NQ1! trade ideas

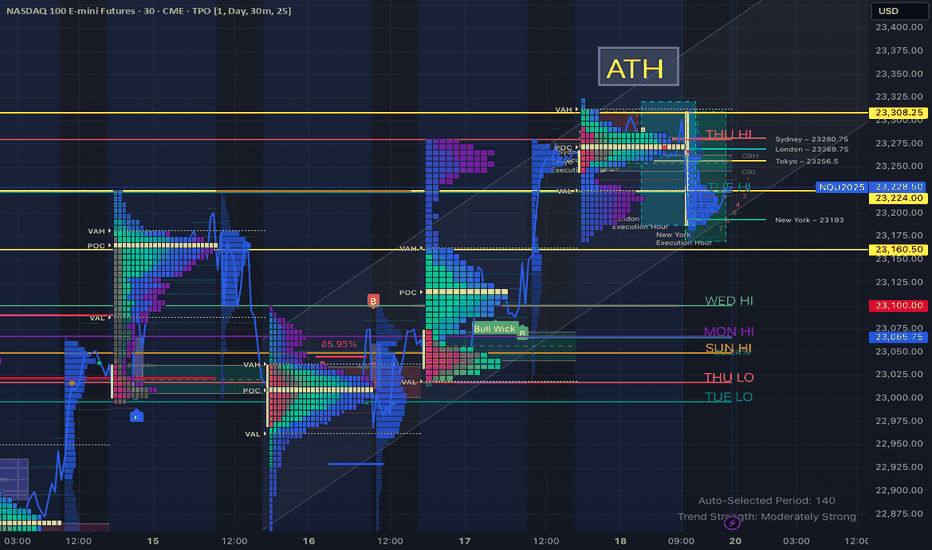

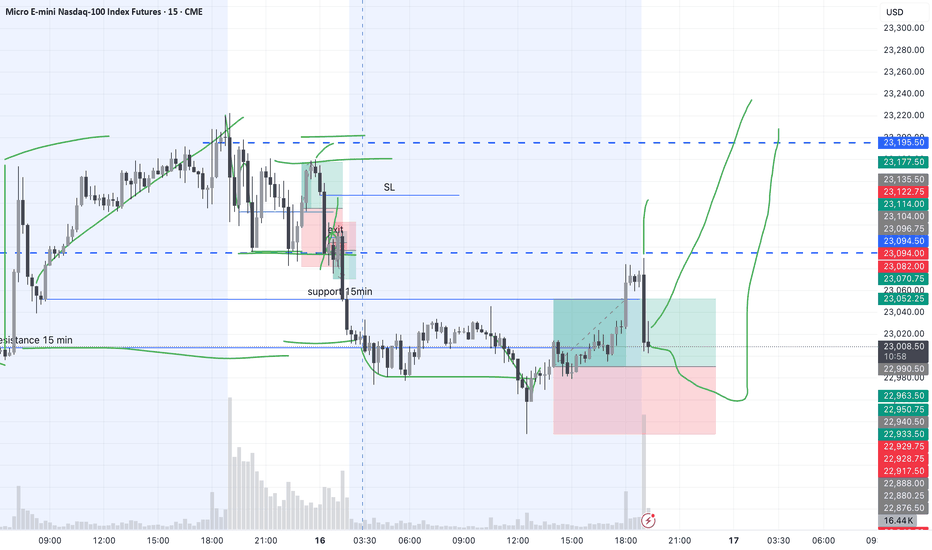

NQ2025 – Range Reclaim and ATH Test in Focus | TPO AnalysisDescription:

The Nasdaq-100 (NQ2025) is showing signs of strength after reclaiming a key value area around 23,224, with price now consolidating above the New York execution low (23,193) and the weekly value area low. Volume structure and price action suggest potential continuation toward the all-time high.

Key Technical Notes:

Range Reclaim: Price reclaimed a composite range zone (23,193–23,224), showing acceptance and strength during NY session.

All-Time High (ATH): 23,308.25 remains the upside magnet.

Initial Balance and ORL: Serving as confluence for bullish structure if retested.

TPO Structure: Value is shifting higher with poor high left above current range, increasing likelihood of continuation.

Primary Scenarios:

Bullish Continuation: Hold above 23,224–23,193 and rotate toward ATH.

Pullback Opportunity: Reclaim of NY low or session VWAP after sweep could offer long re-entry.

Rejection Scenario: Break back below 23,193 may shift control to sellers, targeting 23,160 and 23,065 support.

Support/Resistance Zones:

Resistance: 23,275 → 23,308.25 (ATH)

Support: 23,224 → 23,193 → 23,160

Lower Shelf Support: 23,100 → 23,065.75

This chart utilizes a blend of TPO analysis, intraday session levels, and volume-based structure to align setups with high-probability continuation or reversal zones.

