DOGE/USDT – Is Dogecoin About to Ignite Altseason Again?Hey Traders!

If you’re finding value in this analysis, smash that 👍 and hit Follow for high-accuracy trade setups that actually deliver!

Dogecoin just broke out of a multi-month descending wedge — and history tells us to pay close attention when this meme king wakes up. Let’s dive into why this setup could be the start of something massive.

📈 Chart Pattern

DOGE has been consolidating for months inside a falling wedge — a classic bullish reversal structure. It’s now finally broken out with strong volume confirmation, holding above the 50 EMA and showing signs of momentum building up.

🔍 Historical Clue

Remember what happened in the previous bull markets?

✅ 2021: DOGE exploded 2000%+ and triggered the craziest altseason ever.

✅ 2017: DOGE moved first, followed by hundreds of altcoins rallying massively.

Now, in 2025 — it looks eerily similar. Every time DOGE wakes up, it signals that retail and meme sentiment is heating up, a classic altseason ignition.

🎯 Trade Setup

Entry: $0.198 (Already triggered)

Targets:

TP1: $0.28

TP2: $0.42

TP3: $0.64

Stoploss: $0.162

Risk-Reward: Massive upside potential, with clearly defined invalidation.

💡 Final Thoughts

Altcoins are starting to follow. ETH has broken out. XRP is running. BTC dominance has rejected trendline resistance. Everything is aligning. If history repeats, this breakout in DOGE could mark the official start of Altseason 2025.

👉 Don’t sleep on DOGE. This might just be the trigger we’ve been waiting for.

📌 Follow for more setups & insights. Stay tuned!

DOGEUSDT.P trade ideas

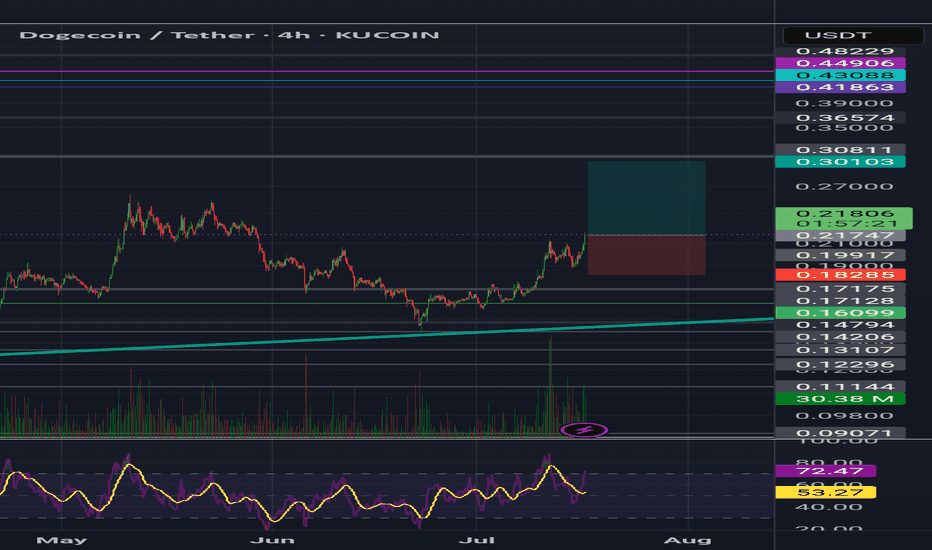

$Doge Dogecoin about 60% retracement from all time high...CRYPTOCAP:DOGE dogecoin has retraced about 60% from an all time high of about 0.49

Current price: 0.20

Reasons why i am bullish on #Doge

CRYPTOCAP:DOGE price action has remained above the 200ema on the weekly timeframe ...bullish!

- $dogecoin has committed an over 60% retracement from all time high of 0.49

- It is currently at double bottom support seen in April

#dogecoin negative money flow is thinning out

- Sentiments are neutral : neither greedy for fearful

- Price action is exactly at point of control on the weekly time frame!

