Coming closer to a potential target for the shortsWell the grind down continues, Es has slowly been grinding down while giving some nice relief pops off of some measured moves of our Daytrader indicator on the bottom right giving traders a chance to join in the trend.

With no major news tomorrow I anticipate another move down to the next gap range on the top right chart and will be watching the yellow lines I have on the left chart that shows the last untouched retracement ranges from previous sessions.

I am not calling bottom there but I will be watching for a possible reaction to start scaling into longs if the opportunity presents itself, but with little catalyst I will not be slamming the buy button. We also have the contract change next week so we might not see anything exciting until after we transition to the next contract and the dust settles.

Trade well and take profit early, this market is giving lots of opportunities for short term trades that can come against you quickly!

ES1! trade ideas

Potential US Stock Market Crash Monday March 17,2025The United States stock market,

as measured by the S+P 500 Stock Index Futures June 2025 Contract (ESM25)

30 Years Of Continuous WEEKLY Chart DATA ( my own proprietary chart )

reveals the stock market could CRASH on Monday March 17,2025

IF todays ES June 2025 Contract Low of 5559.75 is violated Weekly Close on Friday 3/14 !!

Long positions in the stock US stock market should be closely monitored,

or sold outright if this were to occur tomorrow March 14,2025

ES June 25 Contract Last 3/13/25 248 PM 5600.

THE_UNWIND

WOODS OF CONNECTICUT

ES futures trade setup 13/03/'25Hello,

In today's trade analysis, I will review potential setups for this trading day. Since the overall trend is bearish, I favor short positions over long positions.

I have identified two important zones on the 4H timeframe that align well with the 1H timeframe.

4H supply zone: 5,643 - 5,630

4H demand zone: 5,577 - 5,558

We've seen both false breakouts and breakdowns in recent days, indicating choppy market conditions.

My plan is to either go short in the upper 4H supply zone or short a breakdown of the 4H demand zone. For the latter, I'll wait for the candle to close below the zone and set my entry on a retest.

ES Morning Update march 13thThis week has revolved around one key level in ES: 5568-72, which has been lost and reclaimed four times. At 11:20 PM yesterday, it triggered a long setup from an a textbook failed breakdown, leading to a 65+ point rally—and overnight, the same pattern repeated again.

As of now:

• No change—5568-72 remains weak support

• A 5599 reclaim sets up a move to 5616, 5643+

• If 5568 fails, expect further downside

ES1! Wyckoff ReversalPrice these past days has started consolidation right above a unmitigated 4H ORB from september 2024. Selling pressure seems to be weakening and showing some noticable steps to forming wyckoff re-distribution. waiting for price to purge into the ORB, then moving onto to final confirmation.

ES1! Next 12M price action prediction:

1. santa clause run up into year end into HTF resistance

2. sell of in jan we lose 50DMA and support in green line, but then find support on 200DMAQ and support in red + green line.

3. we run up intil end of may and then lose 200DMA to later on drop 20% down to 200WMA and HTF Support.

4. We then run it up again in 2025 2H and 2026

Es Potential for some more downside before we start moving upEs has been in a downtrend for a while now with buyers eagerly trying to dig in a foothold for the next leg up.

These are a couple indicators I have created the right screen is a gap filter range that price will revisit and use as support/resistance before moving to the next one. As you can see today ES has retested the upper range again and we are right back down below it so I am watching for some fresh downside before I look to start taking longs.

The right screen also shows a channel we have been in and an Indicator I created that shows the average retracement ranges of the day and then draws boxes that price will partially or fully mitigate and the boxes will reflect the color (yellow for partial and red for full mitigation).

As you can see the trend has been to clean up some of the most recent ones to make another step down, I will be watching for a reaction if we get down there to start assuming longs. Or we might blast right out of this with news but with todays reaction Im fully expecting some more directional moves down first.

Maybe it's not as bad as we think....I have seen some very goofy things take place in the market, but in 40 years of trading this is really a very special time of misplaced faith in the old style charting, but I can't help but want to buy here. People were literally throwing away their stocks like last Sunday's paper. My world as perceived through e-mini's say's: caution is warranted on the long side, but selling here is just too gut wrenching. Buying into this mess and expecting it's going to turn around tomorrow might be a bit bold, but trading here with a view towards the long side makes sense. A .382 retracement brings us back to the 5716 area and a .618 back to 5820 plus or minus a few ticks.

We will be rolling from March into June contracts soon, and that is always a jolly time and may even provide some upside momentum.

Recap ES Futures Weekly PlanCME_MINI:ES1!

In this TradingView blog, we’ll recap the price action and share our insights from the weekly trade plan posted on March 3rd, 2025.

Our Scenario 3 highlighted mounting risks, with weaker economic data reigniting the stagflation theme. While the price action largely aligned with our expectations, it extended further downward than anticipated. Economic data was mixed: PMIs exceeded expectations, while the NFP report came in lower than forecasted. The unemployment rate ticked up to 4.1%, and average hourly earnings data showed mixed results. The Month-over-Month figures were in line with expectations, but Year-over-Year average hourly earnings came in slightly lower at 4% versus the consensus of 4.1%.

In addition, headline news and tariff uncertainties dampened sentiment across the board.

Our approach primarily involves volume profiling and market auction theory to map out price levels and set expectations based on the prevailing market context at the start of each week. However, as fundamentals, macroeconomic factors, geopolitics, and headline news gain increasing significance and impact the market, we draw on our accumulated experience to incorporate these elements into our analysis.

