Key Events That Could Shape the Dollar This Week🇺🇸 Key Events That Could Shape the Dollar This Week

Three major catalysts are on the radar for USD traders:

📊 ADP Employment Report

💰 Advance GDP (Q2)

🧠 Fed Chair Powell’s Speech

Additionally, ongoing trade developments with the EU may add to volatility.

📊 1. ADP Employment Report

The July ADP report is forecast to show 82K job additions. While this may seem consistent with recent NFP strength, several red flags suggest growing labor market weakness:

Decline in labor force participation

Slowing wage growth

Emerging contraction signals in the services sector

Even if ADP meets expectations, it may not reflect broad-based labor market health. Historically, ADP and NFP have often diverged—so the market reaction may be muted unless the data surprises meaningfully.

💰 2. Advance GDP (Q2)

Q2 GDP is expected to show modest growth, possibly supported by:

Higher tariff revenues boosting government income

A weaker dollar improving export competitiveness

Reduced imports due to elevated import costs

However, much of this growth is likely nominal rather than real. With inflation remaining sticky, headline GDP may be inflated by price effects rather than true economic expansion. Real GDP could remain flat or weak.

🧠 3. Fed Chair Powell’s Speech

This is arguably the most market-sensitive event of the week.

Goldman Sachs and other major banks believe the recent resilience in U.S. data lowers the chances of a rate cut at this meeting. However, political dynamics could add nuance:

With Donald Trump actively campaigning—and reportedly pressuring the Fed to ease rates to boost exports and growth—Powell may face a fine balancing act in his tone.

Markets will dissect every word for clues on future policy.

🌐 U.S.-EU Trade Developments

The U.S. recently announced a new trade agreement with the EU, including a 15% tariff on selected European imports.

In the short term, this could be dollar-supportive, as it:

Favors domestic producers

Reduces reliance on imports

Potentially improves the trade balance

Yet over the longer term, such tariffs can be inflationary and disrupt global supply chains—possibly complicating the Fed’s decision-making.

⚠️ Final Thought

In times of policy uncertainty, markets lose their predictability.

Tariffs, in particular, often have a stronger and more immediate impact than calendar-based economic data.

As a result, traders must monitor trade-related news and tariff decisions just as closely—if not more—than traditional economic releases in order to stay ahead of market direction and central bank decisions.

USDX trade ideas

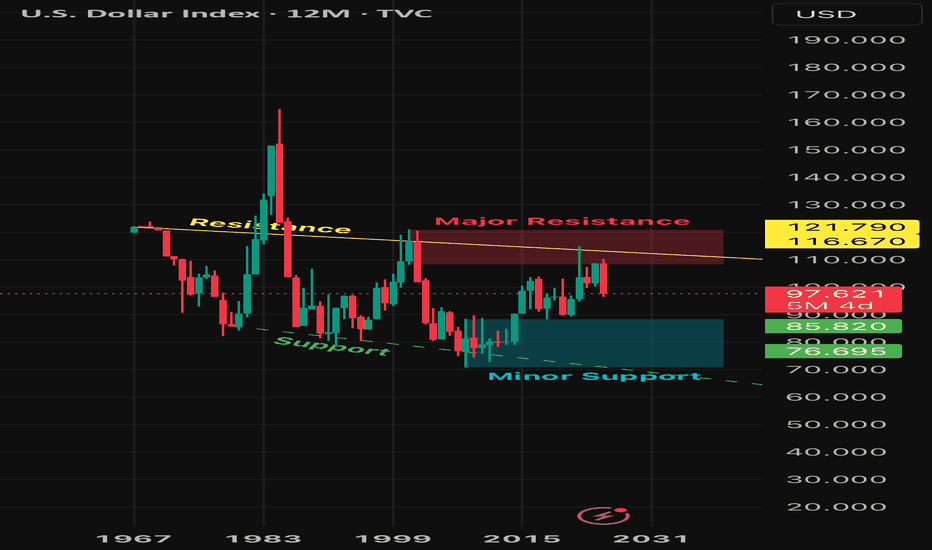

DXY: The Graceful Short This is interesting…Ever since the birth of Bitcoin, the DXY was in an overall uptrend, but that uptrend may have ended in the resistance zone. Price seems to have reversed for the DXY especially after the formation of a bearish engulfing candle on the 6M timeframe. Price may end the year within or on top of the support zone.

What does this mean for crypto and other assets?

If the DXY has reversed and is now in a long term down trend, crypto currencies and other assets will be in long term uptrends! Bitcoin may skip its upcoming bearish year next year or more than likely the bearish year will happen but the retracement may be short. Stay tuned!

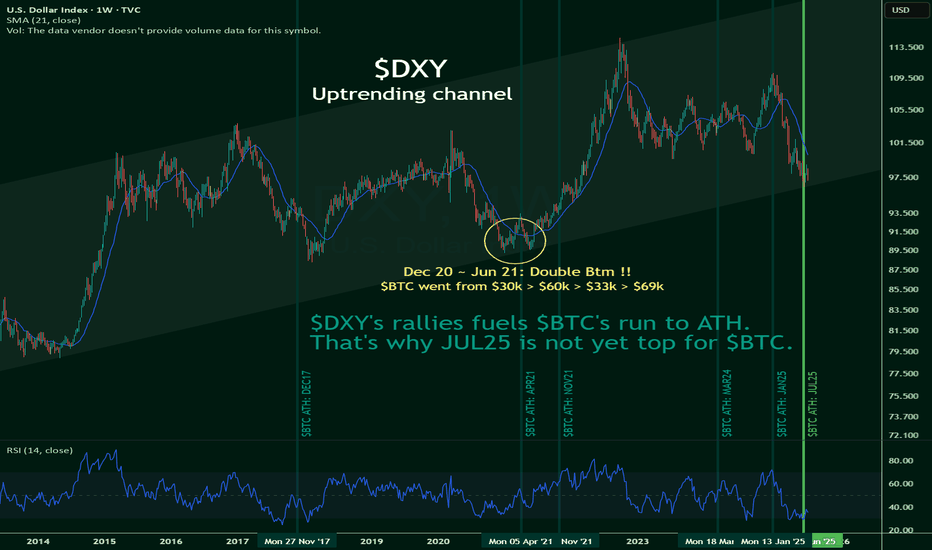

$BTC's run to ATH is fueled by $DXYNOT FINANCIAL ADVICE

I've yet to see this being mentioned anywhere on the internet, but TVC:DXY 's rally may just be CRYPTOCAP:BTC 's best friend.

