DXY Just Broke Through the Lock… Where’s the Market Headed Now?🌅 Good Morning, Friends!

A few days ago, I marked 98.950 as a key threshold for the DXY index. As of today, that level has officially been broken—and the bullish momentum we anticipated is now kicking in. 📈

The next target? 101.000.

That said, it’s crucial to remember: DXY is heavily influenced b

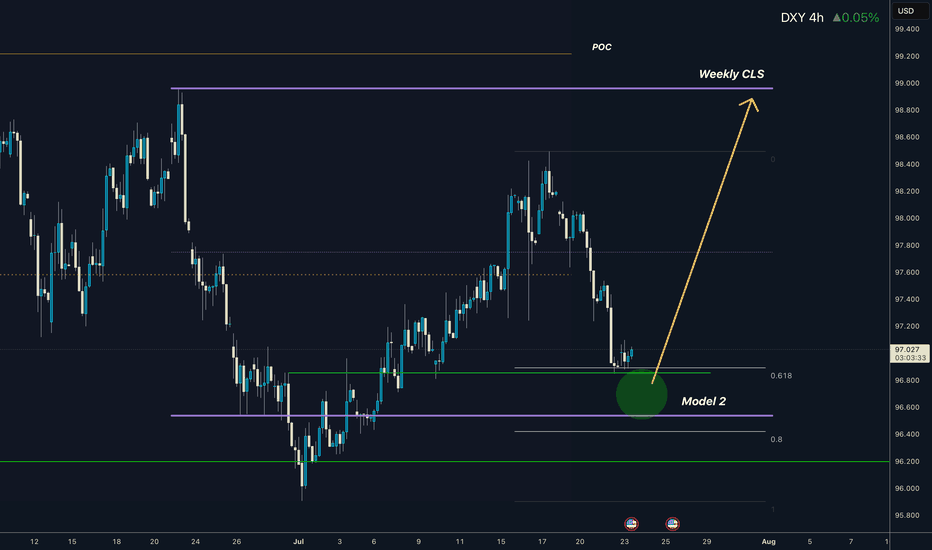

Dollar I Weekly CLS I Model 2 I Ready for pullbackYo Market Warriors ⚔️

Fresh outlook drop — if you’ve been riding with me, you already know:

🎯My system is 100% mechanical. No emotions. No trend lines. No subjective guessing. Just precision, structure, and sniper entries.

🧠 What’s CLS?

It’s the real smart money. The invisible hand behind $7T/d

NFP Volatility Ahead – Is the Dollar Ready to Break Higher?🟢 DXY Outlook – A Key Day for the Dollar Index

Yesterday’s monthly candle closed with strong bullish momentum, marking a powerful start to August. Today, on the first trading day of the month, we’re expecting three major U.S. economic releases:

NFP, Average Hourly Earnings (m/m), and the Unemployme

DXY: USD Flexes Muscle - Pairs SlideFriday, July 25, 2025

The foreign exchange markets are experiencing a pronounced USD bullish session this morning, with the US Dollar Index (DXY) showing robust gains of +0.35% while simultaneously pressuring all major currency pairs into negative territory. The Japanese Yen (JPY) is bearing the b

