Gamma Exposure Analysis SPY & VXX SPY Resistance at 570. The 570 level in SPY likely corresponds to a high gamma concentration for 0DTE (zero days to expiration) options. At this strike, market makers short gamma (i.e., net sellers of options) at this level would dynamically delta-hedge by selling SPY as the price approaches 570, creating selling pressure and resistance. Next resistance level 575.

For VXX , the 48 level likely represents a put-dominated gamma zone: If market makers are net long puts, they would buy VXX as prices decline toward 48 to hedge against further downside, creating support. Next support level 46.50

ES1! trade ideas

ES Premarket UpdateWell, I did mention the small open gap yesterday afternoon, lol.

Looks like Europe sold off and took the US futures with them, MFI is now OVERBOUGHT meaning more downside despite the open gap above. The market is breaking a lot of my usual rules, the only time the market left an open futures gap for an extended time was the initial COVID gap which stayed open for a year.

Looks like Trump is the new COVID, not playing the gap fill anymore, just playing 3 hr indicators now. Also, Powell did not say anything significant yesterday.

MES!/ES1! Day Trade Plan for 03/18/2025MES!/ES1! Day Trade Plan for 03/18/2025

📈5740. 5760

📉5680. 5660

Like and share for more daily ES levels 🤓📈📉🎯💰

*These levels are derived from comprehensive backtesting and research and a quantitative system demonstrating high accuracy. This statistical foundation suggests that price movements are likely to exceed initial estimates.*

ES UpdateWell, apparently you can't just rely on daily indicators and an open gap. All I did was lose money on premium burn with the calls I bought last week, but I added next week's XLF calls when the market opened and XLF went red for some stupid reason.

Wound up dumping everything near the daily peak when I regained lost profits, so at least I'm even now, lol. What I realized is that you gotta pay attention to the 3 hr indicators even at the bottom. You can see how it sold off Monday afternoon/night because RSI and MFI hit overbought, and we got the Powell pump because MFI hit oversold premarket today,

I don't have time to pay attention to the market all day because I have a job now, lol, so you guys will have to track MFI and RSI on your own. 3 hr chart, standard settings for RSI and MFI and make sure your time zone aligns with US east coast (NY), or else the 3 hr charts will look different.

There's also a small gap up aftermarket today that also needs to be filled. Probably more whipsaw, lol. At this point, I'm only trading if I see indicators go oversold or overbought. WIll post plots pre-market if I have time. Good luck.

A degree of comfortThe Fed laid out its forecasting for decreases in Fed funds rate through 2027. I think this brings a certain degree of comfort to the market that there is a roadmap to lower interest rates. The result was a positive movement in the S&P 500 daily chart. The expectation is for follow-through to the upside on Thursday but not a large move.

SP500 (E-mini Futures) - Decision TimeBigger Picture SP500 Futures Update - Decision Time

- Powell (FED) ruled out a recession in todays FOMC Press Conference (Bullish)

- Powell announced drastically slow down QT beginning next month (Extremely bullish for risk assets)

- The Asian and European stock market indices are still showing strength forming new ATHs week by week.

zone trading using fib zones The premise of the zones is as follows :

the zones , which are the orange boxes, present a target for price expansion. Once price CLOSES outside of any zone, not just the wick but the candle, there is a 70% chance it will travel that path to the next zone, before closing out from the zone which it came from. There is a caveat, for the orange line on the chart, between two of the zones, there is a 70% chance price will reach the orange line, not follow through to the end, though it may , as per my backtesting its not as certain as simply assuming it will touch the orange line.

Furthermore, If price reaches the end of one zone, and RSI + MFI are both overbought or oversold, this is a good indicator price may reverse to the zone start.

A good time to take profit for me is if price reaches the end of a zone, or if the MFI and RSI are overbought or sold against my position, I usually exit as that is a deccent signal for price reversal.

The zones should be used as a DIRECTIONAL BIAS , meaning that if the zones are for the hourly chart, you should be looking to enter on a lower timeframe, using your own trading strategy, this simply confirms you entry and tells you which trades might be good to avoid.

