Scalper’s Paradise Part 3 – The Power of Order Flow and DOMWelcome back to Scalper’s Paradise! In this third part of the series, I want to take you into one of the most powerful tools in professional trading: Order Flow and the Depth of Market (DOM).

I chose this topic because during my time as an institutional trader, this was our entire world. We didn’t use indicators. We didn’t guess. We traded exclusively based on what we could see happening live in the DOM and Time & Sales. Every decision was made tick by tick, based on real market activity.

That experience shaped the way I view markets forever—and today, I want to share that perspective with you.

What Is Order Flow, Really?

To me, Order Flow is the most honest information the market can give you. It doesn’t predict, it reveals. It shows who is actually making moves right now. When I was sitting at my institutional desk, I didn’t look at moving averages or oscillators. I looked at who was being aggressive: were market buyers lifting offers, or were sellers smashing the bid?

Watching the tape (Time & Sales) and the footprint chart was like watching a fight unfold in real time. No filters, no guesses. Just raw interaction between buyers and sellers. That’s where real decisions are made.

The DOM: My Daily Reality as a Trader

The DOM (Depth of Market) was the first thing I looked at every morning, and the last thing I closed at night. It shows all visible limit orders resting at each price level. But there’s a catch: not everything you see is real.

In the institution, we were trained to spot real interest versus manipulation. Stacked bids might look strong, but if they disappear the moment price drops tells you that there was never a true intent. Iceberg orders were more interesting, when price gets hit again and again and doesn’t move, that usually meant someone was absorbing quietly.

Reading the DOM is like reading an X-ray of the market’s intentions. And yes, there’s a lot of noise, a lot of deception. But once you learn to read through it, it’s the most powerful tool you’ll ever have.

How We Used Order Flow on the Institutional Side

At the institution, we never chased price. That was rule number one. We let the market come to us (meaning: we used Limit Orders as often as possible) and we used Order Flow to guide every decision.

One of the most important concepts was absorption . If we needed to build a large long position, we didn’t just slam the ask. We would let sellers come in and hit our bids again and again and again. If price didn’t break lower, that told us we were in control.

On the flip side, when we needed to move the market , we switched gears. We used market orders aggressively to push through key levels, forcing reactions, triggering stops, and creating follow-through.

And yes, there were times when we intentionally created traps . We’d push price into obvious zones, make it look like a breakout, then fade it, because we knew how the market reacts afterwards. Order Flow was the only way to read those games in real time.

How You Can Use This as a Retail Trader

I know what you might be thinking: “I’m just a retail trader, how can I possibly use tools like Order Flow or DOM the way institutions do?”

The good news is: you don’t have to compete with institutions, you just need to read their intentions.

Here’s how I would approach it today:

1) Open a footprint chart and look for imbalances, areas where one side is clearly more aggressive. Watch for absorption or sudden volume spikes.

2) Watch the Time & Sales feed. Is there a flurry of trades hitting the ask, but price isn’t moving? That’s someone selling into strength.

3) Use the DOM around key areas like VWAP, previous day high/low, or liquidity clusters. Are orders getting pulled? Is size appearing suddenly? These are all signals.

You don’t need to be early. Let the big player act first, then confirm what you’re seeing across Order Flow and DOM. When everything aligns, that’s your edge.

Bringing It All Together

In Part 1, I shared how we used VWAP and Volume Profile as benchmarks to evaluate execution quality. In Part 2, I showed you how I identify institutional activity using raw volume and 10-second charts. And now, in Part 3, you’ve seen the real-time decision-making tools: Order Flow and DOM.

These aren’t indicators. They’re not theories. They’re the actual battlefield where institutions operate and where I learned to trade.

My goal with this series has always been simple: to give you access to the same mindset I used at the institutional level, but through a lens that makes sense for your reality as a retail trader.

Don’t try to outsmart the market. Observe it. Align with the big players. Let their behavior guide your decisions.

That’s how I learned to trade professionally—and it’s exactly how you can start thinking and acting like a pro, even without the size.