📍#NQ #FuturesTrading #VolumeProfile #TPOAnalysis #DayTrading #TechnicalAnalysis #TradingStrategy

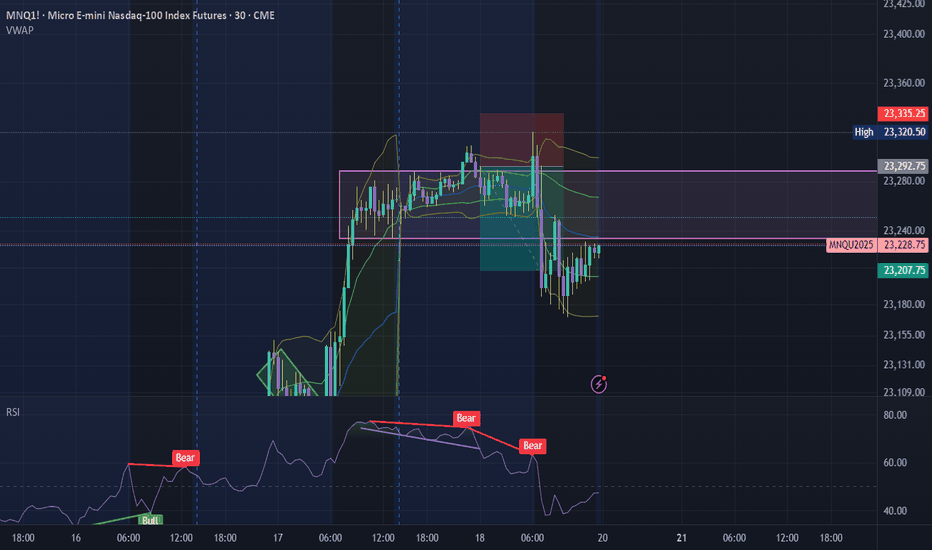

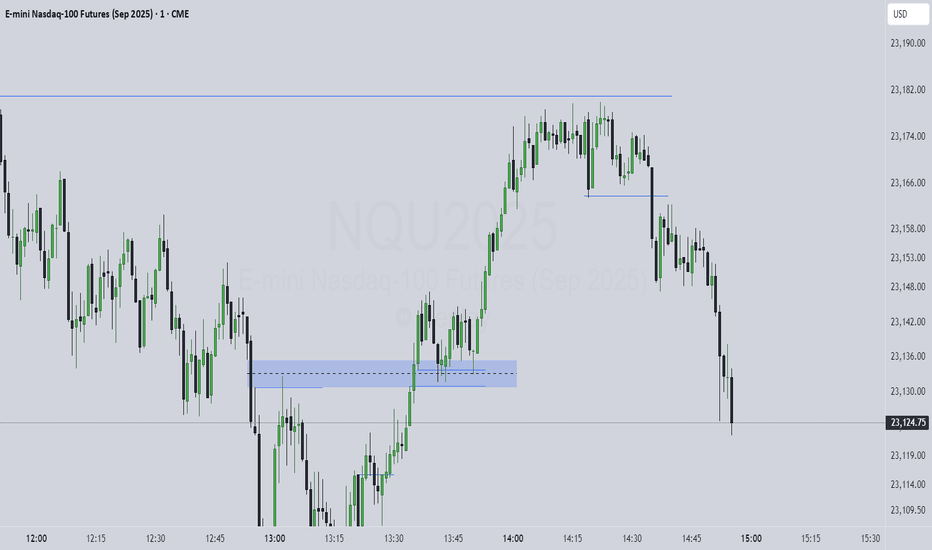

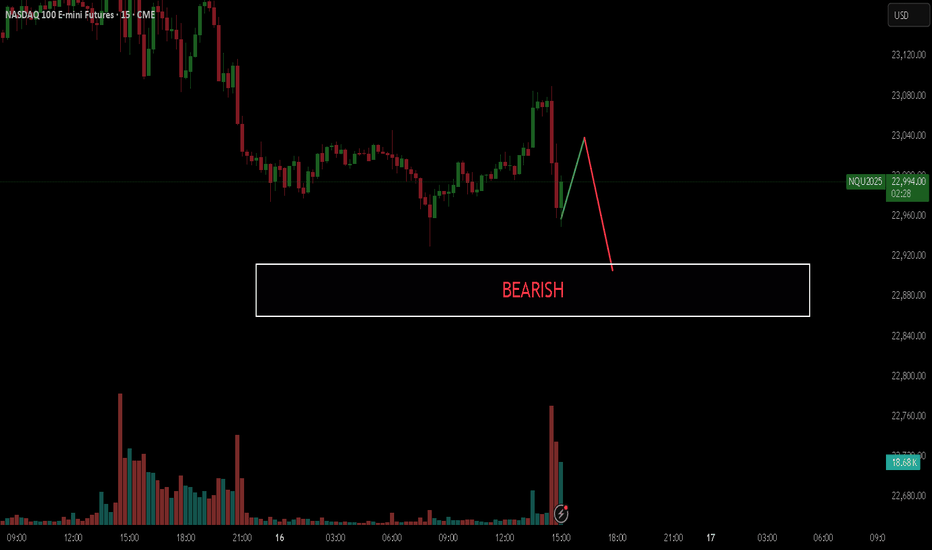

Bearish Divergence using RSIStarting to utilize RSI in confluence with market structure and FVG to create an entry and exit model. Higher highs of price action paired with lower highs of RSI values. Exit towards filling at least 50% of FVG. Don't be greedy, as price can use FVG as support/resistance.

