#CRV/USDT 30% Rally imminent. Bull Flag Breakout Incoming!$CRV/USDT: Missed out on MAGIC? This could be your next opportunity.

ENTRY :- .5778 TO .6100

SL: 0.5626

TARGETS :

.6433

.6782

.7144

.7644

.7881

.8010

Dyor nfs.

I’m sharing some of my high-conviction trades with you all.

I also plan to build a team of traders to participate in trading tournaments.

DM me if you’ve been trading consistently and want to join.

It's free, there are no fees.

See you!

CRVUSDT trade ideas

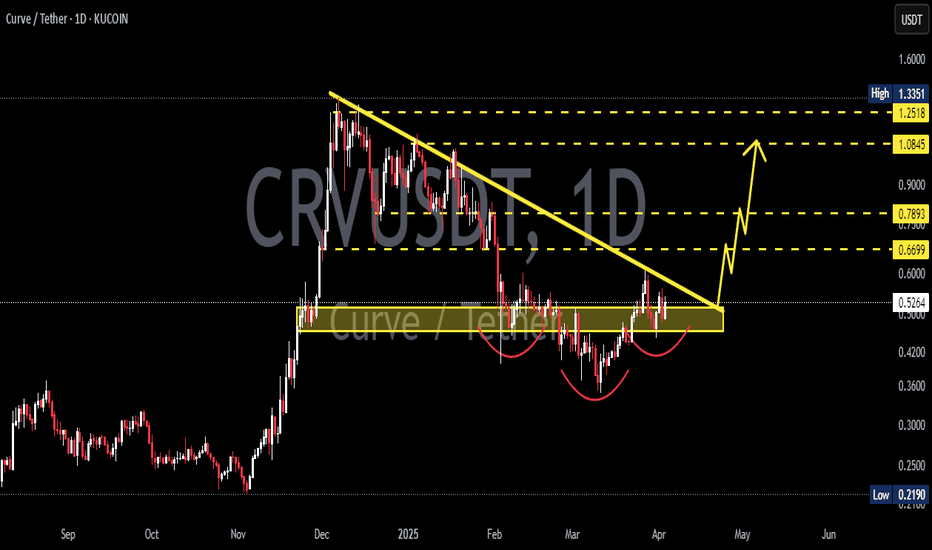

$CRV is gearing up for a breakout! LSE:CRV is gearing up for a breakout! 🚀

Price is ranging tightly & eyeing a breakout. A clean close above resistance could spark a 37% rally.

Entry: 0.6050, 0.5870, 0.5700

Targets: 0.6500, 0.7000, 0.7450, 0.8000, 0.8500

SL: 0.5450

Don’t miss this setup.

DYOR, NFA.

#Altseason2025

Bullish Triangle Pattern on ProgressIn my previous update on BINANCE:CRVUSDT , I mentioned three potential scenarios: a bullish triangle formation, sideways movement, and a double top pattern.

Right now, it looks like the bullish triangle pattern is playing out. If this continues, I expect the price to reach the 0.7853 – 0.8343 target zone. But before that, all eyes are on the key resistance at 0.6667 — the prior high.

The best-case scenario would be a strong breakout above 0.6667, ideally with a solid bullish candle showing strong buyer momentum.

However, stay cautious. If price breaks the resistance but quickly falls back into the triangle and breaks the low of the breakout candle, that could be a false breakout (or what some might call a liquidation sweep). In that case, reducing exposure could be a wise move, as price might enter a sideways phase.

On the other hand, if price gets rejected (before breakout) at 0.6667 with a large red candle, that’s still acceptable — as long as price holds above the invalidation level at 0.5781.

Let’s keep watching how price reacts around key levels. Market structure still favors the bulls, but risk management is key.

CRV Eyes Higher Low as Key Confluence Zone HoldsThe Analysis covers CRV

Curve DAO Token (CRV) may be in the early stages of reversing its downtrend. Price action on the daily chart is now consolidating above a highly significant support zone filled with technical signals that often attract buyers and mark turning points.

- CRV is holding above a cluster of key levels—the value area low, 0.618 Fibonacci retracement, and a nearby swing low—indicating that bulls are defending this area.