It can be used as a standalone strategy but I prefer to use it's bias for a few quick trades on a lower timeframe rather than wait the entire zone or risk a spike out, where price might enter the stop loss area, but not close on that end of the zone, and go the way it was predicted, this as you can guess, is a valid trade idea for a high RR trade reversal!

Dont just take my word for it..... look at the proof ......

Recap: Weekly Trade Plan March 10th, 2025CME_MINI:ES1!

In this TradingView blog, we will recap our trade plan posted on March 10th, 2025.

Please note that this is a recap, and since then, we have also published our updated price map and weekly plan for the current week. Today is also the Federal Reserve's decision day.

Here is our updated price map from the weekly plan published on March 10th, 2025:

Our updated price map for ES Futures

Key Levels:

• Important Level to reclaim if no correction: 5795.25 - 5800

• Key LVN: 5738 - 5696

• Mid 2024 range: 5574.50

• Key Support: 5567.25 - 5528.75

• 2024-YTD mCVAL: 5449.25

• 2022 CVAH: 5280.25

It is important to note that when we provide our thoughts and reasoning for the levels we map in our recap, we have the benefit of hindsight. Likewise, when we publish our weekly trading plan and share our thoughts at the start of the week, we are anticipating potential market movements on the hard right edge. This is where randomness and uncertainty are key points.

If we were to rank our process chronologically, this is how we note the importance of each component that makes up our plan.

1. Big Picture

2. Key Levels/Price Map

3. Scenarios

Our big picture is based on how we view the global macroeconomic and geopolitical landscape.

Key levels are mapped utilizing our methodology considering market auction theory and volume profiling. Note how our key level, 'Mid-range 2024', on higher time frame provided support.

At times you may see two scenarios, at other times three. Scenarios are just an anticipation which a trader should adjust should any new information come to light. Although you may note that our scenarios play out mostly from reviewing our blogs. Our aim is to help you create a process for yourself. Note how we anticipated near-mirroring price action for the week, though our reasoning was influenced by higher inflation data. However, the inflation reading came in lower than expected.

Fast forward to today, all eyes are now on the Federal Reserve’s rate decision, SEP, and the FOMC press conference scheduled for later today.

ES, Mar 19, 2025With today's FOMC Federal Funds announcement, I expect CME_MINI:ES1! to sweep liquidity below the current range, tapping into the daily liquidity level and daily average sweep zone before reversing higher. From there, I anticipate a push through the 4H Imbalance (IFVG) and continuation toward the daily average expansion area, which aligns with key daily buy-side liquidity.

This move would follow a classic liquidity grab and expansion pattern, with price reclaiming key levels and driving higher as liquidity unlocks. If buyers step in as expected, ES should have the momentum to reach and potentially exceed the daily expansion target. Note weekly FVG above daily expansion level.

However, if ES fails to displace above the 4H IFVG, it would signal a lack of strength to sustain a move higher. In that case, a rejection at this level could trigger a shift in momentum, increasing the likelihood of further downside as liquidity is redistributed lower. If that happens, I will be targeting the daily average expansion level at $5,600.

S&P 500 E-mini Futures VWAP Breakout Strategy Sharing a solid intraday idea for you all – something I’ve been running on the S&P 500 E-mini Futures (30-min chart) lately, and it’s been delivering clean setups.

VWAP Breakout Play

I’m focusing on simple VWAP-based breakouts. Here’s the breakdown:

The setup:

• Wait for price to break above or below the VWAP with strong momentum (big candles + solid volume).

• I always confirm with a momentum indicator like MACD or RSI to filter out the noise.

Entries:

• Breakout Long: When price pushes above VWAP + momentum aligns.

• Breakout Short: When price dumps below VWAP + momentum confirmation.

Exits & Stops:

• Scale out at session highs/lows or key pivots.

• Stop-loss goes just beyond VWAP to keep the risk tight.

• If momentum fades, I’m out.

Why I like it:

VWAP attracts institutional flow, and combining it with momentum gives this strategy a solid edge, especially around U.S. session opens when volatility kicks in.

Give it a try and tweak it to your liking!

All Relevant ES Levels Near Current Price (June Contracts)If you want to copy and paste these levels on your chart for the new June contracts:

- Scroll to the bottom outside of this chart publication and look for three dots (…).

