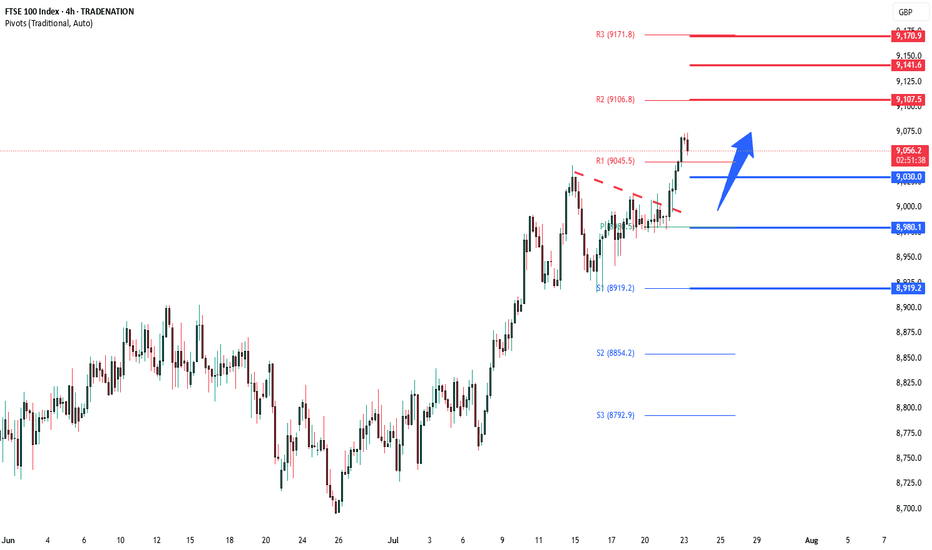

FTSE100 breakout zone now new support at 9030The FTSE remains in a bullish trend, with recent price action showing signs of a continuation breakout within the broader uptrend.

Support Zone: 9030 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 9030 would confirm ongoing upside momentum, with potential targets at:

9107 – initial resistance

9140 – psychological and structural level

9170 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 9030 would weaken the bullish outlook and suggest deeper downside risk toward:

8980 – minor support

8920 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the FTSE holds above 9030. A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

UK100 trade ideas

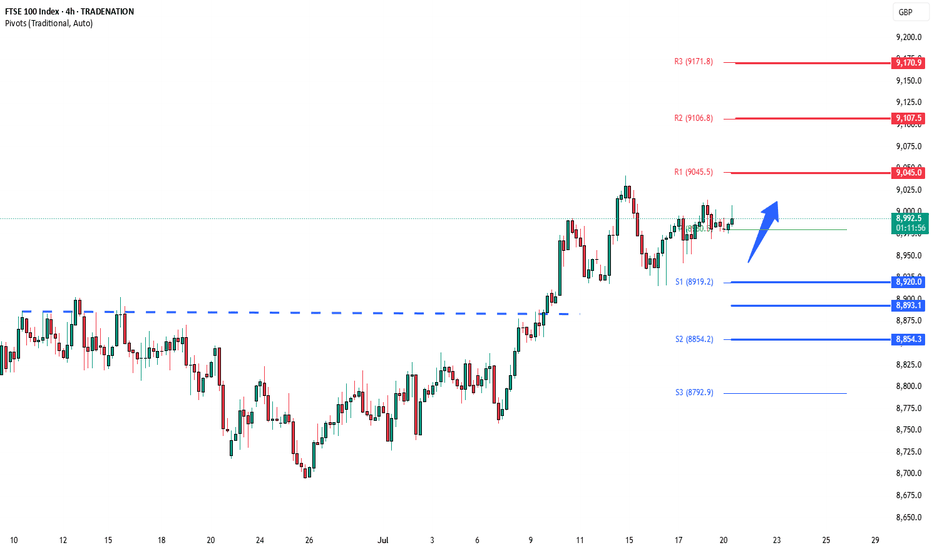

FTSE bullish consolidation resistance at 9045The FTSE remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend.