- A reclaim and steady hold above the key swing low would signal the formation of a higher low, which typically precedes upward continuation.

- A volume increase paired with VWAP holding near this zone would strengthen the bullish case and suggest a potential breakout.

CRV's price is forming what looks like a textbook higher low—an early indicator of a potential shift toward a bullish trend. The current range aligns several critical support indicators: the 0.618 Fib retracement, the value area low, and a local swing low, all layered near a weekly S/R flip. This overlap strengthens the probability of a solid base forming.

The slow, steady price movement just above this zone often hints at accumulation. A quick dip below the swing low and sharp recovery (liquidity grab) could be the final signal before a breakout. If the value area high begins acting as support, it would show growing buyer confidence and a willingness to buy pullbacks.

Should bulls hold the current zone and drive price above the value area high with increasing volume, CRV may be ready to break higher. With accumulation underway, any push above local highs could kick off a stronger trend move. For now, the market is watching to see if the higher low holds firm.

Why This Bearish Trend Is Actually a Bullish Opportunity?Understanding the Multi Timeframe Analysis – Part 2 of 2

Alright from the prior post we talked about how the corrective move on the 4H timeframe turns out to be a bearish trend on the 1H chart. Now, let’s dive deeper into that 1-hour chart.

In this 1H chart, we can observe a trend shift from bullish to bearish.

Before the red arrow, we can clearly see a bullish structure:

Blue arrows continue to form higher lows, and

Orange arrows form higher highs (except one minor failure, which still maintains the bullish structure because price doesn’t break the previous low).

But everything changes after the red arrow:

Orange arrows fail to create new highs,

Blue arrows start forming lower lows,

→ confirming a bearish reversal on the 1H timeframe.

So… How Can We Use This Bearish Trend as a Bullish Opportunity?

Here's where it gets interesting — instead of seeing the bearish trend as a threat, we use it for better entry with an improved risk-reward ratio.

But here’s the catch – some conditions must be met:

Make sure the bigger timeframe (4H) still supports a bullish trend.

Wait for price to drop lower than the last blue arrow (prior low).

Look for bullish divergence + candlestick confirmation before entering.

Once you get the signal, you can place your stop loss below the confirmation candle to limit your risk.

What If Price Breaks the Orange Arrow (Prior High)?

If price invalidates the bearish structure by breaking the previous high, that means:

The 1H bearish trend is over.

The pullback on 4H timeframe is done.

And price is likely resuming the main bullish trend.

So, whether price goes lower or higher — you’re ready either way.

Alright, that’s my take on using multiple timeframes—hope it helps clear up any confusion you had! Let me know your thoughts in the comments. See you in the next post!

Why This Bearish Trend Is Actually a Bullish Opportunity?Understanding the Multi Timeframe Analysis – Part 1 of 2

Have you ever felt overwhelmed when using multiple timeframes in your analysis? Not sure which timeframes to choose or how to combine them effectively?

In this post, I’ll share my thoughts on how to use multi-timeframe analysis with real chart examples.

Let’s take a look at the movement from the first red and blue arrows – we can clearly see that buyers were not in control at that point. But if we compare it to the next red and blue arrows, it’s clear that buyers took control of the market.

This tells us something important:

➡️ The recent price drop from the last red arrow is likely just a corrective move, not a reversal.

Based on the 4-hour timeframe, we can identify the corrective target zone around 0.5593 - 0.5369.

So what’s next?

In smaller timeframes like the 1-hour chart, this corrective move might appear as a short-term bearish trend. But from a higher timeframe perspective, it’s just a pullback – and that can create an opportunity for a precise entry using a strategy like bottom fishing.

In the next post (Part 2), I’ll show you how this works on the 1-hour chart – including the before and after, and how I plan my entry.

Stay tuned!

Do you usually check the bigger timeframe before taking entries? Let me know your approach in the comments.

RAFAQAT X UMAR CRVAs of April 18, 2025, Curve DAO Token (CRV) is exhibiting a neutral technical stance across multiple timeframes.

en.arincen.com

+9

TradingView

+9

TradingView

+9

Price Overview:

Current Price: Approximately $0.9999 USD, maintaining its peg to the US Dollar.

