DOGEUSDT trade ideas

DOGE just broke the falling wedge! More pump ahead...Hello Traders 🐺

In this idea, I want to give you a quick update on my last DOGE analysis. That previous idea had a more mid-term perspective, and guess what? Just after I published it, DOGE pumped nearly 40% in just 3 days! 🚀🔥

So first of all, congratulations to everyone who followed that idea—and if you haven’t yet, make sure to follow me so you don’t miss the next big trade! Now let’s dive into what’s happening with DOGE right now: 👇

📊 Chart Overview

As you can see on the chart, we have a clear and beautiful falling wedge, and as I mentioned before, you can also interpret this as a bull flag, since the pattern formed during an uptrend.

However, if we treat this as a falling wedge, the price target becomes more conservative and likely more realistic. 💡

📍 Key Confluence Zone: $0.40 – $0.42

We’re now approaching a strong supply area at the top of the wedge. In this zone, we have 3 key points of confluence:

1️⃣ Falling wedge target 🎯

2️⃣ 0.786 Fibonacci level

3️⃣ Major horizontal resistance line

This makes the $0.40–$0.42 zone a great area to take partial profits 💰—and then hold the rest in case of further upside momentum. 🧠⚡

I hope you enjoyed this idea, my friends! And always remember:

🐺 Discipline is rarely enjoyable, but almost always profitable 🐺

🐺 KIU_COIN 🐺

DOGEIn my opinion, Dogecoin needs to confirm a breakout and hold above the $0.205 resistance level. After that, we can expect a bullish outlook for Dogecoin, targeting the $0.30 to $0.339 range. Additionally, holding the $0.16 support level is crucial. The scenario I have outlined on the chart may play out, but only if the conditions mentioned above are met. What do you think? Share your thoughts with me.

Dogecoin Foundation Bolsters Reserves with 10M Token Purchase

The Dogecoin Foundation, the non-profit organization dedicated to the development and advocacy of Dogecoin (DOGE), has made a significant move by purchasing 10 million DOGE tokens.1 This strategic acquisition, part of a broader initiative to establish a robust DOGE reserve, signals the Foundation's commitment to the long-term sustainability and growth of the meme-turned-cryptocurrency.2 The purchase coincides with a notable price surge, as traders weigh potential shifts in US tariff and Federal Reserve policies, fueling speculation about Dogecoin's future trajectory.3

In February, the Dogecoin Foundation announced a five-year partnership with House of Doge, designating them as its official commercialization partner.4 This collaboration aims to enhance Dogecoin's utility and adoption by exploring innovative applications and fostering strategic partnerships.5 The establishment of a DOGE reserve, now augmented by the 10 million token purchase, appears to be a crucial component of this broader strategy, intended to provide financial stability and support future development initiatives.6

The purchase reflects a proactive approach by the Foundation to manage Dogecoin's ecosystem. By building a reserve, the Foundation can potentially fund future projects, support community initiatives, and mitigate potential market volatility.7 This move underscores the Foundation's commitment to ensuring Dogecoin's long-term viability, moving beyond its meme origins to establish a more structured and sustainable framework.

Simultaneously, the cryptocurrency market has witnessed a resurgence of interest in Dogecoin, with its price jumping by approximately 7% in a single day.8 This surge is attributed to a confluence of factors, including speculation that upcoming US tariffs might be less severe than initially anticipated. Traders are also closely monitoring potential shifts in Federal Reserve policies, which could impact the broader cryptocurrency market.9

The renewed optimism surrounding Dogecoin has led to its outperformance against major cryptocurrencies like Bitcoin (BTC), Solana (SOL), and XRP.10 This surge in interest highlights the enduring appeal of meme coins, which often experience significant price fluctuations driven by social media sentiment and speculative trading.11

Dogecoin's Bullish Momentum: Analyst Predicts Surge to $0.4

Technical analysis indicates that Dogecoin has recently broken above a bullish daily pattern, further fueling optimism among traders.12 This breakout suggests a potential upward trend, with analysts predicting a possible surge to $0.4.13 The bullish pattern, often characterized by a series of higher lows and higher highs, signals increased buying pressure and a shift in market sentiment.

The $0.4 target represents a significant milestone for Dogecoin, potentially marking a substantial increase from its current price. This prediction is based on technical indicators and historical price action, which suggest that a breakout from the current pattern could lead to a sustained upward trend.

