ETHEREUM CLASSIC: NEW DEVELOPMENTS - PROFIT = 26.64% !!!Our "Crypto Bottom" Trade Indicator has correctly identified a buy in point on the 25th of April 2018 .

Using this buy in point and selling at today's price, you would have expected to net 24.90% PROFIT!!!

The increase in price may also be explained by positive developments including:

April 26: Rency.com Ratings & Analytics Adds Ethereum Classic $ETC.

May 1: Ethereum Classic announces update to Mantis v1.1 Client.

May 2: Annoncement that ETC consistently handles more transactions per day than: $Doge, $DASH, $BCH, $LTC, and $XMR.

May 3: London Block Exchange Enables GBP Trading for Ethereum Classic ETC.

May 3: Ethereum Classic announces release of go-ethereum v5.2.0.

May 4: Emerald Vault v0.22 application is released. It allows for: Secure offline / cold storage ETC account management.

May 4: FastTech.com Accepts ETC as Payment.

May 6: Grayscale Investments Announces Approval of Public Quotation for Eligible Shares of Ethereum Classic Investment Trust.

May 6: Ethereum Classic announces support for Ethereum Classic Command Line application on Linux.

May 6: Ethereum Classic announces ETC sidechain exploration with their "Minimal Viable Sidechain" on Github.

The general uptrend in the crypto markets as well as the positive developments above have caused an increase in demand for the Vechain which has forced up prices.

ETCBTC trade ideas

ETC , updateAfter the BTC spike, most alts fell down, ETC did fall below an important support, thus a new charting is important. here it is.

BTC is still trading withing an ascending chanel, if we break below the buttom trend then a big fall will follow, as long as we stay above it, we heading north for the next run. your SL must be right under the trend line " candle close"

$ETC.X getting ready for lift offETC has tested resistance at .0024 sats a couple times now. It will break it soon enough and should have a nice run through May recovering some lost ground. Many other alts have already recovered but ETC is a late one. As long as BTC remains stable and with some bullish momentum, this should recover nicely. There's a hardfork coming up at the end of May to keep ETC profitable for miners. News from this could help pump the price.

Forgot about $ETC? Get ready for moon.I have a mid term target for $ETC @ 340k sat. Roughly 50% upside from here within the week.

My message to my signals channel:

TL;DR. I am holding $ETH in anticipation of the SEC meeting. Also holding an even amount of $ETC in satoshi value as a hedge.

A number of #TeamNeverWorkAgain members have reached out to me about what to do with their spare $BTC. The other day we made a call stating we were moving roughly half of our portfolios to $BTC and it played out quite nicely. Yes, alts are red, and they look like attractive buys, but we don’t feel this is the bottom yet. Protecting your satoshis in $BTC is a great move as $BTC has been charging up with no indicators saying that it will stop. Feeling like you need to be in all alt coins is FOMO. We are just beginning alt season in my opinion and this is a healthy pullback. In this market, the impatient give their money to the patient. I’m holding off on almost all alt purchased until they look fully bottomed.

That being said: I am holding a fair amount of $ETH. This is in anticipation of the SEC conference on Monday discussing whether or not $ETH will be deemed a security. Many of us have learned time and time again that putting all your eggs in one basket never ends well. It causes emotional thinking and often drives to panic selling. As a hedge to my bet on $ETH, I will be holding an even amount of satoshi value worth of $ETC.

Why? One of the major factor in determining whether or not $ETH will be deemed a security is that $ETH raising capital from a public sale is one characteristic of a security. $ETC however did not raise funds through public sale. In my opinion, $ETH will fall in the short term if it is deemed a security, but will have an inverse reaction and appreciate in value from a fundamental standpoint that it is not a security and consequently will be more difficult to regulate than $ETH.

Please do not be concerned though about $ETH in the long run. I believe both outcomes, $ETH being deemed a security or not, are bullish for crypto overall. If $ETH is classified as a security, institutions that have been on the sidelines will take this movement way more seriously and likely start to join us. If $ETH is not deemed a security, we will be closer to being officially considered an entirely new asset class which in my opinion will have the space going crazy!

On top of all this, $ETC’s weekly chart looks so good that I am going to hold it for a few weeks time. Just look at that bowl baby!

Please remember, you know what’s best to do with your own wealth. This is our opinion and should not be taken as financial advice.

Yours truly,

J

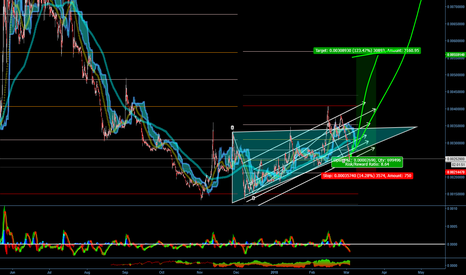

ETC/BTC [ETHEREUM CLASSIC]: A BUMPY BUT PARABOLIC RIDEJust a quick overview of ETC

While 2018 has been a tough year so far for ETC, I believe we're developing a nice parabolic move in the near future.

Wave 1 retraced greatly, which signals to me that wave 3 will not retrace much. This is good news for people jumping in now, as it may just pull enough momentum to hit that all-time-high again.

I myself am not a huge fan of ETC, but I have witnessed ETC making enormous moves in the last year.

I'm not going into a lot of detail with this one, I just wanted to give a bit of chart confidence to anyone who is a big fan of ETC, I know you're out there :)

Much love crypto-fam , remember to always play safe, control your emotions and practice risk management.

Choose your way Hi my fellow crypto friends! I will be very straight here since we have lots of great analysis of BINANCE:ETCBTC borning every hour in TView.

All of you can see we haven't broked a strong support line in 0.001958 (orange), and since then the power of buyers are performing very well, the volume still great and tends to increase.

So I would suggest, just in case you haven't come into the racing yet to buy after the resistance line 0.002446 in (red). Ok I know that looks very slow game but If you like to play hard, you can buy between 0.002152 and 0.002370. The possibilities seem to be on our side, the 20EMA(blue) still leading the run and we have a strong fighting on the MACD. I really believe it could make great profits in short term. So lets the chart say the answers!

Always remember my fellow friends, I'm like everyone here who is trying to improve my views on Charts and patterns, never take this as a financial advise because you are on your own.Never forget to update your stop-losses :D !

If you liked or with you have an opinion about, I'll be happy to read it. 58 and

Etc vs btcshort term target 0.002789

and long term is 0.0037

After invention of $btc and crypto currency the most beneficial discovery is stop loss.

dont trade with your emotion, play(trade) with market emotion. set stop loss.

long term holding is very good but have keen look on market situation.

best of luck to my fellow traders.

ETC / BTC C&H 100%+ RETURNSFor now this is a speculative pattern as it has not reached the neckline and begun to form a handle, however it's an early opportunity for some awesome gains.

Volume is beautifully rounding up as we've reached the end of ETC's accumulation.

I will be selling at neckline and buying upon confirmation of the bottom of a handle with a SL.

Thanks,

Masta