ETCUST trade ideas

ETC/USDT 1D chart reviewHello everyone, let's look at the 1D chart etc to USDT, in this situation we can see how the price moves in a slight side trend in which you can see the output sideways from the downward trend line.

However, let's start by defining goals for the near future the price must face:

T1 = 22.25 $

T2 = = $ 25.63

Т3 = 28.48 $

T4 = 31.06 $

Let's go to Stop-Loss now in case of further declines on the market:

SL1 = 19.04 $

However, you can still see a strong support zone that strongly maintains the price from a larger decline zone from $ 17.11 to $ 15.82.

Looking at the RSI indicator, you can see a return to the center of the range despite slight price movements on the chart, however, there is still room for a potential new growth movement.

Ethereum Classic 8X Trade-Numbers (6,480% Potential)The longest consolidation phase ever is still happening. This is positive for the upcoming bull-market. The longer it takes for Ethereum Classic to move forward, the stronger the growth when it does.

The profits potential on the title is based on a $183 conservative target. As you can see on the chart, ETCUSDT can reach $282 or even $450 or higher. What is important here is the entry and long-term hold.

Let's do some maths:

5X with a $20 entry and a target at $300 would equal to 1,400%. That would be a total 7,000% growth potential with 5X at current price. ETCUSDT.

Another example is 7X, same entry and a target of $444. That would be a huge 14,840% potential if such a target is hit. Without leverage, that would be 2,120%, from $20 to $444.

Below you can find more conservative numbers but still very strong.

_____

LONG ETCUSDT

Leverage: 8X

Entry levels:

1) $21.1

2) $20.1

3) $19.1

Targets:

1) $25.8

2) $27.6

3) $31.2

4) $37.1

5) $44.9

6) $52.5

7) $63.5

8) $77.2

9) $92.8

10) $102

11) $117

12) $128

13) $142

14) $160

15) $183

Stop-loss:

Close monthly below $18

Potential profits: 6480%

Capital allocation: 5%

_____

Something important, once the initial bullish breakout happens, the first jump, there is no going back. Once this move happens, Ethereum Classic, Bitcoin and the entire market will never be the same. The lowest prices after the end of this incoming bull-market will be many times higher compared to what we are seeing today. It is truly the last chance to see Crypto at a discount, trading this low. Once the market starts to move, it will a new world.

Hundreds of thousands of new millionaires will be created. A new economy, the nouveau rich, it will be a different world.

It is not the same saying, "the market is going up," vs experiencing this growth. When the next bull-market start, it will be wild, it will be crazy, it will be amazing and we will be rewarded big time for being early.

Anyway, I am ready for the biggest cycle since I started to write and trade. What about you?

Are you ready for change? Positive change.

It will be amazing. I am telling you.

Namaste.

ETC USDT#Ethereum Classic ( BME:ETC ) Bullish Reversal from Fibonacci Zone 🚀

Ethereum Classic (ETC/USDT) is currently trading at $20.06, forming a falling wedge pattern, which is historically a bullish reversal signal. The price has reached the Fibonacci golden zone (0.786 level), which often acts as a strong support level for trend reversals.

If the reversal holds, the next upside targets are:

🎯 Target Levels:

T: $48.00 🔥

ETC/USDT 1W 🩸 BME:ETC ⁀➷

#EthereumClassic. Macro chart Another

💯 Intermediate Target - $56

🚩 Macro Target 1 - $77

🚩 Macro Target 2 - $115

🚩 Macro Target 3 - $165

- Not financial advice, trade with caution.

#Crypto #EthereumClassic #ETC #Investment

✅ Stay updated on market news and developments that may influence the price of Ethereum Classic. Positive or negative news can significantly impact the cryptocurrency's value.

✅ Exercise patience and discipline when executing your trading plan. Avoid making impulsive decisions driven by emotions, and adhere to your strategy even during periods of market volatility.