Support Zone: 8020 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 8920 would confirm ongoing upside momentum, with potential targets at:

9045 – initial resistance

9107 – psychological and structural level

9170 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 8920 would weaken the bullish outlook and suggest deeper downside risk toward:

8893 – minor support

8854 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the FTSE holds above 8920. A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

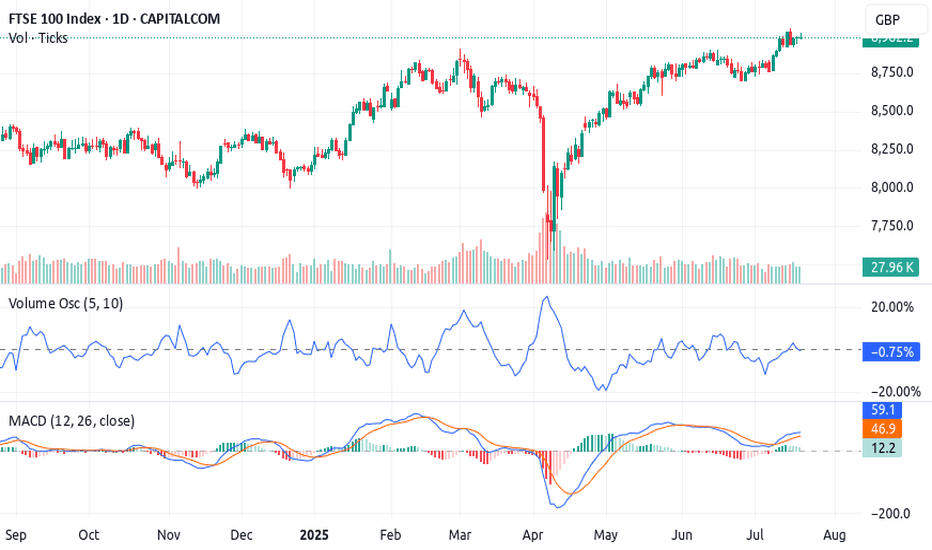

The 3-Step Rocket Booster Strategy – UK100 Bullish Breakout 🚀 The 3-Step Rocket Booster Strategy – UK100 Bullish Breakout Brewing

The UK100 Index is currently aligning perfectly with a high-probability setup I call the 3-Step Rocket Booster Strategy

— a momentum-based play designed to catch strong breakouts before the crowd reacts.

---

🔍 Strategy Breakdown:

✅ Step 1: Price above the 50 EMA

This signals short-term bullish momentum. The UK100 has cleared the 50 EMA decisively, with candles holding strong above it — suggesting buyers are stepping in aggressively.

✅ Step 2: Price above the 200 EMA

Now we’ve got long-term trend confirmation. The index is trending above the 200 EMA, meaning bulls have full control of the higher timeframe direction.

⚠️ Step 3: The Gap-Up with Volume Confirmation

Here’s the key — the "booster". We’re watching for a gap-up move , validated by a Volume Oscillator breakout . While

price has already lifted, the volume hasn’t exploded just yet — this is the final ignition phase before liftoff.

---

📈 Technical Indicators:

MACD: Bullish crossover active — momentum building

Volume Oscillator: Starting to curve upward, hinting at upcoming volume expansion

EMAs: 50 EMA > 200 EMA = confirmed bullish structure

Support Zones : Holding cleanly above recent resistance-turned-support, adding confluence

---

🟢 Trade Insight:

We are now sitting in the perfect entry zone — price is in the pocket before volume confirms . Once volume breaks out, we could see a parabolic move , especially if global market sentiment remains stable.

🎯 Potential Targets :

First target: Recent high (psychological + structural level)

Second target: Measured move based on gap range extension

Risk: A close below the 50 EMA invalidates the setup

---

🔁 Summary:

This setup ticks all three boxes of the 3-Step Rocket Booster Strategy .

The smart money is positioning before the volume shows up. The UK100 is a strong bullish candidate with low-risk entry and high reward potential — don’t ignore this one .

---

📌 Disclaimer: Always use proper risk management. Trade the setup, not the emotion.Use a simulation trading account before you trade with real money

