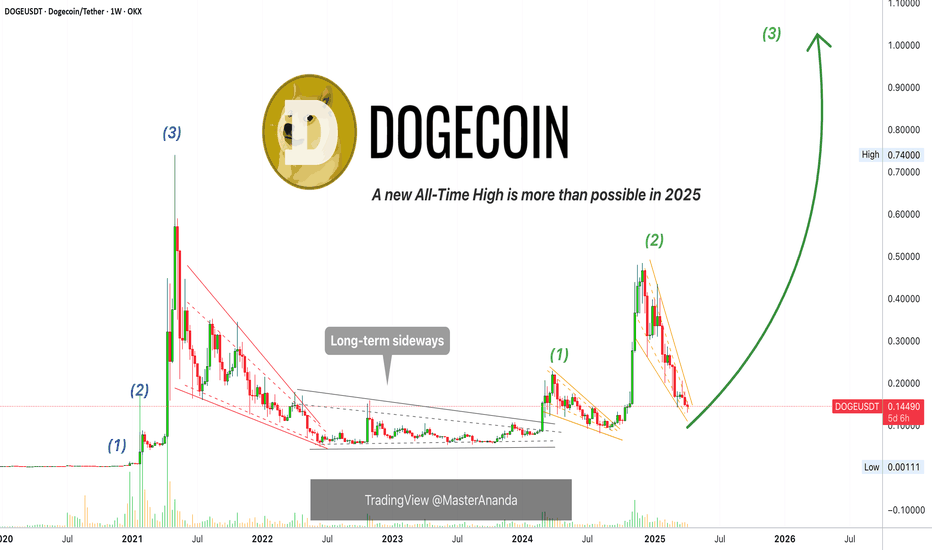

Dogecoin: Your Altcoin ChoiceYou can see it right? The first wave (1) is fairly small. The second wave (2), it goes higher. The third wave (3) will go much, much higher... I mean, it is easy to see as the same happened in 2021.

The '(3)' here is for illustration. I think the final price can go higher.

Ok, let's get into the analysis.

We are looking at Dogecoin based on the long-term.

Notice the left side, before the 2021 bull market there is a strong sideways period. The same is true between 2022 and 2024. So the dynamics are exactly the same. Only one thing is missing, the last wave which is the biggest wave.

It is so great to be alive today.

Let's say that sometimes we can disagree on our market views and the charts, but we can always agree about the overall market; Cryptocurrency is great. Cryptocurrency and being alive... Of course, sharing, work, family, friends and the rest. It is all amazing. What a wonderful opportunity we have here for those who love to trade.

No trading needed. No experience either, you can also just buy and hold.

Crypto can be your savings account, a savings account that grows. No overdraft fees, no hidden scam schemes taking your money away. You buy Cryptocurrency now and overtime value goes up. That's the truth based on past action. Where was this market 10 years ago?

Can you see? $100,000 USD in the bank in 10 years can be worth $1K.

$100,000 USD in Crypto in 10 years can be translated into the life that you deserve. A wealthy and healthy financial live. You will have to take care of the rest.

Our finances are only one aspect and to do good financially we have to take care of our hearts, mind and soul. If we can make money with Crypto, it will be easier to go through all the challenges that life throws at us.

What type of analysis are you looking for?

Yes! Dogecoin will grow.

The current drop is more steep than the previous one.

The current drop erased almost 100% of the previous bullish wave. This means that we are back to square one but with a higher low, a signal of strength.

Namaste.

DOGEUSDT.P trade ideas

DOGE: Position Trading Idea This is just an idea, Already excuted a buy order at @0.22 cents with 18% gains, and waiting to buy at the next zone @16 cents.

Please be carefull and dont be greedy, im optimistic for crypto in general, but in the short term i can see institutions and banks turning greed into fear and then will use same trick, drive the market with strong news and big decisions. so be boring like them and wait for the good discount.

If you have a different opinion please share it.

Thanks!

DOGEUSDT major daily supports are touching As we mentioned before two major daily supports like 0.13$ and 0.09$ can stop price from falling and we are now in support zones and soon heavy pump can lead once again like previous times.

