Inflation vs. Growth : Is the Fed Behind or Ahead of the Curve?CME_MINI:NQ1! CME_MINI:ES1! CME_MINI:MNQ1! CME_MINI:MES1! CBOT:ZN1!

Fed Policy recap:

There is an interesting and unusual theme to keep an eye on this week. The Fed is in a ‘blackout period’ until the FOMC meeting- this is a customary quiet period ahead of an FOMC policy meeting. Fed Chair Powell is scheduled to give a public talk on Tuesday. Although his address will be focused on the capital framework of the large banks, this appearance will be closely watched for any subtle signals on the FOMC policy stance.

Especially given that last week, Federal Reserve Governor Chris Waller made a speech, “The Case for Cutting Now” with a purpose as he stated to explain why the FOMC should reduce rate by 25 bps at the July 30th, 2025 meeting.

His stated reasons were:

1. Tariffs create one-off price level increases with transitory inflation effects, not sustained inflation momentum.

2. He argued that much of economic data points towards interest rates should be lowered to FOMC’s participants' median neutral rate, i.e, 3%.

3. His third stated reason notes that while the state of the labor market looks resilient on the surface, accounting for expected data revisions, private-sector payroll growth has peaked, with more data suggesting increased downside risks.

His speech further explains:

• Growth has decelerated sharply: Real GDP rose only ~1% annualized in 1H25, a significant slowdown from 2.8% in 2H24, and well below long-run potential.

• Consumer spending is weakening, with real PCE growth falling to ~1%, and June retail sales showing soft underlying momentum.

• Broader labor market indicators, including the Beige Book and JOLTS data, show declining labor demand and hiring caution, suggesting increasing downside risks to employment.

• Inflation is slightly above target (PCE ~2.5%) but driven primarily by temporary, one-off tariff effects. Core inflation ex-tariffs is likely near 2%, and expectations remain anchored.

• Current fed funds range (4.25%–4.50%) is well above neutral (3%), implying excessive restraint.

• With inflation risks subdued and macro conditions deteriorating, a preemptive rate cut now provides optionality and avoids falling behind the curve if the slowdown deepens. Further cuts may be warranted if trends persist.

• The tax bill contains pro-growth provisions, but its economic impact is expected to be minimal in 2025.

Source: Federal Reserve Speech, The Case for Cutting Now Governor Waller

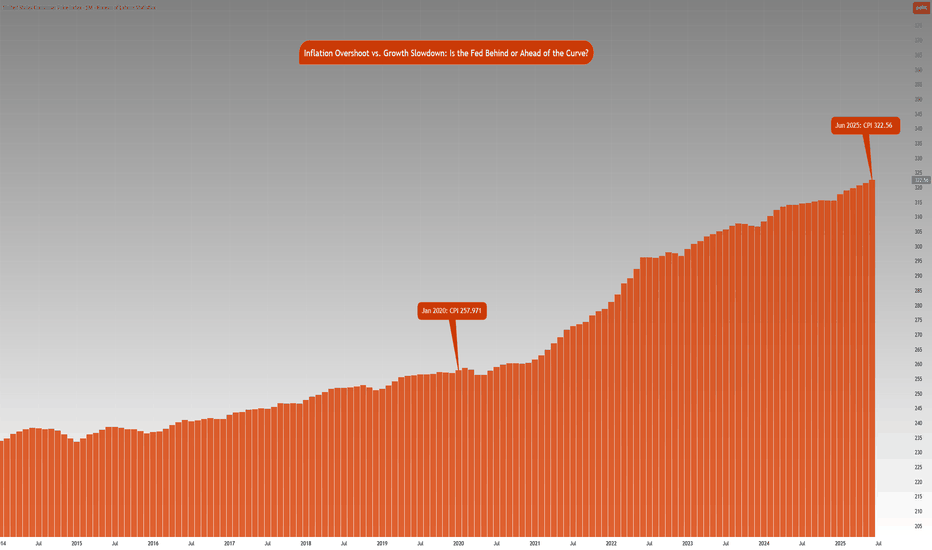

Inflation Analysis:

Let’s compare this with what we have previously mentioned regarding inflation. CPI index stood at 257.971 points in January 2020. Projecting this at a 2% Fed target, June 2025 inflation should be around 287.655 points. However, June 2025 inflation is currently at 322.56 index points, 12.2% higher above 2% the inflation trend. Effectively, this means annualized inflation since January 2020 is roughly 4.15%.