When market regimes shift, technical analysis alone often proves insufficient. A strong understanding of fundamentals, macroeconomic conditions, and geopolitics is crucial to staying aligned with what’s actually happening in the markets, rather than relying on your personal thoughts and assumptions.

Given the myriad factors influencing the economy and markets, traders should recognize that each approach has its merits. We recommend sticking with the strategy that works best for you.

ES Morning Update March 12thSince I prioritize Failed Breakdowns, my job is pretty simple—do absolutely nothing until we get one. This is how you keep an incredibly high wind rate, while easily scaling your accounts. Yesterday, the 5569-72 reclaim triggered the long setup, leading to a 70+ point rally to the 5608 target, where we’re still holding.

As of now:

• 5599, 5569-72 must hold through CPI volatility to keep 5645, 5668, and 5703 in play

• A failure below could open up more downside

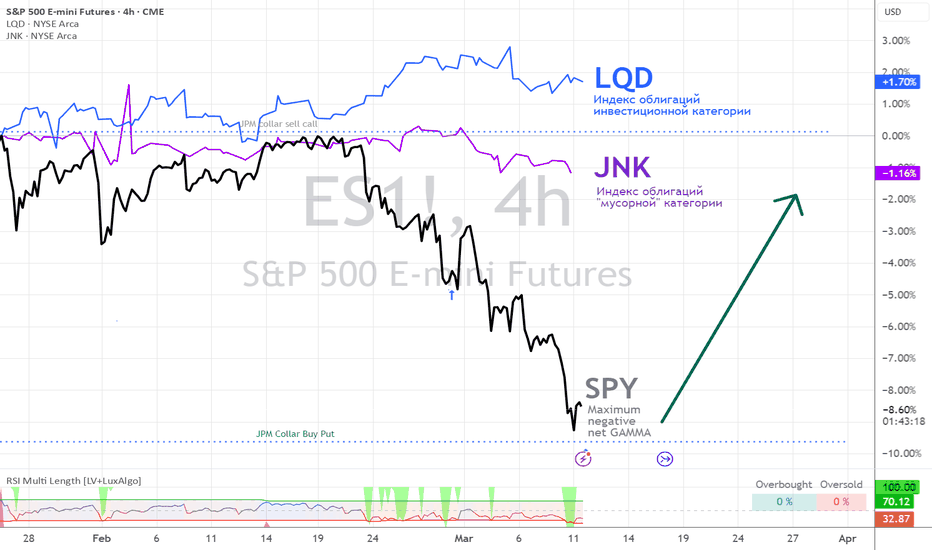

S&P 500 – Unstable Ground, Smart Money Seeks Stability🚨 S&P 500 – Unstable Ground, Smart Money Seeks Stability 🚨

“Markets don’t like uncertainty. Money flows where confidence is strong, and right now… that’s NOT here.”

🔥 Key Concerns:

✅ U.S. Policies Creating Instability – A crisis-driven environment shakes investor confidence.

✅ S&P Struggling to Hold Strength – Momentum is weak, smart money is hesitant.

✅ Blue Box = First Resistance Zone – A tough level to break, especially in this macro climate.

💡 The Game Plan:

Short Bias from the Blue Box – Until proven otherwise, this level is resistance.

LTF Breakdowns & CDV Confirmation = High-Probability Shorts – We don’t guess, we react.

No Clean Break Above? The Trend Remains Fragile.

“Markets punish uncertainty. Right now, the S&P is walking on thin ice—be cautious, be tactical.” 🔥📉

I keep my charts clean and simple because I believe clarity leads to better decisions.

My approach is built on years of experience and a solid track record. I don’t claim to know it all, but I’m confident in my ability to spot high-probability setups.

If you would like to learn how to use the heatmap, cumulative volume delta and volume footprint techniques that I use below to determine very accurate demand regions, you can send me a private message. I help anyone who wants it completely free of charge.

I have a long list of my proven technique below:

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

I stopped adding to the list because it's kinda tiring to add 5-10 charts in every move but you can check my profile and see that it goes on..

To INFINITY, AND BEYOND!! Double Bottom on the ES 1HThe E-mini S&P 500 (ES) is showing signs of a possible market bottom formation after a significant pullback. We are seeing key support levels around 5600.00 holding strong, and the price action is showing signs of a potential reversal to the upside.

Sellers are slowing downThe price action on the daily chart in the S&P 500 implies sellers are still in the market but they are slowing down. The possibility that we've gotten low enough to find buyers is showing up in the current structure. However, no reason to be a buyer at current levels we need to see upward price movement to give us an indication that buyers are present.

ES (March 2025) - Open Interest @ $2.1MWhen aiming for low hanging fruits, it is imperative to understand the boundaries that price cannot go to within a certain time period if the bias is going to play out.

Ideally, I would want to see Monday to Wednesday's price action to book the highs of the week before declining through the weekly BISI FVG @ 5797.75 - 5752.

Sunday gap opening will determine the likelihood of this bias delivering

S&P futures daily chart reviewThe very basic structure of price action is Spike, Pullback and Channel, final flag, double top and reverse to test the start of the channel. I would expect a minor reversal soon, since the market is so badly oversold, but there will be sellers above and a second leg will take the market to target. The lower probability event is a continued move straight to target. IN either case, the bull case is being badly damaged, and may lead to a 2022 multi-leg selloff.

For the first time since 2022, the trade is bearish, and bears are making money.