Resistances above to watch: 0.32, 0.42 up to 0.69

DOGE - Another Perspective- DOGE is currently trading nearing the trendline resistance and pending breakout

- A clear breakout from this resistance line is a must to continue to bullish momentum.

- we will enter the trade after confirmed breakout

Entry: 0.221

SL at: 0.14103

TP1: 0.26035

TP2: 0.33892

TP3: 0.47751

Stay tuned for more updates.

Cheers

GreenCrypto

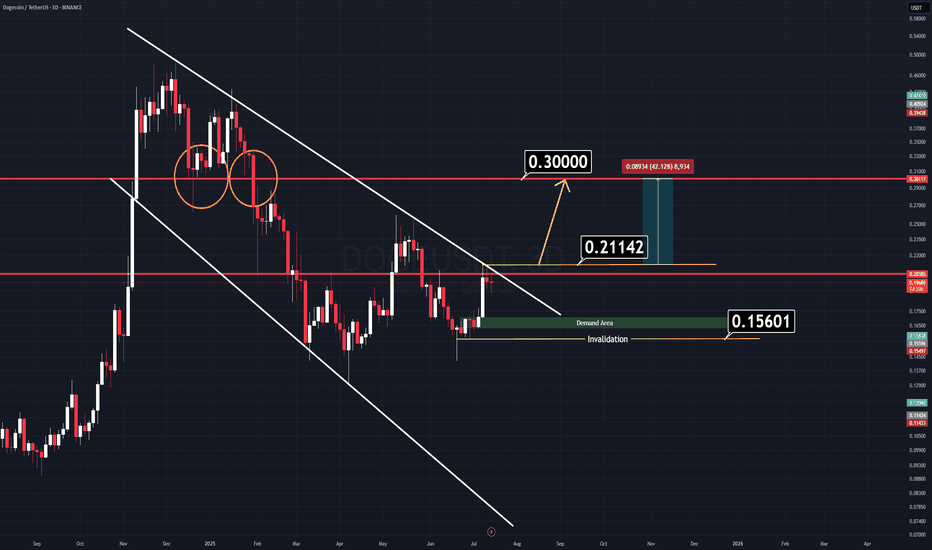

DOGE Analysis (3D)There’s a very simple and clear chart setup on Dogecoin (DOGE) right now.

We have two major horizontal key levels and a channel that is about to break down. If the price manages to close above the yellow-marked line ($0.21142), we can expect a strong rally to follow.

There’s no need for complicated indicators cluttering the screen — all relevant levels are clearly marked on the chart.

Two Logical Entry Approaches:

1️⃣ Breakout Entry: Enter on a confirmed breakout. (Waiting for a daily candle close on a memecoin might slightly reduce your profit range, but it’s the safer approach.)

2️⃣ Demand Zone Entry: Wait for the price to retrace to the green demand zone — though this scenario seems less likely for now.

A combined approach can work best: enter on breakout, use the horizontal levels as support, and set a tight stop-loss to manage risk.

Good Luck.

