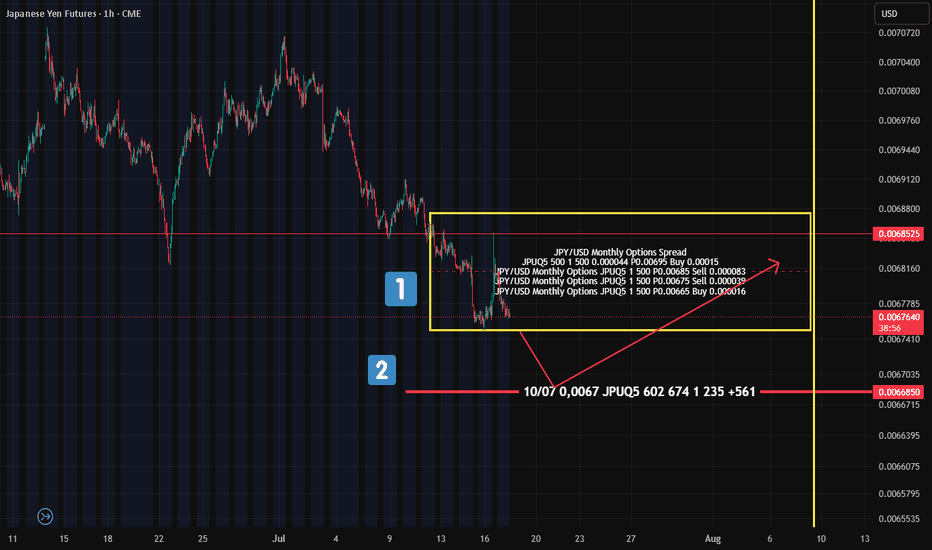

Yen Futures Options: What the "Put Condor" Tells Us About FutureA quick look at the options sentiment on Japanese Yen futures (not spot) — and there’s something interesting on the flow radar.

On July 10 , a "Put Condor" was placed — boundaries marked by the yellow rectangle on the chart (№1).

The goal of this setup? Price should expire within these boundaries — meaning the seller expects limited downside , but still allows for some controlled movement.

What’s notable?

This position was placed before the yen started to weaken — so someone was clearly preparing for this scenario in advance .

Also worth watching:

Further down (№2 on the chart), there’s another cluster of put options at 0.0067 — suggesting this level could act as a support zone if the futures contract drops that low.

📊 Bottom Line:

There are clear signs pointing to continued downside pressure in Yen futures.

The 0.006685 level is key — potential support for a bounce back into the 0.00675–0.00685 range .

6JV2024 trade ideas

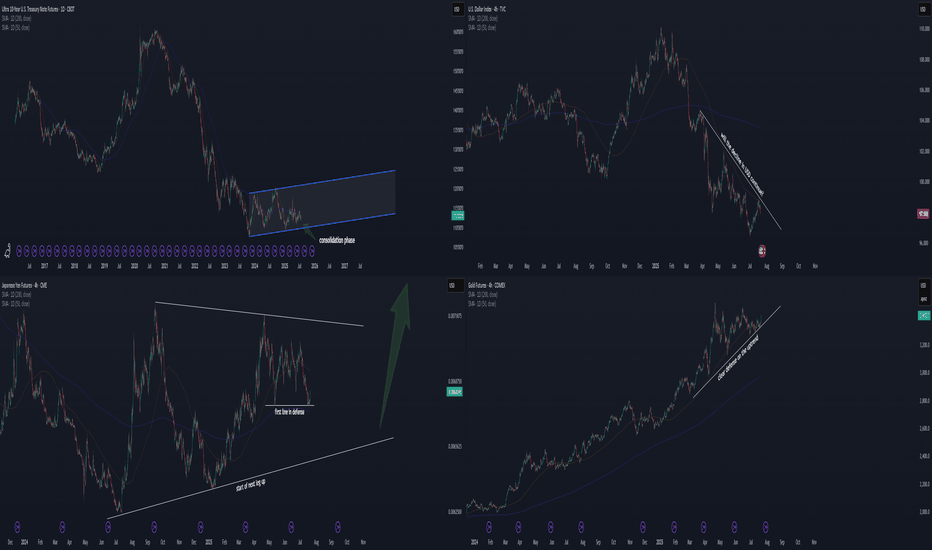

Time to invest in JPY and TN/bond? Hello FX/futures traders!

Market is at a pivotal point. Not in a bad way, but in a good way!

