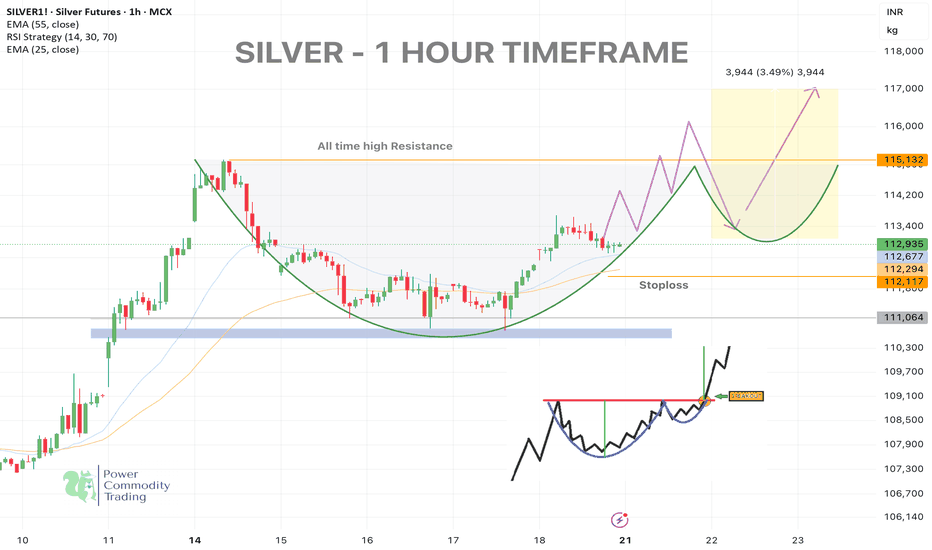

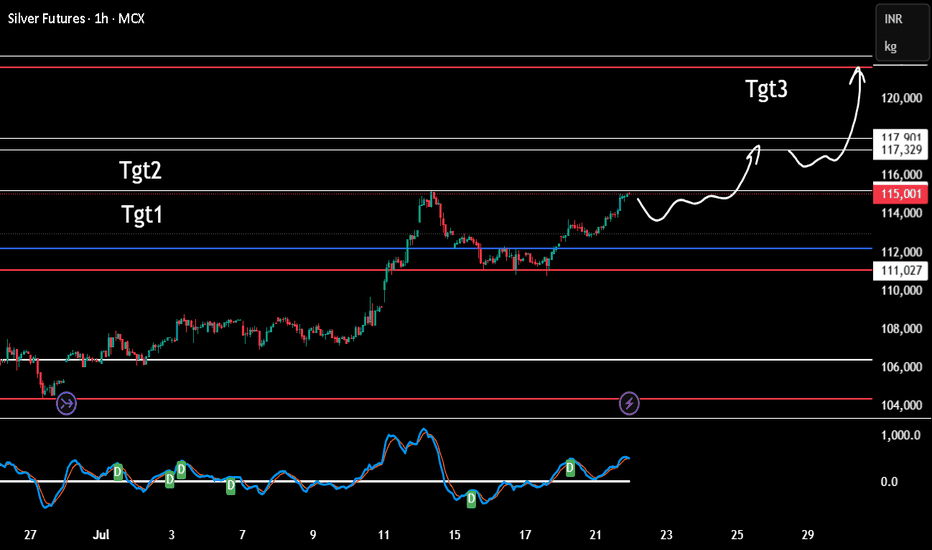

CUP & HANDLE + ROUNDED BOTTOM IN SILVERSilver (MCX: SILVER1!) – 1 Hour Chart Analysis

🔍 Pattern Formation: Cup and Handle + Rounded Bottom

Silver has formed a classic Cup and Handle pattern on the 1H timeframe, indicating a potential bullish breakout above the neckline near 115132 (all-time high resistance).

A smooth rounded bottom co

Related commodities

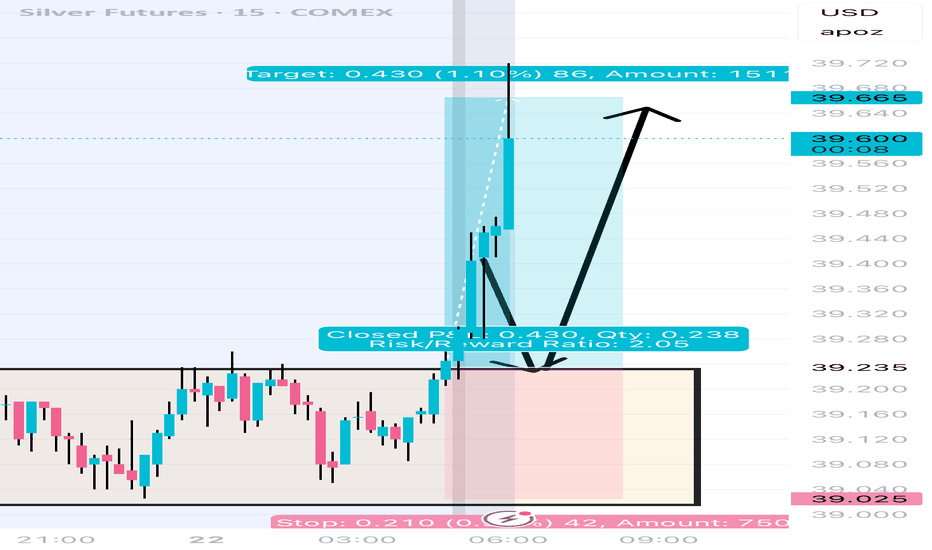

Silver RSI DivergenceLast night, I set a couple of orders on Silver to see if I can get an entry. Got stopped out on a few contracts, but long ~10 between my accounts.