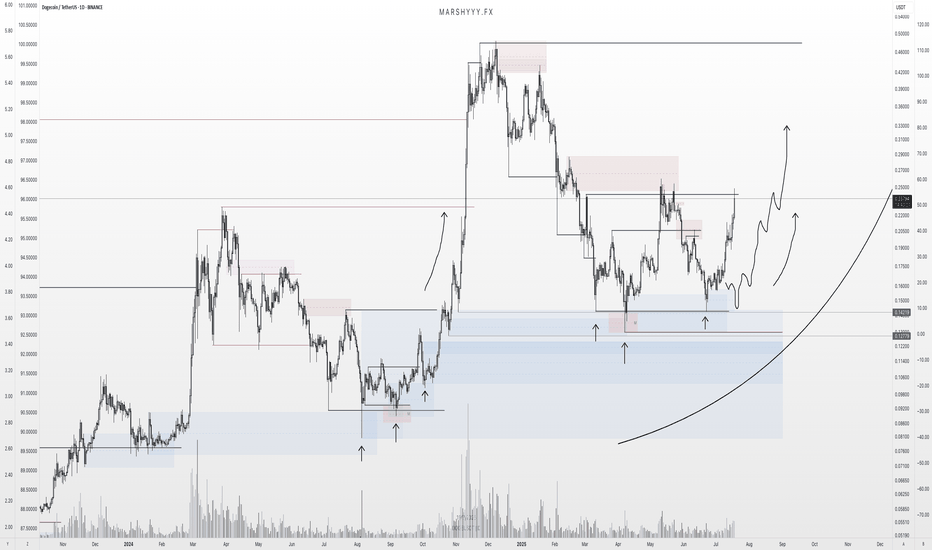

DOGE Update: Reversal Playing Out — $1+ in Sight?DOGE is playing out almost exactly as forecast back on June 14th, where I was monitoring for price to sweep the SSL and tap into range low demand within this larger HTF range.

Price did exactly that — pushing into discount, tagging the marked demand zone, and bottoming out right where I expected the reversal. I DCA’d hard at $0.165 after the initial low printed — just as planned.

Now sitting around +50% on those buys, and my plan remains to ride this out toward the ATH at $0.74 and potentially $1+.

The HTF closes forming here — across 3D, 4D, 5D, 6D candles — are showing clear strength. For me, the low is likely in, and I’m expecting new higher highs and ATHs from here. Now it’s just about letting the market do its thing, trailing stops, and taking profits into strength as alerts and targets get hit.

Zooming way out — I’m also watching DOGE’s 10-year uptrend channel. Price has once again tagged the lower bound of that channel, and historically, this has led to moves back to the channel highs.

🧠 Layer on a fib projection from the previous ATH to the bear market low, and we get:

1.272 Fib → ~$1.54

1.618 Fib → ~$3.92

Both of which align perfectly with the upper bounds of that long-term trend channel — giving us a key HTF reversal zone to monitor in the future.

In summary:

- Reversal from demand ✅

- DCA filled ✅

- HLs printing ✅

- Targets = ATH and beyond

- Watching HTF fibs + channel highs for eventual cycle top formation

DOGE is doing what DOGE does — don’t overcomplicate it.

1D:

3D:

1W:

1M:

#DOGEUSDT: Swing Trade Targeting $0.50| Swing Trade| Setupsfx_|Hey there! Everyone

DOGEUSDT is at a turning point right now, and it looks like it might just reverse course and head towards its target price of $0.50. This is a swing trade, which means it could take a few weeks, or even months, to complete.

We’d really appreciate your support.

Thanks

Team Setupsfx_

DOGEUSDT WEEKLY CHART | MY FAVORITEHELLO, DOGEUSDT

MEMECOIN my favoritoo

This is just my basic analysis. I see that DOGEUSDT Weekly looks very promising.

Why the Weekly? Because I’m aiming for the long term with DOGEUSDT — i'm Doge Holder..

Only patient people will reap the rewards of their efforts.

Remember, trading involves risk, and you are responsible for your own decisions — manage your finances wisely.

Will DOGE Hit $1? Ascending Broadening Wedge in PlayDogecoin is trading within a clear ascending broadening wedge on the weekly chart. The price has bounced strongly from wedge support and the 100 and 200 EMAs, now pushing upward with growing volume and bullish candles. If momentum sustains, DOGE could rally toward the $1 psychological target and broadening wedge resistance.