The Fed is in a real dilemma whether cutting rates given the inflation trend in the last 5 years and risks to inflation outlook justify cutting rates.

Key Questions to ask

Markets are forward looking. Investors and participants want to know:

• How will the rates impact the cost of debt service? Currently the third largest government expenditure, over $1.03 trillion.

• Will the tariff rate offset the tax revenue losses by extending tax cuts?

• Is the fiscal path sustainable?

• What happens to the long end of the yield-curve?

• Will the Fed monetize the debt issuance imbalance?

• Is this simply Governor Waller positioning himself for the next appointment of Fed Chair when Fed Chair Powell’s term expires in May 2026?

It seems there is a huge conflict between longer term implications vs quick short term fixes that align with US administration objectives.

The Week ahead:

It is a relatively light economic calendar in the US. Flash PMI readings and housing data on the docket. The primary focus as it has been for most weeks since President Trump took office, will be on the developments in trade policy and any further comments on Fed and Chair Powell. The threat of renewed tariffs starting August 1st, is also key to monitor and whether these protectionist measures will force US’s trading partners to make further concessions to negotiate trade deals.

The earnings season is off to a good start with major US banks reporting higher EPS and revenue than expectations. This week investors will be looking at Q2 earnings reports from Alphabet, Meta, Microsoft from the Mag 7 and Tesla.

USCPI trade ideas

US CPI inflation is the fundamental highlight of the weekIntroduction: The US Federal Reserve (FED) spoke last week, and the US federal funds rate was left unchanged at its level since last December. Unlike the European Central Bank (ECB) and other major central banks, the FED has yet to resume cutting its interest rate, despite intense verbal pressure from Donald Trump.

This week (May 12), it's the CPI US inflation update that is the fundamental highlight of the week. Indeed, Jerome Powell is demanding more confirmation of disinflation to consider resuming rate cuts.

1) US inflation rate resumed its decline this spring according to the CPI and PCE inflation indices

High-finance circles are astonished by the FED's slowness to match the ECB's rate cuts, when the downward trend in inflation curves has been confirmed in the US by the latest updates of the PCE (the FED's favorite inflation index) and the CPI.

But it seems that Jerome Powell's FED is waiting to see the outcome of the trade diplomacy to be sure that the tariff war will not push inflation back up.

The chart below shows the curves for nominal US inflation and underlying US inflation, and their update on Tuesday May 13 is the dominant fundamental factor of the week. If the fall in the inflation rate is confirmed, the likelihood of the FED cutting its interest rate in June or July will increase, and vice versa.

2) Real-time inflation indicators are optimistic

There are a number of real-time inflation indicators, most of which are ahead of official inflation. This is particularly true of TRUFLATION, the real-time measure of true US inflation, which is already below the FED's 2% target, thanks in large part to the fall in oil prices and the decline in real estate inflation.

3) But fears of a rebound in inflation are strong, especially among US consumers.

But we must remain cautious, as there is a risk of inflation rebounding in the coming months. This risk is present as long as the United States has not signed trade agreements with its main trading partners, notably China and the European Union. It is essential to limit tariffs as much as possible to neutralize any risk of a rebound in inflation, a real risk if US consumer inflation expectations are anything to go by.

Conclusion: US CPI inflation on Tuesday 13th should therefore be kept under very close watch. Confirmation of a fall in the inflation rate would be good news for the equity market, as it would bring the next FED rate cut closer in time.

DISCLAIMER:

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only. The presented idea (including market commentary, market data and observations) is not a work product of any research department of Swissquote or its affiliates. This material is intended to highlight market action and does not constitute investment, legal or tax advice. If you are a retail investor or lack experience in trading complex financial products, it is advisable to seek professional advice from licensed advisor before making any financial decisions.