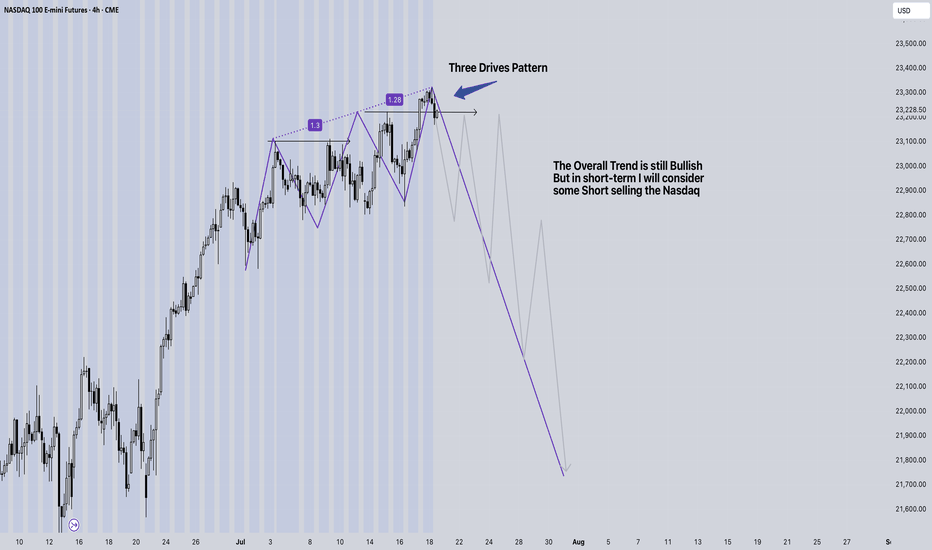

Nasdaq Short Cell or Sell !We Look for the ATM (All Time High) always, But markets Keep Making Higher Highs and New ATMs .

Keep in mind , Nobody Knows the Next Move Or if it goes Higher Or Lower.

We assume and try to Resume as Long As we Can !

The Market is somehow About Survival. If you Survive the next level to achieve is to keep your losses Small when you are wrong and let your profits run as long as they are valid Then you have entered the Realm of 10% profitable traders.

