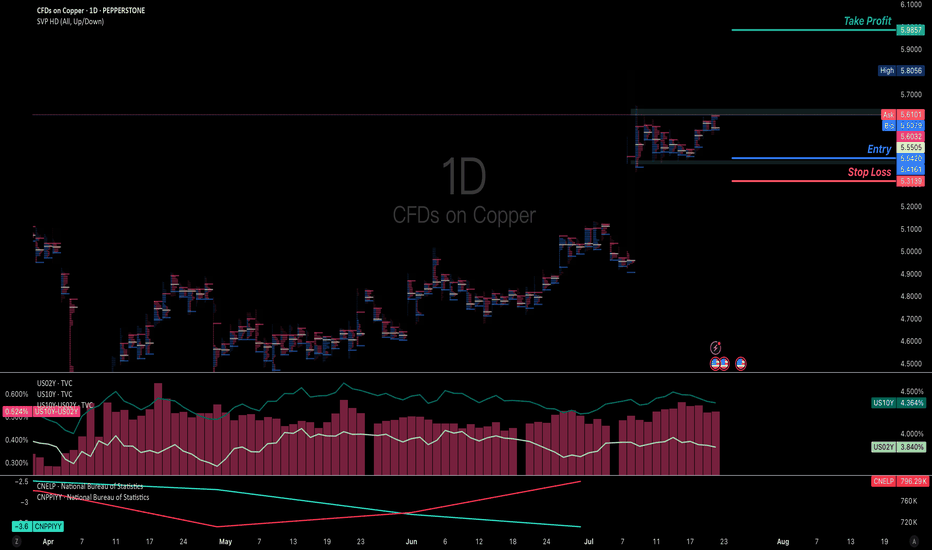

XCU/USD: Low-Risk Loot Opportunity!🔥 THE COPPER HEIST: XCU/USD Robbery Plan (Swing/Day Trade) 🔥

🌟 Attention, Market Robbers & Money Makers! 🌟

(Hola! Oi! Bonjour! Hallo! Marhaba!) 🤑💰💸✈️

Based on the 🔥Thief Trading Style🔥, here’s our master heist plan for the XCU/USD "The Copper" Metals Market! This is a high-probability long setup,

About CFDs on Copper

Copper is an essential industrial metal used worldwide. Copper prices are followed in financial markets around the globe and the metal is growing in popularity. Copper is widely used in construction and because of its electrical properties is found in wires and circuit boards. Copper is mined in open mines around the world, with Chile and the United States leading in overall copper production. The demand for copper is increasing as countries such as China and India continue to develop, while the supply remains tight. The growing demand and constrained supply is likely to keep copper prices volatile in the near future. Copper prices are commonly quoted in USD.

Long the copper for a potential breaking upWith the expectation of PPI bouncing back from the deep valley because China is launching a 1.3 Trillion infrastructure plan to build the largest hydro dam in the Yarlung Tsangpo Grand Canyon on the Qinghai-Tibet Plateau, the long term global demand of industrial copper is more bullish than last ti

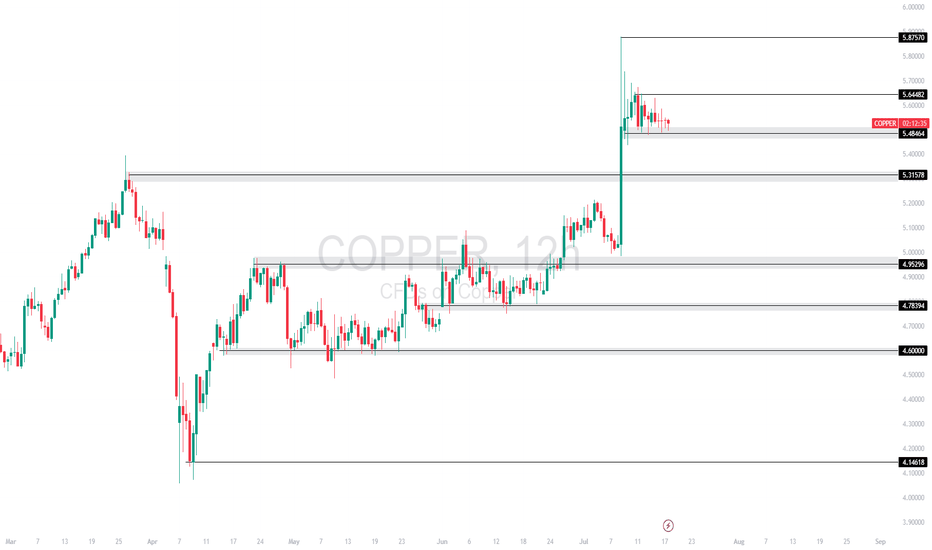

COPPER TECHNICAL ANALYSISCopper spiked into 5.8750 but is now consolidating just below short-term resistance at 5.6448, showing signs of a bullish continuation pattern. Price remains supported at the 5.4864 zone.

Currently trading at 5.4864, with

Support at: 5.4864 / 5.3157 / 4.9929 🔽

Resistance at: 5.6448 / 5.8750 🔼

🔎 Bi

Bullish Consolidation After the copper market exploded higher on the Trump Administration’s 50% tariff headline, the market has been quietly consolidating above the breakout level at 5.33. While above this level the risk is higher, and in case of a break back below the 5.30 level, the risk would be a larger retracement.

Copper Holds Above 14-Year ResistanceFrom a monthly time frame perspective, copper has broken above a major resistance zone defined by consecutive highs dating back to 2011.

The breakout above $5.40 marks a significant technical milestone. A clean move above the $5.87 high could open the door for further upside, potentially targeting

US COPPER: is the technical breakout a trap?The unexpected announcement of a dramatic increase in US copper tariffs triggered a bullish impulse in the copper price, which reached a new all-time high. The question is whether this bullish technical signal is reliable, or whether it could be a false signal and therefore a bullish trap. So let's

Gap below… but copper’s breakout still in playCopper markets erupted higher this week following President Trump's proposal to impose a 50% tariff on copper imports. The price ripped from just above $5.20 to nearly $5.80 in a single 4-hour candle.

Now, copper could be forming a bullish flag or pennant on the 4-hour timeframe. After the vertica

Copper Trading Summary – Trump’s 50% Tariff ImpactCopper futures spiked—largest intraday gain in decades—after Trump announced a 50% import tariff.

Market fears supply disruption, especially from major exporters like Chile and Peru.

Bullish short-term outlook as U.S. buyers may rush to stockpile ahead of enforcement.

Risk of retaliation or broad

Copper is finding it's way to 5.5555...Hi all trading lovers and copper buyers...

Seems that copper is continuing its uptrend targeting 5.5555...

PLEASE NOTE THAT IS ONLY AN ANALYSIS...

MARKET IS BASED ON POSSIBILITIES AND UNCERTAINTIES...

#Forex #Trading #Analysis #Copper #Chart #Spike #Wedge #Uptrend

See all ideas

Displays a symbol's price movements over previous years to identify recurring trends.