Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

3.35 AED

22.46 B AED

96.42 B AED

2.46 B

About EMIRATES NBD BANK

Sector

Industry

CEO

Shayne Kieth Nelson

Website

Headquarters

Dubai

Founded

1963

ISIN

AEE000801010

FIGI

BBG000TGY8X1

Emirates NBD Bank PJSC engages in the provision of financial services. It operates through the following business segments: Corporate and Institutional Banking, Retail Banking and Wealth Management, Global Markets and Treasury, Denizbank, and Other Operations. The Corporate and Institutional Banking segment offers current and savings accounts, overdrafts, trade finance and term loans for government, corporate, commercial, customer deposits, and investment banking. The Retail Banking and Wealth Management segment includes loans and deposits, private banking, equity broking services, asset management and consumer financing. The Global Markets and Treasury segment consists of managing the group's portfolio of investments, funds management, Islamic products, and interbank treasury operations. The DenizBank segment focuses on the operations in Turkey. The Other Operations segment involves Tanfeeth, property management, operations, and support functions. The company was founded on June 19, 1963 and is headquartered in Dubai, United Arab Emirates.

Related stocks

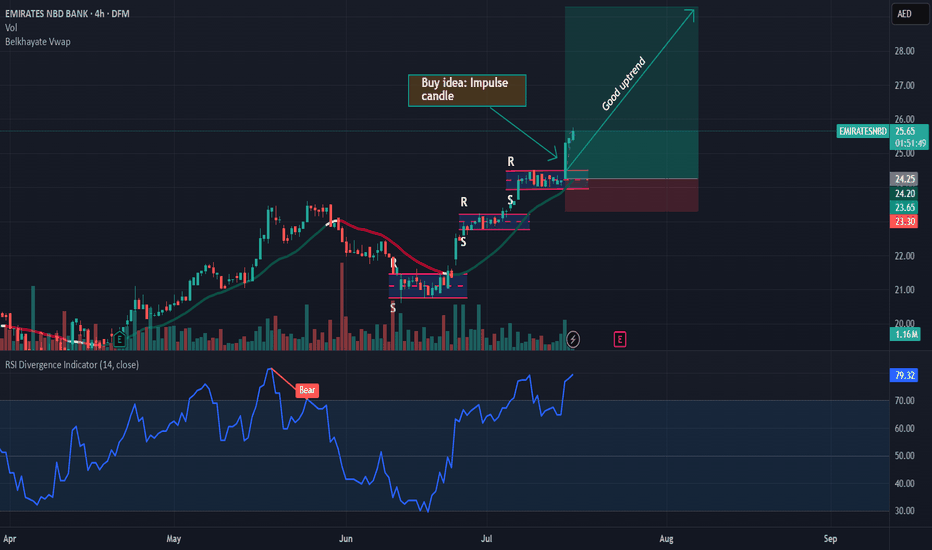

Will Emirates NBD Bank rebound to 21.7 ?Daily chart, the stock is trading in a rising expanding wedge, and may test the minor support S1 line, then rebound to R1 line.

Above R1 line, the target will be 21.7

Below S1 line, target is 15.4 - and can be brakes by the support line S.

Stop loss below support line S.

Emirates NBD Bank UAE Sun Storm Investment Trading Desk & NexGen Wealth Management Service Present's: SSITD & NexGen Portfolio of the Week Series

Focus: Worldwide

By Sun Storm Investment Research & NexGen Wealth Management Service

A Profit & Solutions Strategy & Research

Trading | Investment | Stocks | ETF | Mutua

It will Hit AgainA very heavy weighted stock in Dubai Stock Market, after the dividends its very normal for the price to drop. But the most important thing after the drop is to sustain and bounce back again showing the strength in that company & stock. We are seeing similar kind of reaction from the market its tryin