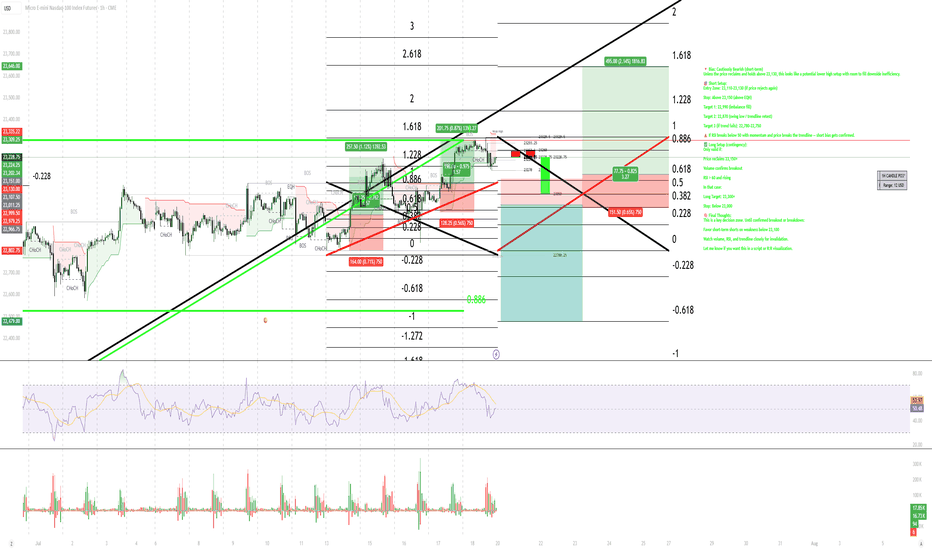

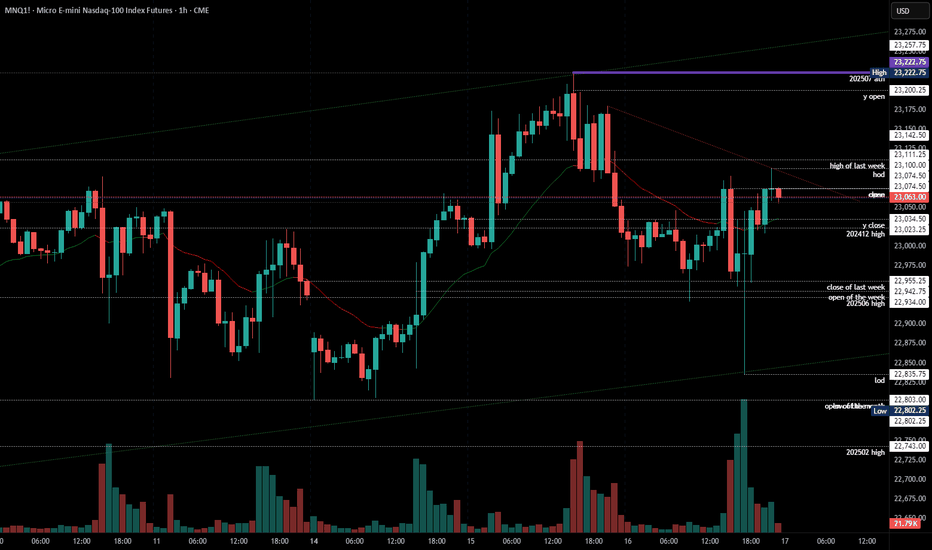

CHAT GPT TRADING This is a 1-hour chart of Micro E-mini Nasdaq-100 Futures (MNQ) with multiple tools active: structure annotations (CHoCH, BOS), SuperTrend, RSI, volume, and trendlines.

🧭 Overall Trend:

Primary Trend: Bullish (uptrend remains intact overall)

Recent Action: Consolidation under resistance (~23,120–23,130), with minor bearish market structure shifts (CHoCHs and BOS).

Key Support: Rising trendline + swing low around 22,870–22,900

RSI: Neutral (50 zone), slightly recovering from oversold dip.

📊 Structure Notes:

CHoCH (Change of Character) and BOS (Break of Structure) are noted frequently, with recent CHoCHs to the downside — showing potential early bearish pressure.

Market is hovering under a key resistance zone with a minor rejection candle and an open imbalance below (green zone).

✅ Suggested Approach:

🔻 Bias: Cautiously Bearish (short-term)

Unless the price reclaims and holds above 23,130, this looks like a potential lower high setup with room to fill downside inefficiency.

🎯 Short Setup:

Entry Zone: 23,110–23,130 (if price rejects again)

Stop: Above 23,150 (above EQH)

Target 1: 22,990 (imbalance fill)

Target 2: 22,870 (swing low / trendline retest)

Target 3 (if trend fails): 22,780–22,750

⚠️ If RSI breaks below 50 with momentum and price breaks the trendline — short bias gets confirmed.

✅ Long Setup (contingency):

Only valid if:

Price reclaims 23,150+

Volume confirms breakout

RSI > 60 and rising

In that case:

Long Target: 23,300+

Stop: Below 23,000

🧠 Final Thoughts:

This is a key decision zone. Until confirmed breakout or breakdown:

Favor short-term shorts on weakness below 23,100

Watch volume, RSI, and trendline closely for invalidation.

Let me know if you want this in a script or R:R visualization.