- Click on those dots and select the option that says “Make it Mine” or “Grab this Chart”.

This will instantly apply my whole chart setup to your own TradingView account. Of course all you need is the levels, so you can adjust the colors or whatever else to your liking if need be.

ES/SPY PathLatest outlook analysis. Possible paths. (two main ones in my view) See how it has exited the channel? This could be good to free itself and produce upward movement out of the W pattern. Or of course it could paint a larger W even with a big exhaustion push down stopping out all the bottom pickers and scooping up all their shares before ripping higher. Of course there are those that speculate we are now transitioning into a bear market. Could they be right? Sure. could they be wrong? Yes. Could we be suck here for a while? Sure. I hope not!

ES futures update 18/03/'25In today's market update, I maintain a neutral stance. While we saw a breakout yesterday, price has since been rejected at the 1-hour resistance. The key area I'm watching is the 4-hour demand zone.

Since the overall trend on higher timeframes remains bearish, I plan to wait until price reaches this level—I'm cautious about entering long positions. If price clearly rejects bullishly from the 4-hour demand zone, I will go long.

However, if the 4-hour demand zone breaks down, I'll look for a short position on a retest of this zone.

18 March 2025S&P edged lower on Tuesday as investors awaited the Federal Reserve's upcoming meeting, which will be closely watched for insights on the potential economic impact of ongoing tariff disputes.

The central bank's two-day policy meeting begins later in the day and will conclude on Wednesday, with markets widely expecting it to keep interest rates unchanged. I believe that Trump may push the Federal Reserve to cut rates.

ES Morning Update March 18thYesterday, the plan for ES was straightforward: rally to ~5755 (adjusted for the June contract, previously 5703 on March) to back-test the 3-month megaphone breakdown from last Monday. The market followed through with an 88-point rally to that level before selling off.

As of now:

• 5720 (reclaimed) and 5698 are key supports

• Holding above keeps 5739 and a second test of 5754 in play

• If 5698 fails, look for selling pressure toward 5668

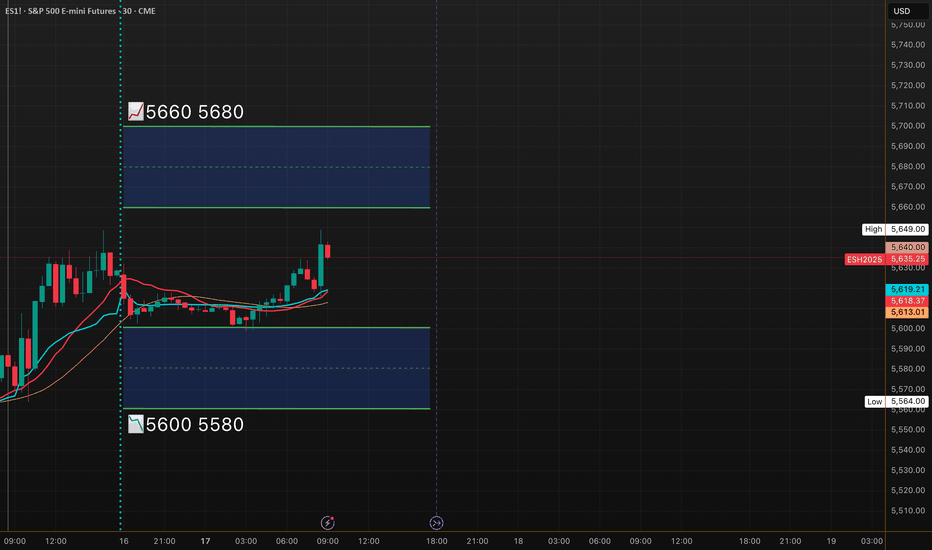

MES!/ES1! Day Trade Plan for 03/17/2025MES!/ES1! Day Trade Plan for 03/17/2025

📈5660. 5680

📉5600. 5580

Like and share for more daily ES levels 🤓📈📉🎯💰

*These levels are derived from comprehensive backtesting and research and a quantitative system demonstrating high accuracy. This statistical foundation suggests that price movements are likely to exceed initial estimates.*