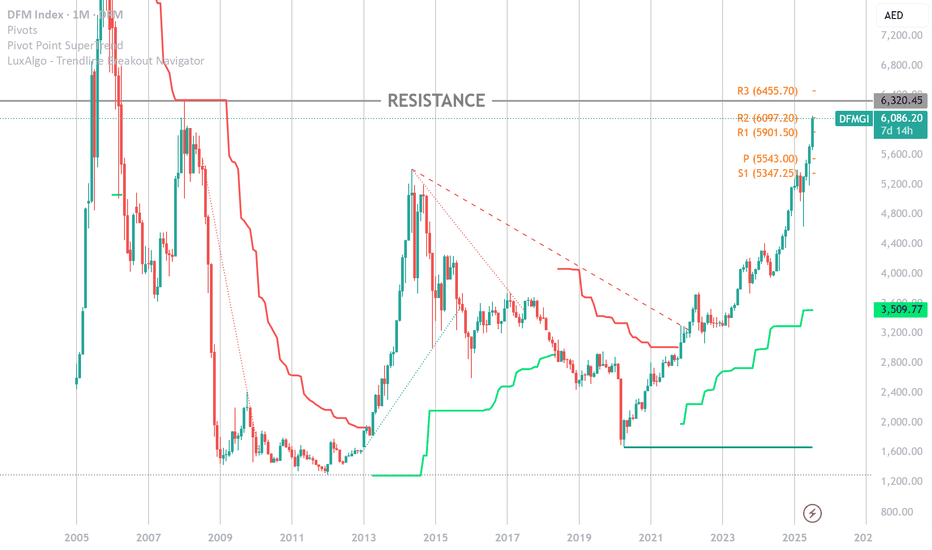

DFM hits ceiling, Now what ?DFM:DFMGI 📊 DFM Index Technical Insight – July 2025 📈

The DFM Index (\ DFM:DFMGI ) is currently trading around 6,086, just shy of its major resistance at 6,320—a level not tested since the 2008 peak. We're witnessing a powerful **parabolic rally**, but caution is warranted at these levels. 🚧

🔍 What the Chart is Saying:

* The monthly candles show strong bullish momentum, with 7 consecutive green bars and a +6.67% monthly gain so far.

* RSI is deeply overbought at 82.80, which historically signals cooling-off zones or consolidation phases. ⚠️

* The index has broken out of a multi-year accumulation zone (between \~2,300 and \~4,000), suggesting a long-term trend reversal is intact. 📈

* Current price is far extended from both the Hull MA (9) at 6,096 and historical pivot levels (Classic P = 5,542.98), indicating stretched conditions. 🧭

🧠 Key Levels to Watch:

* Immediate Resistance: 6,320 (multi-year peak zone)

* Support: 5,901 (R1), then stronger floor near 5,542 (pivot)

* If we break above 6,320 with volume, upside continuation toward **6,651 (R3)** is likely 🔓

⚖️ Insight:

DFM is on fire 🔥, but risk is rising. The structure remains bullish, but traders should watch for signs of bearish divergence or exhaustion candles as we near historical highs. 📉 A healthy pullback could offer better entry zones for trend-followers.

📌 Summary:

🌟 Trend = Bullish

📈 Momentum = Strong but Overheated

🕰️ Outlook = Wait for confirmation or consolidation

DFMGI trade ideas

Dubai Financial Market - Quick UpdateOver all Dubai Stock Market Index is trending up, we didnt see any significant correction on the way up after the last panic selling in the market. I think a small pull back will be healthy for the market. Once the resistance is taken out we may see market climbing more higher. Over all i am still bullish.

Hit the like button to show your support ;)

DFMGI - DFM Index - Seasonal Trends [Good News!]Good Day, Trader!

Our seasonal analysis of the DFM Index over the past 10 years reveals that March has historically been bearish more than 70% of the time.

However, there’s good news on the horizon— April has shown a bullish trend in over 70% of the past decade!

For a complete view of the seasonal and cyclic trend analysis of the DFM Index since inception, check out the full chart.

Happy Trading!

DFMGI DUBAI IndexDFMGI Index Analysis: Key Dates and Potential Scenarios

The chart presents two primary scenarios for the DFMGI Index based on the projected key dates:

Potential Upside:

Green Arrow (April 7, 2025): This date could signal a potential bullish reversal or continuation of an upward trend. The index may find support and start gaining momentum towards higher levels. Investors might consider this date as a possible entry point for long positions if the market shows strength leading up to it.

Potential Downside:

Red Arrows (March 29, 2026): This date might mark a significant peak or resistance level, where the index could face selling pressure. The index may start to decline after this point, leading to a potential bearish phase. This could be a critical time to reassess positions and consider taking profits or hedging against downside risks.

Momentum Indicators:

Yellow Line: Reflects the shorter-term momentum, currently showing a cyclic pattern that may align with the projected dates. The upcoming peaks and troughs should be closely monitored as they approach these key dates.

Red Line: Suggests a longer-term momentum trend, which could be approaching a significant inflection point. The market may see more pronounced movements as these dates approach.

Strategic Considerations:

April 7, 2025: Look for signs of market strength leading up to this date, which could indicate a continuation of the bullish trend.

March 29, 2026: Be cautious as the market approaches this date, as it may signal a turning point or the beginning of a correction.

