MCD1! trade ideas

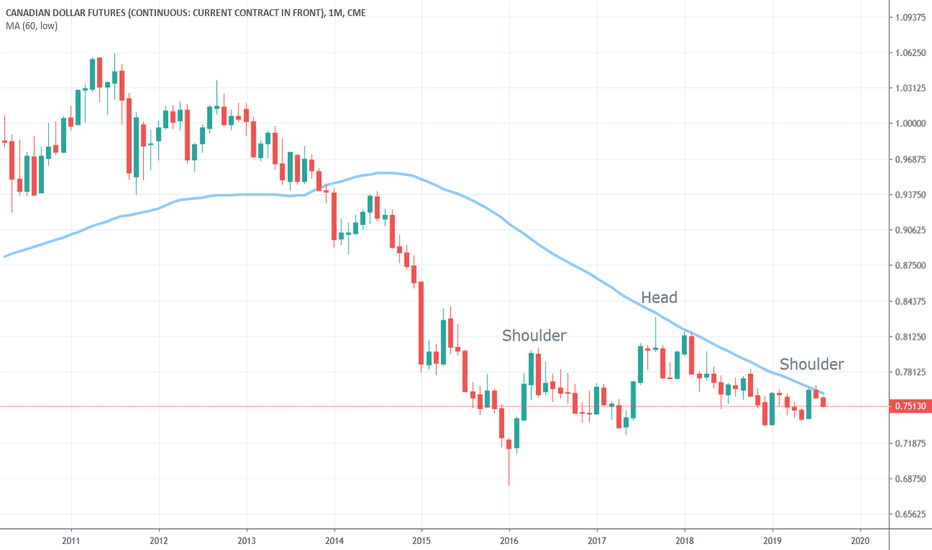

CAD big opportunity!Here is my analysis on the canadian dollar .

A very nice movement to take.

we have the break of the trendline (0.70850) and the pullback.

1st level 0.71860 then direction 0.7330

BE CAREFUL , I love the support trend too, if it's going lower than 0.70375 be careful.

Comment & like my analys.

And ollow me!