Chart 2: TVC:DXY

Let's start with the US Dollar . A declining USD was just well defended the last few days. If this is true, then the stock up, dollar down scenario is likely to continue. This is good for equities.

Chart 4: COMEX:GC1!

Gold defends its trendline as well. It seems like gold wants to go up more. A raising gold in the current scenario suggests declining USD TVC:DXY . This isn't always true, but we have to look at the current correlation and makes the best educated guess on this.

Logical Deduction 1:

Chart 1: CBOT:TN1!

A consolidation phase has been going on for almost 2 years now. This is definitely

a good sign to long bond, as at least we know the likely bottom for stoploss. With dollar leaning down and gold up, I think TN will defend its current level around 110-113.

Logical Deduction 2:

Chart 3: CME:6J1!

JPY is defending its first key level since May 2025. A wedge is forming, and the breakout is about to take place later this year. Likely the consolidation phase will take more time (with likelihood to breakout to either side). But with a declining USD side by side, I consider now a good entry point to long JPY with controllable risk.

Let me know what you think!

USDJPY. 14.07.2025. The plan for the next few days.The nearest interesting resistance zones have already been worked out at night and have given a good reaction. Let's mark the others where we can expect a reaction. It's not certain that there will be a major reversal, but I believe we will see a correction that can be monetized. We are waiting for a reaction and looking for an entry point.

The post will be adjusted based on changes.

Don't forget to click on the Rocket! =)

JPY/USD 6J Futs : Alignment Across All Frameworks🧭

✅ 1. Macro Outlook (Bearish JPY → Bullish USDJPY → Bearish JPYUSD short-term)

BOJ is behind the curve (still dovish)

Fed remains restrictive

Japan faces weak exports, aging demographics, and trade shocks

Result: Short-term pressure on JPY → price consolidates in Discount zone

🟢 This explains the bottom formation seen around 0.00675–0.00685

✅ 2. Medium-Term DSS Prediction

VolanX & DSS show near-term stagnation, then potential recovery after risk shifts

Projection favors a slow grind higher after liquidity sweep, possibly forming a higher low

📈 Matches the zone around Equilibrium ~ 0.00691–0.00697 before a wave up

✅ 3. Long-Term Technical Structure (Chart You Posted)

Chart Highlights:

📉 Completed BOS (Break of Structure) near 2022–2023

🧠 CHoCH (Change of Character) bullish confirmed in late 2024

🔵 Discount + Wick Low at ~0.00657–0.00675 held firmly

⚖️ Current price around Equilibrium zone (0.00691–0.00697) acting as re-accumulation

🔴 Large Premium supply zone at 0.00785–0.00875, then full projection toward:

0.0099735 (Fib 0.618)

0.0112330 (Fib 0.382 from all-time range)

🟡 Structure shows a rounded bottom → equilibrium → rally into premium

🔮 Synthesized Forecast (Multi-Timeframe Outlook)

Timeframe Bias Forecast Price Key Zone

1–2 weeks Neutral/Bearish 0.00685–0.00690 Discount equilibrium zone

3–6 weeks Reversal Bullish 0.00695–0.00715 Micro-premium retest zone

6–12 months Bullish 0.00775–0.00885 Long-term premium targets

2–3 years Expansion Bullish 0.0099735 → 0.0112330 Long-term Fibonacci targets

✅ Final Confirmation

Yes, this chart confirms and aligns perfectly with:

📊 The macro outlook (BOJ lag + Fed pause → JPY depreciation short term, followed by reversion)

🤖 Your DSS and VolanX system predictions

🧠 A smart money thesis showing accumulation > break > expansion

July 7 - 11th: Sell The RIPs, Buy The DIPs! (PART 2)Welcome back to the Weekly Forex Forecast!

This is Part 2 of the FOREX futures outlook for the week of July 7 - 11th.

In this video, we will analyze the following FX markets:

CHF and JPY

Last Friday was a bank holiday, so the price action is discounted. This Monday has no red folders on the calendar, so the environment is set for a day of misdirection. Be careful to take only trades that confirm your directional bias!

USD is still weak, and analyst have determined the FED will put off cutting rates until September. Tariffs wars may start up again July 9th. And Trumps Bill can add 3+ trillion to the debt.

None of this supports the USD!