DISCLAIMER: ((trade based on your own decision))

<<press like👍 if you enjoy💚

DOGE Weekly Chart: Retracement to Key Supply Zone in FocusCRYPTOCAP:DOGE is currently showing signs of potential retracement on the weekly chart, targeting a previous supply zone as a pivotal area for its next major move. This level aligns with a longer-term bullish outlook, presenting an opportunity for accumulation if the retracement holds.

The primary price target for this setup is $42.0, contingent on a confirmed bounce from the supply zone and sustained momentum. Traders should monitor volume and overall market sentiment as DOGE approaches this critical zone, as it could indicate the strength of a potential reversal or continuation. BINANCE:DOGEUSDT

Is DOGE About to Crash Hard From This Trap Zone? Read Before LONYello Paradisers — could this be the perfect bull trap setting up before a bigger drop? Our previous analyses warned about these kinds of setups, and once again, DOGEUSDT is flashing multiple signals that suggest a high-probability reversal could be just around the corner.

💎Currently, DOGEUSDT is trading right inside the golden Fibonacci retracement zone, a level that often acts as a powerful area of rejection. What makes this zone even more significant is the confluence of additional bearish indicators aligning at the same point. Both the 100 and 200 EMAs are present, reinforcing dynamic resistance, and there are clear Fair Value Gaps (FVGs) visible on both the 4H and Daily timeframes. On top of that, a bearish divergence has now formed, signaling early exhaustion in bullish momentum and further reinforcing the potential for a downside move.

💎When these elements align, the probability of a rejection increases substantially. However, we’re not jumping in blindly. If DOGEUSDT starts to bounce from here and shows weakness—such as stalling below resistance—then we’ll be closely watching for confirmation patterns like a double top or a head and shoulders. These would not only validate the bearish narrative but also offer significantly better risk-to-reward ratios for short setups.

💎That said, every setup has its invalidation. If price breaks and closes candle above our invalidation level, then the entire bearish scenario must be considered void. In that case, the best approach would be to stand aside and wait for a cleaner structure to form before taking any action. There’s no reason to force a position in uncertain conditions.

If you want to be consistently profitable, you need to be extremely patient and always wait only for the best, highest probability trading opportunities.

MyCryptoParadise

iFeel the success🌴

Dogecoin (DOGE) to print 300% extension.... very soon!** The weeks ahead **

Following the vitriol received by the public on the short idea (below) it is time once more to extend that audacity with a long idea. Apologies to the 90%, I know how upsetting this must be for you.

On the above 3 day chart price action has corrected (as forecast) 70% from the short publication (red circle). Now is an excellent moment to consider a long position. But why?

1. 90% of the people reading this are selling, fear is not your friend right now. When there's blood on the streets, start a Black Pudding business.

2. Price action and RSI resistance breakouts.

3. Support on past resistance (red arrows).

4. Regular bullish divergence, just as before. Look left.

Is it possible price action continues to correct as a number of tradingview ideas are now calling for? Sure.

Is it probable? No.

Ww

50% short idea

Dogecoin Daily Chart Analysis: A Fresh Start Ahead ?Hello friends, let's analyze Dogecoin, a cryptocurrency, from an Elliott Wave perspective. This study uses Elliott Wave theory and structures, involving multiple possibilities. The analysis focuses on one potential scenario and is for educational purposes only, not trading advice.

We're observing the daily chart, and it appears we're nearing the end of Wave II, a correction. The red cycle degree Wave I ended around 2024 December's peak. Currently, we're nearing the end of red Wave II, which consists of black ((W)), ((X)), and ((Y)) waves. Black ((W)) and ((X)) are complete, and black ((Y)) is nearing its end.

Within black ((Y)), we have Intermediate degree blue (W), (X), and (Y) waves. Blue (W) and (X) are complete, and blue (Y) is nearing its end. Inside blue (Y), red A and B are complete, and red C is nearing its end. Once red C completes, blue (Y) will end, Once blue (Y) completes, means black ((W)) will end that means higher degree cycle wave II in red will end.