Let me know if you’re tracking this setup too 👇

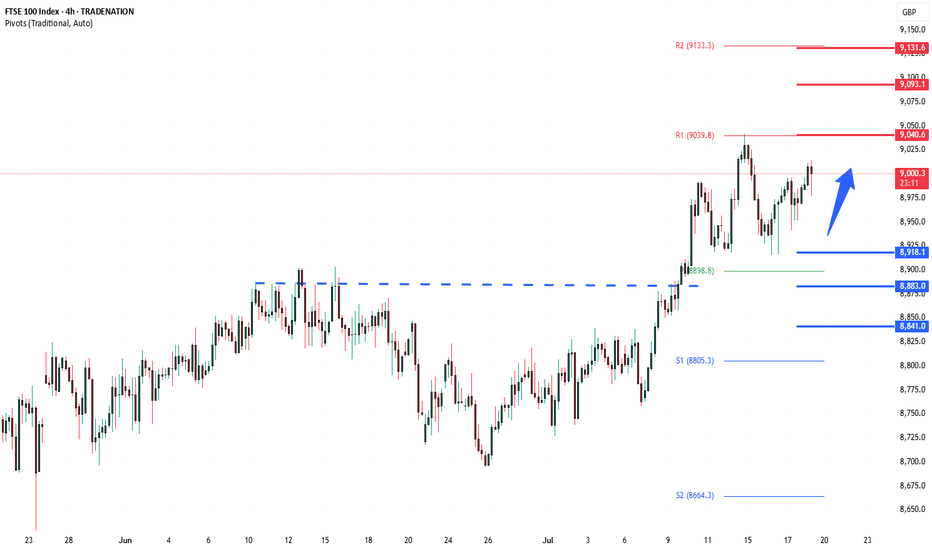

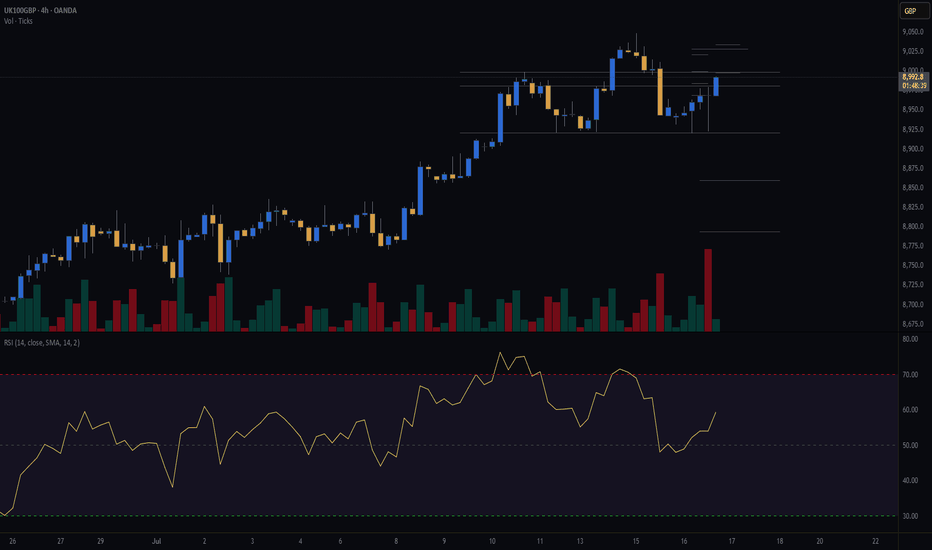

FTSE100 sedeways consolidation supported at 8920The FTSE100 pair price action sentiment appears Bullish, supported by the current rising trend. The recent intraday price action appears to be a sideways consolidation breakout.

The key trading level is at 8920 level, the previous consolidation price range. A corrective pullback from the current levels and a bullish bounce back from the 8920 level could target the upside resistance at 9040 followed by the 9090 and 9130 levels over the longer timeframe.

Alternatively, a confirmed loss of the 8920 support and a daily close below that level would negate the bullish outlook, opening the way for a further retracement and a retest of 8880 support level, followed by 8840 levels.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

