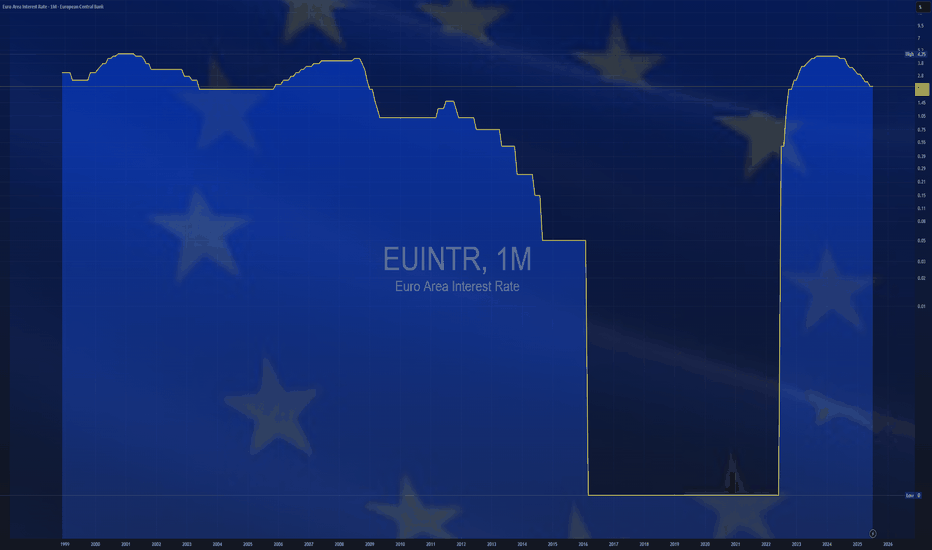

$EUINTR - Europe Interest Rates (July/2025)ECONOMICS:EUINTR

July/2025

source: European Central Bank

- The ECB kept interest rates unchanged in July, effectively marking the end of its current easing cycle after eight cuts over the past year that brought borrowing costs to their lowest levels since November 2022.

The main refinancing rate remains at 2.15%, while the deposit facility rate holds at 2.0%. Policymakers struck a wait-and-see stance, as they evaluate the impact of lingering trade uncertainty and the potential fallout from proposed US tariffs on economic growth and inflation.

Inflation hit the ECB’s 2% target in June, adding to the case for a pause in policy adjustments. Speaking at the ECB press conference, President Lagarde said the central bank is “in a good place” but acknowledged the difficulty in assessing how tariffs will affect price outlooks, given the mix of both inflationary and disinflationary pressures.

On the recent euro appreciation, Lagarde reiterated that the ECB does not target exchange rates directly but considers them when forecasting inflation.

EUINTR trade ideas

$EUINTR - Interest Rates Cut (June/2025)ECONOMICS:EUINTR

(June/2025)

source: European Central Bank

- The ECB cut key interest rates by 25 bps at its June meeting,

based on updated inflation and economic forecasts.

Inflation is near the 2% target, with projections showing 2.0% in 2025 (vs 2.3% previously), 1.6% in 2026 (vs 1.9% previously), and 2.0% in 2027.

Core inflation (excluding energy and food) is seen at 2.4% in 2025, then easing to 1.9% in 2026–2027.

GDP growth is forecast at 0.9% in 2025, 1.1% in 2026 (vs 1.2% previously), and 1.3% in 2027, supported by higher real incomes, strong labour markets, and rising government investment, despite trade policy uncertainties weighing on exports and business investment.

Scenario analysis shows trade tensions could reduce growth and inflation, while resolution could boost both.

Wage growth is still high but slowing, and corporate profits are helping absorb cost pressures.

President Lagarde said that the central bank is approaching the end of a cycle, suggesting a pause may be on the horizon following today’s reduction.

$EUINTR - ECB Lowers Interest Rates by 25bps (April/2025)ECONOMICS:EUINTR - ECB Lowers Interest Rates by 25bps (April/2025)

ECONOMICS:EUINTR

April/2025

source: European Central Bank

- The European Central Bank lowered interest rates by 25 basis points on Thursday, as expected, marking the sixth consecutive cut since June and bringing the key deposit rate down to 2.25%.

Policymakers noted that the disinflation process is progressing well and dropped previous references to a "restrictive" policy stance, while cautioning that the growth outlook has worsened amid escalating trade tensions.

$EUINTR -Europe's Interest RatesECONOMICS:EUINTR

(March/2025)

source: European Central Bank

- The ECB lowered the three key interest rates by 25 basis points, as expected, reducing the deposit facility rate to 2.50%, the main refinancing rate to 2.65%, and the marginal lending rate to 2.90%.

This decision reflects an updated assessment of the inflation outlook and monetary policy transmission.

*The ECB acknowledged that monetary policy is becoming meaningfully less restrictive, easing borrowing costs for businesses and households.

Inflation is projected to average 2.3% in 2025, 1.9% in 2026, and 2.0% in 2027, with core inflation also nearing the 2% target.

