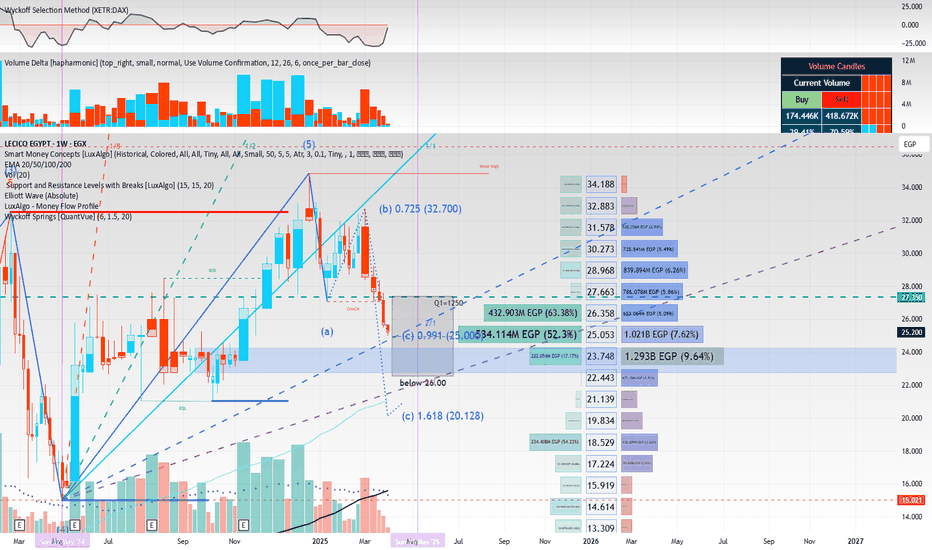

Bullish Breakout & Retest Setup - Great R:R Opportunity!- There's a **downtrend line** that got broken to the upside (marked with an arrow).

- After the breakout, price made a **small pullback** and seems to be finding support around the previous breakout zone.

- You're showing a **long setup** with a favourable risk/reward (small stop-loss area, large target zone).

- The oscillator below (maybe Wave Oscillator or Awesome Oscillator?) shows **momentum shifting**, which supports the bullish idea.

**Summary:**

✔ Breakout of a downtrend

✔ Retest and bounce

✔ Positive momentum building

Summary:

We have a clean bullish breakout from a short-term downtrend, followed by a textbook retest and bounce. Momentum indicators are shifting positively, suggesting a potential strong upside move.

Setup Details:

Entry: Current price (~25.60) after breakout and retest.

Stop-loss: Just below the retest low (~24.80).

Target: Major resistance zone around (~29.50 - 30.00).

Risk/Reward: Approximately 1:4 — excellent potential!

Technical Factors:

✅ Breakout of downtrend line

✅ Successful retest with bullish reaction

✅ Increasing positive momentum (oscillator turning green)

✅ Strong horizontal support below

Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is the best way to keep it relevant, support us, keep the content here free, and allow the idea to reach as many people as possible.

⚠️ Disclaimer: This is NOT financial advice. Always do your own research and manage risk appropriately!

LCSW trade ideas

long-term investor (EGX:LCSW) (EGX:LCSW) Lecico Egypt (S.A.E.) produces and sells sanitary ware products and various tiles in Egypt and Lebanon. The company’s products include bathroom suites, toilets, washbasins, and bidets and urinals; and squatting pan, shower trays, kitchen sink, and taps, as well as other complementary products.The company exports its products. It sells its products under the Lecico brand.Lecico Egypt (S.A.E.) was incorporated in 1975 and is based in Alexandria, Egypt

Mid-Term Target Price (Fair Value Avg): ~85 EGP, implying ~237% potential upside from current levels.

• Technically Weak in Short-Term: Below EMA 200 and entering the Wave C correction suggests consolidation or dip toward the 21–25 EGP range before an upside move.

Technical Overview

• Current Price (April 3, 2025): 25.2 EGP/share

• 52-Week Range: 15.00 – 34.84 EGP/share

• Book Value per Share is 46.68 EGP

• Below EMA 200: Bearish sign; technically under long-term resistance

• Rate of Change (ROC): 24.6 EGP/share

• Gann Analysis TP: ~34.5 EGP in May 2025 (based on (15.02)2+2(15.02)^2 + 2(15.02)2+2)

• Elliott Wave Analysis: In Wave C (correction), target zone: 21–25 EGP/share (current price near upper bound)

Financial Highlights – FY 2024

• Revenue: EGP 6.64 billion (↑ 37% YoY)

• Net Profit: EGP 890.3 million (↑ 99% YoY)

• EPS: 11.13 EGP

• Sanitary Ware: 64.8% of revenue, 77.9% export-driven

• EBIT: EGP 1,151 million (↑ 22%)

• Margins:

o Gross: 28.22%

o Operating (EBIT): 17.32%

o Profit: 13.40%

o EBITDA: 19.47%

Interpretation & Conclusion

• Fundamentally Undervalued: With a P/E of 2.26× and P/B of 0.54×,

Lecico appears significantly undervalued given its strong profitability and book value.

