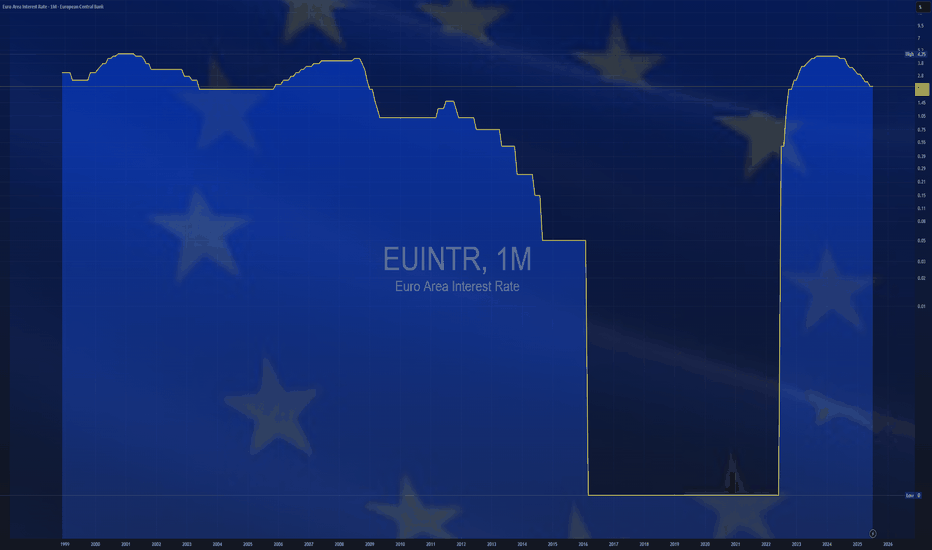

$EUINTR - Europe Interest Rates (July/2025)ECONOMICS:EUINTR

July/2025

source: European Central Bank

- The ECB kept interest rates unchanged in July, effectively marking the end of its current easing cycle after eight cuts over the past year that brought borrowing costs to their lowest levels since November 2022.

The main refinancing rat

Key data points

Last release

—

Observation period

Jul 24, 2025

Next release

—

Forecast

—

Highest

4.75 % on May 2, 2001

Lowest

0.00 % on Jun 9, 2022

About Euro Area interest rate

In the Euro Area, benchmark interest rate is set by the Governing Council of the European Central Bank. The primary objective of the ECB’s monetary policy is to maintain price stability which is to keep inflation below, but close to 2 percent over the medium term. In times of prolonged low inflation and low interest rates, ECB may also adopt non-standard monetary policy measures, such as asset purchase programmes. The official interest rate is the Main refinancing operations rate.

Related indicators

$EUINTR - Interest Rates Cut (June/2025)ECONOMICS:EUINTR

(June/2025)

source: European Central Bank

- The ECB cut key interest rates by 25 bps at its June meeting,

based on updated inflation and economic forecasts.

Inflation is near the 2% target, with projections showing 2.0% in 2025 (vs 2.3% previously), 1.6% in 2026 (vs 1.9% previou

$EUINTR - ECB Lowers Interest Rates by 25bps (April/2025)ECONOMICS:EUINTR - ECB Lowers Interest Rates by 25bps (April/2025)

ECONOMICS:EUINTR

April/2025

source: European Central Bank

- The European Central Bank lowered interest rates by 25 basis points on Thursday, as expected, marking the sixth consecutive cut since June and bringing the key deposi

$EUINTR -Europe's Interest RatesECONOMICS:EUINTR

(March/2025)

source: European Central Bank

- The ECB lowered the three key interest rates by 25 basis points, as expected, reducing the deposit facility rate to 2.50%, the main refinancing rate to 2.65%, and the marginal lending rate to 2.90%.

This decision reflects an updated

$EUNITR - Europe Interest Rates $EUNITR

(January/2025)

source: European Central Bank

- The European Central Bank lowered its key interest rates by 25 bps in January 2025, as expected, reducing the deposit facility rate to 2.75%, the main refinancing rate to 2.90%, and the marginal lending rate to 3.15%.

This move reflects the

$EUINTR -Europe's Interest Rates (December/2024)ECONOMICS:EUINTR

(December/2024)

source: European Central Bank

The European Central Bank (ECB) has decided to cut its key interest rates for the fourth time this year by 25 bps in December 2024, as expected.

This move reflects a more favorable inflation outlook and improvements in monetary poli

$EUINTR -Europe Interest Rates ECONOMICS:EUINTR (October/2024)

source: European Central Bank

- The ECB lowered its three key interest rates by 25 bps in October 2024, as expected, following similar moves in September and June.

The deposit facility, main refinancing operations, and marginal lending facility rates will now be 3

$EUINTR -ECB Cuts Interest Rates for 2nd Time

- The European Central Bank cut the key deposit interest rate by 25bps to 3.5% as expected, after a similar reduction in June, and a pause in July, reflecting an updated inflation outlook and better transmission of policy.

At the same time, the interest rates on the main refinancing operations and

$EUINTR - Highest Level since 2000The European Central Bank raised Interest Rates by a Quarter of a percentage point Thursday, judging that Inflation remains too High ;

even as data points to a deepening economic downturn in the 20 countries that use the euro.

The move takes the benchmark rate in the euro area to 3.75%, the highe

See all ideas

Frequently Asked Questions

Euro Area interest rate is 2.15% at the moment.

Last month Euro Area interest rate was 2.15%, and the month before it reached 2.15%.

Interest rate is the proportion of a loan that is charged as interest to the borrower, typically an annual percentage of the loan outstanding. When it comes to the national level, interest rate is a rate at which banks borrow money from a country's central bank.

Yes, negative interest rate can be used by the government as a monetary policy tool to stimulate economy growth.

Growing or falling interest rate can influence the country's economy, stimulate it or lower the inflation level. Even people can feel the effect of interest rate's movements — for example, if interest rate increases, loans get more expensive.