This, despite the popular notion that when TSX:DXT goes up, CRYPTOCAP:BTC goes down, and vice-versa.

However, this novel idea puts a break to it.

TVC:DXY is hitting the bottoms of its uptrending channel, and it's likely to bounce back up towards the ceilings.

Which means a rally is likely, and this is kinda good for $BTC.

I'll remain bullish, until the numbers say otherwise.

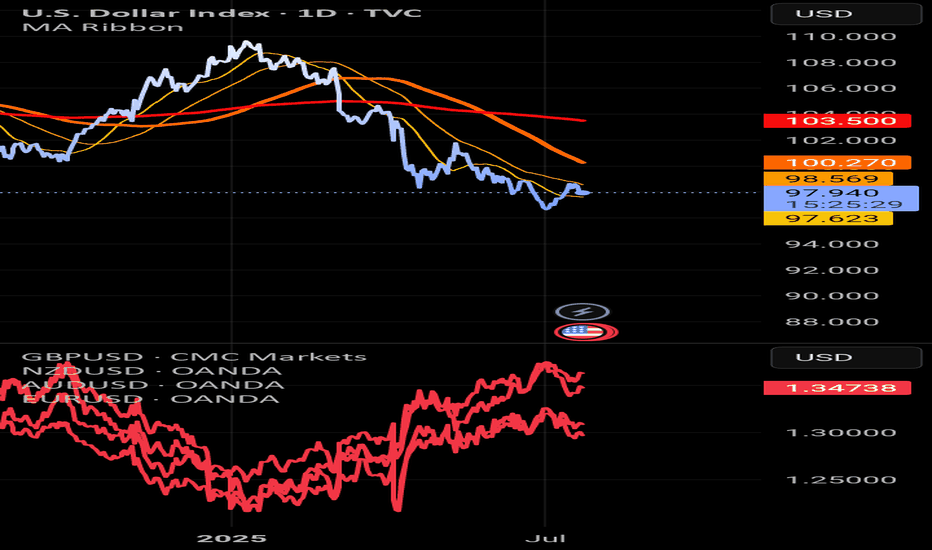

USD Weakness Ahead (3-Month Outlook)EUR/USD: Breaking 1.0850, next target 1.1000

GBP/USD: Cleared 1.2750, heading toward 1.2950

AUD/USD: Rebounded from 0.6650, potential 0.6850

NZD/USD: Above 0.6150, could reach 0.6300

Key Drivers:

1. Fed likely cutting rates before ECB/BoE/RBNZ

2. Commodity recovery (helps AUD/NZD)

3. Political risks weighing on USD

Market Mood:

- Traders reducing long USD positions

- AUD/NZD shorts getting squeezed

Risks:

US inflation surprises upside

Geopolitical shocks boost USD safe-haven demand

Sasha Charkhchian

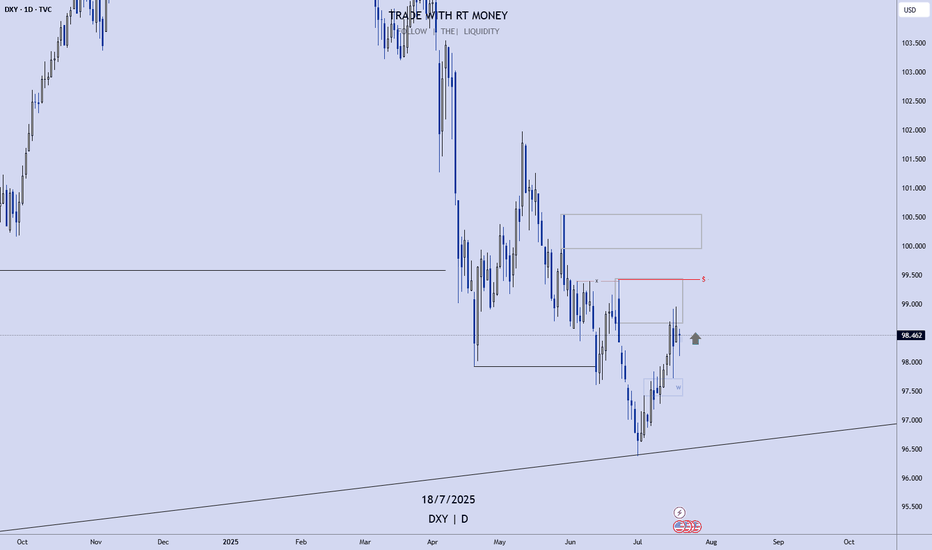

Dollar Index Holds Below 98 as Markets Await Trade Deal ProgressThe dollar index remained below 98 today, extending its two-day decline as investors watched trade negotiations ahead of the August 1 deadline. Treasury Secretary Scott Bessent said deal quality is the priority, suggesting Trump could grant extensions to countries showing real progress.

Markets are also focused on Fed Chair Powell’s speech for signals on interest rates. Despite Trump’s push for a cut, traders are not expecting action this month.

