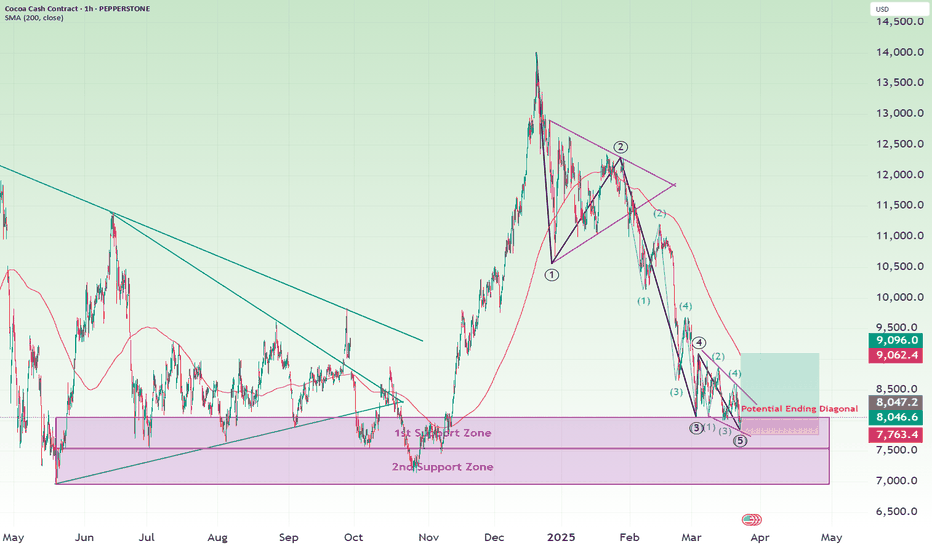

Cocoa futures near a key technical resistance areaMARKETSCOM:COCOA futures have been trending lower, while trading within a falling channel pattern since around mid-May of this year. But we are near the upper bound of that channel. Let's see if it holds.

Let us know what you think in the comments below.

Thank you.

75.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.

COCOA trade ideas

Cocoa - Chocolate is DIPPING (literally)Hello Market Watchers 👀

I bring today an update on your favorite commodity (mine actually)... 🍫

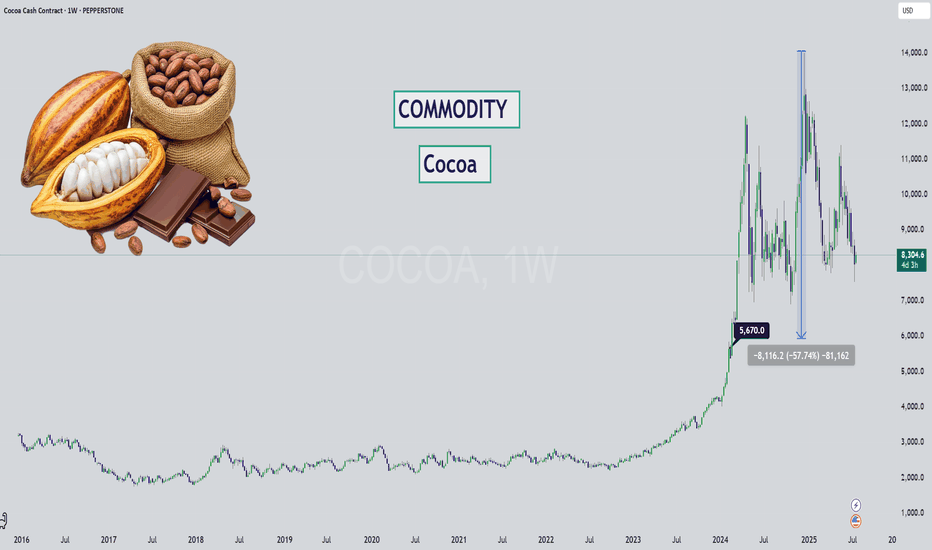

The weekly timeframe from a multi-year perspective is what's on the cover and one thing is clear - cocoa has never increased so much as it during May23' to Dec24'.