If our view remains correct, the invalidation level for this Elliott Wave count is 0.04913. If this level holds and doesn't touch below it, we can expect a significant reversal to unfold wave III towards new highs. This is an educational analysis, and I hope you've learned something by observing the chart and its texture.

I am not Sebi registered analyst.

My studies are for educational purpose only.

Please Consult your financial advisor before trading or investing.

I am not responsible for any kinds of your profits and your losses.

Most investors treat trading as a hobby because they have a full-time job doing something else.

However, If you treat trading like a business, it will pay you like a business.

If you treat like a hobby, hobbies don't pay, they cost you...!

Hope this post is helpful to community

Thanks

RK💕

Disclaimer and Risk Warning.

The analysis and discussion provided on in.tradingview.com is intended for educational purposes only and should not be relied upon for trading decisions. RK_Charts is not an investment adviser and the information provided here should not be taken as professional investment advice. Before buying or selling any investments, securities, or precious metals, it is recommended that you conduct your own due diligence. RK_Charts does not share in your profits and will not take responsibility for any losses you may incur. So Please Consult your financial advisor before trading or investing.

Lingrid | DOGEUSDT bearish TREND with Short-Term Relief RallyThe price perfectly fulfilled my last idea . It reached the target. The market has completed an impulse leg and recently bounced off the support level that was previously tested in October 2024. Overall, the market is making lower lows and lower closes, indicating bearish dominance. As we can see, the price is currently testing the 0.1500 level, and I believe it may move higher toward the channel border around 0.1600. Considering the overall bearish trend, I expect the market to continue making lower lows or possibly create a consolidation zone at this current support area. My goal is support zone around 0.1400

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 👩💻

Long Position DOGE/USDT🚨 DOGE/USDT – 15-min Outlook: Early Signs of a Bullish Reversal?

Following to my recent accurate prediction for a big fall on DOGE/USDT:

And a related long prediction on a strong support level of 0.1321 on this post which touched and rebounded where DOGE is now 0.1500:

now after tapping into the critical macro support level of 0.1300, DOGE posted a sharp rebound, hinting at a potential mid-term trend reversal.

🔹 Current Price: 0.1500

🔹 Possible Long Zone: 0.1419 – 0.1340

🔹 Target Resistance: 0.1660 (+16% potential upside or even more)

📈 Price is currently forming higher lows along a rising intraday trendline. However, a healthy pullback into the Possible Long Zone could provide a premium entry for bulls targeting the 0.1660 resistance—and possibly beyond.

🐕 This zone coincides with a previous liquidity sweep and demand reaction, suggesting strong institutional interest. A successful defense here could mark the beginning of a broader recovery leg, even hinting at the early stages of a larger bullish cycle for DOGE.

🧠 Key Levels to Watch:

Support to Hold: 0.1419

Invalidation: Below 0.1340

Breakout Confirmation: Clean candle close above 0.1525

This setup could shape the next wave of momentum—smart money is watching. Are you?

Doge: Balancing Hype and RealityDogecoin is currently trading at $0.1464, reflecting a modest 0.11% increase over the past 24 hours. This slight uptick contrasts with the broader cryptocurrency market, which has declined by 4.4% in the same period, showcasing Dogecoin’s relative resilience among altcoins. However, it remains far from its all-time high of $0.7376 (reached in May 2021). Some users point to whale accumulation as a bullish sign, while others flag bearish risks tied to macroeconomic factors, such as U.S. inflation data and Federal Reserve policy shifts.

Broader Context: Dogecoin’s Unique Position

Unlike many cryptocurrencies with defined utility, Dogecoin’s value is driven largely by its meme status and vibrant community. This makes it highly reactive to social media trends and influencer endorsements, think Elon Musk or other high-profile figures. Recent chatter on the internet about whale activity suggests big players might be accumulating or offloading, which could foreshadow significant price shifts. However, its speculative nature leaves it exposed during broader market downturns, as seen in today’s risk-off environment. For Dogecoin to sustain momentum, it relies heavily on ongoing community engagement and real-world adoption, such as its use by merchants like the Dallas Mavericks.