I am long ES and Silver due to this weeks macro and expected volatility.

Nice RSI divergence, so expecting a nice play here as the week unfolds and w

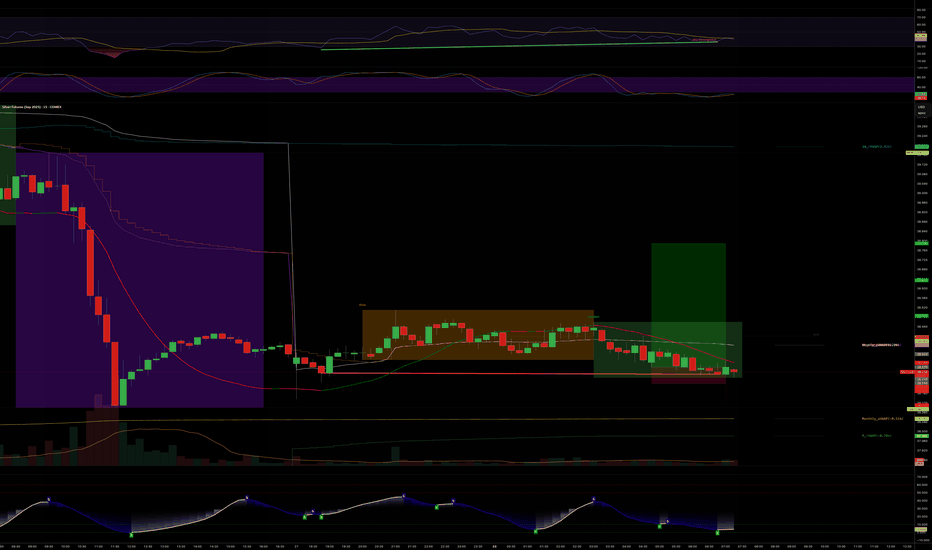

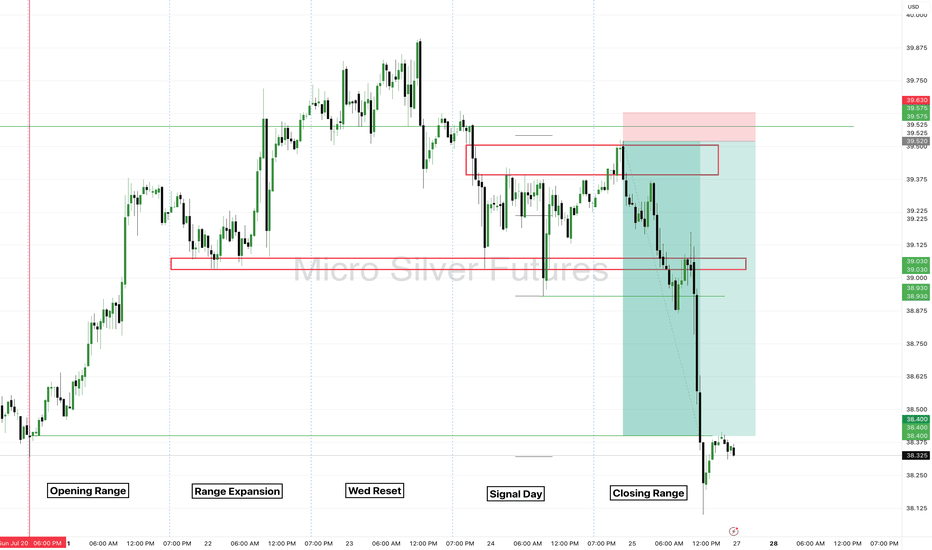

Silver Futures - Closing Range of the Week.Real trading comes down to the patience combined with emotional control to have the highest possible edge.

COMEX_MINI:SIL1!

