Ethereum at Critical Support – Breakout or Breakdown?Ethereum is currently testing a key support zone within a falling wedge structure. This level is crucial for bulls to hold if they want to push higher.

📊 Market Structure Update

ETH remains within a falling wedge, a pattern that often precedes breakouts.

Price is now at a key decision point—holding here could trigger upside momentum.

🔎 What’s Next?

A strong reaction from this support could lead to a breakout attempt.

Failure to hold may open the door for further downside.

Ethereum traders, how are you playing this setup?

ETHBEARUSD trade ideas

I'm begging again, buy ETHUSD,BTCUSD!! Don't miss out...One thing about crypto, just like stock is that it is always bullish. There may be corrections but it will cover them in few years.

You may be waiting for a better entry, a steeper fall, you may be waiting for when you're sure but I assure you, now is the time.

Now, ETH has corrected really well, to price I've never expected. Buying eth at 1800 is like buying BTC at 20k. You may think it can fall more but that doesn't matter, it can always rise more

DXY has been falling, crypto falling with it. This doesn't usually happen in bull market.

It signifies either accumulation for an explosive move, or a ranging market.

Either way, you're safe buying now.

The market recovered from 2008 market crash, what then will make ETH or BTC not to recover?

Dont start liking posts after the trade is profitable. Trade and make money.

SL- 1735

TP- 5000

ENTRY- 1800

Ya gaziere unu

(ETH) ethereum "update"Ethereum update. Nothing per se to analyze. More of an image to share with two indicators. Not much else to say here. It would be better if the average lines (pink and purple) had dots closer together. The further those dots become on a descent, the higher the likelihood there is of a big drop in price. We want the purple line to begin to curve in a reversal pattern for the price to recover from what is losing right now. Huge discount on Etheruem though, if you like that sort of thing, and Ethereum.

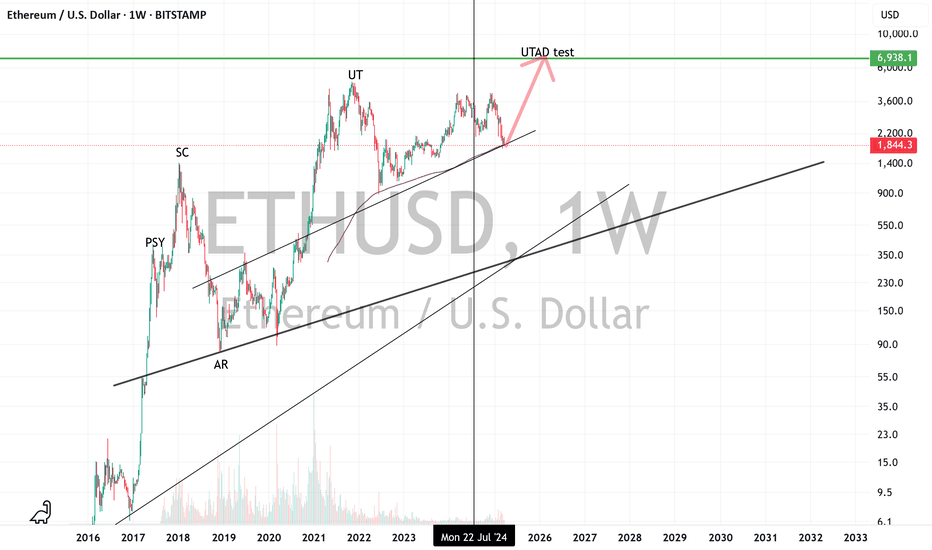

ETH - UpdateETH has been "crashing" lately but I think it is in the end state of a long rally. In fact I think we are in the last stage of Wyckoff distribution and we could see a major rally soon. Looking at the 300 SMA we bottomed there in June 22 and if we hold there, it could be the spring board for a massive rally to new highs.

Also I think GLD will top in a week or so which will be good for BTC and ALTS.

Not investment advice. Please like and share and leave a comment.

ETHEREUM Huge bullish divergence targets $4000Ethereum / ETHUSD formed a Double Bottom while the 1day RSI was on a Rising Support.

This is a similar bottom formation like the September 6th 2024 Double Bottom.

Technically once the Falling Resistance breaks, the new bullish wave begins.

Target the bottom of the Resistance Zone at $4000.

Follow us, like the idea and leave a comment below!!

Buy EthereumThe idea that Bitcoin (BTC) and Ethereum (ETH) tend to go up around 70 days after global liquidity (M2) increases is based on how liquidity drives risk asset prices—especially in speculative markets like crypto. Here's a breakdown of why this happens, particularly with the 70-day lag:

🔍 What is M2 Global Liquidity?

M2 includes:

Cash

Checking deposits

Savings accounts

Other near-money assets

When global M2 increases, it usually means central banks are easing (e.g., lowering rates, injecting liquidity), which tends to:

Increase money supply

Lower the cost of capital

Make riskier assets more attractive

💸 Why Does BTC/ETH React to M2?

Crypto = High-Beta Asset Class

BTC and ETH are risk-on assets, meaning they thrive when:

Investors are optimistic

There's more disposable capital floating around

Liquidity Flows Down the Risk Curve

When liquidity enters the system:

It first boosts safe assets (e.g., bonds, large-cap stocks)

Then mid-cap equities

Finally flows into speculative plays like crypto

Crypto’s Reaction is Delayed (~70 Days)

This 70-day lag happens because:

Institutions take time to reallocate capital

Retail follows after they see initial market strength

It takes time for M2 to affect sentiment, demand, and actual buying

📊 Empirical Backing

Analysts like Arthur Hayes, Macro Alf, and others have noted:

BTC price often correlates with global M2, with a lag of 60–90 days

Crypto tends to front-run rate cuts, but lags money supply changes

⏱️ Summary: Why the 70-Day Lag?

