Strength in Precious Metals ContinuesThere was a good mix in price action across many asset classes on the day today where the precious metals traded higher led by the Silver market, which traded up near 1.3% on the day. There was a mixed set of data being released today with manufacturing data and PMI, and the S&P and Nasdaq finished

Related commodities

Copper testing support!Following the surprise announcement that the US administration is exempting tariffs on refined metals, the price of copper has tanked and connected with a 6M support from US$4.3805. Notably, directly above, we have a 1Y resistance level from US$4.4590 and a 3M resistance level at US$4.5515, while a

Copper: Trump Signs Tariffs on Imports Amid National Security...President Donald Trump signed a proclamation on Wednesday that imposes tariffs on copper imports, citing concerns over national security.

The White House announced that the new policy will introduce a 50% tariff on semi-finished copper products and other copper-derived goods that are highly depende

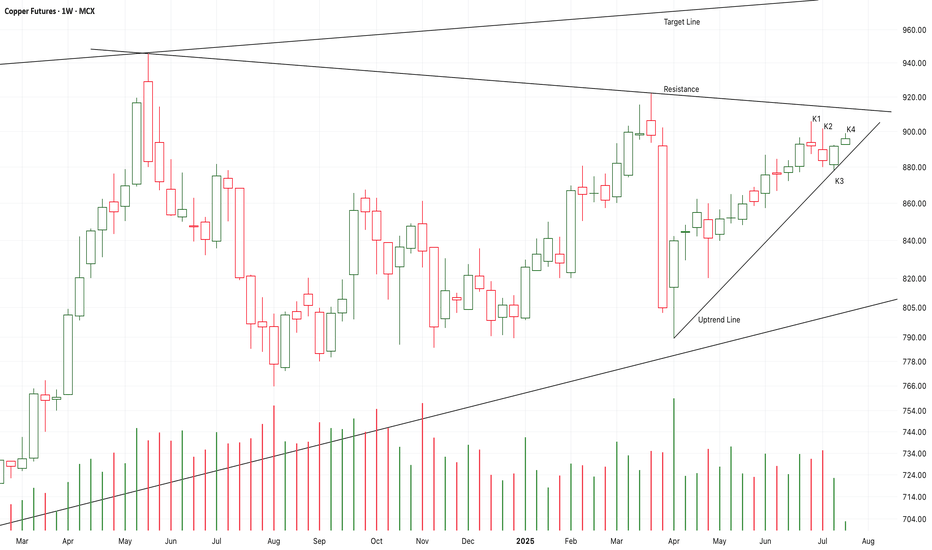

Chart Pattern Analysis Of Copper

K2 and K3 is a strong bullish up engulfing pattent.

K4 started with a bull gap to verify it.

It seems that K5 or K6 will break up the resistance to test the target line in the near future.

If I didn’t buy it earlier,I will try to buy it here.

I still hold the idea that the expensive metals such a

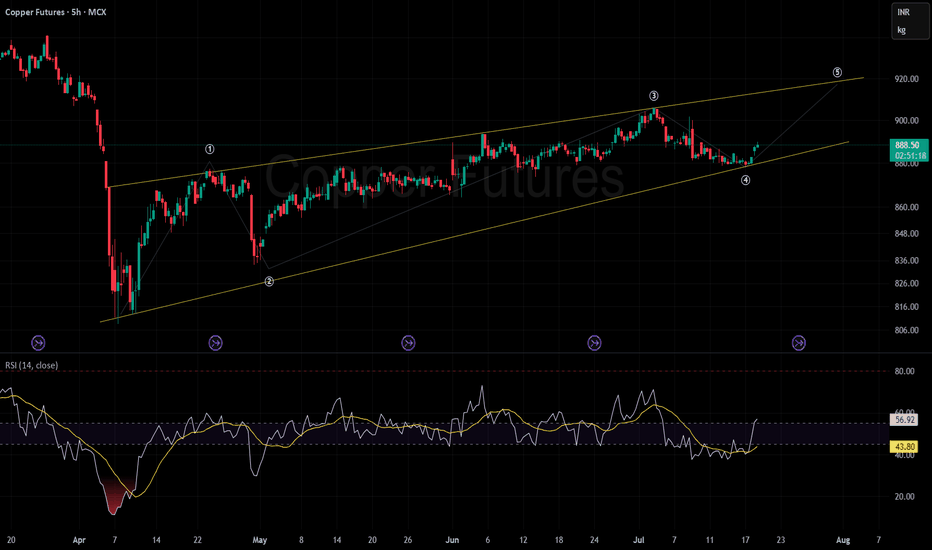

Copper looking good an upmoveKey Observations

Channel Pattern & Elliott Wave Count:

Price action is moving within a well-defined upward-sloping channel (yellow lines).