Ask ChatGPT

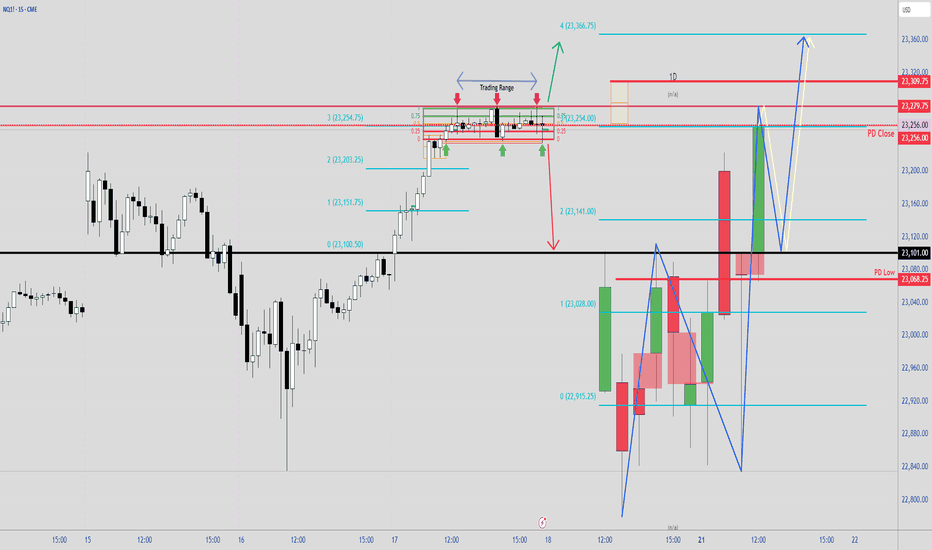

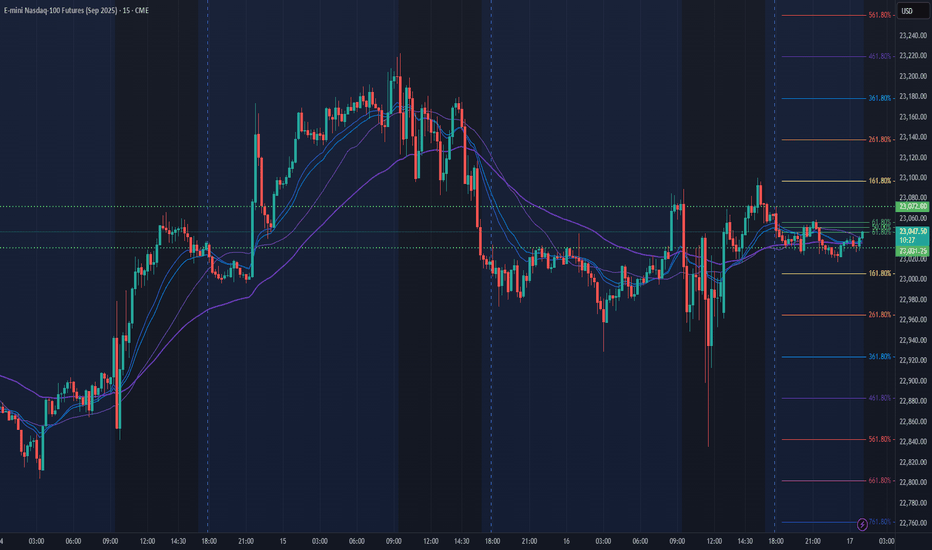

$NQ Supply and Demand Zones 7/18/25 This is for SEED_ALEXDRAYM_SHORTINTEREST2:NQ chart only, not as many supply zones with the limited timeframes I can use for TradingView free plan. This is my chart coming into next week.

However, we have so far found rejection from new ATH and making our way to retest the imbalances and previous resistance-now support levels of past supply zones.

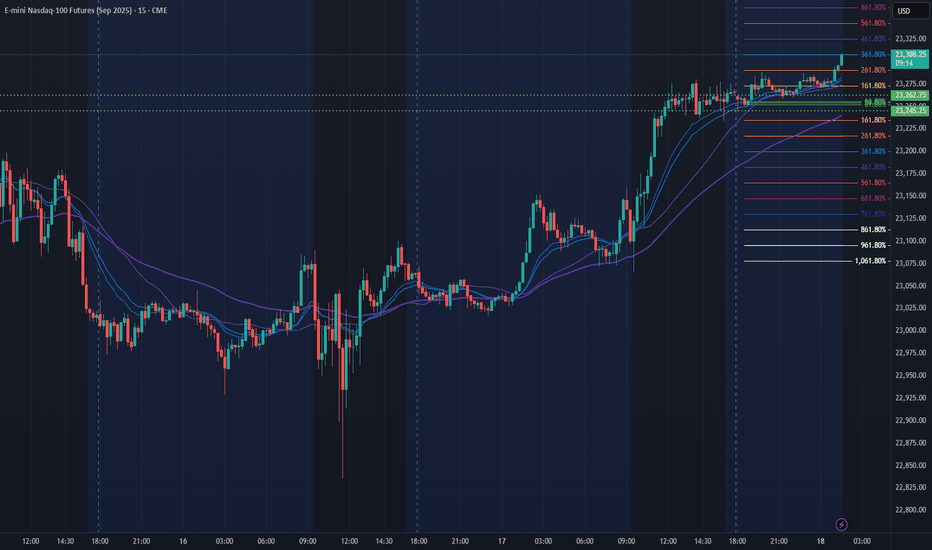

NQ Power Range Report with FIB Ext - 7/18/2025 SessionCME_MINI:NQU2025

- PR High: 23262.75

- PR Low: 23245.25

- NZ Spread: 39.0

No key scheduled economic events

Pushing ATH through overnight hours

Session Open Stats (As of 1:15 AM 7/18)

- Session Open ATR: 272.56

- Volume: 18K

- Open Int: 286K

- Trend Grade: Neutral

- From BA ATH: -0.0% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 23811

- Mid: 22096

- Short: 20383

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

$NQ Supply and Demand Zones - All Time High! 7/17/25This chart is for SEED_ALEXDRAYM_SHORTINTEREST2:NQ only.