Cause Effect

Global M2 rises Money becomes more available

Institutions adjust portfolios Risk-on flows begin

Investors re-enter crypto Demand for BTC/ETH increases

~70 days later BTC/ETH prices begin to climb

(ETH/USD) Breakout from Falling Wedge – Bullish Momentum Ahead?Ethereum (ETH/USD) Breakout from Falling Wedge – Bullish Momentum Ahead?

This 4-hour Ethereum chart shows a breakout from a falling wedge pattern, a bullish reversal formation. The price has started forming higher lows, signaling potential upside movement. The projected target is around $2,411, indicating a significant recovery.

A successful retest of the breakout level could confirm further upward momentum. Traders may consider long positions while monitoring resistance levels.

📌 Key Levels:

Support: ~$1,879

Target: ~$2,411

Resistance Zones: $2,100 - $2,200

Would you like me to refine this further? 🚀

Ethereum’s drop is due to market issues, but upgrades may helpEthereum , one of the most popular and widely used blockchain platforms, is going through a rough patch. Since its launch in 2015, the cryptocurrency has drawn attention for its decentralized nature and its capabilities for smart contracts and decentralized applications (DApps). However, despite its early success, Ethereum has experienced significant price fluctuations in recent years. According to analysts, its price has dropped approximately 45.4% in the last quarter alone.

Several key factors are driving Ethereum’s recent price decline. First , increasing competition from faster and cheaper blockchains like Solana and Cardano is drawing in users and developers, reducing demand for Ethereum. Second , high transaction fees — especially during times of network congestion — make the platform less attractive for users who prioritize speed and cost-efficiency. Finally , delays in implementing upgrades such as the full transition to Ethereum 2.0 have eroded investor and user confidence, negatively impacting the token’s price.

Despite the current challenges, Ethereum remains one of the most promising cryptocurrencies. In 2025, its value and adoption may rise significantly due to several critical developments:

Full transition to Ethereum 2.0: The long-awaited move to Ethereum 2.0 — set to improve transaction speed, enhance security, and reduce fees — could serve as a major growth driver. The switch from Proof of Work (PoW) to Proof of Stake (PoS) will improve the network’s energy efficiency, making it more eco-friendly and cost-effective. With these enhancements, Ethereum could better compete with rival blockchains and attract more users and investors.

Boom in Decentralized Finance (DeFi): Ethereum serves as the foundation for many DeFi applications, which continue to gain popularity. In 2025, the growth of DeFi projects and the increasing total value locked in these apps may fuel demand for Ethereum. Ongoing development and integration of new financial instruments in the Ethereum ecosystem will further cement its role in the crypto economy.

Emergence of Layer 2 technologies: Layer 2 solutions like Optimistic Rollups and zk-Rollups could greatly enhance Ethereum’s scalability by reducing the load on the mainnet and lowering transaction fees. These technologies are essential for mass adoption, helping Ethereum scale efficiently while maintaining decentralization.

Growth of NFTs and asset tokenization: As tokenization and NFTs continue to rise in popularity, Ethereum remains the leading platform in this space. By 2025, we could see further expansion in the NFT market and tokenized assets, driving increased demand for Ethereum as the go-to platform for creating and exchanging digital assets.

Global crypto adoption and regulatory clarity: In 2025, regulatory frameworks for cryptocurrencies are expected to become clearer around the world. With growing government acceptance and legal recognition of crypto assets, Ethereum could become a foundational element of future financial systems—attracting fresh investment and pushing its value higher.

Despite the current headwinds, Ethereum has strong potential for recovery and future growth. FreshForex analysts predict a rebound could occur as early as Q3 or Q4 of 2025, driven by upcoming upgrades and network improvements. Don’t miss the chance to get in at the right time!

Exclusive offer for our readers: Get a massive 10% bonus on your balance for every crypto deposit of $202 or more! Just contact support with the promo code 10CRYPTO , fund your account, and trade with extra power. Full bonus terms available here.

At FreshForex, you can open trading accounts in 7 cryptocurrencies and access over 70 crypto pairs with up to 1:100 leverage — trade 24/7.

Karma hit fastKarma hit fast.

Hacker steals 2,930 ETHETH CRYPTOCAP:ETH ($5.4M) from zkLend... then gets phished while using Tornado Cash.

All 2,930 ETHETH CRYPTOCAP:ETH ($5.4M) gone — to another thief.

Trade ETHETH CRYPTOCAP:ETH , come to Gate – no need to think of reasons, just a pure recommendation! 😄

How is the market predictible? I was just wondering if there is some pattern on the market/economy...

The 2020-2023 range was wild because of the pandemic so I'm not sure if it relevants as it is. The next cycle (nowadays) is more calmer, could it be a reference point for the future forecast?

Has it linear increase or even concave upward like hyperbolic?

What do you think?

These are just speculations, wery rough numbers more like share my thought.

DOUBLE BOTTOM IN ETH / ETH TO $2,500Hello! We have confirmation of a double bottom. Eth has a bullish pattern, the price reached the liquidity zone at $1,780, took positions, and the price began to form a double bottom. The price of Eth has already gained liquidity, and on a weekly and daily chart, the price will be looking at $2,500. Remember that a weekly chart is for seeing results between 20-30 days and a weekly chart will be seeing results over a period of 3 months. It is not ruled out that the price remains in its range. However, the indicators, price action, and market sentiment tell us that Eth is suitable for long positions.