This content is not intended to manipulate the market or encourage any specific financial behavior.

Swissquote makes no representation or warranty as to the quality, completeness, accuracy, comprehensiveness or non-infringement of such content. The views expressed are those of the consultant and are provided for educational purposes only. Any information provided relating to a product or market should not be construed as recommending an investment strategy or transaction. Past performance is not a guarantee of future results.

Swissquote and its employees and representatives shall in no event be held liable for any damages or losses arising directly or indirectly from decisions made on the basis of this content.

The use of any third-party brands or trademarks is for information only and does not imply endorsement by Swissquote, or that the trademark owner has authorised Swissquote to promote its products or services.

Swissquote is the marketing brand for the activities of Swissquote Bank Ltd (Switzerland) regulated by FINMA, Swissquote Capital Markets Limited regulated by CySEC (Cyprus), Swissquote Bank Europe SA (Luxembourg) regulated by the CSSF, Swissquote Ltd (UK) regulated by the FCA, Swissquote Financial Services (Malta) Ltd regulated by the Malta Financial Services Authority, Swissquote MEA Ltd. (UAE) regulated by the Dubai Financial Services Authority, Swissquote Pte Ltd (Singapore) regulated by the Monetary Authority of Singapore, Swissquote Asia Limited (Hong Kong) licensed by the Hong Kong Securities and Futures Commission (SFC) and Swissquote South Africa (Pty) Ltd supervised by the FSCA.

Products and services of Swissquote are only intended for those permitted to receive them under local law.

All investments carry a degree of risk. The risk of loss in trading or holding financial instruments can be substantial. The value of financial instruments, including but not limited to stocks, bonds, cryptocurrencies, and other assets, can fluctuate both upwards and downwards. There is a significant risk of financial loss when buying, selling, holding, staking, or investing in these instruments. SQBE makes no recommendations regarding any specific investment, transaction, or the use of any particular investment strategy.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. The vast majority of retail client accounts suffer capital losses when trading in CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Digital Assets are unregulated in most countries and consumer protection rules may not apply. As highly volatile speculative investments, Digital Assets are not suitable for investors without a high-risk tolerance. Make sure you understand each Digital Asset before you trade.

Cryptocurrencies are not considered legal tender in some jurisdictions and are subject to regulatory uncertainties.

The use of Internet-based systems can involve high risks, including, but not limited to, fraud, cyber-attacks, network and communication failures, as well as identity theft and phishing attacks related to crypto-assets.

Bitcoin to $1,000,000, This is It. (Breakdown Explained)

Well here we are, no recession? no rate hikes? what's going on?. The currency collapse is imminent that's what is going on while majority wait for a recession.

No reserve currency has ever survived going past 121% Government Debt to GDP (what about USA in ww2?, this was the start of parabolic technology growth + decrease in spending + war debt repressions

(forced).

Government Debt + Interest will collapse the currency faster if the FED raises interest rates so this is not a possible outcome unless you want to roll the dice.

CPI + Inflation has barely been tamed, FED balance sheet failed to reduce + BTFP.

SPY (priced in USM2) has started a new bubble breakout

(yes meaning it has just started).

Japan raising interest rates means the carry trade is closing (people sell the US Bonds they bought with cheap JPY) adding artificial pressure on the US10Y market.

FED raising rates at 121% Government Debt to GDP will send it to 200% faster than you can imagine, a recession? forget it can't be allowed to happen.

Theory breakdown what happens next?

FED unable to raise rates will start to introduce confidence lost in the dollar that will trigger loss in confidence in US bonds that will require YCC like WW2. When the USA has done this before it equated to the FED needing to get rates back to zero.

The FED has an objective to save the US dollar above all means necessary, raising rates in a situation like this on paper makes sense but leads to to a accelerated debt cycle collapse.

Jerome Powell's only option was to raise rates fast as possible strengthening the DXY as much as they can flowing all capital globally back into the dollar for risk management.