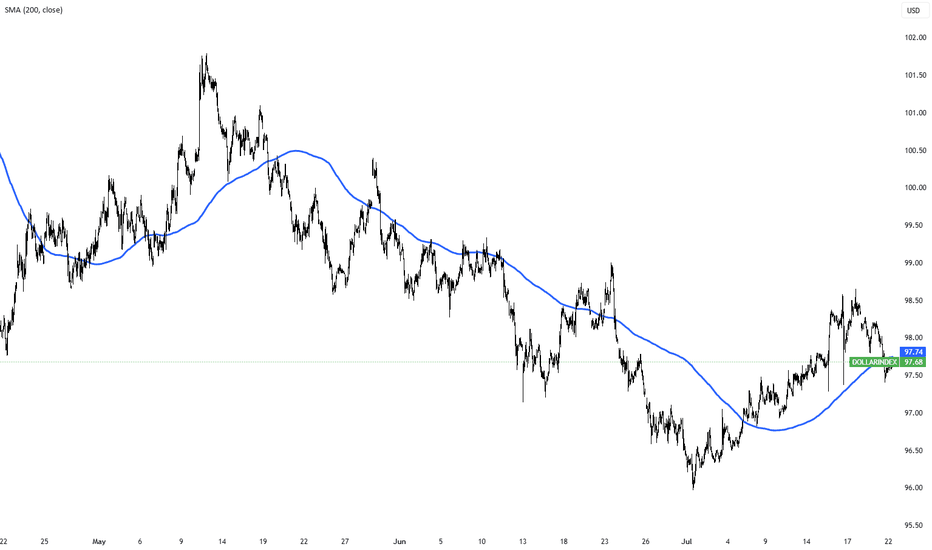

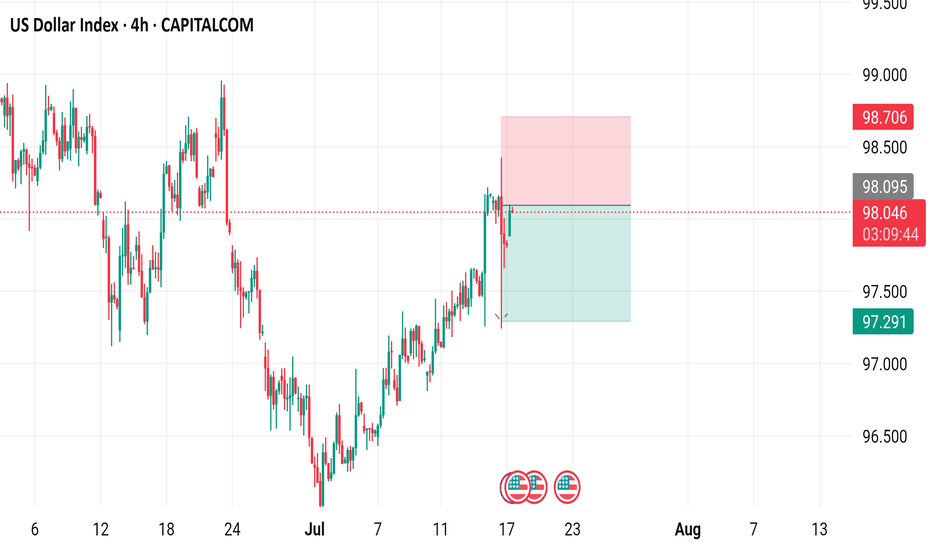

US Dollar Index (DXY) - 4 Hour Chart4-hour performance of the US Dollar Index (DXY) from CAPITALCOM, showing a current value of 98.040 with a 0.23% increase (+0.222). The chart includes recent buy and sell signals at 98.094 and 98.040, respectively, with a highlighted resistance zone around 98.706-99.000 and a support zone around 97.291-98.040. The timeframe covers data from early July to mid-August 2025.