Part 1:

Part 2:

MNQ1! trade ideas

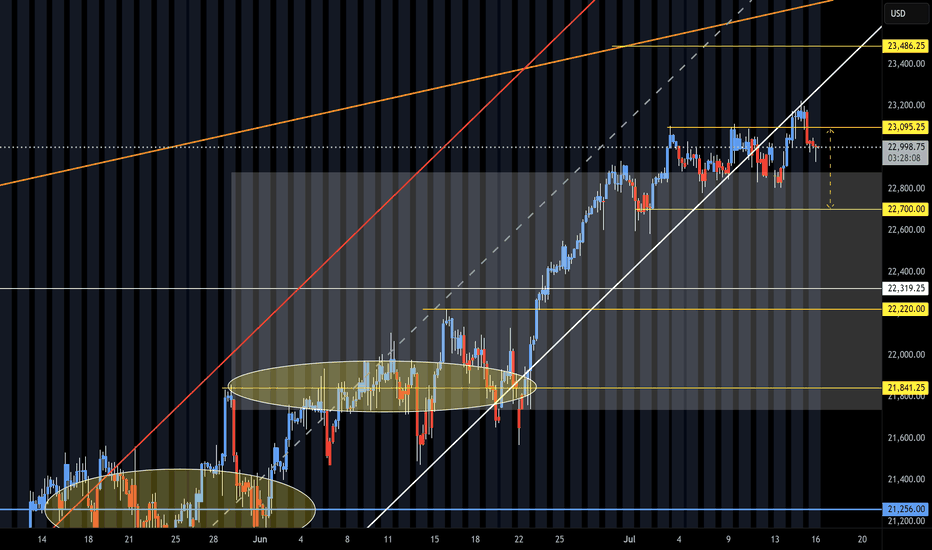

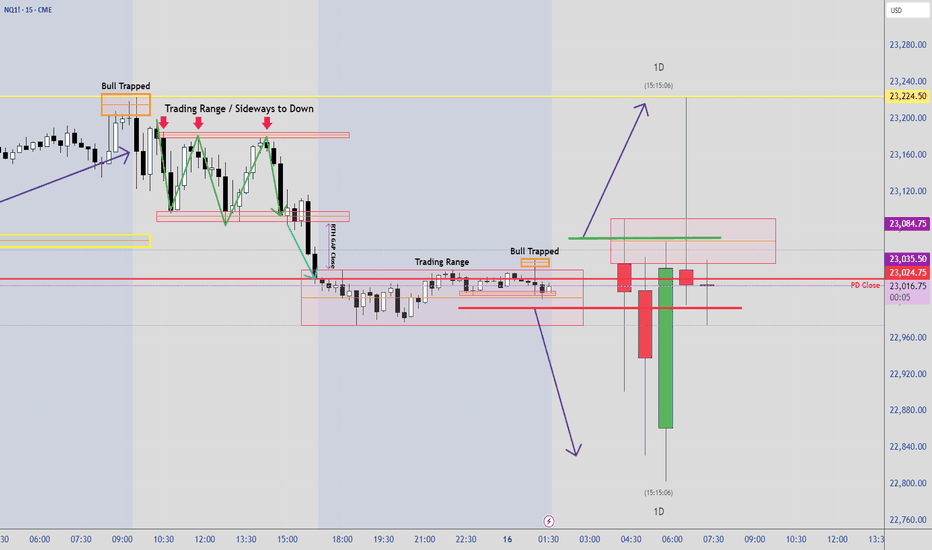

To fade all time highs or not?Not trying to fade ATH run but the SSL in this daily range looks too obvious to me. Super premium.

Price was in a consolidation July 7th - 14th. Took external range high today. I really could see shorts playing out if theres a intraweek reversal confirmed after purging the ERH.

Would need to see 1h CISD confirm intraweek reversal to the downside then trade the daily continuation lower targeting 22,779, 22,578 & EQ of the range at 22,370. Also, the daily BISI that needs sellside delivery.

CPI scheduled this week. PPI following.