We recently hit ATH this AM session and now price is accumulating and we are waiting to see what it wants to do next. Continue to hold support at ATH before we breakout higher, or break below and close below ATH support for a retest lower?

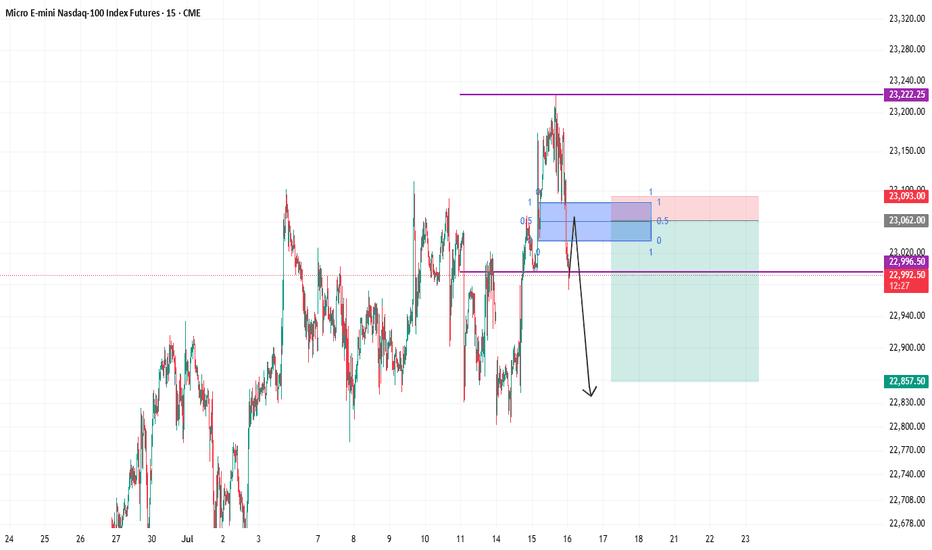

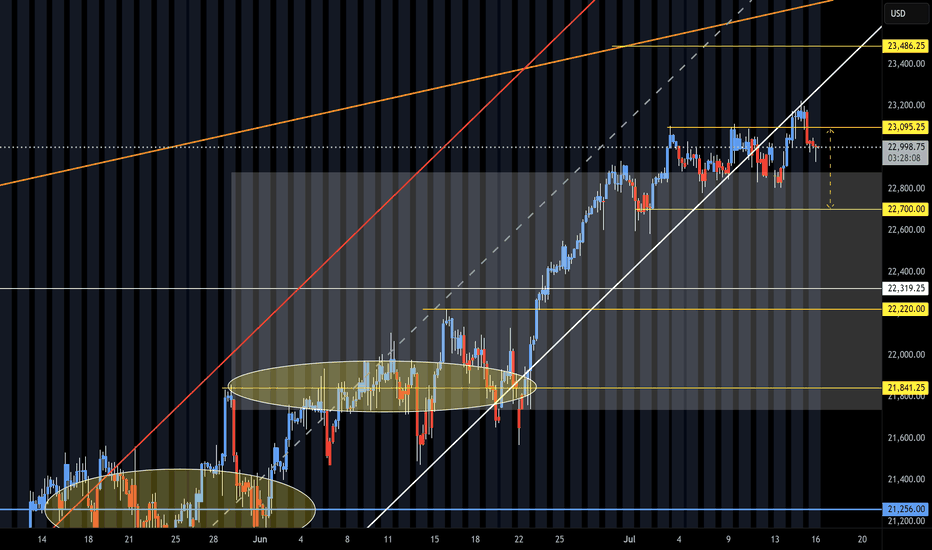

NQ Weekly Recap-Projection 13.07.2025NQ Weekly Recap + Outlook

1️⃣ Recap:

NQ made a new All-Time High, but the breakout ended up being a deviation. Price got rejected and started pulling back.

This signals potential weakness and suggests price may want to explore lower levels.

2️⃣ Bearish Scenario:

📍Target: Daily Swing low (Blue line)

📍Deeper target: Weekly Fair Value Gap (Purple zone)

I’ll look for LTF confirmations around these zones to position for potential longs.

3️⃣ Bullish Catalyst Watch:

There’s increasing speculation that Powell may resign this week.

If that happens, we could see:

✅ Strong bullish momentum

✅ Little to no retracement

✅ Immediate push into new ATHs

Weekly Plan Summary:

🔸 Scenario 1 - Pullback Continuation:

Look for reactive long setups at Daily Swing or W FFVG zone.

🔸 Scenario 2 - Powell Resignation:

Expect a breakout move with momentum — potentially no retrace.