MarketBeat

+3

CoinMarketCap

+3

Gate.io

+3

24-Hour Trading Volume: Around $9.99 million.

CoinMarketCap

Technical Indicators:

Relative Strength Index (RSI): 51.87, indicating a neutral momentum.

TradingView

+7

Free Crypto Screener

+7

MarketScreener

+7

Stochastic Oscillator: 5.95, suggesting a potential buying opportunity.

TradingView

MACD: 0.0007840, showing a neutral trend.

SoSoValue

+5

Free Crypto Screener

+5

TradingView

+5

Williams %R: -94.16, indicating the asset is in the oversold territory.

Free Crypto Screener

Moving Averages:

SMA20: 0.9992, aligning closely with the current price.

Free Crypto Screener

SMA50: 0.9969, slightly below the current price, suggesting short-term support.

SMA100: 0.9924, indicating a stable medium-term trend.

en.arincen.com

SMA200: 0.9854, reflecting long-term stability.

Free Crypto Screener

Market Sentiment:

The technical indicators present a mixed outlook, with some suggesting potential buying opportunities while others remain neutral. Given CRV's nature as a stablecoin, significant price fluctuations are uncommon, and its value remains closely tied to the US Dollar.

CoinMarketCap

Conclusion:

CRV is currently maintaining its stability, with technical indicators reflecting a balanced market sentiment. Investors should monitor for any changes in market conditions or technical signals that could indicate a shift in trend.

CRV/USDTKey Level Zone: 0.605-0.615

HMT v8 detected. The setup looks promising, supported by a previous upward/downward trend with increasing volume and momentum, presenting an excellent reward-to-risk opportunity.

HMT (High Momentum Trending):

HMT is based on trend, momentum, volume, and market structure across multiple timeframes. It highlights setups with strong potential for upward movement and higher rewards.

Whenever I spot a signal for my own trading, I’ll share it. Please note that conducting a comprehensive analysis on a single timeframe chart can be quite challenging and sometimes confusing. I appreciate your understanding of the effort involved.

Important Note :

Role of Key Levels:

- These zones are critical for analyzing price trends. If the key level zone holds, the price may continue trending in the expected direction. However, momentum may increase or decrease based on subsequent patterns.

- Breakouts: If the key level zone breaks, it signals a stop-out. For reversal traders, this presents an opportunity to consider switching direction, as the price often retests these zones, which may act as strong support-turned-resistance (or vice versa).

My Trading Rules

Risk Management

- Maximum risk per trade: 2.5%.

- Leverage: 5x.

Exit Strategy

Profit-Taking:

- Sell at least 70% on the 3rd wave up (LTF Wave 5).

- Typically, sell 50% during a high-volume spike.

- Adjust stop-loss to breakeven once the trade achieves a 1.5:1 reward-to-risk ratio.

- If the market shows signs of losing momentum or divergence, ill will exit at breakeven.

The market is highly dynamic and constantly changing. HMT signals and target profit (TP) levels are based on the current price and movement, but market conditions can shift instantly, so it is crucial to remain adaptable and follow the market's movement.

If you find this signal/analysis meaningful, kindly like and share it.

Thank you for your support~

Sharing this with love!

HMT v2.0:

- Major update to the Momentum indicator

- Reduced false signals from inaccurate momentum detection

- New screener with improved accuracy and fewer signals

HMT v3.0:

- Added liquidity factor to enhance trend continuation

- Improved potential for momentum-based plays

- Increased winning probability by reducing entries during peaks

HMT v3.1:

- Enhanced entry confirmation for improved reward-to-risk ratios

HMT v4.0:

- Incorporated buying and selling pressure in lower timeframes to enhance the probability of trending moves while optimizing entry timing and scaling

HMT v4.1:

- Enhanced take-profit (TP) target by incorporating market structure analysis

HMT v5 :

Date: 23/01/2025

- Refined wave analysis for trending conditions

- Incorporated lower timeframe (LTF) momentum to strengthen trend reliability

- Re-aligned and re-balanced entry conditions for improved accuracy

HMT v6 :

