SILVER – Breakout Attempt Underway SILVER | 1H TIMEFRAME

Price is breaking out of the falling wedge + forming a cup-type rounded bottom from support.

📊 Technical Overview:

• Cup formation breakout spotted ✅

• Price attempting to sustain above falling wedge resistance

• 55 EMA & 25 EMA crossed bullish

• Volume buildup visible

•

Contract highlights

Related commodities

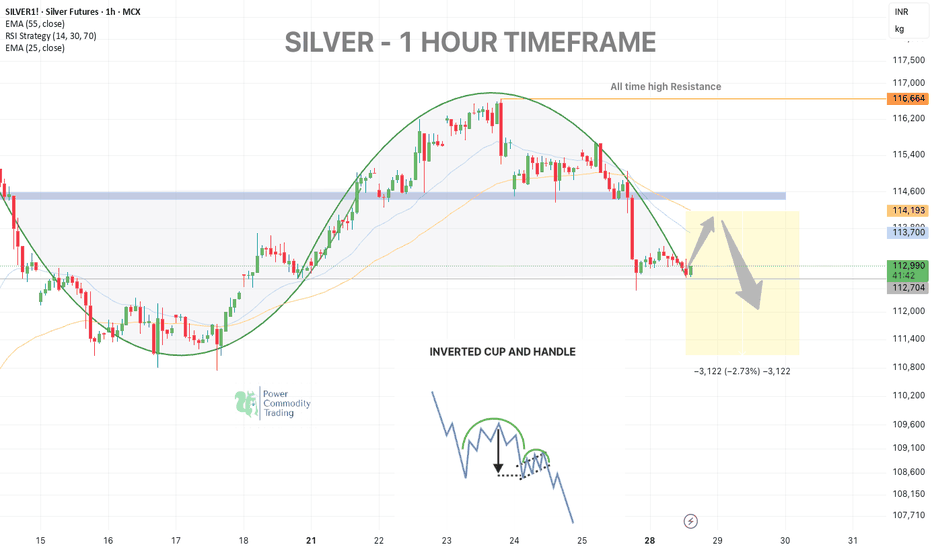

SILVER WEEKLY UPDATE - Dead Cat Bounce Setup📉 SILVER – 1H TIMEFRAME - Inverted cup and handle pattern

Silver tested support around 112,800–113,000 after a rounded top formation, rejecting the key EMA zones (25 & 55) and the previous demand-turned-supply zone.

🟠 Scenario Unfolding:

Expecting a short-term bounce towards 113,750–114,200 (EMA c

Silver Near $40: Deficits and Demand Fuel the RallySilver prices surged to multi-year highs in July 2025, driven by an extraordinary convergence of bullish factors, pushing prices above $39 per ounce, levels last seen in 2011.

Silver’s rally, supported by robust industrial demand and safe-haven inflows, aligns with traditional patterns as the U.S.