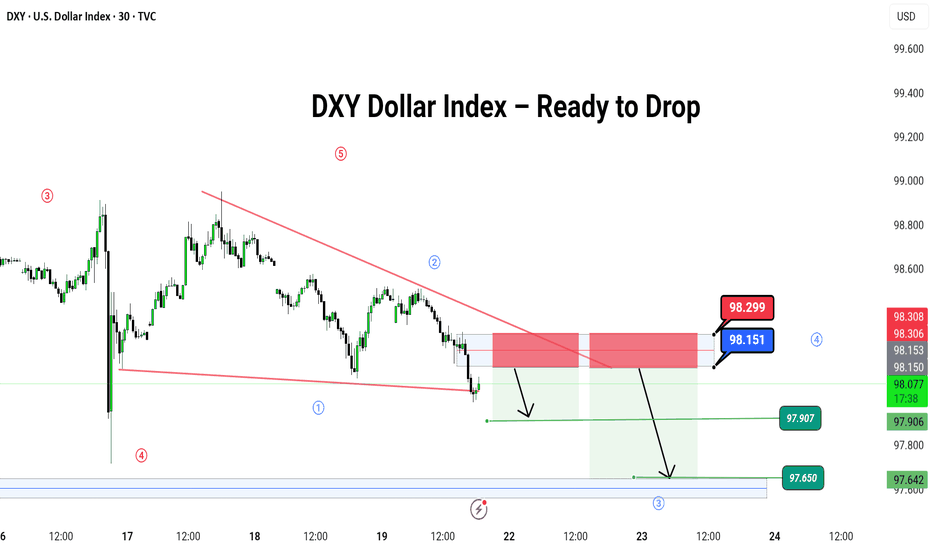

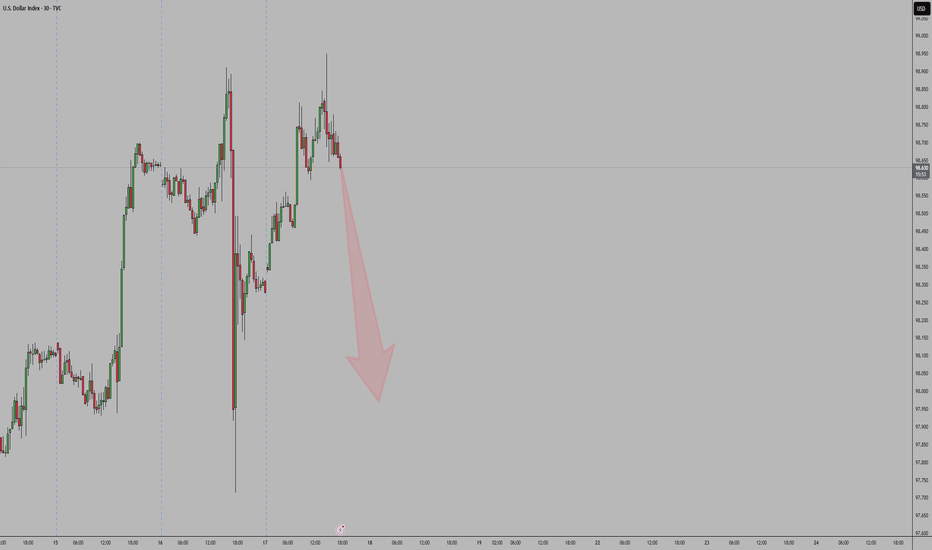

DXY Dollar Index – Ready to Drop

🌪️ DXY Dollar Index – Ready to Drop Like a Hot Potato? 💸

Hey traders! 🎯

The DXY (U.S. Dollar Index) is dancing inside a falling wedge 🔻, and it just hit the top of the party zone (red box 🎁).

📍 We're watching for a bounce up to this red zone near 98.151–98.299, then expecting a big slide down like a rollercoaster 🎢 toward:

🎯 Target 1: 97.907

🎯 Target 2: 97.650

🛑 Stop if it jumps over: 98.299

🌀 Pattern: Ending Diagonal / Wave 5 Setup

🧠 Logic: Smart money might be setting up the final wave before a major fall. Let it pop, then drop!

💡 It’s like the last spark before the fireworks go out 🎆

---

#DXY #USDIndex #ForexTrading #Wave5 #PriceAction #ChartPattern #SimpleTrading #DollarDrop

---

Let me know if you have ant suggestion ,

DXYThe current COT data shows a bullish bias for the U.S. Dollar, with institutional traders positioning net long. Although DXY is moving sideways, this positioning suggests a likely continuation of USD strength. If price breaks above key resistance levels, it would confirm the bullish sentiment reflected in the COT report.