Potential Scenarios

Bullish Case: If $0.14 support holds and $0.15 is breached with strong volume, Dogecoin could climb to $0.16 in the short term, potentially reaching $0.20 longer term if community hype or positive news (e.g., Elon Musk tweets) kicks in.

Bearish Case: A drop below $0.14 might test $0.13, with further declines to $0.10 possible if selling pressure intensifies.

Historical Patterns and What’s Next

Looking back, Dogecoin has a history of explosive rallies followed by steep corrections, its 2021 surge to $0.7376 was fueled by retail mania and celebrity hype, only to crash as momentum faded. Today’s price action at $0.1464 feels more subdued, but the potential for a breakout (or breakdown) remains. If whale accumulation continues and sentiment flips bullish, a revisit to $0.20 or higher isn’t out of the question. On the flip side, a broader crypto sell-off could push it toward $0.08 support. Patience is key, wait for confirmation via volume or a catalyst before jumping in.

DOGE is approaching my POI, where we can look for spot/longs DOGE is quickly approaching the 3D HOB at 0.12 and 2M Demand at 0.15, which would be a fantastic RR opportunity if in confluence with BTC and TOTAL.

All the information, such as TP, short, and supply, is provided in the chart.

Mark those key levels and keep an eye on them :)

Can Dogecoin hold or is a $0.14 retest coming?Hello and greetings to all the crypto enthusiasts, ✌

All previous targets were nailed ✅! Now, let’s dive into a full analysis of the upcoming price potential for Dogecoin 🔍📈.

Dogecoin is currently trading within a descending channel and has reached its upper resistance level. Based on technical analysis, a potential 17% decline is anticipated, bringing the price toward the mid-range of the channel. Following this movement, a retest of the $0.14 level—our primary target—remains a key scenario to watch.📚🙌

🧨 Our team's main opinion is: 🧨

Dogecoin is at the top of a falling channel, and a 17% drop to the mid-level, with a retest of $0.14 as the main target, seems likely.📚🎇

Give me some energy !!

✨We invest hours crafting valuable ideas, and your support means everything—feel free to ask questions in the comments! 😊💬

Cheers, Mad Whale. 🐋

DOGEUSDT Quick Insight: Short-Term Sell Signal ActivatedBased on the latest EASY Trading AI strategy analysis, DOGEUSDT shows a clear short-term Sell signal. Enter at 0.16898, targeting a Take Profit at 0.16615 with a protective Stop Loss positioned at 0.17175.The forecast emerged after the AI identified weakening bullish momentum and increased selling pressure near crucial resistance levels. Technical indicators suggest a high probability of a corrective move downward, aligning with current bearish sentiment in short-term analysis.Trade responsibly, sticking precisely to the listed parameters.

Short trade

Trade Breakdown – Sell-Side (Crypto Weekend Setup)

📅 Date: Saturday, April 5, 2025

⏰ Time: 3:00 PM NY Time (NY Session PM)

📉 Pair: DOGE/USD

📉 Trade Direction: Short (Sell)

Trade Parameters:

Entry Price: 0.16821

Take Profit (TP): 0.16173 (+3.85%)

Stop Loss (SL): 0.17009 (-1.12%)

Risk-Reward Ratio (RR): 3.45

Reasoning:

Demand Turned to Resistance" — this signals a bearish shift in structure:

I assume a likely failed rally, where previous demand could not hold for confirmation bias

and price seemed to respect the demand zone (highlighted blue) as resistance, giving confluence for a short. Targeting a pivotal low, suggesting a liquidity grab or structure retest.

"DogeCoin vs Tether" Crypto Market Heist Plan (Swing / Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the DOGE/USDT "DogeCoin vs Tether" Crypto Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level. I Highly recommended you to put alert in your chart.

Stop Loss 🛑:

Thief SL placed at the recent/swing low level Using the 2H timeframe (0.16000) Day trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 0.22000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

DOGE/USDT "DogeCoin vs Tether" Crypto Market Heist Plan (Swing / Day Trade) is currently experiencing a bullishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro, COT Report, On Chain Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets.. go ahead to check 👉👉👉

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

DOGEUDST NEXT MOVESell after bearish candle stick pattern, buy after bullish candle stick pattern....