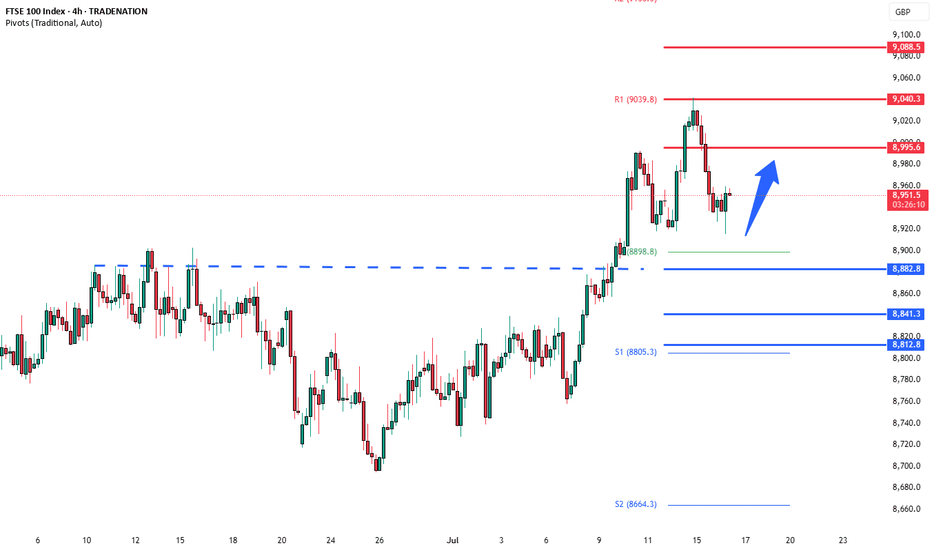

FTSE100 overbought pullback supported at 8880The FTSE remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend.

Support Zone: 8880 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 8880 would confirm ongoing upside momentum, with potential targets at:

8900 – initial resistance

9040 – psychological and structural level

9090 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 8880 would weaken the bullish outlook and suggest deeper downside risk toward:

8840 – minor support

8820 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the FTSE holds above 8880. A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

FTSE INTRADAY continuation pattern breakout. The FTSE remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend.

Support Zone: 8880 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 8880 would confirm ongoing upside momentum, with potential targets at:

8900 – initial resistance

9040 – psychological and structural level

9090 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 8880 would weaken the bullish outlook and suggest deeper downside risk toward:

8840 – minor support

8820 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the FTSE holds above 8880. A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

UK100 – Buy the Dip Near Support as Bottom FormsTrade Idea

Type: Buy Limit

Entry: 8,905

Target: 9,015

Stop Loss: 8,867

Duration: Intraday

Expires: 15/07/2025 06:00

Technical Overview

Price action is forming a potential bottom, suggesting that downside momentum is slowing.

The primary trend remains bullish, with no clear indication that the broader uptrend is ending.

The strategy favors buying on dips, supported by bespoke support at 8,905, offering a low-risk entry area.

If price moves above 9,015, it would confirm a rebound and support a move toward higher resistance levels in subsequent sessions.

No major events are expected in the next 24 hours, allowing technical dynamics to guide price action.

Key Technical Levels

Support: 8,915 / 8,620 / 8,390

Resistance: 9,290 / 9,485 / 9,770

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

FTSE100 overbought pullback supported at 8880The FTSE remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend.

Support Zone: 8880 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 8880 would confirm ongoing upside momentum, with potential targets at:

8900 – initial resistance

9040 – psychological and structural level

9090 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 8880 would weaken the bullish outlook and suggest deeper downside risk toward:

8840 – minor support

8820 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the FTSE holds above 8880. A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

FTSE 100 Wave Analysis – 10 July 2025

- FTSE 100 broke key resistance level 8900.00

- Likely to rise to resistance level 9100.00

FTSE 100 index recently broke above the key resistance level 8900.00 (which has been reversing the price from March, as can be seen below).

The breakout of the resistance level 8900.00 continues the active short-term impulse wave 3 of the intermediate impulse wave (3) from the end of June.

Given the clear daily uptrend, FTSE 100 index can be expected to rise to the next resistance level 9100.00 (target for the completion of the active impulse wave 3).

FTSE breaking out?Following a lengthy consolidation, the FTSE appears to be poking its head above the resistance trend of a triangle formation and resistance circa 8830-35 area today, potentially paving the way for a run to a new all-time high.

This comes as markets have taken the latest tariff threats from Trump in their stride. Equity indices were quick to recoup most of their losses, with US futures trading higher and the DAX hitting a new weekly high today, reaching its highest levels since early June. I

Investors presumably expect more deals to be done before the extended August 1 deadline. After all, Trump himself has said that he’s open to negotiations and that the August 1 deadline for implementation of new levies was “not 100% firm”.

By Fawad Razaqzada, market analyst with FOREX.com

FTSE100 resistance breakoutThe FTSE remains in a bullish trend, with recent price action showing signs of a resistance breakout within the broader uptrend.