Look to buy the dips xxx USD, and look to sell the rips vs USD xxx.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

Buy the Dip into 0.0070 Pre-Expiry Pin & Policy RiskThe Japanese yen has experienced significant swings in recent weeks, both higher and lower, reflecting a fragile balance between diverging monetary policies and ongoing geopolitical uncertainty. That said, its status as a safe-haven currency continues to offer it defensive appeal among global investors, independent of technical flows, such as the major USD/JPY option expiry scheduled for Monday, June 16.

Fundamental Analysis

Central banks have entered a wait-and-see mode. The Federal Reserve is widely expected to hold rates steady at its upcoming June 18 meeting. According to the CME FedWatch tool, markets price in a 97% probability of no change, with only a 3% chance of an immediate cut. In this context, the USD still benefits from rate differentials, but forward guidance is now increasingly balanced over the next 6 months.

Meanwhile, the Bank of Japan has started to normalize its ultra-loose policy. After decades of zero or negative interest rates, the BoJ raised its policy rate to 0.50% in January 2025. Although no hike is expected on June 17, the central bank has signaled vigilance toward imported inflation and yen depreciation. As a result, the USD/JPY interest rate gap remains wide but is gradually narrowing.

On the geopolitical front, Israel’s recent airstrike on Iranian strategic sites has lifted energy prices and reignited risk aversion. The VIX briefly jumped around 22, before retreating to 20. Historically, such uncertainty tends to benefit the yen, as risk-averse capital flows gravitate toward defensive assets.

Technical Analysis

The Japanese currency has gained over 8% year-to-date, with spot USD/JPY retreating to a low of 140 in April. This level corresponds to 0.007263 on the 6JU2025 futures contract.

We now shift focus to the September contract, with the March expiry settling this Monday.

After the volatility spike mostly driven by US tariffs (which pushed the VIX above 50 for the first time since the pandemic), risk conditions have stabilized. The yen has since consolidated within a well-defined range with stable volumes.

In late May, buyers stepped in aggressively around 0.00692, leading to a sharp rebound to 0.00710. Price action has now stabilized near 0.00700, inside a pivot zone that acts both as equilibrium and a tactical entry area. These dynamics suggest a buy-on-dip strategy may offer strong asymmetry.

If price returns to the 0.00692–0.00700 area, the trade setup remains valid. However, a clean daily break below 0.00691 would invalidate the bullish view and suggest a return to a broader sideways range.

Sentiment Analysis

According to the CFTC Commitment of Traders (COT) report, asset managers remain net long the yen, reflecting a structurally bullish bias. These positions are consistent with macro/geopolitical hedging strategies, and reflect growing expectations that the policy rate differential between the Fed and the BoJ may gradually narrow.

On the retail side, positioning is surprisingly neutral on USD/JPY, a rare condition for a pair often dominated by consensus directional trades. This suggests that retail traders are in a wait-and-see mode, likely due to the policy event risk ahead.

Options Analysis – The $7 Billion USD/JPY 145.00 Magnet

A massive $7+ billion USD/JPY option position at the 145.00 strike is due to expire Monday, June 16, at the 10am NY cut. This level currently acts as a gravitational anchor on spot price action, keeping USD/JPY within a tight range near 145.

Market makers are likely adjusting hedges as expiry approaches, suppressing volatility in the short term. This has also indirectly stabilized the 6JU2025 contract in the 0.00700–0.00705 range.

Once the strike expires, we may see a volatility release and potentially a new trend emerge, depending on the Fed-BoJ policy tone.

Trade Idea – Buy on Dip Around 0.00700

Strategy: Buy the pullback ahead of expiry and potential breakout

• Entry target: Buy at 0.0070000 (tactical dip zone)

• Stop-loss: 0.0069100 (below the May 29 rejection low)

• Take-Profit 1: 0.0071000 (recent resistance)

• Take-Profit 2: 0.0072500 (near YTD highs)

Rationale:

Geopolitical risk and Fed-BoJ policy events support safe-haven flows

• Technically clean reaction from 0.00692 suggests strong buying interest

• Option expiry-induced pin near spot 145 could offer a lower entry window

• COT positioning supports a bullish JPY view

• Attractive risk-reward setup with tight stop

This setup allows traders to take advantage of a volatility compression regime due to options expiry before potential breakout catalysts next week, with well-defined risk.

The 6JU2025 contract is currently resting in a strategic equilibrium zone near 0.00700. Macro fundamentals and speculative positioning both argue in favor of yen stabilization or modest appreciation.

The expiry of the $7B option on Monday, followed by central bank events midweek, could unleash a directional move. Until then, a dip-buying strategy near 0.0070 appears compelling, as long as the 0.00691 support holds on a daily closing basis.

