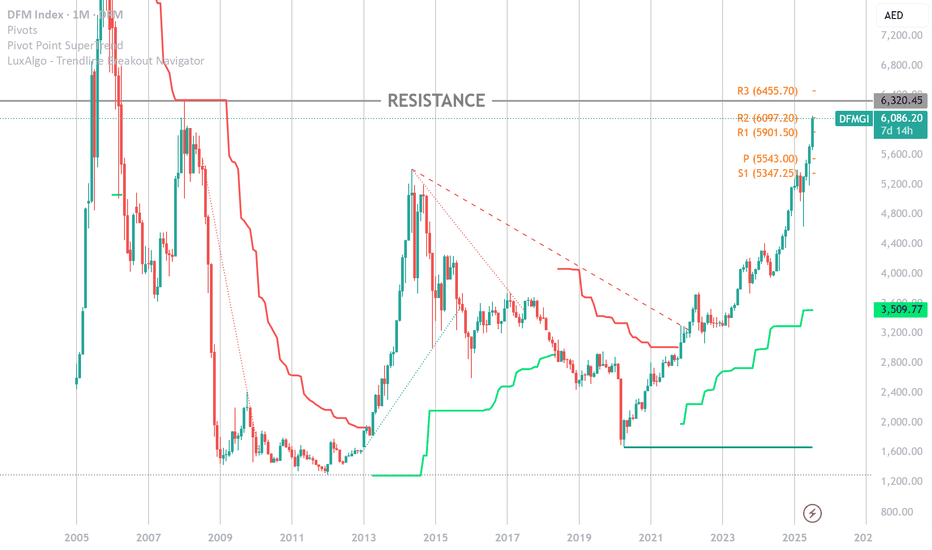

DFM hits ceiling, Now what ?DFM:DFMGI 📊 DFM Index Technical Insight – July 2025 📈

The DFM Index (\ DFM:DFMGI ) is currently trading around 6,086, just shy of its major resistance at 6,320—a level not tested since the 2008 peak. We're witnessing a powerful **parabolic rally**, but caution is warranted at these levels. 🚧

🔍 Wh

Related indices

Dubai Financial Market - Quick UpdateOver all Dubai Stock Market Index is trending up, we didnt see any significant correction on the way up after the last panic selling in the market. I think a small pull back will be healthy for the market. Once the resistance is taken out we may see market climbing more higher. Over all i am still b

DFMGI - DFM Index - Seasonal Trends [Good News!]Good Day, Trader!

Our seasonal analysis of the DFM Index over the past 10 years reveals that March has historically been bearish more than 70% of the time.

However, there’s good news on the horizon— April has shown a bullish trend in over 70% of the past decade!

For a complete view of the

DFMGI DUBAI IndexDFMGI Index Analysis: Key Dates and Potential Scenarios

The chart presents two primary scenarios for the DFMGI Index based on the projected key dates:

Potential Upside:

Green Arrow (April 7, 2025): This date could signal a potential bullish reversal or continuation of an upward trend. The index ma

DFM Market Is Gearing UPTalking about the trend DFMGI is in a downtrend on the daily chart. Lately it has been trading in a tight ascending triangle pattern, in Friday's session finally it broke up with good volumes and from here it has got a very good chances of trend reversal.

However keep it mind that in case if this a

DFM General Index (DFMGI) Signals Long Bullish Trend

Heading:

DFM General Index (DFMGI) Signals Long Bullish Trend 🚀

Hey Traders!

🌟 Greetings to all traders out there,

The DFM General Index (DFMGI) is currently showing promising signs of a long bullish trend, potentially opening up lucrative opportunities for traders like you.

DFM:DFMGI

Still not a confirmationFor now dfmgi is under selling pressure, we cannot see a defined trend to the upside. This can be a short recovery dont trust the move for now. Let it make a positive price action to get onboard. Any negative news and market goes crazy. So if you are buying anything quick entry and exit that too wit

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current value of DFM Index is 6,150.45 AED — it has risen by 0.64% in the past 24 hours. Track the index more closely on the DFM Index chart.

DFM Index reached its highest quote on Nov 6, 2005 — 8,544.65 AED. See more data on the DFM Index chart.

The lowest ever quote of DFM Index is 1,294.10 AED. It was reached on Jan 16, 2012. See more data on the DFM Index chart.

DFM Index value has increased by 0.76% in the past week, since last month it has shown a 9.94% increase, and over the year it's increased by 45.48%. Keep track of all changes on the DFM Index chart.

The top companies of DFM Index are DFM:EMIRATESNBD, DFM:DEWA, and DFM:EMAAR — they can boast market cap of 44.56 B AED, 38.19 B AED, and 36.76 B AED accordingly.

The highest-priced instruments on DFM Index are DFM:MASQ, DFM:EMIRATESNBD, and DFM:EMAAR — they'll cost you 267.00 AED, 26.10 AED, and 15.70 AED accordingly.

The champion of DFM Index is DFM:UPP — it's gained 135.88% over the year.

The weakest component of DFM Index is DFM:SUKOONTAKAFL — it's lost −33.33% over the year.

DFM Index is just a number that lets you track performance of the instruments comprising the index, so you can't invest in it directly. But you can buy DFM Index futures or funds or invest in its components.

The DFM Index is comprised of 41 instruments including DFM:EMIRATESNBD, DFM:DEWA, DFM:EMAAR and others. See the full list of DFM Index components to find more opportunities.