CIRA EDU | Breakout Brewing After Rate Cut – Eyes on 16.80 EGP! CIRA is showing early signs of a bullish reversal just as Egypt's Central Bank slashes bond interest rates by 2.5%. With a fresh MACD bullish crossover and rising momentum, the stock is pushing off key support and aiming for the top of the Ichimoku cloud.

Momentum: Price just broke out of a short-term consolidation zone

Ichimoku Cloud: Price is trying to break upward but still under the cloud → neutral to mildly bullish

Stochastic RSI: Entering overbought territory (above 80)

RSI: Around 42–43 → still has upside room

MACD: Gave a bullish crossover, histogram flipped green → early bullish signal

🟢 Entry: 14.40 EGP

🎯 TP Levels: 15.45 / 16.4

🔻 SL: 13.3

The education sector tends to thrive in lower rate environments, and with strong dividend growth and improving EBITDA, CIRA could be a hidden gem for short- to medium-term traders.

CIRA trade ideas

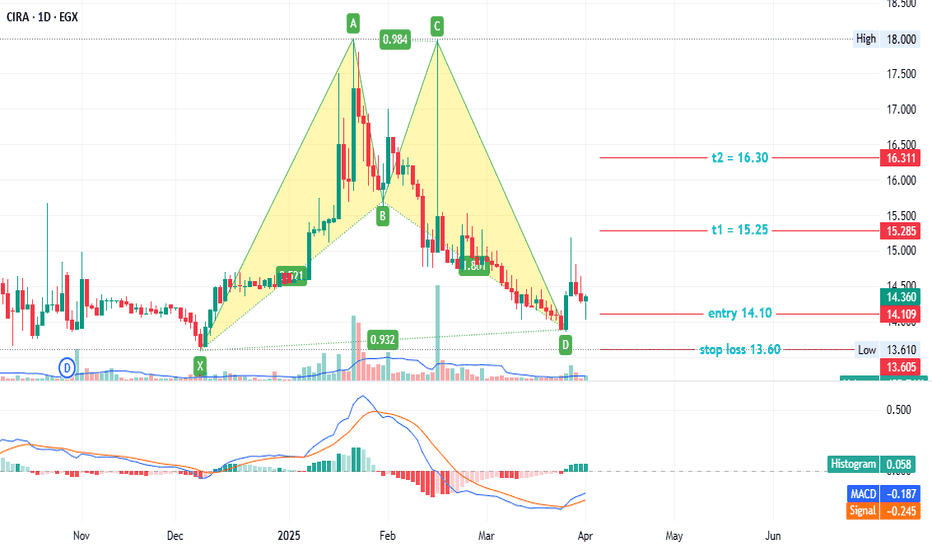

#CIRA - Egyptian stock#CIRAtime frame 1 DAY

Created a Bullish Gartley pattern

Entry level at 14.10

Stop loss 13.60 (-5% estimated loss )

First target at 15.25 ( 8% estimated profit )

Second target 16.30 ( 15% estimated profit )

NOTE : this data according to time frame I DAY , it`s may take period up to 3 months to achieve targets , you must study well the Alternative opportunities before invest in this stock .

Its not an advice for investing only my vision according to the data on chart

Please consult your account manager before investing

Thanks and good luck

CIRA is waiting for a bullish market- Probably the best looking chart at the moment in the market.

- market needs to be bullish for this trade to work.

- its hanging now around a good R:R.

- We have a gap on the monthly around the 16.40. Once we break the 14 area, we may get an impulsive move towards the gap.