Sure inflation brought on by covid has a role to play. But even so, factoring in the amount of +509%? That is way out.

We could likely see this kind of stair step down movement on cocoa, since it has been following the logic of: " previous support = new resistance ".

Either way what this tells me is that cocoa has been running overly hot for too long... and it's time for a cooldown. Prices will likely never return to pre-covid levels, unless there is unfortunate weather or other supply chain issues.

Ultimately, a return back to the $5,600 zone would be a reasonable market correction for such a large increase.

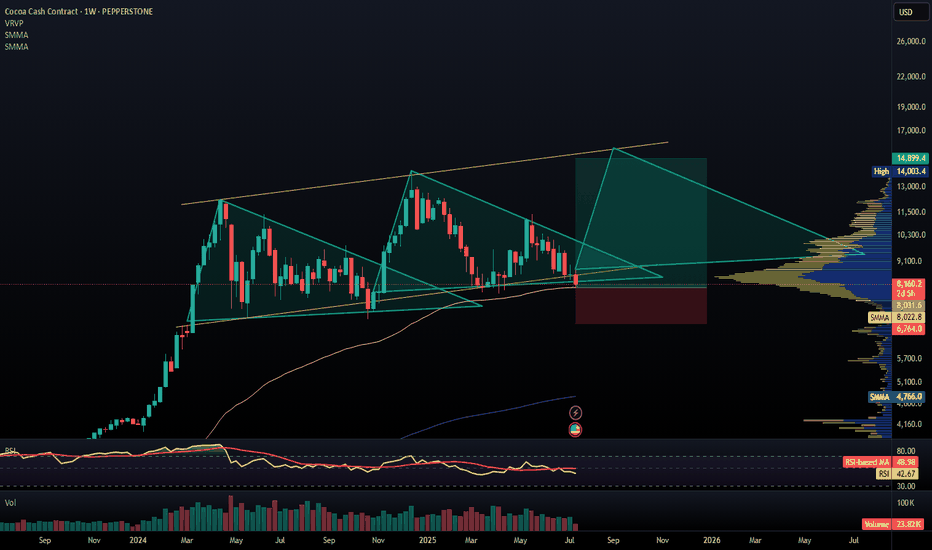

Cocoa Bull Run over?There’s something brewing in the charts here, and it’s not a hot cup of cocoa. We had a clear rejection at the 0.382 Fibonacci and potentially the start of a C leg in a corrective pattern.

This is lower high after the bull flag breakout pattern. If we lose support here we could break the neckline and confirm the head and shoulders pattern, which is very bearish.

There’s a lot of moving parts to consider here. If you follow my trades you will know I already anticipated this as I am long a stock that behaves in an inverse manner to cocoa.

Not financial advice, do what’s best for you

Rob the Cocoa Market Before the Trend Escapes🏴☠️Cocoa Vault Breach: Sweet Profit Heist in Progress!🍫💰

(Thief Trader’s Swing/Day Plan – Only Bulls Allowed)

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

We’ve cracked the code to the 🏉"COCOA"🏉 Commodities CFD market, and now it’s time to launch a high-stakes heist based on 🔥Thief Trading style technical + fundamental analysis🔥.

🎯 Mission Objective: Infiltrate the overbought zone, where traps are set, robbers are lurking, and the market’s about to turn. The plan? Ride the bullish wave, loot the Red Zone, and vanish with sweet profits. 🏆💸

🔓 Entry Point:

"The vault is wide open!"

Buy at will — loot that bullish treasure!

⏱️ Best tactic: Set buy limits on the 15M or 30M swing low/high zones. Set alerts and stay sharp.

🛑 Stop Loss:

SL = Nearest 4H Swing Low

🔐 Protect your stash. Use risk-adjusted SL based on trade size and number of entries.

🎯 Target:

11,300 or escape early if the pressure builds!

⚔️ Scalper’s Note:

Only steal on the long side.