Investment Strategy

If you’re a long-term investor:

• Accumulate in the 21–25 EGP correction zone.

• Monitor EMA 200 breakout and ROC reversal for momentum entry.

Mid-Term Upside Targets

• TP1: 34.5 EGP (Gann target)

• TP2: 58.8 EGP (DCF Value )

• TP3: 65.6 EGP (CHF estimate) refer to Cairo Financial Holding company

• TP4: 85.0–105.6 EGP (Sector-based fair value) refer to Ostoul Securities Brokerage Bond Trading Company

Lecico Egypt has a potential to re-hit Resistance line at 29.2Daily chart

The stock is trading in a broadening pattern (mainly between lines R and S); and the next level is 25.6

Above this resistance , the next targets will be 27.3, 28.0 and 29.2

The technical indicators RSI and MACD are supporting this view.

Consider the stop loss below 22.6 - And raise the protection level as the price goes up.

**Technical Analysis of LCSW****Technical Analysis of LCSW**

LCSW has recently been observed consolidating after closing 10 successive Heikin Ashi red candlesticks. A significant shift in market behavior was noted at a critical level of 17.42 EGP, which represented a major change in character. This was followed by a Market Structure Break at 18.9 EGP, moving upwards to a bullish Market Structure Break at 21.24 EGP.

Upon application of the Fibonacci retracement tool, LCSW demonstrated respect for the 100% retracement level, showing a rebound while yet remaining below the critical threshold delineated by the red Kumo cloud. Concurrently, the Senkou Span B has exhibited a flat trajectory, whereas the Senkou Span A is in a downward slope, paralleled by a similarly declining Tenkan Sen. There is also an observable pattern wherein the Kijun Sen mirrors the trajectory of the Senkou Span B.

Furthermore, from a lower timeframe perspective, LCSW’s price action is expressing bullish tendencies. However, the candlestick formations over the last three days — specifically the appearance of red Doji and spinning top candlesticks — suggest a prevailing sense of market indecision.

In summary, while the short-term bullish signals provide a positive outlook for LCSW, the recent indecisive candlestick patterns and the underperformance relative to key Ichimoku components recommend caution. Traders should continue to monitor these technical indicators closely for signs of definitive market direction.

Given the current technical outlook for LCSW, I would recommend the following actions for traders and investors:

1. **Monitor Key Levels**: Pay close attention to how LCSW interacts with the significant price levels identified—17.42 EGP, 18.9 EGP, and 21.24 EGP. These levels are critical in determining whether the stock maintains its bullish momentum or reverts to bearish trends.

2. **Watch for Breakouts**: A sustained breakout above the 21.24 EGP level could indicate a continuation of the bullish trend. On the other hand, a drop below 17.42 EGP might signal a bearish reversal. Prepare to adjust positions based on these developments.

3. **Consider the Ichimoku Cloud**: Since LCSW is currently trading below the red Kumo (cloud), this suggests a bearish sentiment in the market. A move above this cloud could shift the outlook to bullish. Keep an eye on Senkou Span A and B for changes in their slopes as these can provide early signals for potential trend reversals.

4. **Heed the Doji and Spinning Top Candlesticks**: The recent appearance of red Doji and spinning top formations implies market indecision. It's prudent to watch for subsequent candlestick patterns which may confirm or negate this sentiment.

5. **Adjust Risk Management Strategies**: Given the mixed signals from bullish price movements and bearish Ichimoku and candlestick indicators, consider employing tighter stop-loss orders to manage risks effectively.

6. **Stay Informed**: Continuously update your market knowledge and technical analysis as new data comes in. This will aid in making informed decisions and adjusting strategies timely.

Since the market is showing signs of indecision, maintaining a cautious approach with readiness to act on confirmed signals is advisable.

Disclaimer:

The content provided is for Educational purposes only. It should not be interpreted as legal, tax, investment, financial, or any other form of advice. Investing in stocks carries inherent risks and may lead to potential losses, including the loss of principal. It's important for investors to recognize that past performance does not guarantee future returns, and market fluctuations can impact investment value. Stocks discussed here are not synonymous with, nor should they be seen as a replacement for time deposits or similar saving instruments. Investing in securities of smaller companies may involve higher risks compared to larger, more established firms, possibly resulting in substantial capital losses. Decisions to buy, sell, hold or trade in securities, commodities and other investments involve risk and are best made based on the advice of qualified financial professionals. The practice of "Day Trading" involves particularly high risks and can cause you to lose substantial sums of money. Before undertaking any trading program, you should consult a qualified financial professional. Please consider carefully whether such trading is suitable for you in light of your financial condition and ability to bear financial risks. Under no circumstances shall I be liable for any loss or damage you or anyone else incurs as a result of any trading or investment activity that you or anyone else engages in based on any information or material you receive through TradingView