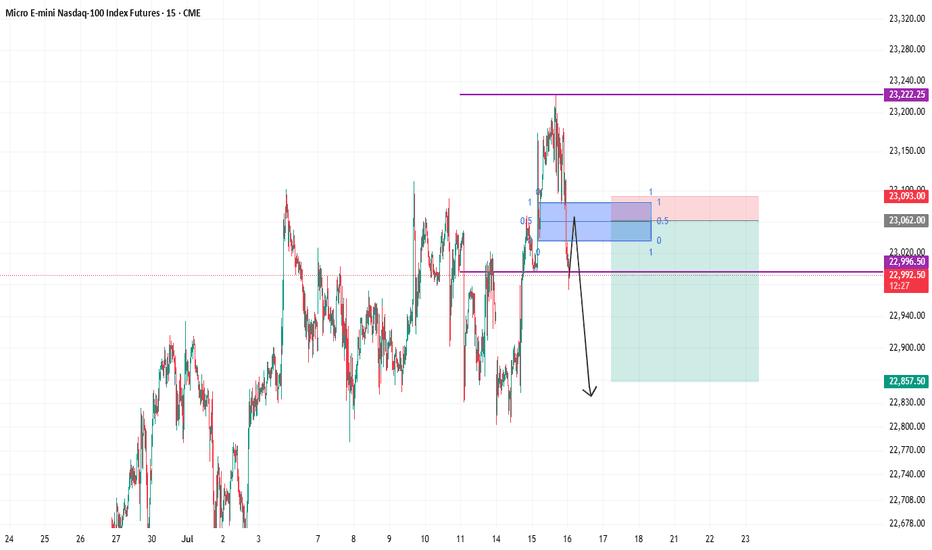

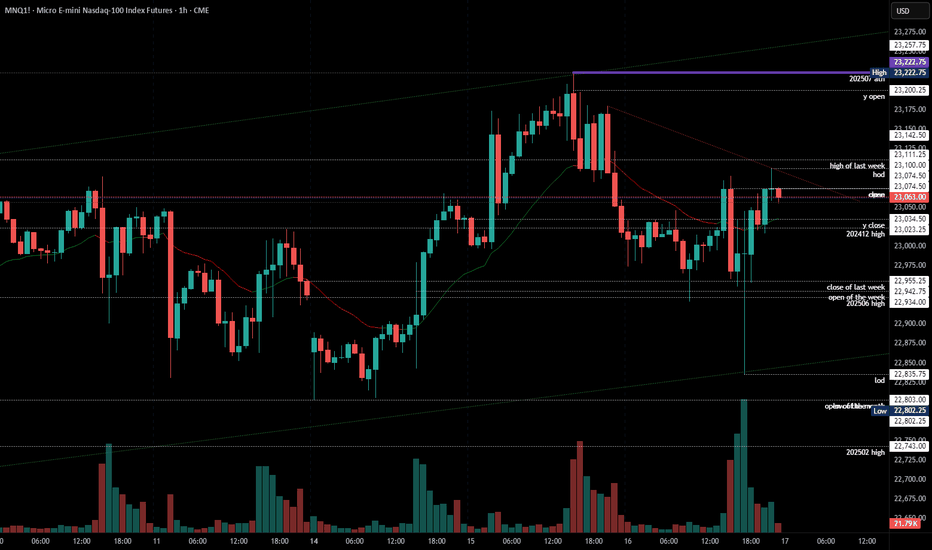

NASDAQ: Time For A Pullback?In this Weekly Market Forecast, we will analyze the NASDAQ for the week of July 14 - 18th.

The NASDAQ had a strong week, until Tariff Tensions Friday arrived.

This by itself doesn't mean we should start looking for sells. Just like the S&P 500, I'm expecting short term bearishness, as price goes from ERL to IRL.

With Tuesday CPI Data coming, this short term consolidation is to be expected until the news is announced.

Let the markets pick a direction, and flow with it.

Have a plan of action in place so you can react to the price action promptly!

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

NQ Short (07-16-25)NAZ again can't hold on the Monday off session pump during the Reg Session and does hit lower zone of 22,920. Next trick is Gov't controlled news (released in off session of course) should that not lift it then KL's 881-780 may be next.

The NAZ will go lower under 780 and will be a Strong Short under 22,700. The issue is with getting past the off session propping/rigging (up). Circles to the left are drop target zones that are likely to be revisited as ultimately the NAZ goes sideways in a larger range. The current 14 day sideways moves feels like an Long Mop up or Long Trap. The NAZ will need Tweets, O/N Prop moves and Dead Zone magic lifting to stay away from the Danger Zone of sell orders near 22,881-780.

Shorting NQ Yep, weakness started to creep in on NQ this time.

Firstly, the higher timeframes shows massive divergence, even when whales tried to push the price high and continue the trend, massive shorts came in with massive volume. It only tells me that bears are in control this time, and they are coming in with force.