💰 Big money = Go direct

💼 Small bags = Team up with swing traders

📉 Use trailing SLs to guard your gains.

🔥Cocoa Market is Bullish – Why?

☑️ Fundamentals

☑️ Macroeconomics

☑️ COT Report

☑️ Sentiment Signals

☑️ Intermarket Vibes

☑️ Seasonal Patterns

☑️ Trend Forecasts & Target Levels

👉 Dive into the data: 🔗🔗🔗

⚠️ Trading Alerts:

News releases = Danger zones!

❌ No new entries during news

✅ Trailing SL to protect ongoing raids

💥 Smash the Boost Button 💥

Support this Thief Plan and keep our crew winning daily.

💪 Rob with confidence. Win with consistency.

🎉 Thief Trading Style = Your daily cash machine.

💣Stay tuned for the next robbery blueprint!

— Your Friendly Market Criminal, 🐱👤

"COCOA" Commodities CFD Market Bullish Heist (Swing Trade Plan)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the 🏉"COCOA"🏉 Commodities CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is to escape near the Dangerous Red Zone Level. It's a Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA line breakout (9700) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level for Pullback entries.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a buy stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📍 Thief SL placed at the recent/swing low level Using the 2H timeframe (8900) Day/Swing trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 10700 (or) Escape Before the Target.

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💰💵💸🏉"COCOA"🏉 Commodities CFD Market Heist (Swing Trade Plan) is currently experiencing a neutral trend there is high chance for bullishness,., driven by several key factors. .☝☝☝

📰🗞️Get & Read the Fundamental, Macro economics, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Seasonal Factors, Positioning and future trend targets with Overall Score..... go ahead to check👉👉👉🔗🔗🌎🌏🗺

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

This commodity called Cocoa is offering an excellent risk/rewardThe red dotted line shown is the weekly bearish trend line that has recently got a break out.

You can go to a smaller time frame, the 4H or 1H to find a better entry point. That may be a retracement that offers you a good opportunity to get in.

Now, commodity is much more volatile so don't be stingy with your SL , give it a wider margin else you will be disappointed when the game is over much faster than you anticipated.

Good luck!

"COCOA" Commodity CFD Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "COCOA" Commodity CFD market. Please adhere to the strategy I've outlined in the chart, which emphasizes long & Short entry. 👀 Be wealthy and safe trade 💪🏆🎉

Entry 📈 : You can enter a Bull or Bear trade at any point after the breakout.

Buy entry above 11,800

Sell Entry below 10,000

Stop Loss 🛑: Using the 2H period, the recent / nearest Pullbacks.

Goal 🎯: Bullish Robbers TP 13,600 (or) Escape Before the Target

Bearish Robbers TP 8,800 (or) Escape Before the Target

Fundamental Outlook 📰🗞️

The COCOA Market is expected to move in a Bullish direction, driven by the following key factors:

🔵Macro Factors:

Global Economic Growth: Rising global economic growth, particularly in emerging markets, is expected to increase demand for cocoa.

Inflation: Moderate inflation levels in major cocoa-consuming countries are expected to support cocoa prices.

Currency Fluctuations: A weaker US dollar is expected to support cocoa prices, as it makes cocoa more competitive in international markets.

🟡Fundamental Factors:

Supply and Demand Imbalance: The global cocoa market is expected to face a supply shortage in the 2022/23 crop year, supporting prices.

Weather Conditions: Favorable weather conditions in major cocoa-producing countries, such as Côte d'Ivoire and Ghana, are expected to support cocoa yields.

Certification and Sustainability: Growing demand for certified and sustainable cocoa is expected to support prices for high-quality cocoa beans.

🟠Sentimental Factors:

Investor Sentiment: Positive investor sentiment, driven by improving global economic growth and supply chain disruptions, is expected to support cocoa prices.

Market Positioning: The commitment of traders (CoT) report shows that hedge funds and other large speculators are net long cocoa, indicating a bullish sentiment.

Technical Analysis: Cocoa prices have broken out above a key resistance level, indicating a bullish trend.