Analysts emphasize the importance of monitoring key support and resistance levels. A sustained break above the current resistance could validate the bullish prediction, while a failure to maintain momentum could lead to a price correction. The volatile nature of the cryptocurrency market necessitates a cautious approach, as unexpected developments can significantly impact price movements.14

The confluence of factors, including the Dogecoin Foundation's token purchase, the potential easing of US tariffs, and the bullish technical analysis, has created a perfect storm for Dogecoin. The surge in trading volume and increased social media activity further amplify the bullish sentiment, contributing to the overall market optimism.15

However, it's crucial to acknowledge the inherent risks associated with cryptocurrency trading. The market is highly volatile, and price predictions are subject to significant uncertainty.16 While the current momentum appears promising, unexpected news or market corrections could quickly reverse the trend.

Will Dogecoin Reach $1? The Speculative Frenzy

The question on many traders' minds is whether Dogecoin can reach the coveted $1 mark. This milestone, once considered a distant dream, now seems within reach for some optimistic investors. The recent price surge and positive market sentiment have reignited speculation about Dogecoin's potential to achieve this target.

Achieving $1 would represent a significant increase from Dogecoin's current price, requiring a substantial influx of capital and sustained buying pressure.17 The cryptocurrency market is known for its rapid and unpredictable price swings, making such predictions inherently speculative.18

The Dogecoin community, known for its enthusiastic support and social media prowess, plays a crucial role in driving price movements.19 The power of social media and online communities to influence market sentiment cannot be underestimated, particularly in the case of meme coins like Dogecoin.20

However, fundamental factors, such as adoption rates, technological developments, and regulatory clarity, will ultimately determine Dogecoin's long-term success. The Dogecoin Foundation's efforts to enhance the cryptocurrency's utility and establish a stable ecosystem are crucial steps in this direction.21

The partnership with House of Doge and the establishment of a DOGE reserve demonstrate a commitment to building a more sustainable and functional cryptocurrency. These initiatives aim to move beyond the meme-driven hype and establish a solid foundation for long-term growth.

In conclusion, the Dogecoin Foundation's purchase of 10 million tokens, coupled with positive market sentiment and bullish technical indicators, has created a wave of optimism.22 While the $1 target remains speculative, the recent developments suggest that Dogecoin is experiencing a resurgence of interest and potential for further growth.

Traders should remain vigilant and exercise caution, as the cryptocurrency market is inherently volatile.23 The blend of community, development, and market conditions all contribute to the current and future potential of Dogecoin.

The key is whether it supports around 0.18951

Hello, traders.

If you "Follow", you can always get new information quickly.

Please also click "Boost".

Have a nice day today.

-------------------------------------

(DOGEUSDT 1D chart)

The key is whether it can maintain the price by rising above 0.18951.

If it rises after receiving support near 0.18951, we need to see whether it can rise above the M-Signal indicator on the 1W chart.

In other words, we need to see whether it can maintain the price above 0.21409.

If not, it is likely to show a downward trend like the previous trend.

-

Therefore, I think this is a great opportunity to turn into an upward trend in line with the flow of BTC.

What we need to do is to check if it is supported around 0.18951.

If it is supported, it is a time to buy.

Since the M-Signal indicator of the 1M chart is passing around 0.18951, it is highly likely that it will show a different flow than before.

Since OBV has to break through the upper line of the Price channel to surge, it is better not to rush too much and check if it is supported around 0.18951 before trading.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

- Big picture

I used TradingView's INDEX chart to check the entire range of BTC.

(BTCUSD 12M chart)

Looking at the big picture, it seems to have been following a pattern since 2015.

In other words, it is a pattern that maintains a 3-year bull market and faces a 1-year bear market.

Accordingly, the bull market is expected to continue until 2025.

-

(LOG chart)

Looking at the LOG chart, we can see that the increase is decreasing.

Accordingly, the 46K-48K range is expected to be a very important support and resistance range from a long-term perspective.

Therefore, we do not expect to see prices below 44K-48K in the future.

-

The Fibonacci ratio on the left is the Fibonacci ratio of the uptrend that started in 2015.

That is, the Fibonacci ratio of the first wave of the uptrend.

The Fibonacci ratio on the right is the Fibonacci ratio of the uptrend that started in 2019.