So technically, iam looking for a short up until 22,858

What is really confusing is that also gold is showing weakness which is really something odd, so either iam right in my analysis for Gold and NQ or iam wrong in one of them.

But we will see.

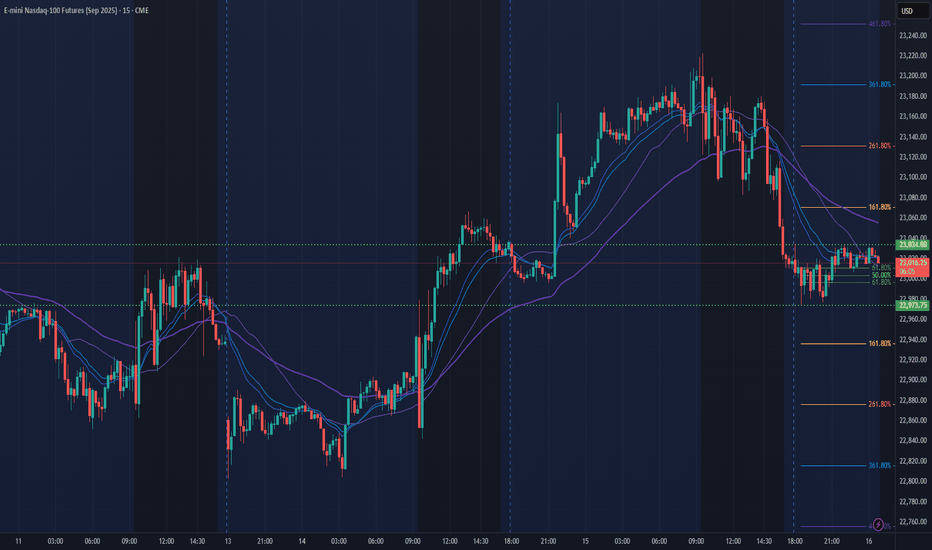

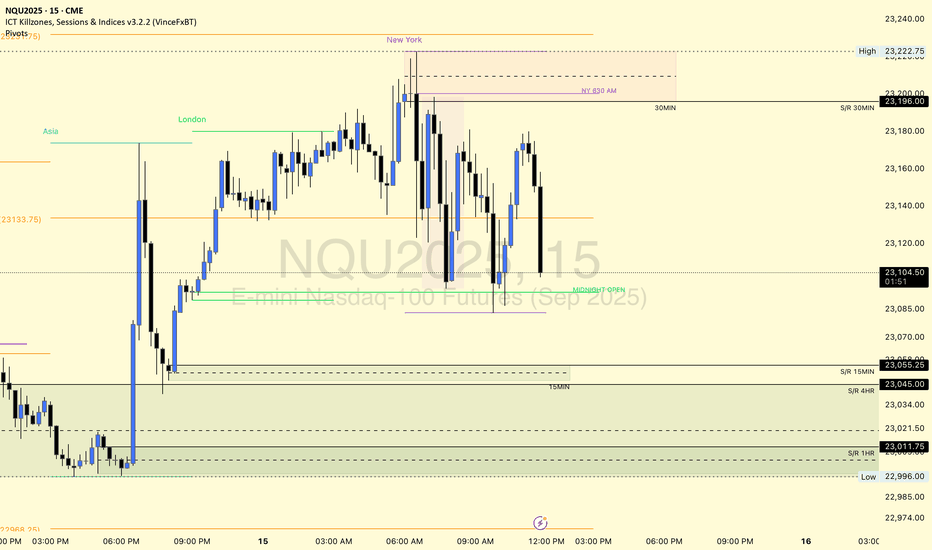

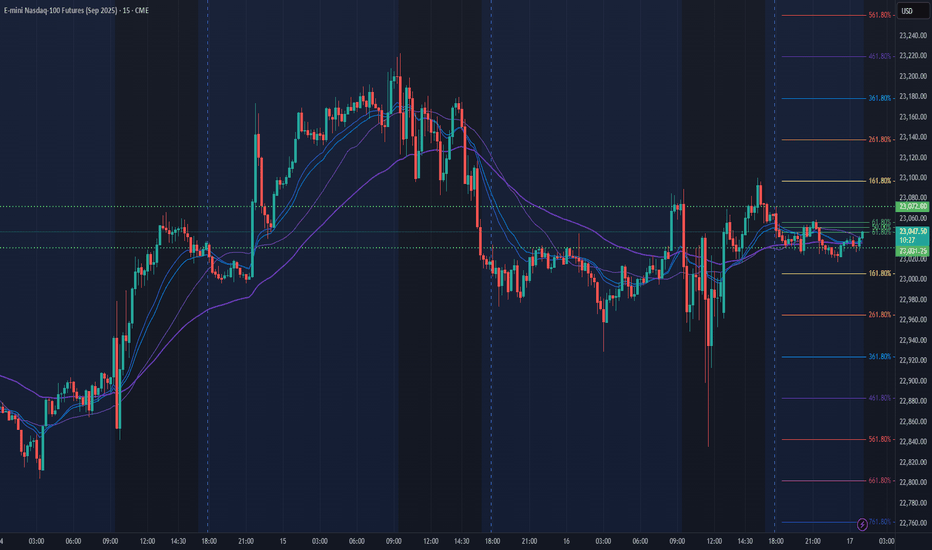

NQ Power Range Report with FIB Ext - 7/15/2025 SessionCME_MINI:NQU2025

- PR High: 23036.00

- PR Low: 23000.00

- NZ Spread: 80.5

Key scheduled economic events:

08:30 | CPI (Core|MoM|YoY)

Asian hours vol spike breakout swing into new ATHs

Session Open Stats (As of 12:15 AM 7/15)

- Session Open ATR: 290.39

- Volume: 42K

- Open Int: 276K

- Trend Grade: Neutral

- From BA ATH: -0.3% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 23239

- Mid: 21525

- Short: 20383

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

NQ Power Range Report with FIB Ext - 7/16/2025 SessionCME_MINI:NQU2025

- PR High: 23034.25

- PR Low: 22973.75

- NZ Spread: 135.5

Key scheduled economic events:

08:30 | PPI

10:30 | Crude Oil Inventories

AMP margins raised overnight for expected PPI volatility

Session Open Stats (As of 12:25 AM 7/16)

- Session Open ATR: 277.22

- Volume: 27K

- Open Int: 277K

- Trend Grade: Neutral

- From BA ATH: -0.8% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 23239

- Mid: 21525

- Short: 20383

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

Market Watch UPDATES! Stock Indices, Gold, Silver, US OILWelcome to the Market Watch Updates for Monday, July 14th.

In this video, we will give the forecast updates for the following markets:

S&P500, NASDAQ, DOW JONES, GOLD, SILVER and US OIL.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

NQ Analysis ICT Liquidity Search Break-Out TradePrice is expected to open not just 1, but inside 2 previous days.

We have 2 options:

1) ICT silver bullet up my bum trader strategy traders are waiting

for liquidity search breaking highs or lows then reversing.

2) Break-out trades waiting for price to break and close above or below

24hour range and trade in direction of break-out.

NQ Targets (07-18-25)I have not posted a Target call in awhile, this one is Long to upper TZ (23,486) and Short to YTD Open level. Prior use of Diablo's to Target drop was prior to NAZ 25% drop (11/24 Post's).

We are due for some drop retesting as we watch typical Long Side Tweets, Tricks and Games start to fizzle some. Today into Monday will be a key signal.