- Bullish Sentiment: 83% of clients are long on COCOA, indicating a strong bullish trend.

- Bearish Sentiment: 17% of clients are short on COCOA, indicating a relatively weak bearish trend.

- Neutral Sentiment: No explicit data available, but we can infer it's relatively low given the strong bullish trend.

📌Please note that sentiment analysis can change rapidly and may not always reflect the actual market performance. These percentages are based on current market data and may not reflect future market movements.

That this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🫂

"COCOA" Commodities CFD Market Bearish Heist (Swing/Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the 🏉COCOA🏉Commodities CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Yellow MA Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on!

however I advise to Place sell limit orders within a 15 or 30 minute timeframe most nearest or swing, low or high level for Pullback Entries.

Stop Loss 🛑:

📌Thief SL placed at the nearest/swing High or Low level Using the 8H timeframe (8600) Day/Swing trade basis.

📌SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 7000 (or) Escape Before the Target

🏉"COCOA"🏉 Commodities CFD Market Heist Plan (Swing/Day Trade) is currently experiencing a Neutral trend (there is a chance to move bearishness),., driven by several key factors.👇👇👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Seasonal Factors, Sentimental Outlook, Intermarket Analysis, Future trend targets.. go ahead to check 👉👉👉🔗🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

"COCOA" Commodities CFD Market Bearish Heist (Swing/Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "🏉COCOA🏉" Commodities CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Pink MA Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on!

however I advise to Place sell limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level for Pullback entries.

Stop Loss 🛑:

📌Thief SL placed at the nearest/swing High or Low level Using the 4H timeframe (8800) Day/Swing trade basis.

📌SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 6800 (or) Escape Before the Target

🏉"COCOA"🏉 Commodities CFD Market Heist Plan (Swing/Day Trade) is currently experiencing to move bearishness.., driven by several key factors.👇👇👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Seasonal Factors, Sentimental Outlook, Intermarket Analysis, Future trend targets.. go ahead to check 👉👉👉🔗🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Cocoa short: End of double combination As depicted in this chart, I believe that cocoa is going to go down after finishing a double combination correction up. We should be going down in a C wave. The stop loss is above the double top.

Take note that the double top also stop around previous wave 4 end (blue line).

COCOA Nearing Major Support - Rebound Towards 9,000$?PEPPERSTONE:COCOA is approaching a significant support zone. This area has consistently acted as a key level where buyers have stepped in, leading to notable reversals in the past. The current move suggests the potential for a bullish reaction if price action confirms rejection through signals such as bullish engulfing candles, long lower wicks, or increased buying volume.

If the support holds, I anticipate a move upward toward the 9,000 level, aligning with the expectation of a short-term reversal. However, if the price breaches this zone and sustains below it, the bullish outlook may be invalidated, potentially opening the door for further downside.

Monitoring candlestick patterns and volume at this critical zone is essential for identifying buying opportunities. Proper risk management is advised to navigate potential volatility.

Just my take on support and resistance zones—not financial advice. Always confirm your setups and trade with solid risk management.

Best of luck!

Markets Technical Analysis 6th April 2025Summary:

- Expects Equities (NK225, HSI, SPX, NDX) to bounce on Monday trading session (7th April 2025).

- Big US tech stocks (AAPL, MSFT, NVDA, AMZN, TSLA, META, GOOG, NFLX) are at support levels.

- Expects commodities (Oil, Copper, Gold, Silver, Cocoa) to be down in the longer term.

I will post this idea as neutral even though it is long for equities in the very short term and short for commodities in the longer term.

COCOA; Heikin Ashi Trade ideaPEPPERSTONE:COCOA

In this video, I’ll be sharing my analysis of COCOA, using my unique Heikin Ashi strategy. I’ll walk you through the reasoning behind my trade setup and highlight key areas where I’m anticipating potential opportunities. My goal is to help you enhance your trading skills and insights.

I’m always happy to receive any feedback.

Like, share and comment!