When charting futures, the data provided could be delayed. Traders working with the ticker symbols discussed in this idea may prefer to use CME Group real-time data plan on TradingView: tradingview.com/cme/.

This consideration is particularly important for shorter-term traders, whereas it may be less critical for those focused on longer-term trading strategies.

General Disclaimer:

The trade ideas presented herein are solely for illustrative purposes forming a part of a case study intended to demonstrate key principles in risk management within the context of the specific market scenarios discussed. These ideas are not to be interpreted as investment recommendations or financial advice. They do not endorse or promote any specific trading strategies, financial products, or services. The information provided is based on data believed to be reliable; however, its accuracy or completeness cannot be guaranteed. Trading in financial markets involves risks, including the potential loss of principal. Each individual should conduct their own research and consult with professional financial advisors before making any investment decisions. The author or publisher of this content bears no responsibility for any actions taken based on the information provided or for any resultant financial or other losses.

Weekly FOREX Forecast Jun 2 - 6th: CHF & JPY FuturesThis is the FOREX futures outlook for the week of Jun 2 - 6th.

In this video, we will analyze the following FX markets:

CHF JPY

It's been a consolidative week, but the USD is still weak. Look for valid breakdowns of consolidations before buying against the USD.

NFP week ahead! Mon-Wed will be the best days to trade.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

Yen tells a different storyDespite the poor data that came out of Japan, the price action has been telling a different narrative. I'm going to pay attention on this asset until it has reached towards the Weekly objective. I'd like to see the price purge the obvious swing high as noted and fails to push higher to confirm my bias. Fundamentally all the data is supporting for the Yen to have a bearish outlook, but until it happens I'll wait for further confirmation.

Downtrend Confirmed Is the Yen About to Weaken Further?Hey Traders so today here is way to trade a downtrending market. See the Yen I have been able to connect 3 Bar trendline projecting it lower. But as you can see it has now pulled back to the trendline this is normally the best place to sell beacause momentum is on your side. Not only that but it also closed below the 50% retracement level which is also a strong bearish sign.

So if your going to think about selling YEN this is a good place.

However if your going to be bullish yen wait until a close about resistance.

Always use Risk Management!

Hope This Helps Your Trading

Clifford

How to Trend the Trend for Beginners part 3 Hey Traders so today we are going to the final part of the series for beginners about how to trade trends using techincal analysis.

So today we will go over what I believe is the best way to confirm that the market is trending using the best method.

Enjoy!

Clifford

The Yen’s Comeback Starts Here—and it Seems the COT Knew First1. Introduction: A Market Everyone Gave Up On

For a while, the Japanese Yen looked like a lost cause. After topping out in early 2021, Yen futures (6J1!) began an unrelenting slide, shedding value week after week like an old coat in spring. Traders stopped asking, “Where’s support?” and started asking, “How low can it go?”

The macro backdrop didn’t help. The Bank of Japan clung to ultra-loose monetary policy, even as the Fed hiked aggressively. Speculators piled on shorts. The Yen was a one-way ticket down, and no one seemed interested in punching the brakes.

But beneath that apathy, a quieter shift was underway. While price kept bleeding, trader positioning began to hint at something different—something the chart didn’t show yet. And if you were watching the Commitments of Traders (COT) report closely enough, you might’ve seen it.

2. The COT Trend That No One Was Watching

The COT report isn’t glamorous. It’s slow, lagging by a few days, and rarely makes headlines. But for those who track what the big players are doing—those large enough to be required to report their positions—it’s a treasure trove of subtle clues.

One of those clues is Total Reportable Positions. This metric tells us how active large market participants really are—regardless of whether they’re long or short. When that number is dropping, it suggests the “big dogs” are losing interest. When it starts climbing again? Someone’s gearing up to play.

From 2021 through most of 2024, Total Reportable Positions in 6J were in a steady decline—mirroring the slow death of the Yen's bullish case. But in late 2024, something changed. Using a simple linear regression channel on this COT data, a clear breakout emerged. Positioning was picking up again—for the first time in nearly three years.

And it wasn’t just a bounce. It was a structural shift.

3. Did Price Listen?

Yes—and no. Price didn't immediately explode higher. But the structure began to change. The market stopped making new lows. Weekly closes began to cluster above support. And importantly, a Zig Zag analysis started marking a pattern of higher lows—the first signs of accumulation.