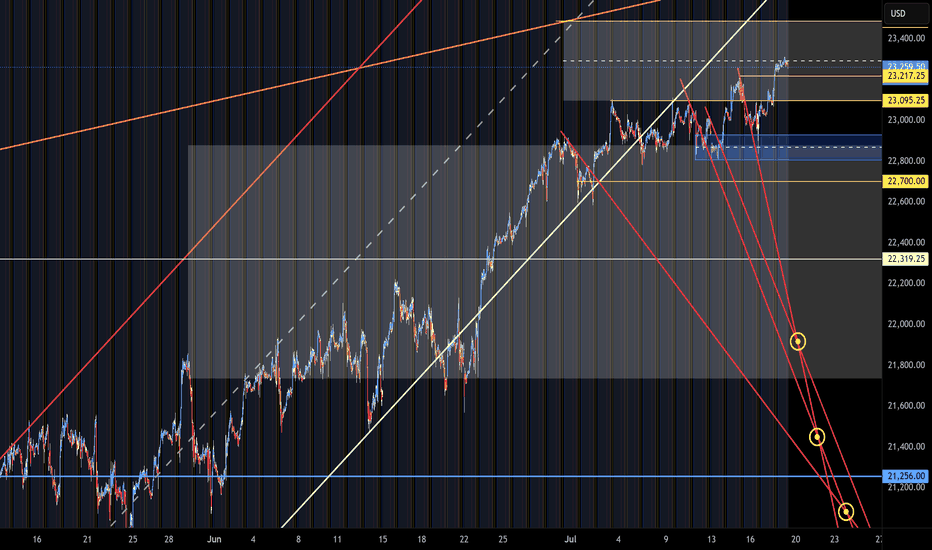

NQ Weekly Recap-Projection 13.07.2025NQ Weekly Recap + Outlook

1️⃣ Recap:

NQ made a new All-Time High, but the breakout ended up being a deviation. Price got rejected and started pulling back.

This signals potential weakness and suggests price may want to explore lower levels.

2️⃣ Bearish Scenario:

📍Target: Daily Swing low (Blue line)

📍Deeper target: Weekly Fair Value Gap (Purple zone)

I’ll look for LTF confirmations around these zones to position for potential longs.

3️⃣ Bullish Catalyst Watch:

There’s increasing speculation that Powell may resign this week.

If that happens, we could see:

✅ Strong bullish momentum

✅ Little to no retracement

✅ Immediate push into new ATHs

Weekly Plan Summary:

🔸 Scenario 1 - Pullback Continuation:

Look for reactive long setups at Daily Swing or W FFVG zone.

🔸 Scenario 2 - Powell Resignation:

Expect a breakout move with momentum — potentially no retrace.

Stay nimble. Trade what the chart confirms, not what the news promises.

A Bearish July for Nasdaq?I hadn’t anticipated the -212 point move unfolding during the After Hours session—I'd mapped that reaction for the upcoming New York AM session open. That said, with momentum already in play, I’m maintaining my short bias. Price appears poised to revisit the July lows, with a high probability of trading through them and pressing further beneath the Monthly VWAP. I’m eyeing continuation to the downside as long as structure confirms the move.

Eyes on the Gap – Discipline Over FOMO NQ📌 Waiting for High-Probability Levels to Engage

Right now, price has been stuck in a multi-week range, coiling just beneath major resistance and above strong demand. I’m not forcing trades — I’m waiting for price to reach the key gap zone and confirmed strong support near 22,781.75.

No reason to act until the market gives me a clear setup.

The real move will come from the edges — not the middle.

🔹 Support Confluence: Gap fill zone + Strong Support label

🔹 Range Context: Price capped under ATH & recycling between session highs/lows

🔹 Bias: Bullish only after sweep or confirmed hold of the lower zone

💬 Discipline is waiting when others get chopped up in the middle. Let the trap spring — then strike.

#PlaymakerTrading #GapZone #SmartMoneyLevels #NQFutures #MarketStructure #SupportAndResistance

MNQ at the Supply Buffet. Will It Eat or SpitMNQ is hovering just under local highs after a textbook rally into a potential supply shelf. Price is compressing into a wedge between short-term resistance and dynamic trend line support. This is where the market reveals its hand either we break clean and run, or we roll over and unwind the entire move.

Here’s my full breakdown including swing entries, scalp options, confluence layers, and what I’m watching through the Tokyo, London, and NY sessions.

Primary trend: Bullish

Current condition: Compression under resistance (23,100 zone)

Market posture: Still within the ascending channel, but showing signs of indecision

We’re stacked on top of well-respected demand levels and riding a well-tested trend line. But price has now spent 5 sessions ranging just under short-term supply, and that opens up both breakout and breakdown scenarios depending on how it reacts in this key zone.

BULLISH SCENARIO — Trend Continuation

This play assumes the channel holds and buyers defend the 22,700 breaker block.

Primary Entry: 22,700 (Key reclaim level / breaker block)

Aggressive Entry: 22,950 (early reaction from structure front-run)

TP1: 23,500 (equal highs and channel extension)

TP2: 24,000 (clean trend extension target)

SL: 22,000 (below trend line and deep value failure)

Confluences:

Breaker block support from July 3 demand leg

Anchored VWAP from July 7 sits just above entry zone

Perfect alignment with channel midpoint and dynamic support

Buyers defended 22,700 multiple times during NY and London sessions

Macro still favouring tech risk-on

This is the continuation play. If 22,700 holds, I expect a swift push through supply with high reward potential.