Therefore, this Fibonacci ratio is expected to be used until 2026.

-

No matter what anyone says, the chart has already been created and is already moving.

It is up to you how to view and respond to it.

Since there is no support or resistance point when the ATH is updated, the Fibonacci ratio can be appropriately utilized.

However, although the Fibonacci ratio is useful for chart analysis, it is ambiguous to use it as a support and resistance role.

The reason is that the user must directly select the important selection points required to create the Fibonacci.

Therefore, it can be useful for chart analysis because it is expressed differently depending on how the user specifies the selection point, but it can be seen as ambiguous for use in trading strategies.

1st: 44234.54

2nd: 61383.23

3rd: 89126.41

101875.70-106275.10 (when overshooting)

4th: 134018.28

151166.97-157451.83 (when overshooting)

5th: 178910.15

-----------------

DOGEUSDT soon after or before touching 0.10 pump is coming Two major daily supports which are:

A. 0.13$

B. 0.09

are ahead and can soon pump the price and after breaking this descending channel to the upside heavy pump will lead and we are looking for targets like 0.50$.

DISCLAIMER: ((trade based on your own decision))

<<press like👍 if you enjoy💚

DOGE is Waking Up — 200% Potential in Sight! Hello Traders 🐺

In this idea, I want to talk about DOGE, but I’ll keep it short and sweet—because everything is already very clear on the chart!

As you can see, DOGE is forming a falling wedge pattern, which you could also consider as a bull flag, since we’re currently in an uptrend. This falling wedge may simply be a pause before the next leg up! 🔥📈

🟢 Two Bullish Scenarios:

1️⃣ Falling Wedge Target ➜ The top of the wedge

2️⃣ Bull Flag Target ➜ Close to the previous all-time high (~$0.87) 🚀

💡 What Should You Do?

Take 50% profit at the first target (top of the wedge), and hold the rest for the second target—the potential ATH retest.

I hope you enjoyed this quick idea! Don’t forget to like and follow for more updates and support! 🙌🔥

And always remember:

🐺 Discipline is rarely enjoyable, but almost always profitable 🐺

🐺 KIU_COIN 🐺

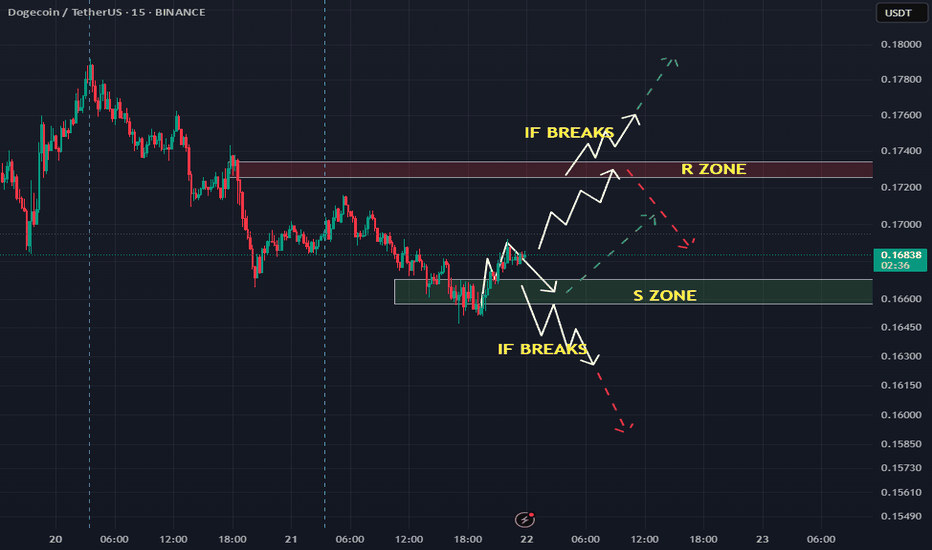

DOGE consolidating between key zones: Is a breakout imminent?The chart shows a strong prior downtrend that has halted and transitioned into a consolidation phase, forming a clear trading range between the marked support and resistance zones, where the lower zone acts as key support preventing further decline, while the upper zone serves as strong resistance limiting upward movement, meaning the price is likely to continue fluctuating within this range until a decisive breakout occurs, with a break above resistance potentially signaling further growth and a drop below support possibly triggering additional declines; however, caution is needed in the event of a breakout due to multiple touches of these zones, as a false breakout could mislead traders and result in a swift price reversal back into the existing range.

