targets.

Back on Bullish Euro Futures The EURO is currently displaying a bullish intraday market structure, with a series of higher highs and higher lows. After consolidating near key support levels, the Euro looks set for an upward move as it breaks above a recent swing high. This price action suggests the potential for further upside during today's trading session