Although domestic inflation remains elevated due to delayed wage and price adjustments, wage growth is moderating.

Economic growth forecasts were revised downward to 0.9% for 2025 and 1.2% for 2026, reflecting weak exports and investment.

*The ECB remains data-dependent and will adjust its policy as needed to ensure inflation stabilizes around its 2% medium-term target without committing to a specific rate path.

$EUNITR - Europe Interest Rates $EUNITR

(January/2025)

source: European Central Bank

- The European Central Bank lowered its key interest rates by 25 bps in January 2025, as expected, reducing the deposit facility rate to 2.75%, the main refinancing rate to 2.90%, and the marginal lending rate to 3.15%.

This move reflects the ECB’s updated inflation outlook, with price pressures easing in line with projections.

While domestic inflation remains elevated due to delayed wage and price adjustments, wage growth is moderating, and corporate profits are absorbing some inflationary effects.

Despite persistent tight financing conditions, the rate cut is expected to gradually ease borrowing costs for firms and households.

The ECB remains data-driven and has not committed to a predetermined rate path, emphasizing a cautious approach to ensuring inflation stabilizes at its 2% target.

$EUINTR -Europe's Interest Rates (December/2024)ECONOMICS:EUINTR

(December/2024)

source: European Central Bank

The European Central Bank (ECB) has decided to cut its key interest rates for the fourth time this year by 25 bps in December 2024, as expected.

This move reflects a more favorable inflation outlook and improvements in monetary policy transmission.

Inflation is expected to gradually decrease, with forecasts of 2.4% in 2024, 2.1% in 2025, and 1.9% in 2026.

Core inflation, excluding energy and food, is also expected to fall, with a target of 2% in the medium term.

Despite easing financing conditions due to the rate cuts, borrowing costs remain tight due to previous hikes still affecting existing loans.

Economic recovery is projected to be slower than before, with growth expected at 0.7% in 2024, 1.1% in 2025, and 1.4% in 2026.

The ECB remains focused on ensuring inflation returns to its 2% target and will adjust its policies based on incoming data, without committing to a fixed rate path.

$EUINTR -Europe Interest Rates ECONOMICS:EUINTR (October/2024)

source: European Central Bank

- The ECB lowered its three key interest rates by 25 bps in October 2024, as expected, following similar moves in September and June.

The deposit facility, main refinancing operations, and marginal lending facility rates will now be 3.25%, 3.40%, and 3.65%, respectively.

This decision stems from an updated assessment of inflation, which shows disinflation progressing well.

In September, inflation in the Eurozone fell below the ECB’s target of 2% for the first time in more than three years.

While inflation is expected to rise in the short term, it should decline toward the 2% target in 2025.

Wage growth remains high, but pressures are easing.

The ECB remains committed to restrictive rates to ensure inflation reaches its medium-term goal, using a data-driven, flexible approach without committing to a specific rate path.

$EUINTR -ECB Cuts Interest Rates for 2nd Time

- The European Central Bank cut the key deposit interest rate by 25bps to 3.5% as expected, after a similar reduction in June, and a pause in July, reflecting an updated inflation outlook and better transmission of policy.

At the same time, the interest rates on the main refinancing operations and the marginal lending facility were lowered to 3.65% and 3.90% respectively.

source: European Central Bank

$EUINTR - Highest Level since 2000The European Central Bank raised Interest Rates by a Quarter of a percentage point Thursday, judging that Inflation remains too High ;

even as data points to a deepening economic downturn in the 20 countries that use the euro.

The move takes the benchmark rate in the euro area to 3.75%, the highest since October 2000.

Euro Area Interest Rate Reduction a signal? Euro Area Interest Rate

◻️Reduced from 4.5% to 4.25% as expected

◻️We can acknowledge the pattern & recognize its significance without jumping to any immediate conclusions

◻️Chart will need to be combined with others to make assertions, such as the 10Y/2Y Yield Spread

U.S. 10Y/2Y Yield Spread with U.S. Unemployment rate

The amount of months that have passed prior to recession initiation after the yield curve makes its first turn back up towards 0% level

◻️ Historical Average timeframe is April 2024

◻️ Historical Maximum timeframe would be Jan 2025

No guarantee that history will repeat. Again, just a chart and some data that is worth keeping an eye on. Some people state the bond market is now broken and manipulated, we should know within 12 - 18 months, or sooner.

PUKA

ECB maintains interest rate at 4.50% but for how long? History of prior EU Rate pauses:

4 months | Oct 00 - Apr 01

12 months | Jun 07 - Jun 08

3 months | Jul - Oct 2011

4 months | Sept 2023 - Present ⏳SO FAR⏳

At least they could say that this is not the shortest one ever now that we are into month 4.

Historical Average: 6 months (March 2024)

Interestingly this is when the Bank Term Funding Program in the US is ending which was providing liquidity to the banks. It might be a case of one foset gets turned off and another gets turned on.

PUKA