Stay nimble. Trade what the chart confirms, not what the news promises.

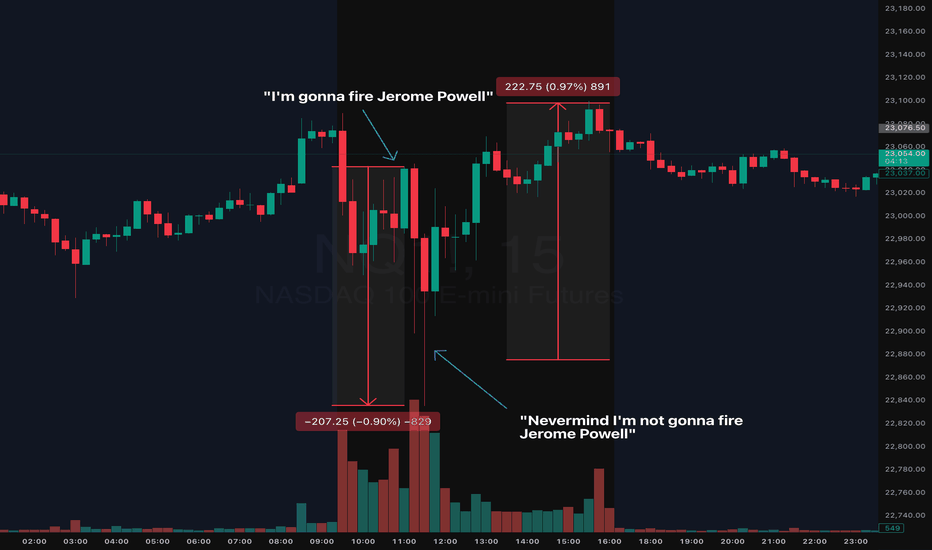

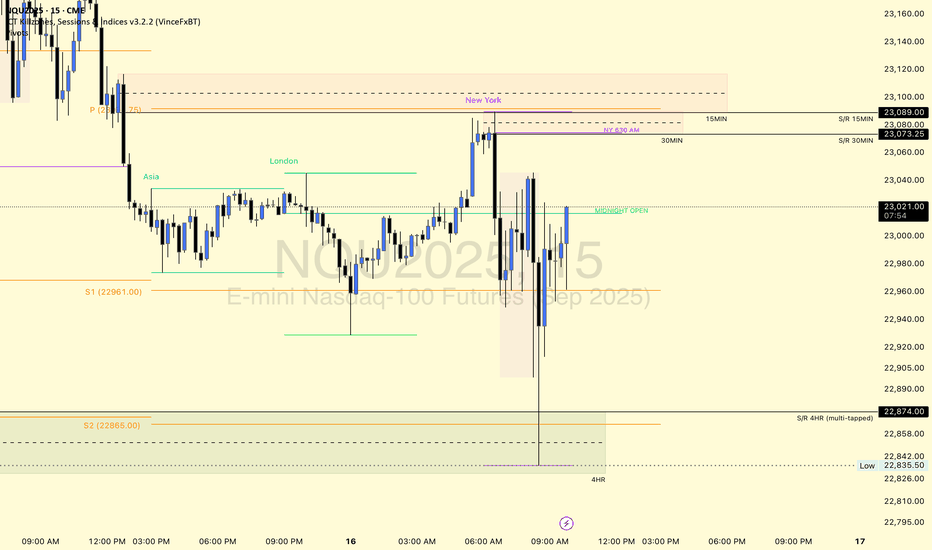

2025 Trading Final Boss: Daily Market Manipulation, The New NormMarking this point in history because we'll likely forget and move on.

During the early hours of the July 16th NYC session, we saw indices quickly flush ( CME_MINI:NQ1! CME_MINI:ES1! ) nearly 1% on the news that Trump will fire Jerome Powell. The dip was bought almost instantly.

Shortly after the dip was bought (roughly 0.50% recovery), guess what? Trump announced, he is "not considering firing Jerome Powell". The dip then recovered and achieved a complete V to finish the day somewhat green. Make what you want of it but always use a stop loss in these tough conditions.

