Time to invest in JPY and TN/bond? Hello FX/futures traders!

Market is at a pivotal point. Not in a bad way, but in a good way!

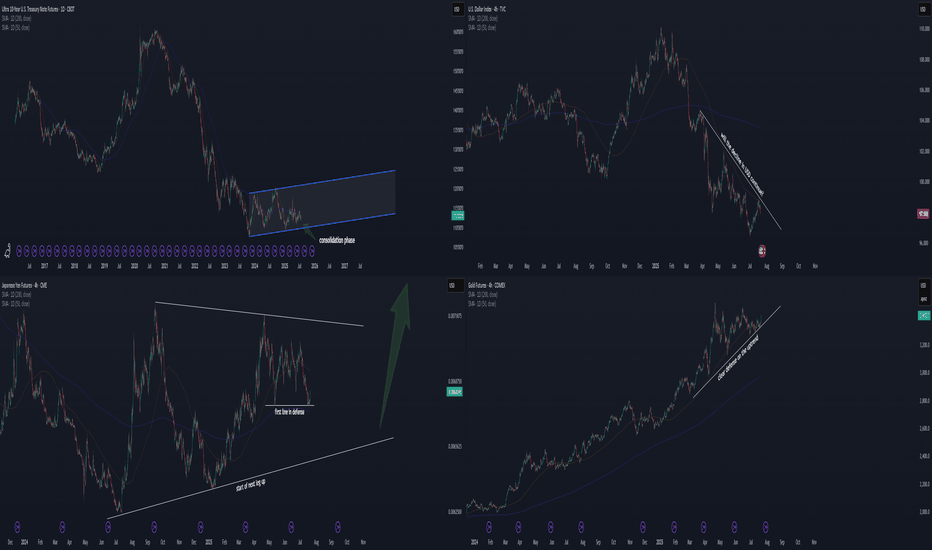

Chart 2: TVC:DXY

Let's start with the US Dollar . A declining USD was just well defended the last few days. If this is true, then the stock up, dollar down scenario is likely to continue. This is good

Related futures

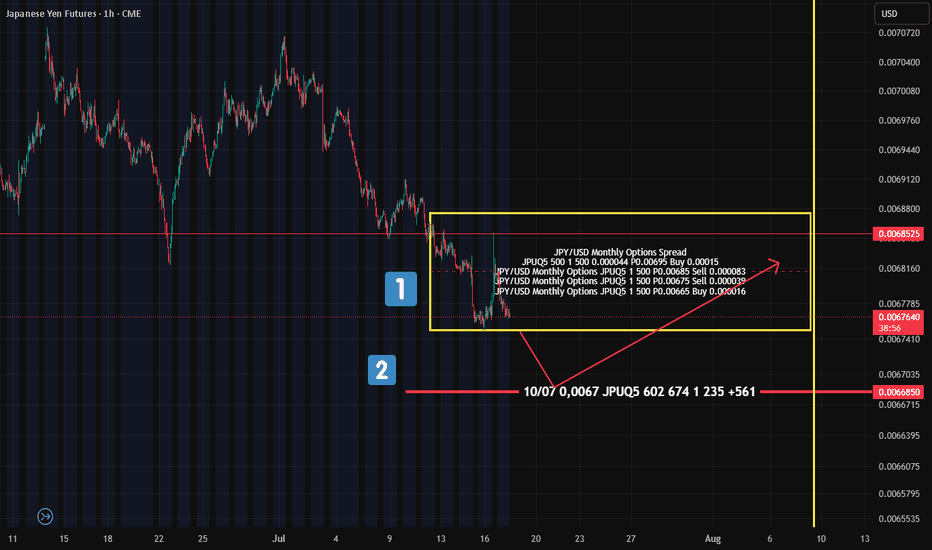

Yen Futures Options: What the "Put Condor" Tells Us About FutureA quick look at the options sentiment on Japanese Yen futures (not spot) — and there’s something interesting on the flow radar.

On July 10 , a "Put Condor" was placed — boundaries marked by the yellow rectangle on the chart (№1).

The goal of this setup? Price should expire within these boundaries —

USDJPY. 14.07.2025. The plan for the next few days.The nearest interesting resistance zones have already been worked out at night and have given a good reaction. Let's mark the others where we can expect a reaction. It's not certain that there will be a major reversal, but I believe we will see a correction that can be monetized. We are waiting for

JPY/USD 6J Futs : Alignment Across All Frameworks🧭

✅ 1. Macro Outlook (Bearish JPY → Bullish USDJPY → Bearish JPYUSD short-term)

BOJ is behind the curve (still dovish)

Fed remains restrictive

Japan faces weak exports, aging demographics, and trade shocks

Result: Short-term pressure on JPY → price consolidates in Discount zone

🟢 This explains

July 7 - 11th: Sell The RIPs, Buy The DIPs! (PART 2)Welcome back to the Weekly Forex Forecast!

This is Part 2 of the FOREX futures outlook for the week of July 7 - 11th.

In this video, we will analyze the following FX markets:

CHF and JPY

Last Friday was a bank holiday, so the price action is discounted. This Monday has no red folders on the cale

Buy the Dip into 0.0070 Pre-Expiry Pin & Policy RiskThe Japanese yen has experienced significant swings in recent weeks, both higher and lower, reflecting a fragile balance between diverging monetary policies and ongoing geopolitical uncertainty. That said, its status as a safe-haven currency continues to offer it defensive appeal among global invest

Weekly FOREX Forecast Jun 2 - 6th: CHF & JPY FuturesThis is the FOREX futures outlook for the week of Jun 2 - 6th.

In this video, we will analyze the following FX markets:

CHF JPY

It's been a consolidative week, but the USD is still weak. Look for valid breakdowns of consolidations before buying against the USD.

NFP week ahead! Mon-Wed will be t

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of Japanese Yen E-mini Futures is 0.006769 USD — it has fallen −0.69% in the past 24 hours. Watch Japanese Yen E-mini Futures price in more detail on the chart.

The volume of Japanese Yen E-mini Futures is 194.00. Track more important stats on the Japanese Yen E-mini Futures chart.

Open interest is the number of contracts held by traders in active positions — they're not closed or expired. For Japanese Yen E-mini Futures this number is 1.83 K. You can use it to track a prevailing market trend and adjust your own strategy: declining open interest for Japanese Yen E-mini Futures shows that traders are closing their positions, which means a weakening trend.

Buying or selling futures contracts depends on many factors: season, underlying commodity, your own trading strategy. So mostly it's up to you, but if you look for some certain calculations to take into account, you can study technical analysis for Japanese Yen E-mini Futures. Today its technical rating is sell, but remember that market conditions change all the time, so it's always crucial to do your own research. See more of Japanese Yen E-mini Futures technicals for a more comprehensive analysis.