Here’s where the chart really gets interesting: the timing of the COT breakout coincided almost perfectly with a key UFO support at 0.0065425—a price level that also marked the bottom in COT Traders Total Reportable Longs. This adds a powerful layer of confirmation: institutional orders weren’t just showing up in the data—they were leaving footprints on the chart.

And above? There’s a UFO resistance level at 0.0075395. If the Yen continues to climb, that could be a significant price level where early longs may choose to lighten up.

4. The Contract Behind the Story

Before we go deeper, let’s talk about what you’re actually trading when you pull the trigger on Yen Futures.

The CME Japanese Yen futures (6J) contract represents 12.5 million Japanese Yen, and each tick move—just 0.0000005 per JPY—is worth $6.25. It’s precise, it’s liquid, and for traders who like to build macro positions or take advantage of carry flows, it’s a staple.

As of May 2025, margin requirements hover around ~$3,800 (Always double-check with your broker or clearing firm—these numbers shift from time to time.)

But maybe you’re not managing seven-figure accounts. Maybe you just want to test this setup with more flexibility. That’s where the Micro JPY/USD Futures (MJY) come in.

Contract size: 1/10th the size of 6J

Tick move: 0.000001 per JPY increment = $1.25

Same market structure, tighter margin requirement around ~$380 per contract

Important note: The COT report aggregates positioning across the whole futures market—it doesn’t separate out micro traders from full-size. So yes, the data still applies. And yes, it still matters.

5. Lessons from the Shift

This isn’t about hindsight bias. The value in this setup isn’t that the Yen happened to bounce—it’s how Total Reportable Positions broke trend before price did.

Here are the real takeaways:

COT data may or may not be predictive—but it is insightful. When positioning starts expanding after a long contraction, it often signals renewed interest or risk-taking. That’s tradable information.

Technical support and resistance as well as highs and lows give context. Without them, COT breakouts can feel theoretical. With them, you have real, observable UFO levels where institutions may act—and where you can plan.

6. Watchlist Insights: Where This Might Work Again

You don’t have to wait for another yen setup to apply this framework. The same structure can help you scout for early positioning shifts across the CME product universe.

Here’s a simple filter to start building your own COT watchlist:

✅ Look for markets where:

Price has been in a long, clean downtrend (or uptrend)

Total Reportable Positions are falling—but starting to reverse

A breakout occurs in positioning trend (draw a regression channel and watch for a clean violation)

A key support or resistance lines up with recent extremes in COT positioning

Whether it's crude oil, corn, or euro FX, this template gives you a framework for exploration.

🎯 Want to See More Setups Like This?

We’re just getting started. If this breakdown opened your eyes to new ways of using COT reports, UFO levels, and multi-dimensional trade setups, keep watching this space.

When charting futures, the data provided could be delayed. Traders working with the ticker symbols discussed in this idea may prefer to use CME Group real-time data plan on TradingView: www.tradingview.com - This consideration is particularly important for shorter-term traders, whereas it may be less critical for those focused on longer-term trading strategies.

General Disclaimer:

The trade ideas presented herein are solely for illustrative purposes forming a part of a case study intended to demonstrate key principles in risk management within the context of the specific market scenarios discussed. These ideas are not to be interpreted as investment recommendations or financial advice. They do not endorse or promote any specific trading strategies, financial products, or services. The information provided is based on data believed to be reliable; however, its accuracy or completeness cannot be guaranteed. Trading in financial markets involves risks, including the potential loss of principal. Each individual should conduct their own research and consult with professional financial advisors before making any investment decisions. The author or publisher of this content bears no responsibility for any actions taken based on the information provided or for any resultant financial or other losses.

Weekly Forecasts UPDATES! ALL Markets Analyzed! Stocks & FOREXIn this Weekly Forecast UPDATE, we will analyze the S&P 500, NASDAQ, DOW JONES, Gold and Metals futures, and the FOREX Majors for Thursday, May 8th.

The targets set in last weekend's forecasts are still in play! Trade accordingly.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

Strengthen your trading strategy? How about a statistical entryFor those watching or trading the USD/JPY pair: the spread of 0.007–0.0072 on the Yen futures is still in play

We're 30 days out from expiry, and there are no clear reasons to brake a rally in the futures contract (which would mean a drop in USD/JPY).

Now, a quick word on Expected Range (ER) and its boundaries.

As we’ve seen, price didn’t quite reach the 2 ER level before bouncing back up. Quick note here — price doesn’t owe us anything. It doesn’t have to hit any statistically calculated levels just because we’re watching them.