✅ Remember that trading always involves risk, and there are no guarantees of profit. Conduct thorough research, analyze market conditions, and be prepared for various scenarios. Trade only with funds you can afford to lose and avoid excessive risk-taking.

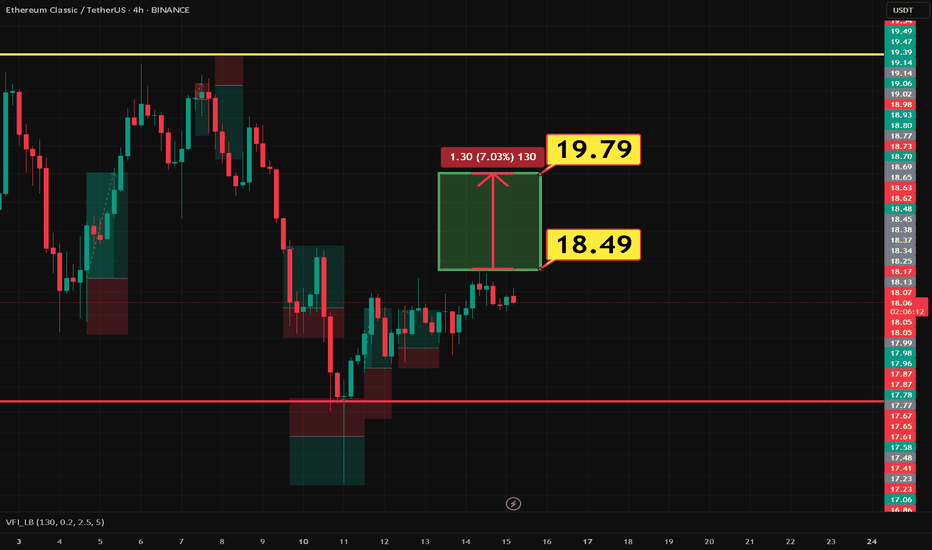

ETC/USDT 1H Chart ReviewHi everyone, let's look at the 1h ETC to USDT chart, in this situation we can see how the price has fallen below the uptrend line, and what's more we can see the first attempt to return above the trend line, however we can see the place that rejected the price.

Let's start by defining the targets for the near future that the price has to face:

T1 = 20.79 USD

T2 = 21.09 USD

Т3 = 21.60 USD

Т4 = 21.95 USD

Now let's move on to the stop-loss in case the market continues to fall:

SL1 = 20.19 USD

SL2 = 19.73 USD

SL3 = 19.26 USD

SL4 = 18.90 USD

On the Stoch RSI indicator we can see how the energy is decreasing and staying in the lower part of the range, keeping the price from a bigger drop for now.

Long term Long on Ethereum ClassicEthereum Classic (ETC) is the original Ethereum (ETH) blockchain that launched in July 2015. Its main function is as a smart contract network, with the ability to host and support decentralized applications (DApps). Its native token is ETC.

Since its launch, Ethereum Classic has sought to differentiate itself from Ethereum, with the two networks’ technical roadmap diverging further and further from each other with time.

ETC Impossible To Break Support: 2025 Bull-Market Launch-zoneGood afternoon my fellow Cryptocurrency trader, here we have a very simple chart and this time we are going to focus on support and why the recent flush marks the bottom for Ethereum Classic.

How are you feeling in this wonderful day?

In June 2024 ETC moved below $22 for the first time after a strong bullish wave. This move below $22 started a long consolidation phase and at the same time the creation of a long-term support.

Between June and November 2024 ETCUSDT went sideways, establishing a major long-term support zone. After five months of sideways, it broke bullish and produced what I call the "initial bullish breakout." Which is the first move that happens preceding a bull-market.

Now, the initial bullish breakout was corrected as is usual and the action moved back below daily MA200. MA200 reading $23. As soon as ETCUSDT moved below this level, the strong long-term support was activated again. The range that produced the 2024 initial bullish breakout, the same range that will launch the 2025 bull-market. This support level is impossible to break.

