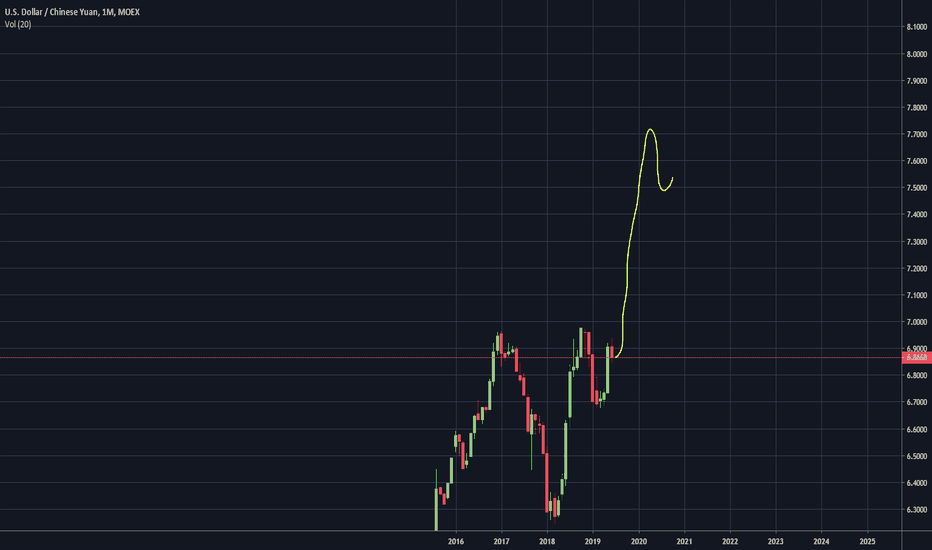

$CNY: Moving higher$CNY is higher than the initial breakout which caused mass panic among the macro tourists on TV. Instead all eyes are on the hapless Fed Chair who shall be known as the man who crashed equities markets. Equity markets will get spooked regardless whatever Powell decide to do. A hold means money's too tight, a full blown rate cut program means an acknowledgment that fundamentals are in the gutter. Jackson Hole is just another step closer to the end game which the bond markets have been signalling for ages. Wakey wakey for folks still buying equities.

Back to the USDCNY, it is a breakout so it is going to go higher. As previously mentioned, the bid ask spread between the US and China in this trade war is too far apart and the FX is an adjustment mechanism to the tariffs especially when the Chinese have been keeping the RMB artificially STRONG .

CNYUSD trade ideas

Chinese Yuan: HKD anchor currency swap strategy propositionLooking at a number of currencies performance extending back to the 2007/2008 global financial crisis, and focusing on the yuan in juxtaposition to the HKD, USD, GBP, EUR. Some interesting trends become evident, suggest that perhaps the PRC have a long-term strategy that they are working through in terms of Hong Kong's currency integration into the mainland's central planning, development and implementation, particularly with regards to large-scale infrastructure, Greater Bay Area projects, and the Belt and Road Initiative (BRI).

USDCNY: The Chinese Need to Prepare for DevaluationThere is not much to say here. The chart says it all.

The Chinese need to prepare for the coming Yuan devaluation. Gold is headed higher as defense against this reckless monetary policy. I have a feeling that USA will follow suit. You can hedge against senseless money printing using gold. That's why the price of gold is going up lately. This trade war will continue to drag out until at least the end of the current US administration, but could last even longer if Trump is re-elected. I believe that gold and Bitcoin will be strong beneficiaries of this macroeconomic situation. There is a lot of volatility in Bitcoin, but may be used as a potential hedge against global economic turmoil.

Actionable Idea: Sell the Yuan and receive USD. You can wait for about 7.63 on the chart. Then, unwind the position by selling the USD and receiving the Yuan. Stop loss at about 6.83.

Watch for Breakout on USD/CNY, U.S. Dollar vs. Chinese YuanRecently, FX_IDC:USDCNY has been making bullish moves. First, the 65-period EMA crossing over the 200-period EMA: a golden cross. Price action began to consolidate in a fixed range, before making a false-breakout, quickly correcting itself. With increasing trade tensions between the U.S., China, and Mexico, another breakout from this supported range will be highly indicative of medium-term price movements.