An Elliott Wave structure is marked (① to ⑤). The price just completed wave ④, suggesting the next move may attempt to form wave ⑤ towards the upper channel b

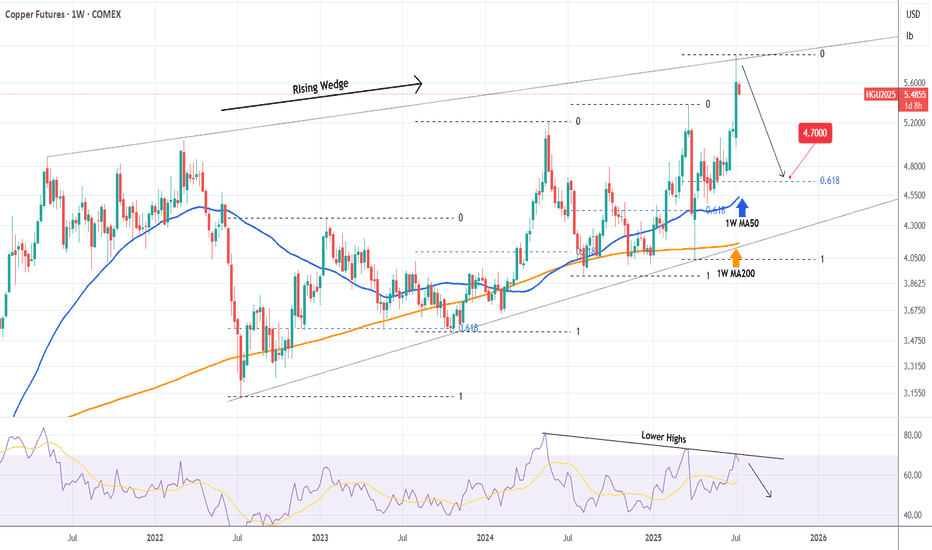

COPPER Top of 4-year Rising Wedge. Sell.Copper (HG1!) eventually followed the bearish break-out signal we gave on our last analysis (April 03, see chart below) and within 2 days it hit our 4.1250 Target:

Right now the price sits at the top of the 4-year Rising Wedge pattern and on the 1W time-frame it is a textbook technical sell sig

Tariffs Ignite a Copper FrenzyCOMEX copper has surged to a record premium over London Metal Exchange (LME) copper over the past few weeks, reflecting a lucrative arbitrage as traders rush metal into the U.S. ahead of looming import tariffs.

President Donald Trump’s announcement of a 50% tariff on U.S. copper imports (effective

Bullish Reversal Builds in Copper: Eyes on $5.20 Resistance

The current price has closed above the Bollinger Band middle line (20-day SMA), indicating short-term upward momentum.

A sustained close above 4.90–4.95 could open the way to challenge the psychological level of 5.00 and possibly 5.20.

Immediate resistance: 4.95 → 5.00 → 5.20

Support zones: 4.7

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of Micro Copper Futures is 4.4790 USD — it has risen 0.40% in the past 24 hours. Watch Micro Copper Futures price in more detail on the chart.

The volume of Micro Copper Futures is 7.81 K. Track more important stats on the Micro Copper Futures chart.

Open interest is the number of contracts held by traders in active positions — they're not closed or expired. For Micro Copper Futures this number is 7.56 K. You can use it to track a prevailing market trend and adjust your own strategy: declining open interest for Micro Copper Futures shows that traders are closing their positions, which means a weakening trend.

Buying or selling futures contracts depends on many factors: season, underlying commodity, your own trading strategy. So mostly it's up to you, but if you look for some certain calculations to take into account, you can study technical analysis for Micro Copper Futures. Today its technical rating is sell, but remember that market conditions change all the time, so it's always crucial to do your own research. See more of Micro Copper Futures technicals for a more comprehensive analysis.