The action moved on a flash-crash below $20 and hit a low of $17. The same day the action recovered with the session closing at $22. This means that buyers were active, waiting and ready to buy and they bought. The reason for a smart Cryptocurrency market participant being ready to buy on a flash crash is because prices entered a major support zone. A long-term support zone and this zone can't break. It can't break because it has already been confirmed, last year, with five months of consolidation. The strong reaction when this zone was activated confirms that it is really strong.

If last year the market went sideways in this zone for 5 months, mainly 3 months after August, this year it will happen for 1.5 months at the most. This support will hold.

(Note: The lower end of the range can be challenged on a wick but it would always hold on a weekly or monthly session close.)

This means that we can start our accumulation strategy once more. Sell when prices are high; buy when prices are low.

Ethereum Classic is now trading at bottom prices, the best time to buy before long-term growth.

How far up can it go?

Just visit my profile and search for ETCUSDT, we have many charts with new ATH projections.

This post is meant to remind you, alert you, that the correction is over; the market is ready to grow.

It will take a while, only a short while. After this short while we will see maximum growth.

This support zone just mentioned is very strong.

This is a great opportunity.

Fortune favors the brave.

Notice that just a few weeks ago everybody was over-excited and buying like there was no tomorrow and the market broke down completely liquidating more than 10B worth of over-leveraged trades. Try and gauge the feeling of the market now, people are running away. This is the time to buy, when there is no excitement, just clear thinking...

When we are hyped up and ready for 1,000,000%+, that's a sure sign that something behind the scenes is wrong.

When we have time and space to breathe. Nobody is pressuring us, there is no rush. That's the time to enter. The time is now but, focus on the long-term, the short-term can be filled with swings and shakeouts, pure market noise.

It cannot be stopped.

We are going big in just a matter of months.

This is a friendly reminder.

Thanks a lot for your continued support.

Namaste.

TradeCityPro | ETCUSDT Buyers and Sellers War👋 Welcome to TradeCityPro Channel!

Let's go together in the final hours of the week and the financial markets are closed. Let's analyze and review another of our altcoins in a short and concise manner.

🌐 Overview Bitcoin

There is no need to include Bitcoin analysis in this analysis because I analyzed Bitcoin in detail for you today. I will put the link below. Be sure to check it out and pay attention to its chart.

📊 Weekly Timeframe

In the weekly time frame, ETC is one of the coins that is still fluctuating in its box range, but this time it has risen from the higher bottom of 17.67 and has not moved towards 14.90, which is a positive point.

I probably will not hold this coin for re-buying, but if you want to enter, I suggest you do so after the 37.16 break and follow this very closely as soon as possible. Don't happen in this time frame

On the other hand, if you bought with the 20.44 break, continue to hold for now, but the previous rejection from 37.16 is a good trigger for saving profit or exiting the main capital, and wait for the main exit and exit below 14.90

📈 Daily Timeframe

In the daily time frame, we are also suffering in the 24.71 to 28.12 range box, but the good thing is that we are one level above the daily box break box, which is 20.92, and we are in a better situation than the other coins that returned to this box.

I want to pay close attention to the 17.55 to 20.92 box, which is a complete daily range box, and you can see this in the weekly chart as well, and I want to show you that our purchase is after the box ceiling breaks and momentum and volume enter the chart and coin, which makes us stay in the position less and the fastest way Take our potential profit from the market

To buy again, you can make your purchase after the 24.71 break with the momentum I just explained, but your main trigger in higher time frames is the 38.24 break and it is better to involve your main risk there. If you intend to buy, you can also enter at 28.17 as a risk to have an entry point.

I do not recommend below 24.71 for the exit, but if you want to exit, if we return to the box again, make your purchase at the same number of dollars you sold, and your main exit trigger will be below 14.67.

Now you may be wondering why the daily resistance is at 28.17. The reason is a fake breakout that happened. The previous series and the fake breakout are exactly these two candles that go above the box and return exactly. Even if we remove them, nothing special will happen on the chart and the data will be wasted.