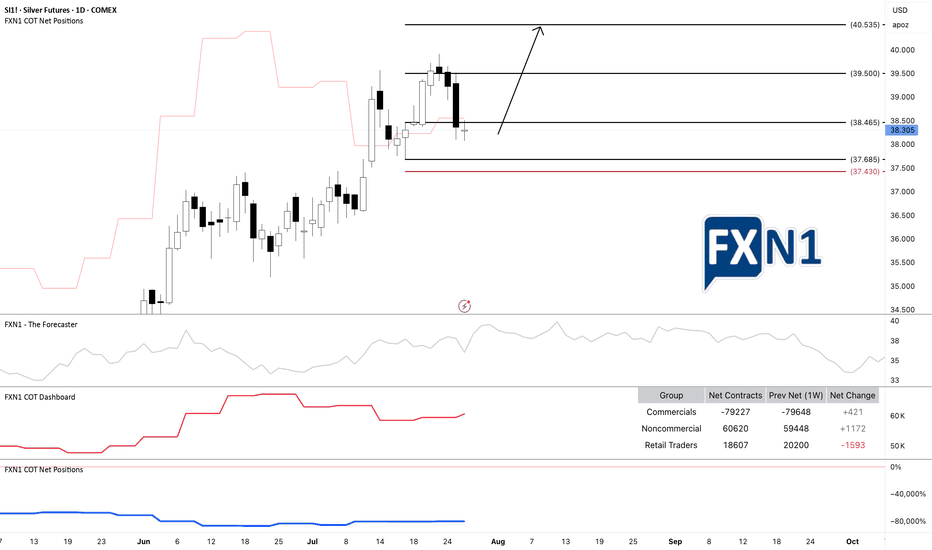

SI1!: Silver Demand Zone: Possible Bullish ContinuationI am currently observing a potential long-term continuation on SI1! Silver (XAG/USD), as the Commitment of Traders (COT) data indicates an increase in positions from both commercial and non-commercial traders. The price is approaching a demand zone on the daily chart, suggesting a possible bullish m

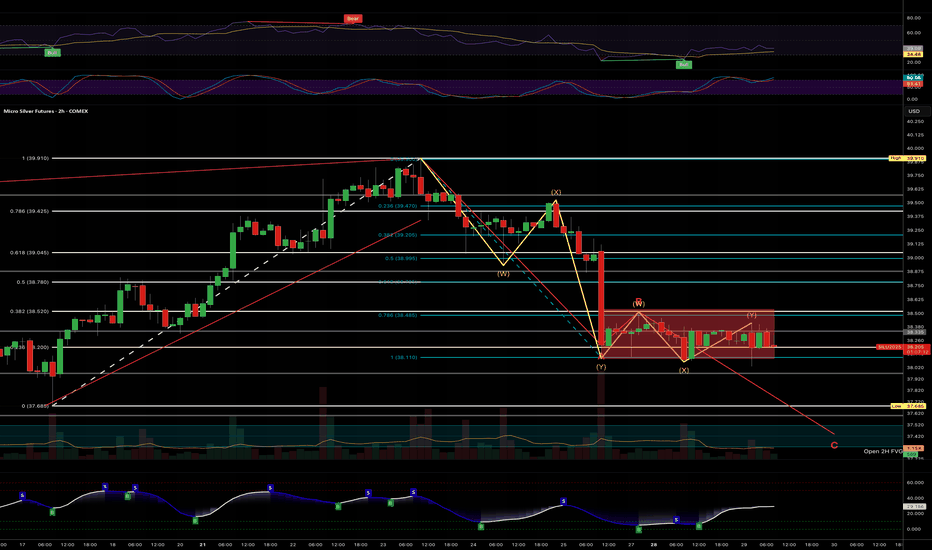

Silver - failure to break highs yesterday...This week is news packed... I was hoping to see Silver break above recently lower highs.

I am out of all positions - but I would not be surprised to see further breakdown in a second corrective leg, finding support at the FVG above next fib retracement.

Like I said, though, this week has alot of

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of Silver Futures (Apr 2027) is 41.355 USD / APZ — it has risen 1.32% in the past 24 hours. Watch Silver Futures (Apr 2027) price in more detail on the chart.

Track more important stats on the Silver Futures (Apr 2027) chart.

The nearest expiration date for Silver Futures (Apr 2027) is Apr 28, 2027.

Traders prefer to sell futures contracts when they've already made money on the investment, but still have plenty of time left before the expiration date. Thus, many consider it a good option to sell Silver Futures (Apr 2027) before Apr 28, 2027.

Buying or selling futures contracts depends on many factors: season, underlying commodity, your own trading strategy. So mostly it's up to you, but if you look for some certain calculations to take into account, you can study technical analysis for Silver Futures (Apr 2027). Today its technical rating is buy, but remember that market conditions change all the time, so it's always crucial to do your own research. See more of Silver Futures (Apr 2027) technicals for a more comprehensive analysis.