But if it *had* reached that 2 ER boundary, it would’ve been a killer entry setup. Why? Because as a reminder, 2 ER marks about a 95% probability that price won’t break through — meaning a strong chance of a bounce.

P/S

For more detailed insights, don’t forget to check out our website and leverage the extensive original analysis from our team to enhance your trading performance! 💪💼

Has sellers set the tone?Although there was a positive close in the S&P 500 daily chart, sellers appeared at new highs. The broader structure is a neutral zone. This implies the possibility of a down day on Friday but not a large move lower. It will be very interesting to see how this market absorbs the Friday economic reports.

USDJPY / 6J1! - Compelling reversal pointThe Yen futures (inverted from USD.JPY) are entering a multi-year resistance level. Considering the yen has arrived at this zone on one-sided trading with high momentum, a reversal trade is compelling from a market psychology perspective. As an additional non-technical confluence, there are also news rumours circulating on social media streams regarding an imminent new trade agreement between the two countries.

If prices remain static for the next hour, the daily close will print a shooting star reversal candlestick pattern. Using a retracement entry at today's developing POC, which roughly aligns to the 0.382 intraday fib level, with a stop above the intraday (H1) swing high. A RR at opening of approximately 1:10 is available. Ideally, risk would be managed on H1 time frame for this type of trade.

Note USD.JPY Forex charting will be inverted from the futures.

Yen Outlook: Preparing for the Coming Week! During the recent short trading week, we did not observe significant changes in the portfolios of major players. No outflows or overbought conditions—this indicates that the targets remain unchanged, and we are getting closer to the 0.0072 mark. 📊

I recall how, back in mid-December of last year, we noticed the first signs of volume accumulation in the portfolio. It felt like discovering a new horizon! We shared this insight with our subscribers, allowing us to prepare a plan in advance and identify well-founded entry points for the rise of the yen futures. 🚀

Currently, as we maintain a long position on the futures (or a short on the dollar/yen pair), it is essential to keep in mind the boundaries of the expected volatility range.

We have marked these on the chart: the yellow rectangle for Monday and the red rectangle for the upcoming week. 📅

Given the sustained positive sentiment surrounding yen futures, opening a long position as the price approaches the lower boundary of the range could present an excellent opportunity . As indicated by the arrows on the screenshot, don’t miss your chance! 🎯

Summary, we see that the yen continues to be in focus, and we have a clear action plan. We are holding our long position, monitoring the range boundaries, and preparing for the opportunities the market presents. 🌈

No Valuable Data, No Edge!

6J1!: Yen Steady as Dollar Recovers: Reversal WatchThe Japanese Yen maintains its strength in relation to the recovering US Dollar. However, recent improvements in global risk sentiment are beginning to weaken the JPY's appeal as a safe-haven currency. At this point, the Yen is positioned within a significant supply zone, where we are closely monitoring for potential reversal opportunities.

According to the latest COT report, retailers are predominantly holding long positions, which adds an interesting dynamic to the current market environment. As we evaluate the situation, our focus is on the possibility of a reversal, especially as the US Dollar shows signs of regaining momentum. This scenario could lead to notable shifts in currency dynamics, and we are keen to see how these factors will unfold in the near term.

✅ Please share your thoughts about 6J1! in the comments section below and HIT LIKE if you appreciate my analysis. Don't forget to FOLLOW ME; you will help us a lot with this small contribution.

JPY Futures: Bulls vs. Bears at 0.00717 – Weekly Decision ZoneJapanese Yen Futures – Weekly Chart Analysis

The Japanese Yen has been climbing steadily after bouncing from a strong demand zone near 0.0062–0.0063, an area where buyers stepped in hard after months of selling. This bounce has created a solid uptrend, breaking previous highs and showing strong bullish momentum.

Right now, price is approaching a key resistance area where sellers took control in the past. This zone has already rejected price once, so we should be watching closely to see if it happens again.

Current Momentum showed us...........

-Strong buying from the demand zone

-Near break above recent highs

-Buyers in control short term

What to Watch Now is............

-Price is near a major supply zone (0.00717) this is where heavy selling occurred before, and sellers may show up again.

-If we see signs of rejection (like long wicks or a sharp drop), we might get a nice pullback

-f price breaks above 0.00717, that would be a strong bullish signal, possibly leading to more upside.

In short

-Short-term trend is Bullish

-Near-term risk possible reversal at resistance

-Trade idea is towait for price reaction at this key level. If rejection shows, short setups could form. If it breaks cleanly, bulls are still in control.