Jerome Powell now must cut rates back to zero and initiate YCC on the US bond market, reinitiate Quantitative Easing to avoid any recession backstopping every market. Inflation must be allowed to run near 20%-100%. Large capital will see this event unfolding and run into assets like Bitcoin & Gold, we already see this and should understand why Spot ETF's and leverage ETF's were rushed to the market pre cuts.

If the US bond market fails, global capitalism as we know it today fails.

If my thesis was invalidated Jerome Powell would have started multiple more rate hike since I first mentioned this back in late 2023.

CPI & Inflation Rate USHello everyone! Let's take a look on what happened yesterday on the US financial market and understand the impact of CPI and inflation rate.

The Consumer Price Index (CPI) and inflation news from the United States can have a significant impact on financial markets and the value of the U.S. dollar. The CPI measures the change in the price of a basket of goods and services consumed by households, and inflation is the rate at which the general level of prices for goods and services is rising.

When the CPI and inflation numbers are higher than expected , it can indicate that the economy is growing, which can boost stock prices, lead to higher interest rates, and appreciate the dollar. This is because as the economy grows, companies will see increased demand for their products and services, which can lead to higher profits and stock prices. Higher interest rates can also attract more investors to bonds, which can lead to higher bond prices. Additionally, a strong economy can lead to increased demand for U.S. goods and services, and increased foreign investment in the U.S. economy. As a result, the demand for dollars increases, which can lead to an increase in the value of the dollar.

On the other hand, if the CPI and inflation numbers are lower than expected , it can indicate that the economy is slowing down , which can lead to lower stock prices, lower interest rates and depreciation of the dollar. This is because as the economy slows down, companies will see decreased demand for their products and services, which can lead to lower profits and stock prices. Lower interest rates can also lead to less investors in bonds, which can lead to lower bond prices. Additionally, a weak economy can lead to decreased demand for U.S. goods and services, and decreased foreign investment in the U.S. economy. As a result, the demand for dollars decreases, which can lead to a decrease in the value of the dollar.

It's important to note that the Federal Reserve uses inflation as an indicator to change the monetary policy, as they use interest rates as a tool to control inflation. Typically if inflation is too high, the Fed will increase interest rates to slow down the economy and curb inflation, and if inflation is too low, the Fed will decrease interest rates to stimulate the economy. These monetary policy decisions can also have an impact on the value of the dollar, as when the Fed raises interest rates, it can make the U.S. a more attractive place to invest, which can lead to an appreciation of the dollar. Conversely, when the Fed lowers interest rates, it can make the U.S. a less attractive place to invest, which can lead to a depreciation of the dollar.

ASSETS /INFLATION DEFLATION JUST STARTED Since 1971 ALL ASSETS have inflated based on the start of M2 and the start of money velocity . it is just starting down housing BUBBLE is about 5 x of 2007 as is the pension system . when it is over it will be a very DARK TIME and a NEW System . FIXED money . CASH AND T BILLS ARE THE ONLY SAFE HAVEN !! I HAVE WARNED OF MAJOR CIVIL ARREST and having a good 1 yr of dry goods something to protect you and you family . and move as far away from any city or state thats BLUE

Can we expect more inflation? A look US Consumer Price Index.We are living in very uncertain times. I wanted to provide a couple of view in order to understand the current market situation better and determine a strategy going forward.

So I have created a US consumer price indes YOY% chart.

We have not seen such high interest rates since the 1970s when demographics created a demand shock and oil embargos and Iran crisis created a demand shock leading to high inflation.

Today, respectively as a result from 2 years of Covid-19 (measures) and now a war we have seen tremendous supply shock.

Now can we expect the peak of the inflation fear has passed?

Will we see a slow growth and a declining inflation?

Stay tuned for more charts....

--------------------------------------------------------------------------------------------------------

** Please support this idea with your likes and comments, it is the best way to keep it relevant and support me. **

--------------------------------------------------------------------------------------------------------

!! Donations via TradingView coins also help me a great deal at posting more free trading content and signals here !!