📝 Final Thoughts

Stay calm, trade wisely, and let's capture the market's best opportunities!

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

etc longterm buy"🌟 Welcome to Golden Candle! 🌟

We're a team of 📈 passionate traders 📉 who love sharing our 🔍 technical analysis insights 🔎 with the TradingView community. 🌎

Our goal is to provide 💡 valuable perspectives 💡 on market trends and patterns, but 🚫 please note that our analyses are not intended as buy or sell recommendations. 🚫

Instead, they reflect our own 💭 personal attitudes and thoughts. 💭

Follow along and 📚 learn 📚 from our analyses! 📊💡"

Miladasamaei //@version=5

indicator("Custom Crypto Trading Indicator", overlay=true)

// Input parameters

entryRange1 = input.float(1.0, title="Entry Range 1 (%)")

entryRange2 = input.float(2.0, title="Entry Range 2 (%)")

takeProfit1 = input.float(1.0, title="Take Profit 1 (%)")

takeProfit2 = input.float(2.0, title="Take Profit 2 (%)")

takeProfit3 = input.float(3.0, title="Take Profit 3 (%)")

takeProfit4 = input.float(4.0, title="Take Profit 4 (%)")

takeProfit5 = input.float(5.0, title="Take Profit 5 (%)")

stopLoss = input.float(1.0, title="Stop Loss (%)")

leverage = input.float(2.0, title="Leverage")

// Calculate entry levels

entryLevel1 = close * (1 - entryRange1 / 100)

entryLevel2 = close * (1 - entryRange2 / 100)

// Calculate take profit levels

takeProfitLevel1 = close * (1 + takeProfit1 / 100)

takeProfitLevel2 = close * (1 + takeProfit2 / 100)

takeProfitLevel3 = close * (1 + takeProfit3 / 100)

takeProfitLevel4 = close * (1 + takeProfit4 / 100)

takeProfitLevel5 = close * (1 + takeProfit5 / 100)

// Calculate stop loss level

stopLossLevel = close * (1 - stopLoss / 100)

// Plot entry levels

plot(entryLevel1, color=color.blue, linewidth=2, title="Entry Level 1")

plot(entryLevel2, color=color.red, linewidth=2, title="Entry Level 2")

// Plot take profit levels

plot(takeProfitLevel1, color=color.green, linewidth=2, title="Take Profit 1")

plot(takeProfitLevel2, color=color.green, linewidth=2, title="Take Profit 2")

plot(takeProfitLevel3, color=color.green, linewidth=2, title="Take Profit 3")

plot(takeProfitLevel4, color=color.green, linewidth=2, title="Take Profit 4")

plot(takeProfitLevel5, color=color.green, linewidth=2, title="Take Profit 5")

// Plot stop loss level

plot(stopLossLevel, color=color.orange, linewidth=2, title="Stop Loss")

// Display leverage

label.new(x=bar_index, y=high, text="Leverage: " + str.tostring(leverage), color=color.white, textcolor=color.black, style=label.style_label_down)

// Alert conditions

alertcondition(close <= entryLevel1, title="Entry Level 1 Reached", message="Entry Level 1 Reached")

alertcondition(close <= entryLevel2, title="Entry Level 2 Reached", message="Entry Level 2 Reached")

alertcondition(close >= takeProfitLevel1, title="Take Profit 1 Reached", message="Take Profit 1 Reached")

alertcondition(close >= takeProfitLevel2, title="Take Profit 2 Reached", message="Take Profit 2 Reached")

alertcondition(close >= takeProfitLevel3, title="Take Profit 3 Reached", message="Take Profit 3 Reached")

alertcondition(close >= takeProfitLevel4, title="Take Profit 4 Reached", message="Take Profit 4 Reached")

alertcondition(close >= takeProfitLevel5, title="Take Profit 5 Reached", message="Take Profit 5 Reached")

alertcondition(close <= stopLossLevel, title="Stop Loss Reached", message="Stop Loss Reached")

ETC On Vital Trendline Retracement !Ethereum Classic (ETC/USDT) is showing promising signs of bullish momentum following its breakout from a descending triangle formation. The price is currently consolidating above the trendline, indicating that the breakout level is holding as a strong support. This consolidation phase often precedes the next leg of a price movement, as the market builds strength for a potential continuation.