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

XS2015340891

EmiraNBDPBkJSC 4,33% 20/06/2039Yield to maturity

6.29%

Maturity date

Jun 20, 2039

EBIUH0126AED

EMIRATES NBD BANK 5.125% SNR 12/01/2026 AEDYield to maturity

6.08%

Maturity date

Jan 12, 2026

XS1987796957

EmiraNBDPBkJSC 4,9% 29/04/2039Yield to maturity

5.99%

Maturity date

Apr 29, 2039

XS2219274789

EmiraNBDPBkJSC FRN 28/08/2025Yield to maturity

5.43%

Maturity date

Aug 28, 2025

XS2323053392

EmiNBDB 3% 31Yield to maturity

5.28%

Maturity date

Mar 31, 2031

A28T8C

EMIRATES NBD BANK PJSC 2020-26.02.30 SERIES ENBD05 TRANCHE 1Yield to maturity

5.24%

Maturity date

Feb 26, 2030

EMIA6029506

Emirates NBD Bank (P.J.S.C) FRN 22-JAN-2030Yield to maturity

5.17%

Maturity date

Jan 22, 2030

XS1889002249

EmiraNBDPBkJSC 5,16% 03/10/2033Yield to maturity

5.16%

Maturity date

Oct 3, 2033

XS1884763928

EmiraNBDPBkJSC 5,14% 27/09/2033Yield to maturity

5.14%

Maturity date

Sep 27, 2033

XS1963196891

EmiraNBDPBkJSC 5,076% 14/03/2039Yield to maturity

5.08%

Maturity date

Mar 14, 2039

XS2209982151

EmiraNBDPBkJSC 3,72% 29/07/2030Yield to maturity

5.07%

Maturity date

Jul 29, 2030

See all EMIRATESNBD bonds

Curated watchlists where EMIRATESNBD is featured.

Frequently Asked Questions

The current price of EMIRATESNBD is 26.10 AED — it has decreased by −2.43% in the past 24 hours. Watch EMIRATES NBD BANK stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on DFM exchange EMIRATES NBD BANK stocks are traded under the ticker EMIRATESNBD.

EMIRATESNBD stock has risen by 0.38% compared to the previous week, the month change is a 12.99% rise, over the last year EMIRATES NBD BANK has showed a 37.37% increase.

We've gathered analysts' opinions on EMIRATES NBD BANK future price: according to them, EMIRATESNBD price has a max estimate of 30.00 AED and a min estimate of 23.30 AED. Watch EMIRATESNBD chart and read a more detailed EMIRATES NBD BANK stock forecast: see what analysts think of EMIRATES NBD BANK and suggest that you do with its stocks.

EMIRATESNBD reached its all-time high on Jul 17, 2025 with the price of 27.60 AED, and its all-time low was 2.25 AED and was reached on Feb 1, 2010. View more price dynamics on EMIRATESNBD chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

EMIRATESNBD stock is 3.07% volatile and has beta coefficient of 1.01. Track EMIRATES NBD BANK stock price on the chart and check out the list of the most volatile stocks — is EMIRATES NBD BANK there?

Today EMIRATES NBD BANK has the market capitalization of 164.86 B, it has increased by 9.09% over the last week.

Yes, you can track EMIRATES NBD BANK financials in yearly and quarterly reports right on TradingView.

EMIRATES NBD BANK is going to release the next earnings report on Oct 23, 2025. Keep track of upcoming events with our Earnings Calendar.

EMIRATESNBD earnings for the last quarter are 0.98 AED per share, whereas the estimation was 0.83 AED resulting in a 18.10% surprise. The estimated earnings for the next quarter are 0.86 AED per share. See more details about EMIRATES NBD BANK earnings.

EMIRATES NBD BANK revenue for the last quarter amounts to 12.06 B AED, despite the estimated figure of 11.76 B AED. In the next quarter, revenue is expected to reach 12.10 B AED.

EMIRATESNBD net income for the last quarter is 6.17 B AED, while the quarter before that showed 6.06 B AED of net income which accounts for 1.83% change. Track more EMIRATES NBD BANK financial stats to get the full picture.

Yes, EMIRATESNBD dividends are paid annually. The last dividend per share was 1.00 AED. As of today, Dividend Yield (TTM)% is 3.83%. Tracking EMIRATES NBD BANK dividends might help you take more informed decisions.

EMIRATES NBD BANK dividend yield was 4.66% in 2024, and payout ratio reached 28.10%. The year before the numbers were 6.94% and 36.12% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

Like other stocks, EMIRATESNBD shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade EMIRATES NBD BANK stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So EMIRATES NBD BANK technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating EMIRATES NBD BANK stock shows the buy signal. See more of EMIRATES NBD BANK technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.