These dates are critical for making informed decisions based on the projected market sentiment and technical analysis.

DFM Market Is Gearing UPTalking about the trend DFMGI is in a downtrend on the daily chart. Lately it has been trading in a tight ascending triangle pattern, in Friday's session finally it broke up with good volumes and from here it has got a very good chances of trend reversal.

However keep it mind that in case if this a false breakout then sellers will jump in very aggressively which will bring down the index till about 3980 if this does not hold it may even go low till 3930 point. I am bullish biased and I think market will move up from here after the consolidation phase.

Biggies like Emaar Properties, Emaar Develpment, Dubai Islamic Bank & emiratesNBD have picked up very well last week. These stocks are heavy weighted on the market index. Once the big stocks start the action it brings positivity in the market and other small stocks also follow.

Next week will be very interesting, lets see how the market unfolds from here.

Hit like & follow ;)

DFM General Index (DFMGI) Signals Long Bullish Trend

Heading:

DFM General Index (DFMGI) Signals Long Bullish Trend 🚀

Hey Traders!

🌟 Greetings to all traders out there,

The DFM General Index (DFMGI) is currently showing promising signs of a long bullish trend, potentially opening up lucrative opportunities for traders like you.

DFM:DFMGI

Key Insights:

- DFMGI is indicating a strong inclination towards a long bullish sentiment, reflecting positive market dynamics and the potential for significant upward movement.

- Market participants are closely monitoring DFMGI's behavior, anticipating confirmation of the bullish trend and identifying optimal entry points for long positions.

- Various fundamental factors, along with technical indicators, are contributing to the optimistic outlook for DFMGI's future performance.

Technical Analysis:

DFMGI's price chart presents a compelling narrative of a bullish trajectory, characterized by consistent uptrends and favorable technical indicators hinting at further upside potential.

Fundamental Factors:

In addition to technical signals, underlying fundamentals such as economic growth prospects, corporate earnings projections, and geopolitical developments play a significant role in shaping DFMGI's trajectory.

Trading Strategies:

Given the encouraging signals of a long bullish trend in DFMGI, traders may consider exploring strategic long positions, employing effective risk management strategies to maximize potential returns while mitigating risks.

In Conclusion:

With DFMGI showing promising signs of a long bullish trend, traders are advised to exercise prudence and diligence in their trading decisions, capitalizing on opportunities as they arise while remaining mindful of potential risks.

Engage with Us:

🟢 If you find this analysis insightful, please give it a LIKE.

🟡 Don't forget to FOLLOW for more updates.

🔵 SHARE with fellow traders who might benefit from this information.

🔴 Feel free to COMMENT with your thoughts and insights!

Your active participation enriches our trading community, fostering knowledge exchange and collective growth. Share your feedback and ideas in the comments below or by boosting this post.

Looking forward to connecting with you in the next post.

Happy trading!

Still not a confirmationFor now dfmgi is under selling pressure, we cannot see a defined trend to the upside. This can be a short recovery dont trust the move for now. Let it make a positive price action to get onboard. Any negative news and market goes crazy. So if you are buying anything quick entry and exit that too with small quantities.

Hit like & follow guys ;)

Trend is IntactOverall Trend

DFMGI is in a strong uptrend, as we see on the chart it have hit the resistance area of 4100 that is psychological and technical resistance. Its been going side ways for about 2 weeks not this is a good indication that bulls are still defending the support zone.

Breakout

Coming week which will be very crucial as more data will be coming out from CHINA, as well see all eyes are on Yuan & the giant real estate Evergrande that have filled bankruptcy in the USA. Traders & investors will be closely watchin g for signals to take positions respectively. If the data are positive, if there is any sign of relief i think market will break the resistance of 4100 points else it will break the support of 4040-4000 points.

Fundamentals

UAE's economy is very sound and progressing with strong real estate demand that is coming form India, Russia, Israel & UK also not to forget the booming tourism sector everything is aligned for flourishing economy and we are seeing its reflection in the market.

IPO

New Listings are expected later in this year, with the boom of IPO in the middle east people are still having more appetite for IPO's

RoadShow

Dubai Financial Market have recently done a roadshow and its attracting many eye balls. Fund managers are already having easy access to the market which is also another factor stock prices are pumping high.

Conclusion

I am very bullish on this market and i think very soon dfmgi will be around 4500 points.

Time for correctionI think market index for now is be extended and its due for a healthy correction which is positive for the market, I think it should drop back to the marked area and then spend some time to make its base to go higher around 4000 zone.

Over all DFMGI is very bullish no doubt about it.

Hit like & follow guys ;)

Time for correctionDFM market index is on a strong rally to the upside, however very soon we will see a correction phase its almost near the resistance now. At the same time if it spends some time just near the resistance then there are good chances it can touch 3800 level soon.

Over all DFMGI is very bullish.

Hit like & follow guys;)

Make or BreakMarket is at a very crucial stage, Fridays closing of dfmgi was very positive and I expect it to go higher from here. From here there is very good chance for the market to cross 3400 resistance areas, but incase if market does not then it can again come down to the marked support level.

Hit like & follow guys ;)

Dubai Stock Market IndexDubai Financial Market is still bullish and more upside is expected after a small correction. Any dip from now is a buying opportunity(shares) at the same time keep a close watch on FED's statement about its monetary policy which will effect financial markets over the globe.

Hit like & follow for more updates ;)