Welcome to 2025 Trading Final Boss

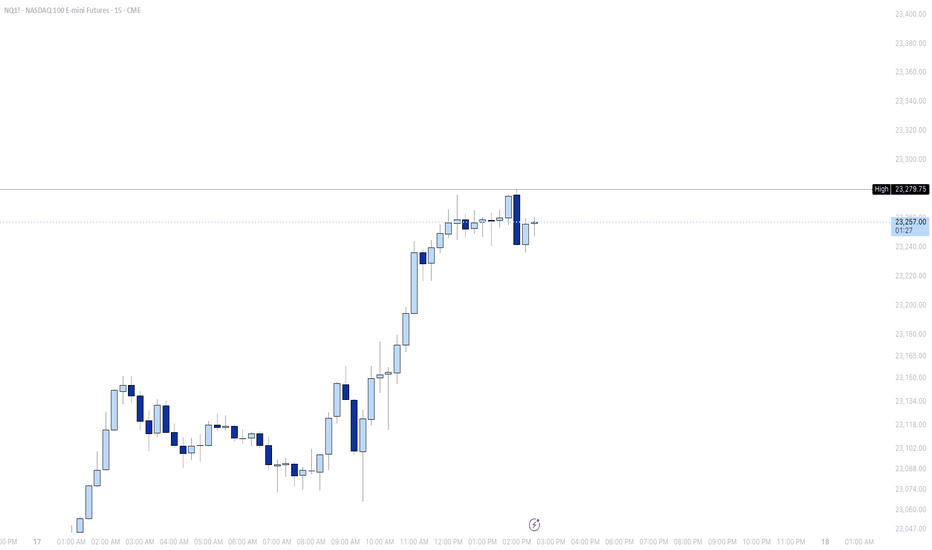

NQ Power Range Report with FIB Ext - 7/17/2025 SessionCME_MINI:NQU2025

- PR High: 23072.00

- PR Low: 23031.25

- NZ Spread: 91.25

Key scheduled economic events:

08:30 | Initial Jobless Claims

- Retail Sales (Core|MoM)

- Philadelphia Fed Manufacturing Index

Session Open Stats (As of 12:35 AM 7/17)

- Session Open ATR: 274.88

- Volume: 18K

- Open Int: 268K

- Trend Grade: Neutral

- From BA ATH: -0.8% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 23239

- Mid: 21525

- Short: 20383

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

To fade all time highs or not?Not trying to fade ATH run but the SSL in this daily range looks too obvious to me. Super premium.

Price was in a consolidation July 7th - 14th. Took external range high today. I really could see shorts playing out if theres a intraweek reversal confirmed after purging the ERH.

Would need to see 1h CISD confirm intraweek reversal to the downside then trade the daily continuation lower targeting 22,779, 22,578 & EQ of the range at 22,370. Also, the daily BISI that needs sellside delivery.

CPI scheduled this week. PPI following.

2025-07-16 - priceactiontds - daily update - nasdaqcomment: Bond markets are going ballistic. Fun times ahead. Technically it’s a trading range under ath and bears are too weak to print any decent bear bar on the daily tf.

current market cycle: bull trend

key levels: 22600 - 23300

bull case: Bulls are might fine. No daily bar is closing on it’s low and we are printing bull bar after bull bar. Daily 20ema is around 22700 and as long as we stay above, bulls remain in full control. Not event imminent firing of JPow and the bond market implosion are stopping this. Truly astonishing.

Invalidation is below 22700.

bear case: Bears are pathetic. Need lower lows below 22770. That’s it. Even if we get them, daily 20ema should be support unless an event triggers big time.

Invalidation is above 23300.

short term: Neutral. Bears barely doing anything but I have no interest in buying this frenzy, given the risks we are facing. We will go down hard soon but right now nothing about this is bearish. I do think the only bearish scenario could be that Jpow resigns/gets fired tomorrow/Friday and we drop down hard to next big support around 22000. I’d be surprised if we could get that low tbh.

medium-long term - Update from 2024-06-29: No change in plans. I expect 20000 to get hit over the next 3 months and maybe 19000 again.

trade of the day: Short US open was my preferred trade today but stop had to be 23223, so far away and target was not all that big since 23000 was the obvious support. The drop down to 22835 was a bit much but given the news, it could have easily led to a much bigger sell-off if the markets weren’t ignoring literally every risk under the sun.

Shorting NQ Yep, weakness started to creep in on NQ this time.

Firstly, the higher timeframes shows massive divergence, even when whales tried to push the price high and continue the trend, massive shorts came in with massive volume. It only tells me that bears are in control this time, and they are coming in with force.

So technically, iam looking for a short up until 22,858

What is really confusing is that also gold is showing weakness which is really something odd, so either iam right in my analysis for Gold and NQ or iam wrong in one of them.

But we will see.

NQ Short (07-16-25)NAZ again can't hold on the Monday off session pump during the Reg Session and does hit lower zone of 22,920. Next trick is Gov't controlled news (released in off session of course) should that not lift it then KL's 881-780 may be next.

The NAZ will go lower under 780 and will be a Strong Short under 22,700. The issue is with getting past the off session propping/rigging (up). Circles to the left are drop target zones that are likely to be revisited as ultimately the NAZ goes sideways in a larger range. The current 14 day sideways moves feels like an Long Mop up or Long Trap. The NAZ will need Tweets, O/N Prop moves and Dead Zone magic lifting to stay away from the Danger Zone of sell orders near 22,881-780.