BEARISH SCENARIO — Structural Breakdown

This play assumes the trend line and 22,700 level give way, confirming a change in structure.

Trigger: Clean 15m or 30m close below 22,700 and no buyer reclaim

Entry on Retest: 22,680–22,700 zone after breakdown

TP1: 22,200 (mid-trend demand base)

TP2: 21,900 (deep value demand zone)

SL: Above 22,800 (back inside structure = idea invalid)

Confluences:

Overhead supply has held 4+ sessions

Multiple liquidity sweeps above 23,100 with no follow-through

Momentum divergence + distribution signs on 5m-15m

London session often traps longs just before breakdowns

This isn’t about calling tops it’s about recognising when support fails. If 22,700 goes, the dominoes start falling.

Scalper Setup (Tokyo/London Focus)

For intraday traders hunting reactive entries with tight stops.

Short Idea:

Setup: Price sweeps into 23,090–23,130 zone during low liquidity (Tokyo/London premarket)

Trigger: Rejection wick or bearish engulfing on 5m–15m

TP: 22,950 or 22,700

SL: 23,150

Long Idea:

Setup: Quick drop into 22,950–22,900 front-run zone (pre-NY)

Trigger: Bullish engulfing or delta flip

TP: 23,100–23,200

SL: 22,850

Chart Structure Summary:

23,090–23,130 Short-Term Supply, Resistance shelf, range ceiling

22,700–22,750 Breaker Block Key structure to hold for bulls

22,200–22,400 Mid Demand Base, Trend structure, good R/R long

21,900–22,050 Deep Value Demand, Swing long zone, last line for bulls

Strategy Notes:

Use 15m for structure, 5m for entry, and 1H to confirm trend

Volume delta and order flow helps confirm traps/sweeps

Watch VWAP if price holds above, bias remains up

Don’t trade blindly into supply without confirmation let it reject or break

This isn’t just a supply test it’s a decision point for the next 300+ ticks.

The market is either:

Absorbing above demand and about to explode, or slowly distributing before a trend break.

As always don’t marry a bias. Let the levels do the talking. React, don’t predict. Let me know in the comments how you’re planning to play this.

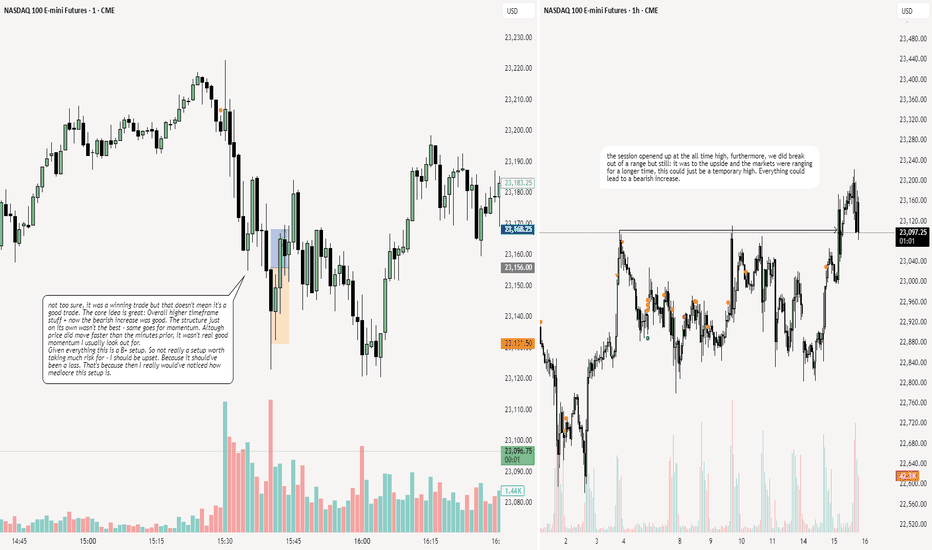

NQ: 218th trading session - recapYeaaa although I did make $2,000 profits it wasn't the best thing ever. I mean I gotta cut myself some slack: The higher timeframe bias was pretty good. And the structure wasn't too shabby. It really was the momentum that turned an A+/S tier setup into a B+ setup which is a HUGE jump.

