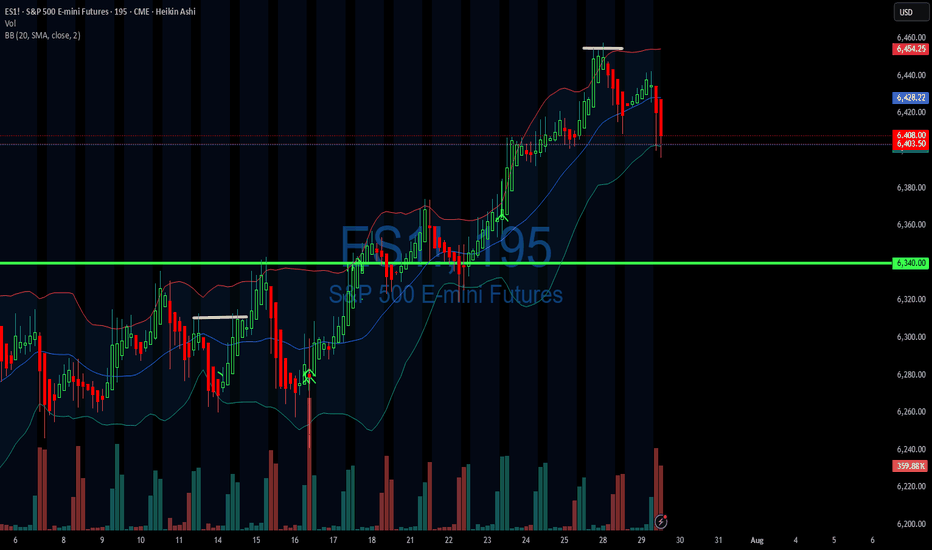

S&P 500 (ES1): Post FOMC, Buyers Pushing Back To The Highs!In this video, we will analyze the following FX market for July 31 - Aug 1st.

S&P 500 (ES1!)

In the Weekly Forecast for the S&P 500, we highlighted:

- price is bullish, and expected to go higher. It did move to ATH before pulling back.

- the sell side liquidity under the ascending lows would dr

Related futures

07/29/25 Trade Journal, and ES_F Stock Market analysis EOD accountability report: +734

Sleep: 5 hours

Overall health: Been struggling with sleep due to heat waves

VX Algo System Signals from (9:30am to 2pm)

— 8:00 AM Market Structure flipped bearish✅

— 9:30 AM VXAlgo NQ X3 Buy Signal✅

— 9:36 AM Market Structure flipped bullish on VX Algo X3! ❌

Stop-Loss Strategies in Retail TradingA Comprehensive Scientific Analysis of Risk Management Effectiveness

This essay provides a comprehensive analysis of stop-loss strategies in retail trading environments, synthesizing empirical evidence from behavioral finance and quantitative risk management literature. Through examination of over

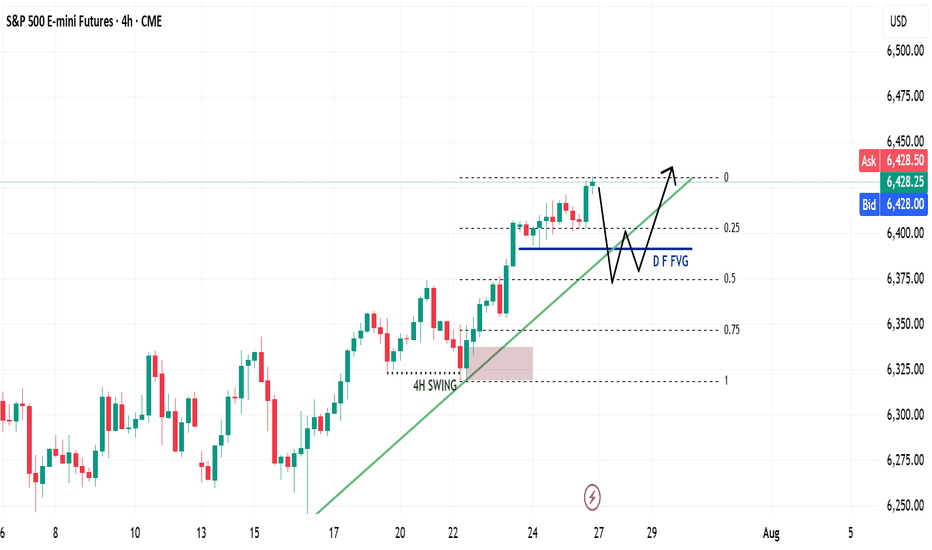

S&P 500 (ES1): Buyers In Control Amid Tariff Deals & EarningsWelcome back to the Weekly Forex Forecast for the week of July 28 - Aug 1st.

In this video, we will analyze the following FX market:

S&P 500 (ES1!)

