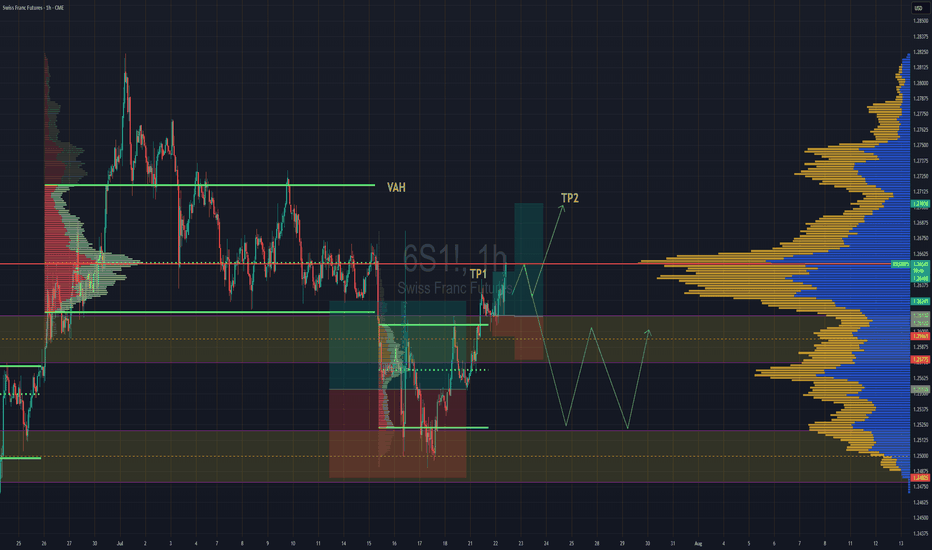

Swiss Gaining Momentum Against The DollarSwiss futures gaining strength against the dollar. We have broken back into previous rotation that was somewhat balanced, but still leaning towards a "b" style volume profile . If we are able to get above the POC, then we''ll go straight for TP2 close to Value are high.

If the POC is really strong

Related futures

Awaiting Breakout **Martingale Friendly**6S (Swiss Franc Futures) on the 1H chart is coiling within a tight range following a multi-day consolidation. Price action shows signs of compression near the mid-range, potentially gearing up for expansion. The current setup features a bullish R:R of ~1.8, with the entry positioned near support and

Swiss Shield: Buy the DipThe tariff agreement that seemingly fell from the Geneva sky earlier this month convinced investors to pivot toward risk-linked assets, allowing the Swiss currency to retreat temporarily. However, the Franc’s safe-haven status, combined with the fragile balance currently settling over the markets, l

Dollar Decline Against All Major CurrenciesThe Dollar’s decline didn’t start with the recent ‘Liberation Day’ tariffs. In fact, it has been gradually weakening since the 1970s.

More recently, however, the Dollar has lost value against many currencies since January. Why is that?

Why have the USD/CHF and USD/SGD strengthened against the US D

Swiss Franc Futures ShortAfter the recent market volatility caused by tariffs, the Swiss Franc skyrocketed and forced retail shorts to cover. Now those same retail traders have opened long positions at a similar rate. If the market begins to reverse these late retail longs will be forced to close. Therefore, a short positio

Why Has the USD Been Falling?Dollar has lost value against many currencies since January. Why is that?

The Dollar’s decline didn’t start with the recent ‘Liberation Day’ tariffs. In fact, it has been gradually weakening since the 1970s.

U.S. Treasury Futures & Options

Ticker: 6E

Minimum fluctuation:

0.000050 per Euro incremen

CHF Supply Demand Trade SetupSee picture for analysis.

-DXY had long-term weak fundamentals + Technicals which will be bullish for CHF and other currencies.

-Price broke downward trend line

-Price removed opposing pivto supply zones structure

-Demand created

Options:

1) possible buy back into 1hr demand

2) Wait for price to r

Support for CADCHF A **quiet day for our CADCHF**—no major moves so far.

I only notice a **slightly weaker tone on CHF**, or more precisely, those **three wicks on the future** suggest a **price rejection**.

Also, at the moment, the **volume delta is in favor of CAD**.

If no other data changes the picture, I’d

Swiss Franc LongRetail traders are currently in a crowded short position with price beginning to reverse. We aim to capture the losses of retail traders in a short squeeze. Additionally, a Swiss Franc long position could work in both a risk-on and risk-off environment given its long standing reputation as a safe ha

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of Swiss Franc Futures is 1.25550 USD — it has fallen −0.11% in the past 24 hours. Watch Swiss Franc Futures price in more detail on the chart.

The volume of Swiss Franc Futures is 11.23 K. Track more important stats on the Swiss Franc Futures chart.

Open interest is the number of contracts held by traders in active positions — they're not closed or expired. For Swiss Franc Futures this number is 75.80 K. You can use it to track a prevailing market trend and adjust your own strategy: declining open interest for Swiss Franc Futures shows that traders are closing their positions, which means a weakening trend.

Buying or selling futures contracts depends on many factors: season, underlying commodity, your own trading strategy. So mostly it's up to you, but if you look for some certain calculations to take into account, you can study technical analysis for Swiss Franc Futures. Today its technical rating is neutral, but remember that market conditions change all the time, so it's always crucial to do your own research. See more of Swiss Franc Futures technicals for a more comprehensive analysis.