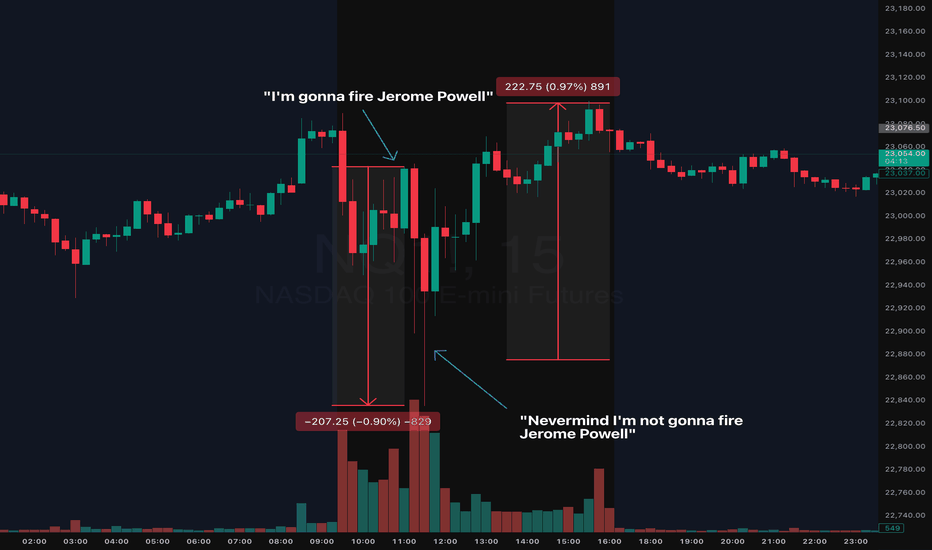

2025 Trading Final Boss: Daily Market Manipulation, The New NormMarking this point in history because we'll likely forget and move on.

During the early hours of the July 16th NYC session, we saw indices quickly flush ( CME_MINI:NQ1! CME_MINI:ES1! ) nearly 1% on the news that Trump will fire Jerome Powell. The dip was bought almost instantly.

Shortly after the dip was bought (roughly 0.50% recovery), guess what? Trump announced, he is "not considering firing Jerome Powell". The dip then recovered and achieved a complete V to finish the day somewhat green. Make what you want of it but always use a stop loss in these tough conditions.

Welcome to 2025 Trading Final Boss

NQ Power Range Report with FIB Ext - 7/17/2025 SessionCME_MINI:NQU2025

- PR High: 23072.00

- PR Low: 23031.25

- NZ Spread: 91.25

Key scheduled economic events:

08:30 | Initial Jobless Claims

- Retail Sales (Core|MoM)

- Philadelphia Fed Manufacturing Index

Session Open Stats (As of 12:35 AM 7/17)

- Session Open ATR: 274.88

- Volume: 18K

- Open Int: 268K

- Trend Grade: Neutral

- From BA ATH: -0.8% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 23239

- Mid: 21525

- Short: 20383

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

2025-07-16 - priceactiontds - daily update - nasdaqcomment: Bond markets are going ballistic. Fun times ahead. Technically it’s a trading range under ath and bears are too weak to print any decent bear bar on the daily tf.

current market cycle: bull trend

key levels: 22600 - 23300

bull case: Bulls are might fine. No daily bar is closing on it’s low and we are printing bull bar after bull bar. Daily 20ema is around 22700 and as long as we stay above, bulls remain in full control. Not event imminent firing of JPow and the bond market implosion are stopping this. Truly astonishing.

Invalidation is below 22700.

bear case: Bears are pathetic. Need lower lows below 22770. That’s it. Even if we get them, daily 20ema should be support unless an event triggers big time.

Invalidation is above 23300.

short term: Neutral. Bears barely doing anything but I have no interest in buying this frenzy, given the risks we are facing. We will go down hard soon but right now nothing about this is bearish. I do think the only bearish scenario could be that Jpow resigns/gets fired tomorrow/Friday and we drop down hard to next big support around 22000. I’d be surprised if we could get that low tbh.

medium-long term - Update from 2024-06-29: No change in plans. I expect 20000 to get hit over the next 3 months and maybe 19000 again.

trade of the day: Short US open was my preferred trade today but stop had to be 23223, so far away and target was not all that big since 23000 was the obvious support. The drop down to 22835 was a bit much but given the news, it could have easily led to a much bigger sell-off if the markets weren’t ignoring literally every risk under the sun.