Resistance 1: $0.35

Resistance 2: $0.60

Resistance 3: $1.00

Stop Loss: $0.14

Cheers

Hexa

COINBASE:DOGEUSD BINANCE:DOGEUSDT

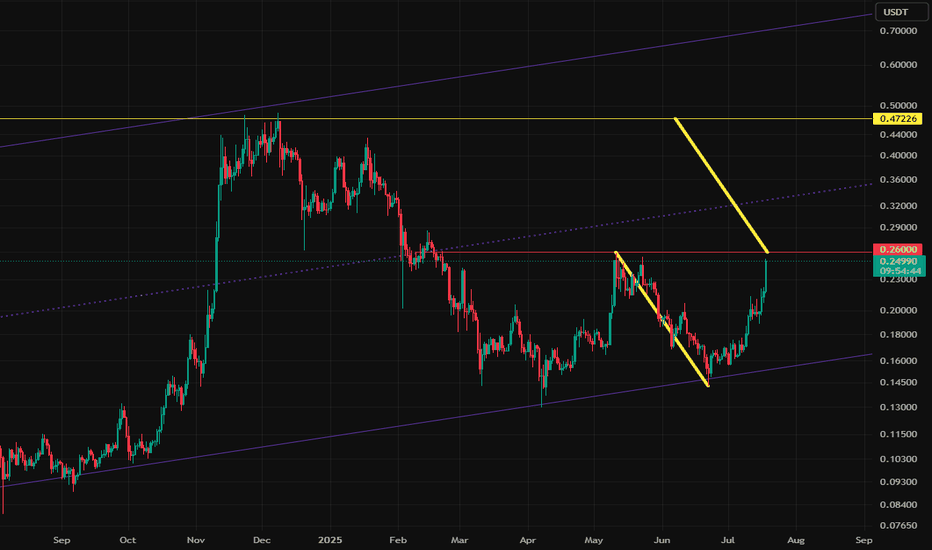

$DOGE Double Bottom TargetIf this double bottom "W" pattern on CRYPTOCAP:DOGE plays out, the target is $0.47.

Two notes:

1. The double-bottom pattern has a 60-65% success rate (no guarantees).

2. The Alt market has been very strong, with new dollars entering the market. If we close above $0.25-0.26 and retest, I think this target is likely as it returns to the high for this cycle.

DOGEUSDT Breaking Out. 250% Rally Incoming? History Says Yes!BINANCE:DOGEUSDT is once again showing its classic breakout behavior, This time breaking above a key trendline with strong momentum. Historically, every time CRYPTOCAP:DOGE has broken out of similar structures, it has delivered powerful rallies averaging around 250% gains. And with the current bullish sentiment across the market, this setup looks ready to repeat history.

CRYPTOCAP:DOGE still appears undervalued, especially considering the broader market is already heating up. Once CRYPTOCAP:DOGE starts its move, it tends to run fast and hard – often leaving latecomers behind. This could be the start of the next explosive leg up.

For investors, this is a prime “BUY and HOLD” zone. For traders, this is the time to enter with proper risk management in place. Always use a stop loss and trail your profits accordingly.

BINANCE:DOGEUSDT Currently trading at $0.204

Buy level : Above $0.2

Stop loss : Below $0.15

Target 1: $0.27

Target 2: $0.35

Target 3: $0.48

Target 4: $0.7

Max leverage 2x

Always keep stop loss

Follow Our Tradingview Account for More Technical Analysis Updates, | Like, Share and Comment Your thoughts