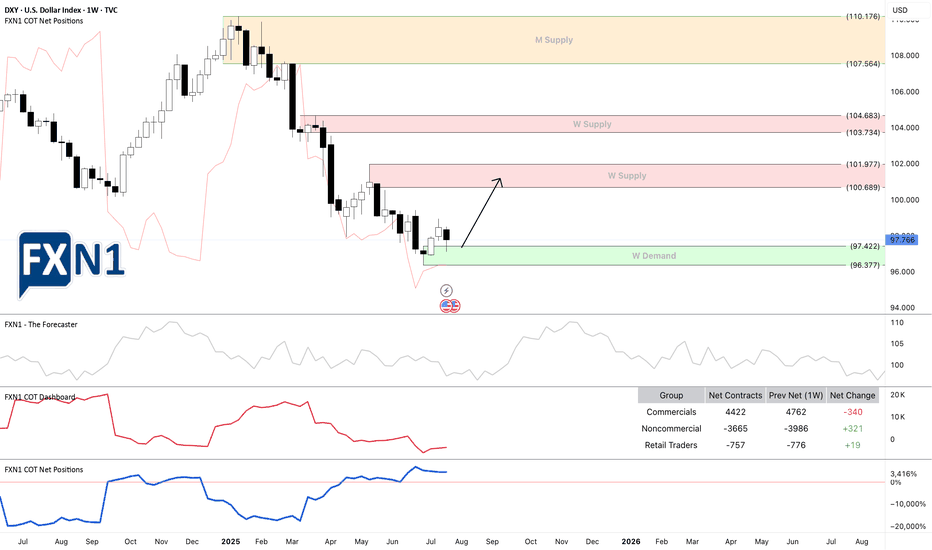

DXY: Weekly OutlookWeekly DXY Outlook

On the weekly chart, the US Dollar Index (DXY) has reached a critical zone that was last tested in February 2022.

While a rebound is not guaranteed, the fact that the DXY has declined nearly 12% over just six months—despite a resilient U.S. economy—suggests the potential for re

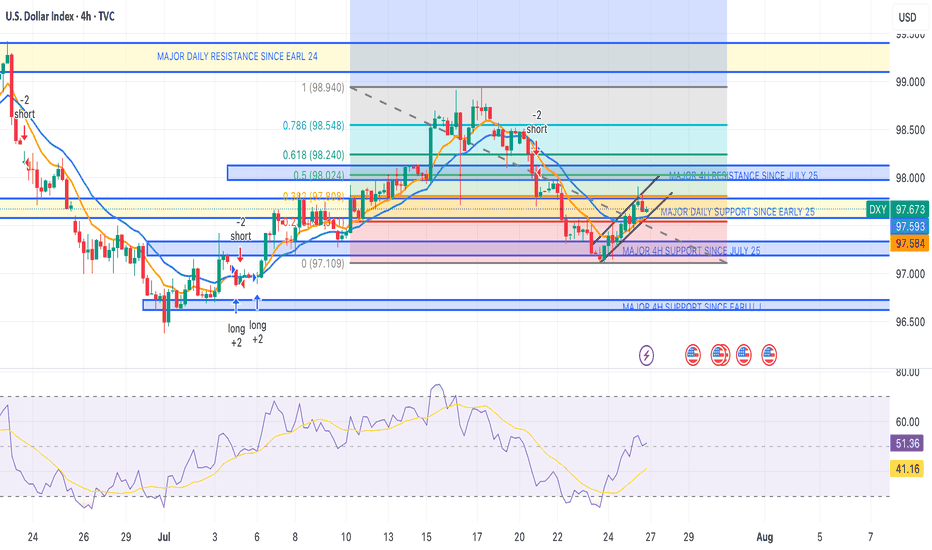

DXY HEADING INTO LAST WEEK OF JULY DXY ZONES

WEEKLY TF, TO DAILY, TO 4HR ANALYSIS.

The successful devaluation of the dollar by the administration since the election continues.

DXY dumped below key daily support at 97.600.

It was reclaimed but failed at key daily resistance dating back to 2024 — the same zone as the 0.382 Fibonacci

See all ideas

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

USD Index (USX) / US Dollar reached its highest quote on Sep 28, 2022 — 114.743 USD. See more data on the USD Index (USX) / US Dollar chart.

The lowest ever quote of USD Index (USX) / US Dollar is 89.163 USD. It was reached on Jan 6, 2021. See more data on the USD Index (USX) / US Dollar chart.

USD Index (USX) / US Dollar is just a number that lets you track performance of the instruments comprising the index, so you can't invest in it directly. But you can buy USD Index (USX) / US Dollar futures or funds or invest in its components.