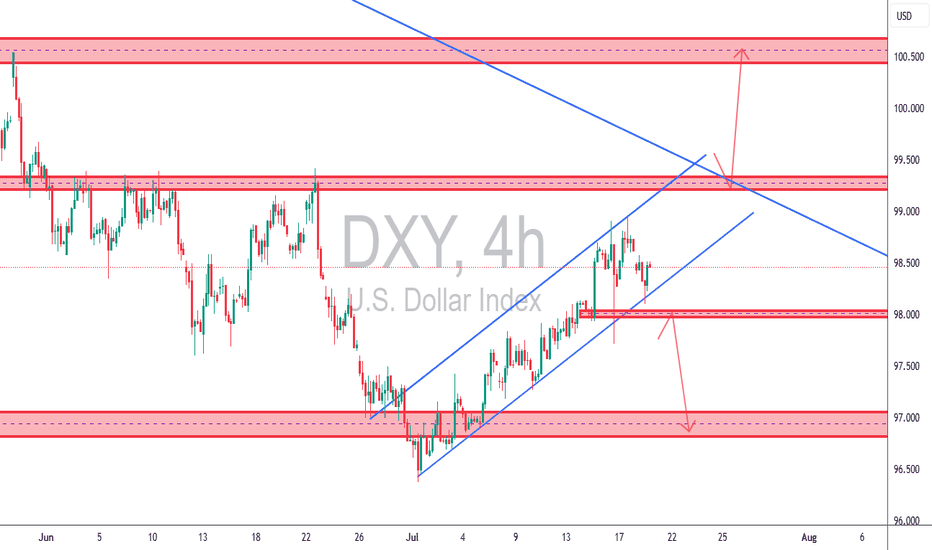

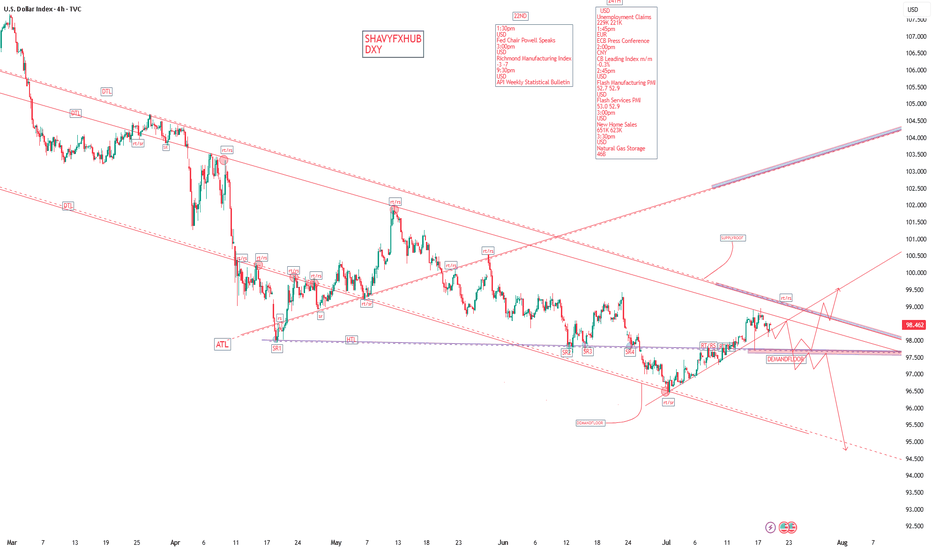

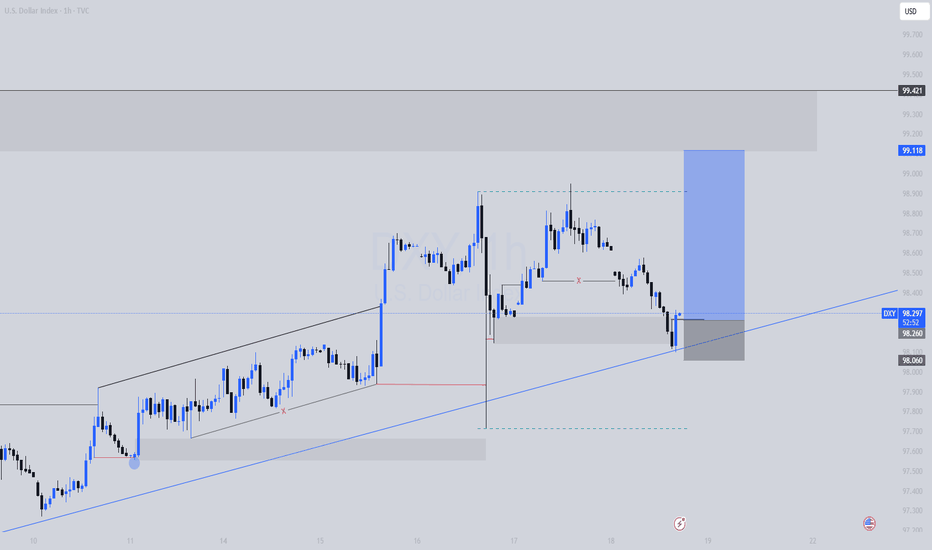

TCB Strategy Application on DXY 4H✅ TCB Strategy Application on DXY 4H

🔹 Trend → Countertrend → Breakout Structure:

• Trend: We’ve had a bullish recovery from the 97.00 zone (bottom demand), moving within an ascending channel.

• Countertrend Zone: Price has now pulled back from the 99.00–99.200 supply area.

• Breakout Watch:

o A break below the ascending channel (support line) + 98.00 zone would signal countertrend breakout → opens potential for 97.000 retest.

o A break above 99.200 would be a bullish breakout targeting the 100.500–101.000 macro supply zone.

________________________________________

🔄 What This Means for Dollar Pairs (Especially XAUUSD):

🟥 Scenario 1: Bearish DXY Breakout (98.00 loss)

• Expect XAUUSD bullish continuation, possibly reclaiming upside zones (especially if DXY targets 97.00).

• GBPUSD, EURUSD, etc., likely to gain against USD.

🟩 Scenario 2: Bullish DXY Breakout (Above 99.200)

• XAUUSD may reject from resistance or fall back toward support zones.

• USD strength will put pressure on GBPUSD, EURUSD, and other majors.

________________________________________

🧠 TCB Notes:

• Checklist Score (Pre-Breakout): ~75%

o ✔ Structure zones marked

o ✔ Channel support tested

o ✔ Reaction to supply zone

o ✖ Awaiting breakout candle + NY session confirmation

________________________________________

🔔 Suggested Alerts (Set in TradingView):

• DXY Breakout Alert: 98.00 (bearish trigger)

• DXY Bullish Trigger Alert: 99.20 or trendline breakout

• Match these alerts with corresponding TCB setups on XAUUSD, GBPUSD, etc.

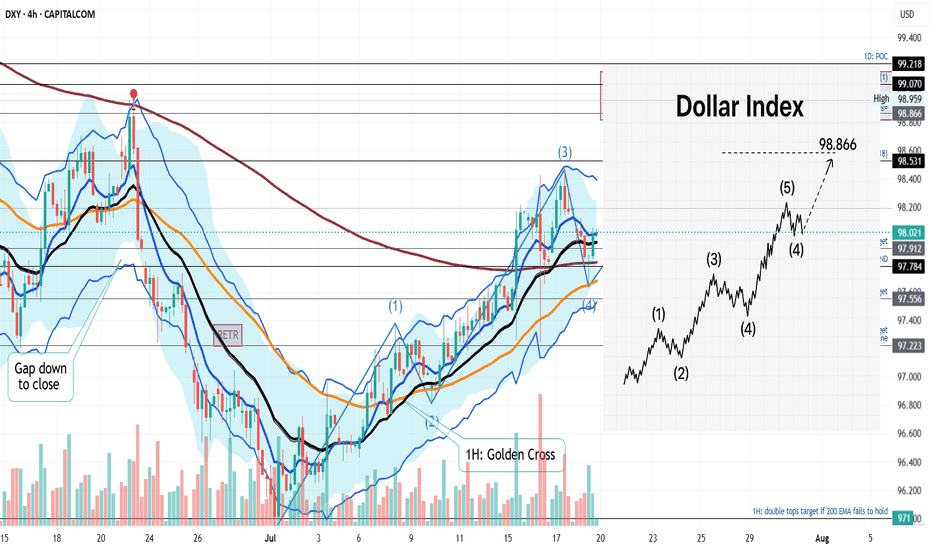

DOLLAR INDEX TO COMPLETE WAVE 5 TARGET at 98.866In this short video I dive into the technical breakdown of the U.S. Dollar Index (DXY) as it approaches the anticipated Wave 5 surge, aiming for the key resistance level of 98.866. Using Elliott Wave Theory, this analysis maps out the market’s current structure on the 4 hours timeframe, highlights critical pivot zones, and projects the bullish momentum that could reshape short-term outlooks. Whether you're a seasoned trader or a curious observer, this chart-driven insight offers clarity in the wave progression and what might come next.