Date : 15/02/2025

- Integrated strong accumulation activity into in-depth wave analysis

HMT v7 :

Date : 20/03/2025

- Refined wave analysis along with accumulation and market sentiment

HMT v8 :

Date : 16/04/2025

- Fully restructured strategy logic

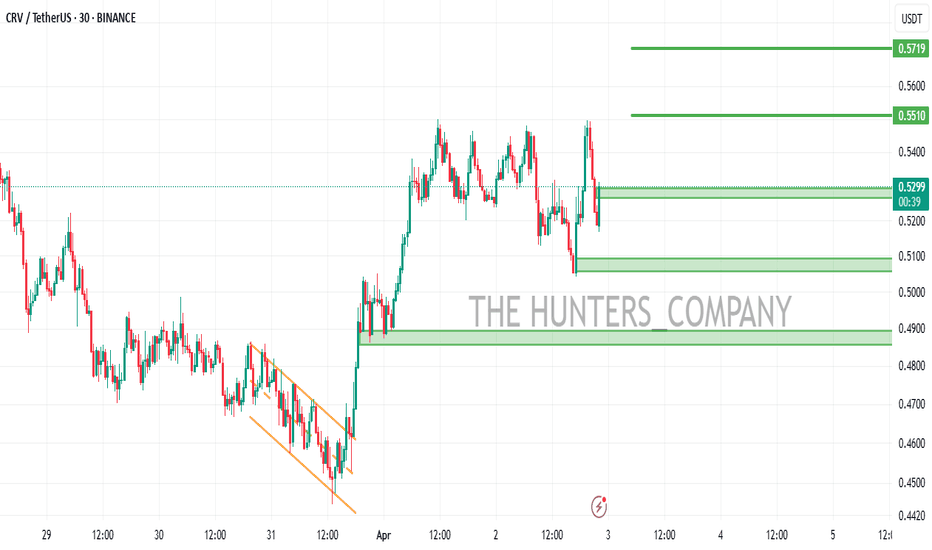

I am short CRVUSDT here..CRVUSDT I think over extended to the upside here with the caveat that BTC is not pumping right now. If it does, it totally invalidates this short. But I think we are at a long standing downward trendline. If it respect this point and gets rejected you can see we may grab a 2.5:1 RRR trade with a SL just outside the swing high on the 27th of March.

I have fractionally small limit short order of which one has filled spread between 0.54-0.5799 as I think if we go higher we only wick up. SL at 0.6198

Enjoy!

CRV: Close above 0.60 and its on like donkey kong My brothers in stablecoin finance:

It is now, for the first time in its history in public markets: the time for CRV to win.

Stablecoin wars of the 2020's rage on and now commence.... Contro-Founder liquidated fully carried out on stretcher

Big winners for me, but not advice. I manage my own risk and ive got my hands full

Curve DAO - crvCurve is a DeFi ecosystem consisting of several core products:

Curve DEX is a decentralized exchange best suited for stablecoins and pegged assets that uses an automated market maker (AMM) to manage liquidity.

crvUSD decentralized stablecoin issuance app allows you to borrow stablecoin against secure assets such as ETH and BTC with collateral liquidation protection.

CRV SHORTCrypto Introduction

Curve is a decentralized exchange liquidity pool on Ethereum designed for extremely efficient stablecoin trading. Launched in January 2020, Curve allows users to trade between stablecoins with low slippage, low fee algorithm designed specifically for stablecoins and earning fees. Behind the scenes, the tokens held by liquidity pools are also supplied to the Compound protocol or iearn.finance where to generate more income for liquidity providers.

Short retest of range breakdown. (if given)

CRV SHORT SETUP ALL trading ideas have entry point + stop loss + take profit + Risk level.

hello Traders, here is the full analysis for this pair, let me know in the comment section below if you have any questions, the entry will be taken only if all rules of the strategies will be satisfied. I suggest you keep this pair on your watchlist and see if the rules of your strategy are satisfied. Please also refer to the Important Risk Notice linked below.

Disclaimer