There is no reason for your chart to filled be filled with ineffective distraction. Instead focus on simplicity to know exactly what to take a trade on. Be a hunter look

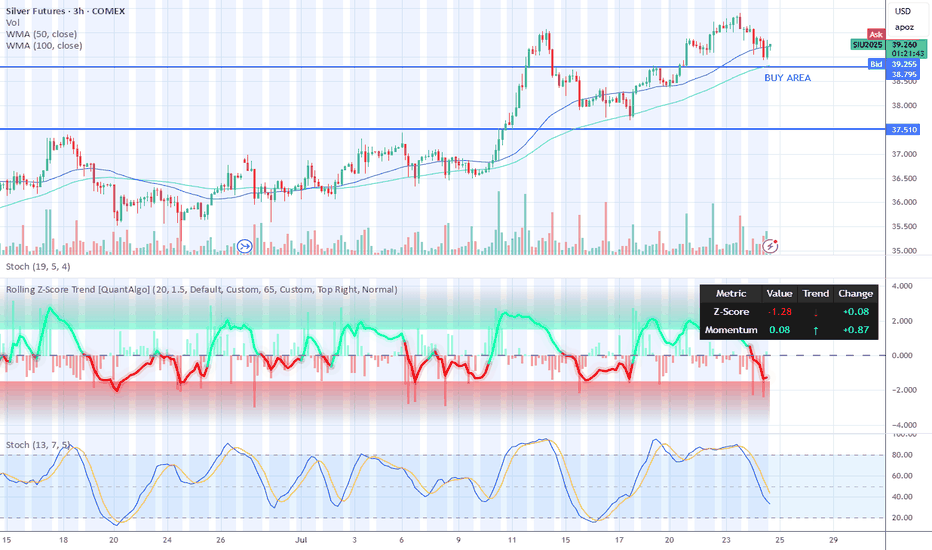

Short term buying opportunity Silver Futures ComexRecent weakness in silver futures could be an buying opportunity on 3 hour candel chart.

Wait for both indicators below to reach oversold levels like it is showing now. Long term 1 day chart showing long term bull trend with much higher upside. I expect silver prices to remain in uptrend. All time h

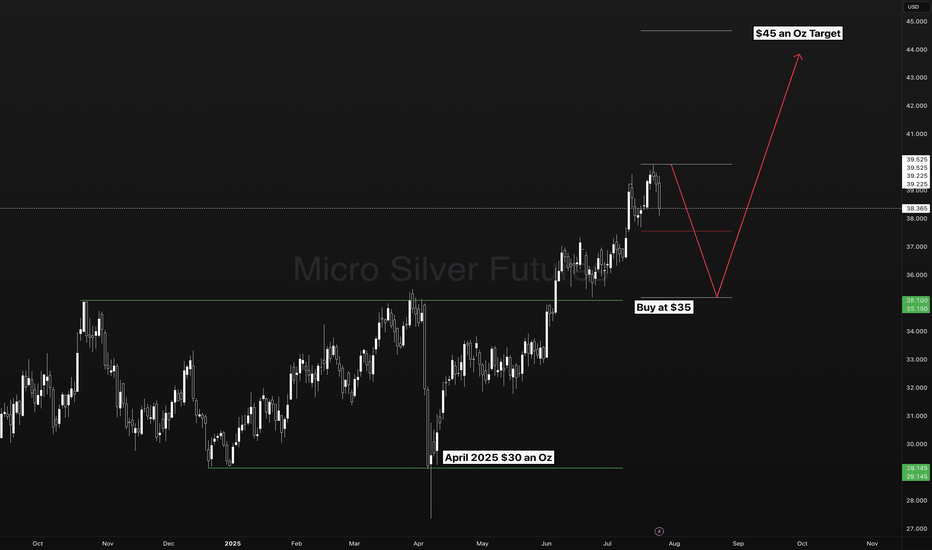

Silver to $38The move from March 2020 to August 2020

Was a measured move that played out to the Tee.

We have a similar structure building that projects to the High 30's

Suggesting #Gold move beyond ATH's and #Silver the beta play to move faster in an attempt to catch up, and move towards it's high's again.

Silver Futures Rally: Riding the Upper Bollinger Band

Price is riding the upper band, a classic signal of strong bullish trend continuation.

Strong support near $34.50–$35.00 (prior consolidation zone and Bollinger midline).

Psychological support at $36.00 which was broken and now may act as support-turned-resistance.

Silver futures could be hitting a high resistance zone.Resistance along this upper channel was significant on 3 prior occasions over the last couple of years. We're here now for the 4th time. Could be a high resistance zone. I expect a retrace at the least.

Fibs are pointing higher however unlikely that seems.

If we bust through, WOAH NELLIE!

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of Micro Silver Futures is 38.365 USD — it has fallen −0.30% in the past 24 hours. Watch Micro Silver Futures price in more detail on the chart.

The volume of Micro Silver Futures is 8.69 K. Track more important stats on the Micro Silver Futures chart.

Open interest is the number of contracts held by traders in active positions — they're not closed or expired. For Micro Silver Futures this number is 9.20 K. You can use it to track a prevailing market trend and adjust your own strategy: declining open interest for Micro Silver Futures shows that traders are closing their positions, which means a weakening trend.

Buying or selling futures contracts depends on many factors: season, underlying commodity, your own trading strategy. So mostly it's up to you, but if you look for some certain calculations to take into account, you can study technical analysis for Micro Silver Futures. Today its technical rating is buy, but remember that market conditions change all the time, so it's always crucial to do your own research. See more of Micro Silver Futures technicals for a more comprehensive analysis.