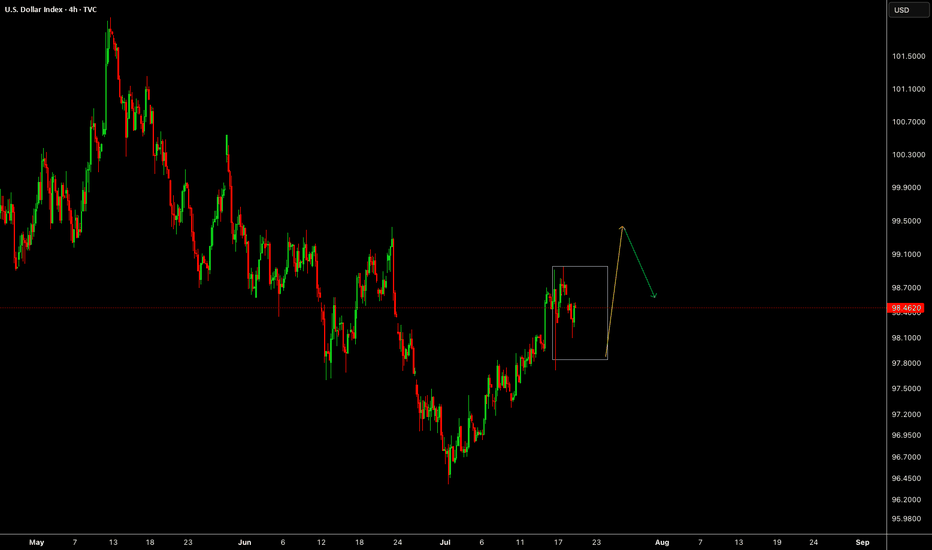

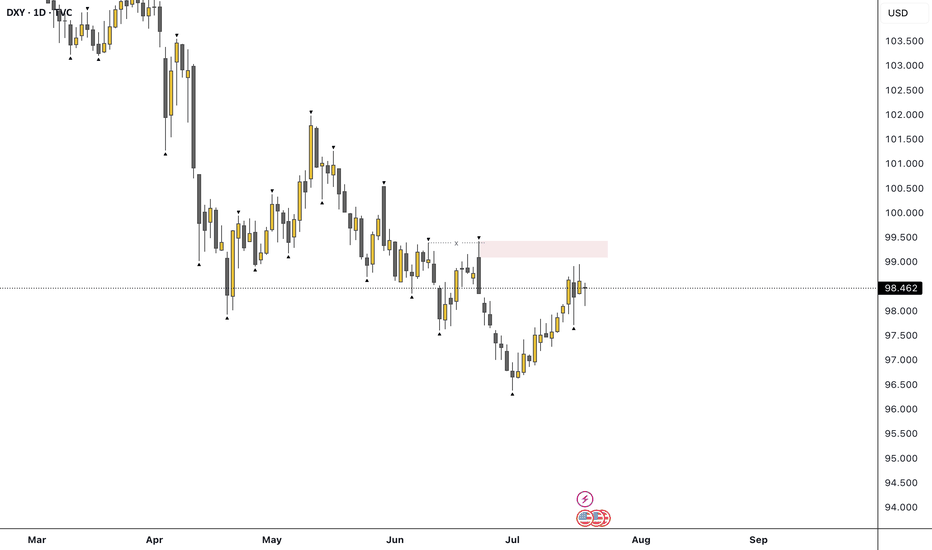

USD Is Still Bullish! Wait For Buys!Welcome back to the Weekly Forex Forecast for the week of July 21-25th.

In this video, we will analyze the following FX market:

USD

The DXY has run bullish last week, up into an area of Supply, where the momentum hesitates now. Next week may pull back a bit... before continuing higher to the buy side liquidity.

Look out for the short term pullback to the W +FVG for a high probability move higher!