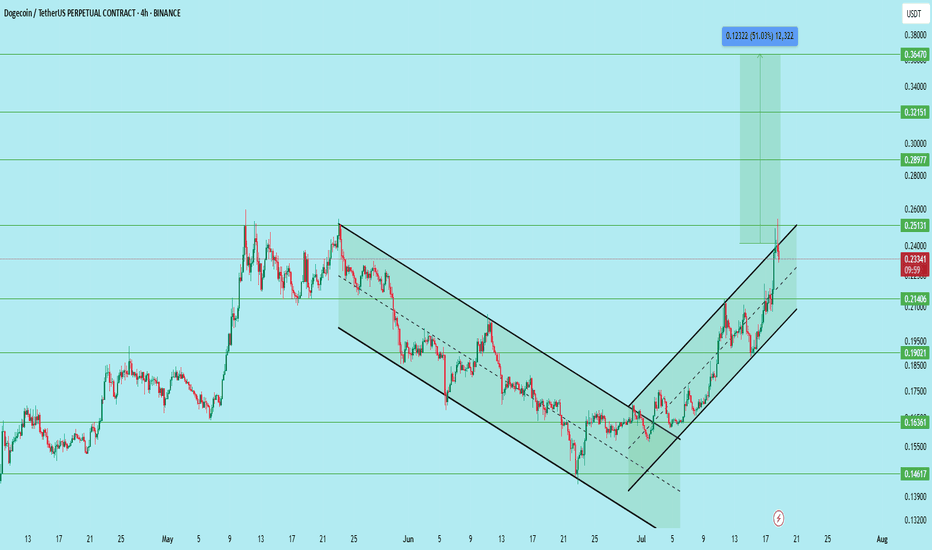

DOGE/USDT – Bullish Setup with Clear Channel BreakoutDogecoin has successfully broken out of a falling wedge and is now trending within a rising channel on the 4H timeframe. The price recently reclaimed the 0.214 support zone and is now showing continuation with strong volume and structure.

After the breakout and multiple retests, the pair offers a compelling long opportunity.

Setup Details:

Entry Zone: 0.208 to 0.214

Stop Loss: 0.186

Targets:

• 0.251 – First major resistance

• 0.289 – Mid-level breakout target

• 0.321 – Psychological round number

• 0.364 – Final target (approx. 51% move)

Technical Structure:

Breakout from falling wedge followed by bullish channel, Higher highs and higher lows clearly forming, Volume supports accumulation near breakout levels, Support holding above 0.214, confirming demand

Support Zones:

0.214 (reclaimed)

0.190 (intermediate)

0.163 (major demand zone)

Resistance Zones:

0.251

0.289

0.321

0.364

This setup offers a clean risk-reward ratio with confirmation on trend continuation. A rejection at 0.251 may present another opportunity to re-enter on a retest.

DYOR. Not financial advice.

DOGEUSDT | Bullish Cup & Handle Revisiting Target +500% (1 USD)?Price Action and Chart Pattern Analysis:

DOGE cup bottom happened around $0.05 with the rim around $0.48. That gives a depth of roughly $0.42. If the breakout occurs near the rim, the measured move target would be $0.90 zone.

This aligns with several analyst projections suggesting DOGE could reach $0.90 to $1.00 if the breakout confirms.

Another way to project this cup & handle is the fibonacci-based target. These levels suggest that if DOGE breaks above the handle and sustains momentum, $0.85–$1.00 is a realistic zone for profit-taking at 161.8% and 200% extension as 1-2-3 wave pattern.

Reliability of the Cup and Handle Pattern for DOGE

The cup and handle is a classic bullish continuation pattern, but when applied to Dogecoin, its reliability depends on several dynamic factors:

Strengths of the Pattern in DOGE’s Context

Historical Accuracy: DOGE has previously respected technical patterns like rounded bottoms or (THE CUP) and breakout channels (THE HANDLE), especially during alt coin rallies.

Current Setup: a well-formed cup and handle on DOGE’s weekly chart, with price rebounding from $0.14 and testing resistance at $0.2 zone which also the key resistance SMA50W and the downtrend channel (the handle)

WATCH OUT: still a possible throw-under pattern or a final bear trap liquidity below previous low!

Key Action: If breakout confirmed with volume > Follow BUY | if not, wait for retraced SMA20 or breakout support.

Always trade with affordable risk and respect your stop...