Support Zone: 8785 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 8785 would confirm ongoing upside momentum, with potential targets at:

8900 – initial resistance

8930 – psychological and structural level

8960 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 8785 would weaken the bullish outlook and suggest deeper downside risk toward:

8760 – minor support

8730 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the FTSE holds above 8785. A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

5-Swing Elliott Wave Sequence in FTSE Supports Bullish BiasThe ongoing rally in the FTSE Index, originating from the April 7, 2025 low, continues to unfold as a five-wave impulse structure within the Elliott Wave framework. This signals sustained bullish momentum. From the April 7 low, wave 1 peaked at 7984.19. Wave 2 pullback followed which concluded at 7599.56. The index then surged in wave 3, reaching 8902.4. The subsequent wave 4 correction manifested as a double three Elliott Wave structure, as evidenced on the 1-hour chart. From the wave 3 peak, wave (w) declined to 8809.91. It was then followed by a wave (x) recovery to 8858.56. The decline in wave (y) reached 8741.4, completing wave ((w)) in a higher degree. The rally in wave ((x)) peaked at 8831.9 before the index resumed lower in wave ((y)). Within this decline, wave (a) ended at 8757.97. Wave (b) ended at 8792.43, and wave (c) concluded at 8706.91, finalizing wave ((y)) of 4.

The FTSE has since turned higher in wave 5, requiring a break above the wave 3 high of 8902.4 to negate the possibility of a double correction. The structure from the wave 4 low is developing as a five-swing sequence, reinforcing the bullish outlook. From wave 4, wave (i) reached 8818.44, wave (ii) corrected to 8726.92, wave (iii) advanced to 8828.16, and wave (iv) pulled back to 8738.99. The final wave (v) concluded at 8837.75, completing wave ((i)) in a higher degree. A wave ((ii)) pullback is anticipated, likely correcting the cycle from the June 26, 2025 low in a 3, 7, or 11-swing pattern before resuming higher, provided the pivot at 8706.91 remains intact. This structure underscores a robust bullish bias, with the index poised for further upside as long as key support levels hold.

FTSE 8840 resistance retestThe FTSE remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend.

Support Zone: 8740 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 8740 would confirm ongoing upside momentum, with potential targets at:

8840 – initial resistance

8870 – psychological and structural level

8900 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 8740 would weaken the bullish outlook and suggest deeper downside risk toward:

8695 – minor support

8640 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the FTSE holds above 8740. A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

UK showing strong upside once breaks above C&H to 9,772

A very large Cup and Handle has formed on UK100.

There are many reasons for the upside to come but here are a few ones I can think of.

📉 2. Undervalued vs. Other Indices

FTSE 100 has lagged behind the US and EU — now global investors are eyeing it as a catch-up play.

💷 3. Weak Pound Helps Export Giants

A softer GBP = stronger revenue for big FTSE names like Shell, BP, Unilever, etc., which dominate global markets.

🏦 4. Rate Cut Hopes Are Back

With UK inflation cooling, the Bank of England might ease up — which is fuel for stocks, especially banks and housing.

📈 5. Rotational Flows Into Value

Traders are rotating out of overbought tech and into solid dividend/value plays — and the FTSE is packed with them.

And this is looking great for upside.

We can expect upside to come ONCE the price breaks above the brim level.

Price>20 and 200MA.

9,772

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

FTSE100 H1 | Approaching a multi-swing-high resistanceThe FTSE100 (UK100) is rising towards a multi-swing-high resistance and could potentially reverse off this level to drop lower.

Sell entry is at 8,825.21 which is a multi-swing-high resistance.

Stop loss is at 8,855.00 which is a level that sits above the 127.2% Fibonacci extension and a swing-high resistance.

Take profit is at 8,791.98 which is a pullback support.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

FTSE oversold rally resistance at 8820The FTSE remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend.

Support Zone: 8740 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 8740 would confirm ongoing upside momentum, with potential targets at:

8840 – initial resistance

8870 – psychological and structural level

8900 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 8740 would weaken the bullish outlook and suggest deeper downside risk toward:

8695 – minor support

8640 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the FTSE holds above 8740. A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

UK100/FTSE100 - TIME TO SEND UK100 TO RECESSIONTeam, we are setting two strategies to the SHORT UK100/FTSE100

Ensure you understand your RISK - can always discuss with us in the room

Let's SHORT UK100/FTSE100, I still expect the market to be volatile even though the US expect a rate cut. on the 9th JULY, there will be a tariff announcement, and it could also extend towards September

We are SHORTING UK100 at 8789 toward 8816

Target at 8762-8745

I will DOUBLE the short at 8836-8862

Target at 8816-8805

Nearly UK time to shine to 9,721Now it looks like it's UK time to shine.

It is priming for a strong breakout above the Cup and Handle.

Once it breaks the brim, it could be all upside to 9,721.

Large Cup and Handle

Price near above 20 and 200

Target 9,721

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.