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

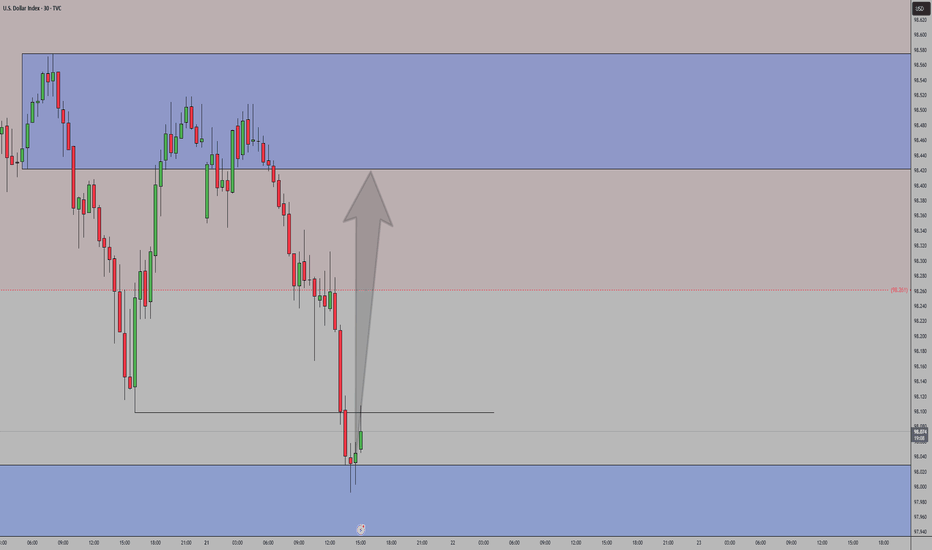

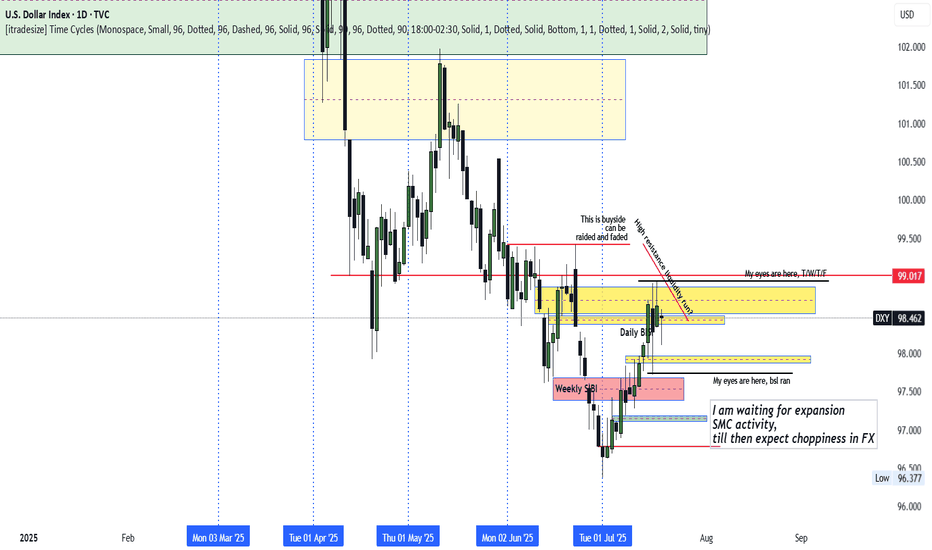

DXY Indecisive

DXY remains locked in its previous week's range, especially locked in Wednesday's range.

The Thursday rally above Wednesday's high appears to be a fake breakout aimed at trapping traders long.

With stops seemingly below Wednesday (Previous Week Low), how we trade past the previous week high or/and low should inform the unfolding direction.

With a run to the previous week's low and high possible, caution is recommended. Await expansion avoid the surge of new's release in the coming week and the choppiness that could unfold.

DXYDXY refers to the U.S dollar index ,an index that measures the value of united state dollar relative to a basket of six major foreign currencies ,it was originally developed by FED'S

THE SIX MEJOR CURRENCIES ARE ;

.euro,japaneses yen, pounds sterling, Canadian dollar, Swedish krona,swiss franc.

the index is used by investors ,traders and economist to gauge the overall strength of the U.S dollar in a global currency markets. Its rise and fall will influence trade ,investment and monetary policy decision in fx window.

on 4hr we are rejected and i will watch market open and close on Monday for trade directional bias for the following pairs (AUDUSD,USDCAD,USDZAR,GBPUSD,EURUSD,USDJPY,XAUUSD XAGUSD,XCUUSD,BITCOIN )

NOTE;TRADING IS 100% PROBABILITY,RISK MANAGEMENT IS KEY AND GET ACCOUNTABLITY PARTENER WHO WILL BE CHECKING YOUR WORK..

#DXY #DOLLAR

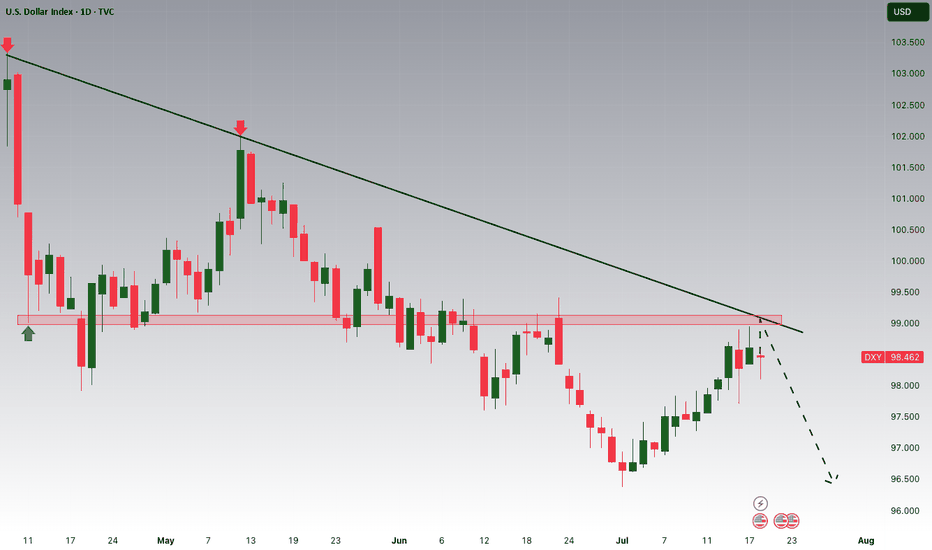

DXY area to watch.Approaching the extreme of the recent bearish leg. If it holds, then expect most major pairs (EURUSD, GBPUSD etc) to continue their upside momentum. If it fails, then we can expect to see further downside moves on the majors.

As per my strategy. That extreme POI swept a previous high, created the BOS, and sits beautifully on the 71% retracement level. The majority of my confluences are ticked, just missing that clear 'Imbalance'. So now we wait, and monitor the reaction on the 4H. If we see a nice clean liquidity sweep, BOS + Imbalance then I'm in for sells.

Let me know your thoughts, anything can happen!

DXY – Short-Term OutlookThis week, we’ll be analyzing several currency pairs that are showing promising trading setups.

Unlike previous weeks, we plan to focus on lower timeframes and shorter market cycles to take advantage of more agile trading opportunities.

If the price manages to give us a clear confirmation within the marked zone, we can start considering a potential shift to a bullish trend on DXY.

This would set the stage for preparing long positions, as market structure would likely begin aligning in favor of the bulls.

Until that confirmation arrives, we stay cautious and wait for price action to validate the move.