At the current price of $27, Ethereum Classic appears to be in a retesting phase. This is a critical moment where the price tests the breakout level to confirm it as support. Successfully holding this level would reinforce the validity of the breakout and provide confidence for further upward movement.

A significant factor to watch here is volume. A notable spike in trading volume would signal strong buying pressure, which could drive the price higher. If this occurs, the next resistance to overcome lies around $31, and surpassing that could lead ETC toward the $35 to $40 range, based on historical price action and the measured move from the triangle breakout.

If the price fails to maintain support above the $25.50-$27 range, it could lead to a deeper pullback, invalidating the bullish scenario. This makes the current consolidation phase a crucial moment for traders to watch.

Ethereum Classic is positioned for a potential upward move, provided it holds above the trendline and volume supports the breakout. Patience and vigilance are key as the market awaits a decisive push.

Alikze »» ETC | Scenario 3 or C bullish - 1W🔍 Technical analysis: Scenario of wave 3 or C in the ascending channel

BINANCE:ETCUSDT In the daily timeframe, according to the analysis presented earlier , it encountered demand after reaching the Buyer zone, which led to the breakdown of the descending channel and the touch of the target of $25.

- Currently, after exiting the congestion, it is moving within an ascending channel, which is currently at the ceiling of the first channel.

💎 In case of correction, at the ceiling of the first ascending channel, it can encounter demand in the middle range of the channel or the OB zone and continue its growth to the ceiling of the second channel.

⚠️ In addition, in the bullish scenario, the Invalidation LVL zone should not be touched. ⚠️

💎In case of touching the mentioned zone, the currency's movement path should be reviewed and updated again.

ETC/USDT - 1W interval Chart Hello everyone, I invite you to review the ETC pair to USDT chart, taking into account the interval of one weekend.

As we can see, the price is currently in the support zone from the level of $25.60 to the level of $24.27, but if the zone is broken, we still have visible support at the level of $21.85 and then we can see a drop to the level of $17.55.

Looking the other way, when the trend reverses, the important resistance level is $29.35, then the resistance level is $33.30, and the next significant level is $36.26.

ETC LONGAnalysis:

We are currently observing an accumulation phase in the market as the price tests a significant support level. This area is crucial for determining if the market will rebound or break further down.

The monthly open is highlighted, showing that price action has been trading below this level.

A potential breakout to the upside is expected, with the conservative target set around $32. This aligns with previous resistance zones, where price has struggled to break above.

If the price breaks above the $32 mark, the next potential target would be near the PMH (Previous Monthly High) at around $40.

Trade Plan:

Buy at current price levels near $24.34 with a stop loss just below the support (around $21).

Target 1: $32 (Conservative Target)

Target 2: $40 (PMH)

Risk Management:

Keep stop-loss orders below the accumulation zone to limit risk in case of a breakdown.

Note:

This setup is based on technical analysis and assumes that the market continues to show signs of a bullish reversal. Keep track of broader market trends and adjust accordingly.

Ethereum Classic - 2025/2026 Boom ?Hello guys, this is my smart idea.

What Is Ethereum Classic (ETC)?

Ethereum Classic (ETC) is the original Ethereum (ETH) blockchain that launched in July 2015. Its main function is as a smart contract network, with the ability to host and support decentralized applications (DApps). Its native token is ETC.

Total supply: 210.7M ETC

Max. supply: 210.7M ETC

Circulating supply: 150.31M ETC

Price prediction?

I think the price may go down, year 2025 to 14 usdt. Good for entry now, 25 usdt.

Long time price can mark 135-150 usdt. It depends on how this project takes off.

This is only my idea guys.

This is not financial advice !

Please do your analysis and consider investing !! Thanks