DOGEUSDT NEXT MOVESell after bearish candle stick pattern, buy after bullish candle stick pattern....

Best bullish pattern , engulfing candle or green hammer

Best bearish pattern , engulfing candle or red shooting star

NOTE: IF YOU CAN'T SEE ANY OF TOP PATTERN IN THE ZONE DO NOT ENTER

Stop lost before pattern

R/R %1/%3

Trade in 5 Min Timeframe, use signals for scalping

DOGEUSDT near two major daily support zoneAs we can see last and major daily support zones are touching here and soon we can expect range and gain for the price here like the green arrows to the upside.

Major resistances and targets are also mentioned on the chart with red zones too.

DISCLAIMER: ((trade based on your own decision))

<<press like👍 if you enjoy💚

JUST IN: Elon Musk's DOGE Blocks $52 Mln Payment to WEFThe Department Of Government Efficiency (D.O.G.E) a mechanism set up by the President Donald Trump headed by Elon Musk in a shocking news has block $52 million payments intended to be given to the World Economic Forum (WEF). This and many more blockage and unnecessary spendings was tracked and blocked by the DOGE team.

Now, knowing Elon Musk's unwavering support to the altcoin Dogecoin ( CRYPTOCAP:DOGE ) a token that is based on the popular "doge" Internet meme and features a Shiba Inu on its logo, CRYPTOCAP:DOGE coin price is fundamentally tied to The Department Of Government Efficiency (D.O.G.E).

Somehow this mechanism set up by Donald Trump might be the catalyst needed by CRYPTOCAP:DOGE coin to break the psychological $1 resistant with traders eyeing a $1 move this year. As more frivolous spendings and wasting of government funds are unravel, CRYPTOCAP:DOGE coin might be on the verge of a breakout amidst a falling wedge pattern formed since the 2nd week of February, 2025.

Dogecoin Price Live Data

The live Dogecoin price today is $0.169289 USD with a 24-hour trading volume of $1,053,328,921 USD. Dogecoin is down 2.66% in the last 24 hours, with a live market cap of $25,141,281,592 USD. It has a circulating supply of 148,510,656,384 DOGE coins and the max. supply is not available.

Rising Wedge: "Continuation"OKX:DOGEUSDT Analysis – Potential Downtrend Continuation

The bulls initially pushed the price above the rising wedge but failed to hold it as support. As a result, the price retraced, breaking below the trendline once again. The bears not only successfully breached this level but also converted the upper trendline into resistance. Subsequently, within 2 to 3 hours, the price broke below the lower trendline, signaling further bearish momentum.

Traders should be cautious of a potential downtrend continuation. At the $0.161694 level, a large-scale liquidation of approximately $3.01 million is present, making it a potential profit-taking zone if the bears manage to hold the lower trendline as resistance.

This is just my perspective—trade wisely! 🤞⚡💰

DOGE/USDT 1H: Bullish Momentum Holding – Can $0.182 Be ReachedDOGE/USDT 1H: Bullish Momentum Holding – Can $0.182 Be Reached?

🚀 Follow me on TradingView if you respect our charts! 📈 Daily updates!

Current Market Conditions (Confidence: 8/10):

Price at $0.1752, showing strong bullish momentum.

No clear divergences present on RSI, suggesting sustained strength.

Market Maker accumulation visible, confirmed by a recent sweep of lows at $0.163 and strong bounce.

LONG Trade Setup:

Entry: $0.174 - $0.175 zone.

Targets:

T1: $0.178 (initial resistance).

T2: $0.182 (extended liquidity zone).

Stop Loss: $0.171 (below recent support).

Risk Score:

8/10 – Strong risk-to-reward setup with confirmation of Smart Money accumulation.

Market Maker Activity:

Accumulation phase completed with a liquidity sweep below $0.163.

Order blocks at $0.173 - $0.174 indicate continued bullish pressure.

Minimal selling pressure suggests a continuation of the uptrend.

Recommendation:

L

ong positions remain favorable within the $0.174 - $0.175 entry range.

Monitor reaction at $0.178, as a strong breakout could confirm the move to $0.182.

Use tight stops, as pullbacks could occur before continuation.

🚀 Follow me on TradingView if you respect our charts! 📈 Daily updates!