Best bullish pattern , engulfing candle or green hammer

Best bearish pattern , engulfing candle or red shooting star

NOTE: IF YOU CAN'T SEE ANY OF TOP PATTERN IN THE ZONE DO NOT ENTER

Stop lost before pattern

R/R %1/%3

Trade in 5 Min Timeframe, use signals for scalping

The key is whether it can rise to around 0.18951

Hello, traders.

If you "Follow", you can always get new information quickly.

Please click "Boost" as well.

Have a nice day today.

-------------------------------------

(DOGEUSDT 1D chart)

Most coins (tokens) are below the M-Signal indicator on the 1D chart.

In order to turn into a short-term uptrend, the price must be maintained above the M-Signal indicator on the 1D chart at least.

-

In order to continue the uptrend, the price must be maintained above the M-Signal indicator on the 1M chart.

Therefore, what we should be interested in is whether there is support around 0.18951.

Then, if it rises above 0.21409 and maintains the price, an uptrend is expected to begin.

-

If not and it falls, it is important to find support near 0.13377.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

- Here is an explanation of the big picture.

I used TradingView's INDEX chart to check the entire range of BTC.

I rewrote the previous chart to update it while touching the Fibonacci ratio range of 1.902(101875.70) ~ 2(106275.10).

(Previous BTCUSD 12M chart)

Looking at the big picture, it seems to have been maintaining an uptrend following a pattern since 2015.

That is, it is a pattern that maintains a 3-year uptrend and faces a 1-year downtrend.

Accordingly, the uptrend is expected to continue until 2025.

-

(Current BTCUSD 12M chart)

Based on the currently written Fibonacci ratio, it is displayed up to 3.618 (178910.15).

It is expected that it will not fall again below the Fibonacci ratio of 0.618 (44234.54).

(BTCUSDT 12M chart)

Based on the BTCUSDT chart, I think it is around 42283.58.

-

I will explain it again with the BTCUSD chart.

The Fibonacci ratio ranges marked in the green boxes, 1.902 (101875.70) ~ 2 (106275.10) and 3 (151166.97) ~ 3.14 (157451.83), are expected to be important support and resistance ranges.

In other words, it seems likely that they will act as volume profile ranges.

Therefore, in order to break through these ranges upward, I think the point to watch is whether they can receive support and rise near the Fibonacci ratios of 1.618 (89126.41) and 2.618 (134018.28).

Therefore, the maximum rising range in 2025 is expected to be the 3 (151166.97) ~ 3.14 (157451.83) range.

In order to do that, we need to see if it is supported and rises near 2.618 (134018.28).

If it falls after the bull market in 2025, we don't know how far it will fall, but based on the previous decline, we expect it to fall by about -60% to -70%.

Therefore, if it starts to fall near the Fibonacci ratio 3.14 (157451.83), it seems likely that it will fall to around Fibonacci 0.618 (44234.54).

I will explain more details when the bear market starts.

------------------------------------------------------

DOGE Update1I expect DOGE goes down to 0.1580-0.1590 and bounce back. It is my assumption not a financial advice!

Current RSI Overview:

1-Hour RSI: Around 25-27, deep in the oversold zone.

4-Hour RSI: Below 10, extremely oversold, suggesting a potential bounce.

Daily RSI: Around 32-33, approaching oversold territory but not yet fully there.

Likelihood of a Drop Below $0.165:

Moderate Probability (~30-40%) – While RSI suggests a bounce is likely, there’s still a possibility of a quick dip to test stronger support below.

Higher Bounce Probability (~60-70%) – Given the oversold conditions and approaching support, a bounce toward the $0.172-$0.175 range is more likely in the short term.

DOGEUSDT from two major daily supports can pumpAs we can see two major daily supports now are ahead:

A. 0.135$

B. 0.090$

We are looking for rise and pump from these supports so we set our buy pending and still watching chart also remember because of breakout to the upside here pump may start sooner.

DISCLAIMER: ((trade based on your own decision))

<<press like👍 if you enjoy💚