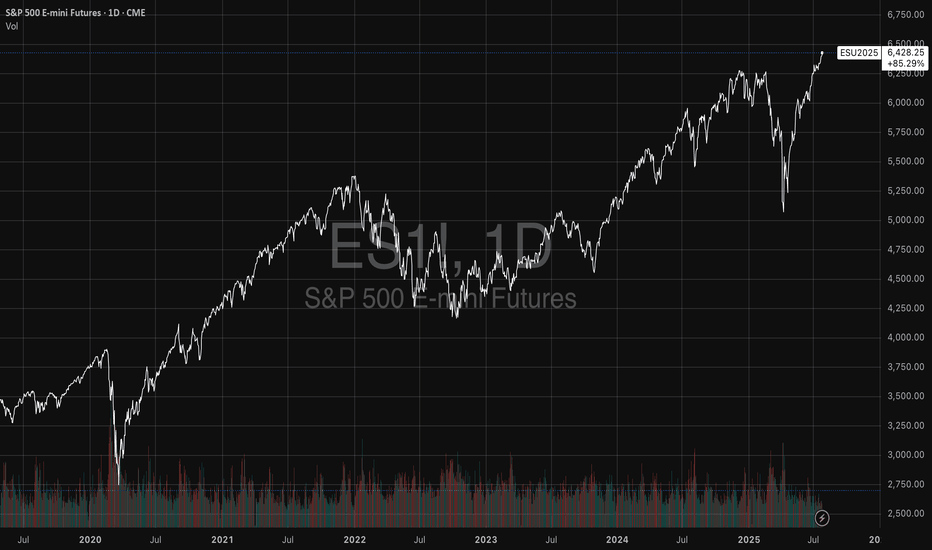

The S&P 500 rose Friday to fresh highs, following a busy week of tariff updates and earnings. The S&P ended the week with its fifth straight record

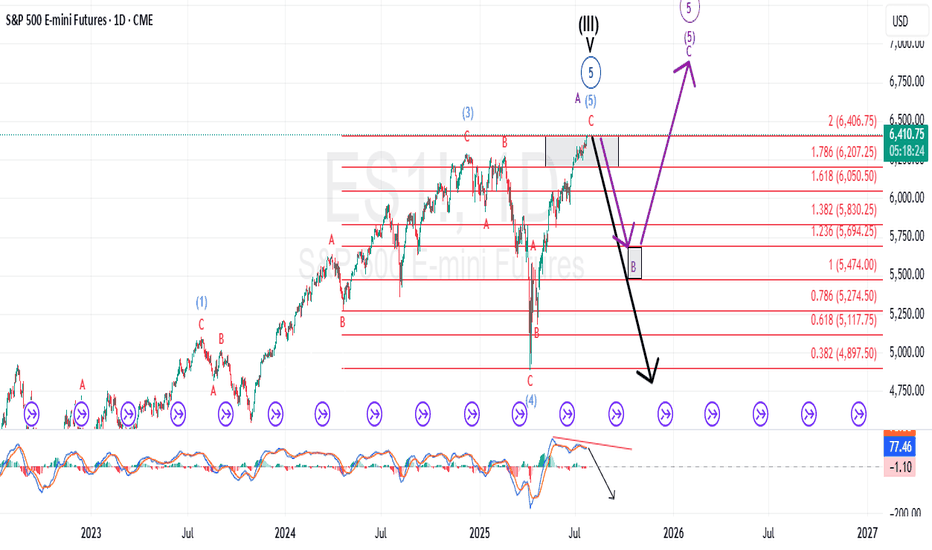

SP500 E-Mini Futures will pump to 6,442.00 and then dump hardSP500 E-Mini Futures is showing in the lower timeframes a possible continuation at least more 6,30% reaching the 6,442.00 mark and at the same time with some bearish divergences in the higher time frames that if the price gets there could iniate a pullback between 30% and 40% to bring the price back

Extended rally off April lows should be completing imminentlyEvery so often, a market move defies conventional expectations of retracement—and the rally off the Liberation Day lows is exactly that. It’s extended longer and climbed higher than even the most bullish forecasts imagined in early April. No one remembers the calls for an imminent recession by most

Time to catch its breathAfter the break to lower prices in the daily S&P 500 chart, the expectation for Monday is for the market to stop and catch its breath which means are not looking for a big day down on Monday but rather a sideways so only slightly lower move without new fundamental information to stimulate the market

ES Weekly Recap & Gameplan – 27.07.2025🧭 Market Sentiment

The overall sentiment remains bullish, supported by:

• Declining inflation figures

• Trump’s pivot toward aggressive rate cuts

This shift reinforces a risk-on environment across U.S. indices.

🔙 Previous Week Recap

• ES continued its price discovery journey

• Price ran the 4H swin

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of E-mini S&P 500 Futures (Sep 2026) is 6,463.00 USD — it has fallen −2.09% in the past 24 hours. Watch E-mini S&P 500 Futures (Sep 2026) price in more detail on the chart.

Track more important stats on the E-mini S&P 500 Futures (Sep 2026) chart.

The nearest expiration date for E-mini S&P 500 Futures (Sep 2026) is Sep 18, 2026.

Traders prefer to sell futures contracts when they've already made money on the investment, but still have plenty of time left before the expiration date. Thus, many consider it a good option to sell E-mini S&P 500 Futures (Sep 2026) before Sep 18, 2026.

Open interest is the number of contracts held by traders in active positions — they're not closed or expired. For E-mini S&P 500 Futures (Sep 2026) this number is 14.00. You can use it to track a prevailing market trend and adjust your own strategy: declining open interest for E-mini S&P 500 Futures (Sep 2026) shows that traders are closing their positions, which means a weakening trend.

Buying or selling futures contracts depends on many factors: season, underlying commodity, your own trading strategy. So mostly it's up to you, but if you look for some certain calculations to take into account, you can study technical analysis for E-mini S&P 500 Futures (Sep 2026). Today its technical rating is sell, but remember that market conditions change all the time, so it's always crucial to do your own research. See more of E-mini S&P 500 Futures (Sep 2026) technicals for a more comprehensive analysis.