DXY LONG SETUP | Skyrocketinggggg

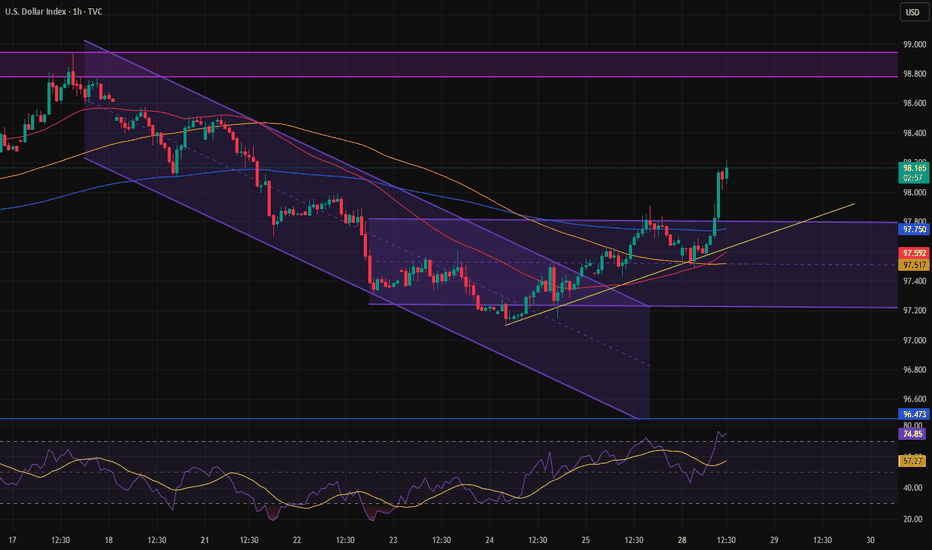

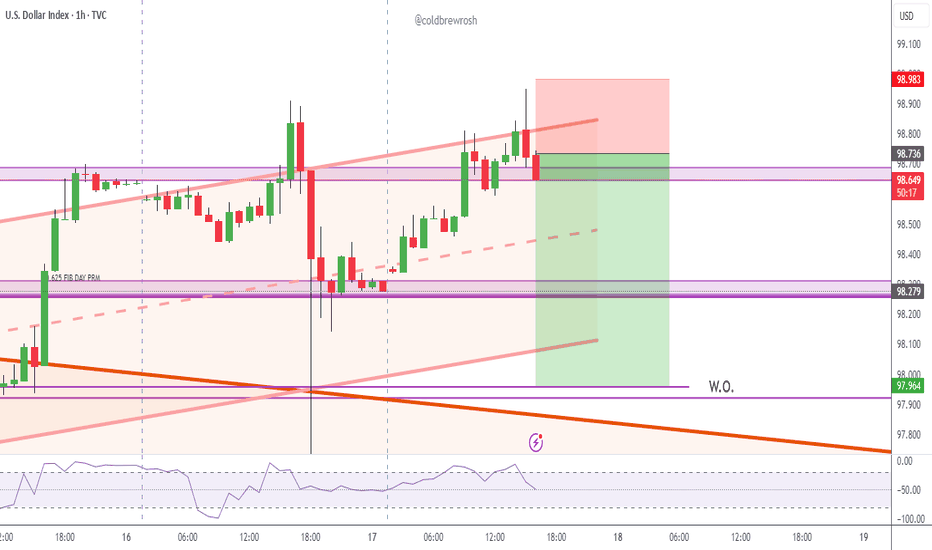

This is a bullish setup on the U.S. Dollar Index (DXY), taken from the 1H timeframe using Smart Money Concepts.

Price retraced into a clearly defined 1H demand zone where it also tapped a trendline support, creating a strong confluence +an LQC. The zone had internal liquidity swept and price mitigated a bullish order block, indicating potential institutional re-accumulation.

Entry was taken after bullish confirmation within the zone (engulfing candle), aligned with my SMC strategy which targets liquidity grabs and mitigation zones.

🔹 Entry: 98.06

🔹 SL: 97.83 (below the zone and structure)

🔹 TP: 99.11 (previous H1 high & clean supply zone)

🔹 RR: Approx. 4.5R

🔍 Technical Confluences:

Demand zone + OB mitigation + LQC

Trendline reaction (support respected)

Liquidity sweep + BOS (Break of Structure)

Clean imbalance above = fuel for price

Bullish engulfing as confirmation

📰 Fundamental Bias:

Today’s U.S. Jobless Claims came in better than expected, signaling labor market strength. Additionally, Retail Sales data was positive, reinforcing USD strength. These support a hawkish Fed narrative, aligning with our bullish technical setup.

Bias remains bullish unless price closes below 97.83 (invalidation level).

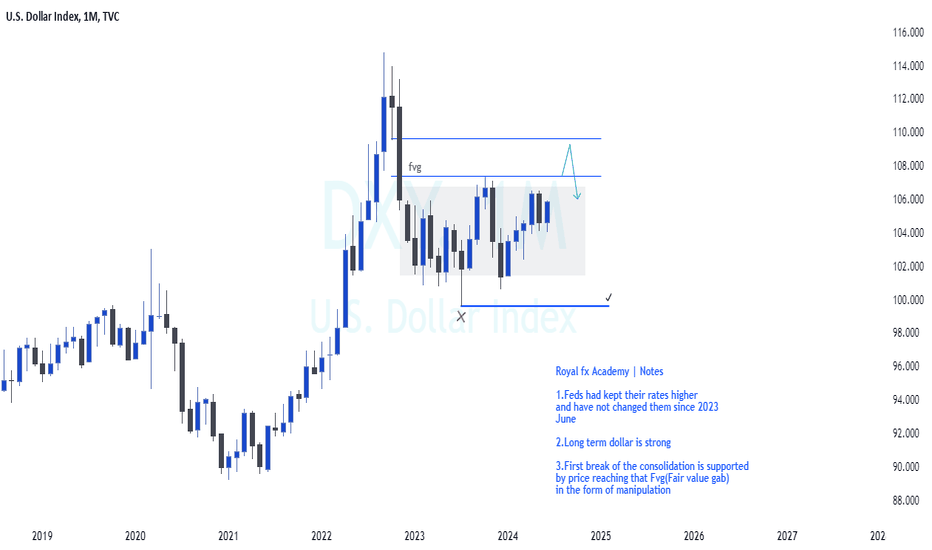

Dollar Index Macro analysisCurrently the Fed's Dollar is kept at 5.50% which is higher than any other currency except for the Kiwi , As we all know interest have high impact on currency prices. We are currently in a consolidation market profile. Therefore my interest is where the next expansion will be at, Clearly defined on my analysis it should be on the upside.