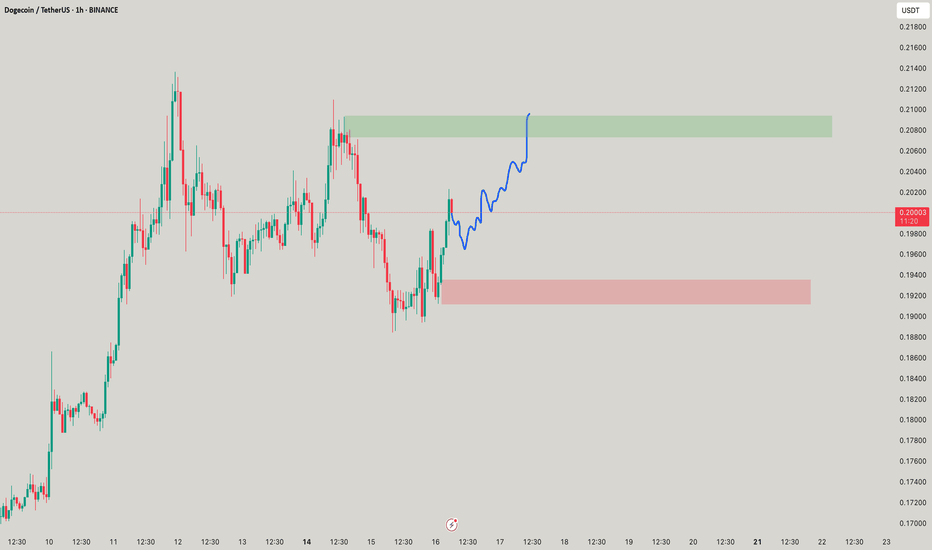

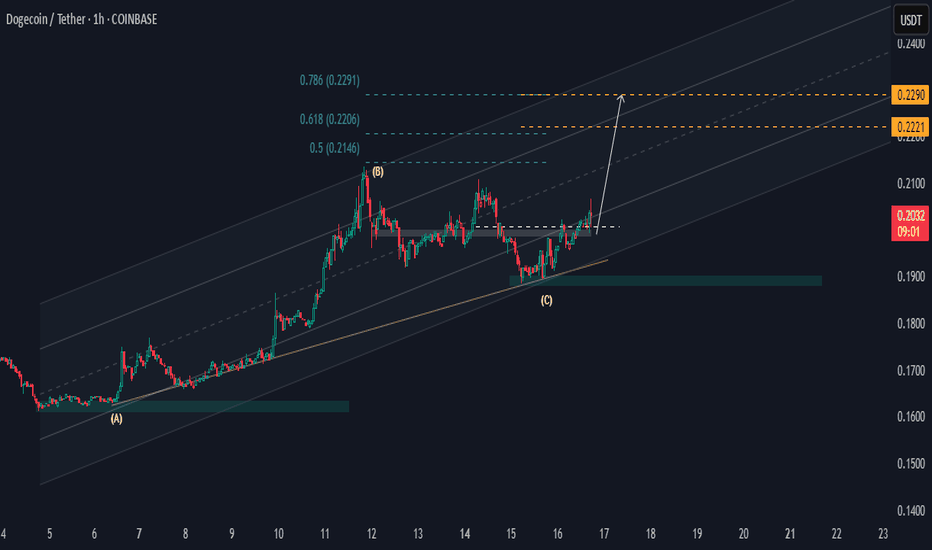

DOGEUSDT Above Key SupportHi there,

DOGE/USDT looks bullish at H1 with two potential price targets for a bias of 0.2290.

The price made a higher low at the 0.1900 area zone and pushed above the key level of 0.1990, and it is hovering above this level. Now, as long as the 0.1900 sustains the 0.1963 low, then the price will rally to previous highs.

Happy Trading,

K.

DOGEUSDT: Time For Bulls To Rule! The Dogecoin is currently trading at a key buying level, making it a potential opportunity to buy. However, we need confirmation before making a purchase or entering a trade. This trade could take time to develop as we are currently in the accumulating phase. To be certain of the price direction, we need to enter the distribution phase. While a single swing trade could be a target, you can set your own risk management parameters.

Good luck and trade safely!

Team Setupsfx_