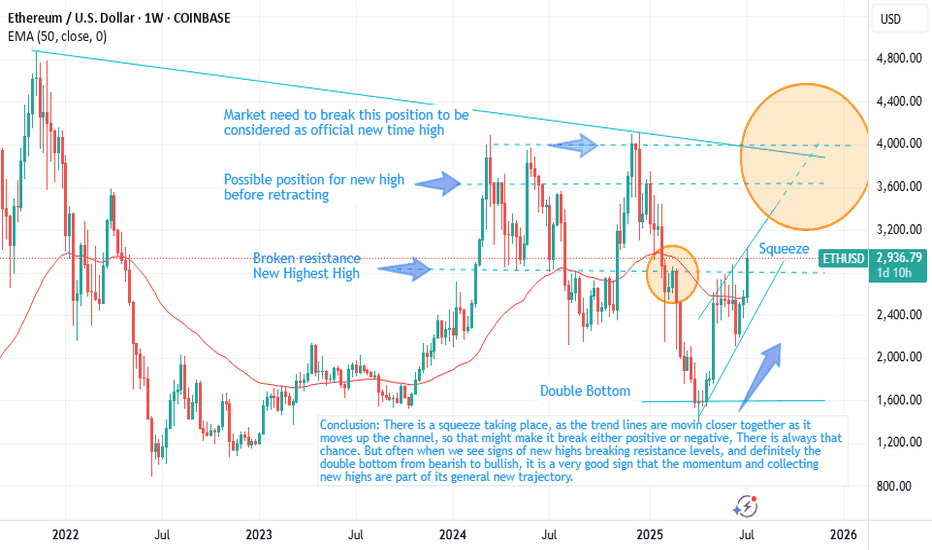

ETH way to test ATHEthereum is making its way toward testing its all-time high, but there are some strong resistance levels in the way—most notably around the $3.5K mark. Still, the technicals are showing promise: RSI has broken out of its trendline, and the monthly Stochastic RSI looks bullish, signaling strong upward momentum.

How ETH reacts to these resistance zones will be key. Historically, Ethereum has led the altcoin market, so if it breaks its ATH, we could see a rapid surge across altcoins. Until then, we’re likely in the middle of a "mini altseason"—some coins running, but the real breakout comes once ETH confirms the move.

ETHEREUM trade ideas

Ethereum: Bullish Momentum Signals Broader Rally Beyond $3000Current Price: $3002.13

Direction: LONG

Targets:

- T1 = $3120.00

- T2 = $3203.00

Stop Levels:

- S1 = $2934.00

- S2 = $2842.00

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intelligence to identify high-probability trade setups. The wisdom-of-crowds principle suggests that aggregated market perspectives from experienced professionals often outperform individual forecasts, reducing cognitive biases and highlighting consensus opportunities in Ethereum.

**Key Insights:**

Ethereum shows robust uptrend momentum, underpinned by significant institutional demand and strengthening market sentiment. As the primary cryptocurrency supporting decentralized finance (DeFi) and non-fungible tokens (NFTs), Ethereum has positioned itself at the forefront of blockchain advancements. The growing adoption by institutions and favorable macroeconomic conditions further consolidate its growth prospects, especially with the increasing recognition of Ethereum as a digital inflation hedge.

Positive developments in regulatory frameworks around cryptocurrencies have also been instrumental in improving market sentiment. Ethereum continues to showcase strong transactional activity on its network, bolstering demand for ETH tokens as a utility. Heightened activity ahead of protocol upgrades is another catalyst that traders are closely monitoring.

**Recent Performance:**

Ethereum has maintained a steady price appreciation trend in alignment with broader cryptocurrency market gains. From its previous trading range below $3000, Ethereum has breached psychological resistance, marking $3002.13 as a pivotal level. Increased trading volume and positive sentiment have allowed Ethereum to test higher resistance levels, making it well-positioned for potential upside continuation.

**Expert Analysis:**

Market experts remain bullish on Ethereum, citing fundamental strengths such as its adaptability, technological utility, and yield-generating capabilities through staking. With investor demand continuing to grow, Ethereum is expected to outperform many altcoins and maintain leadership alongside Bitcoin. Analysts project an intermediate target of $3200, while the longer-term objectives extend beyond $3500 given its current trajectory.

Technical metrics also signal bullish momentum, including sustained moving average support and increasing RSI levels. Investors may find attractive reward-to-risk setups at current levels, supported by favorable macro and crypto-specific factors.

**News Impact:**

Ethereum has benefited from an improving regulatory environment in key crypto jurisdictions, which has alleviated some uncertainty. Simultaneously, positive macroeconomic trends, such as declining inflation expectations and risk-on sentiment across equity markets, have boosted overall investor confidence. Ethereum’s role in various decentralized applications (dApps) and strategic partnerships with enterprises further solidify its potential for sustained growth.

**Trading Recommendation:**

Traders should consider taking a long position on Ethereum, targeting $3120 and $3203 as near-term objectives while maintaining disciplined risk management with stops at $2934 and $2842. The combination of fundamental strength, technical indicators, and favorable news impacts positions Ethereum as an attractive investment opportunity amidst current market dynamics.

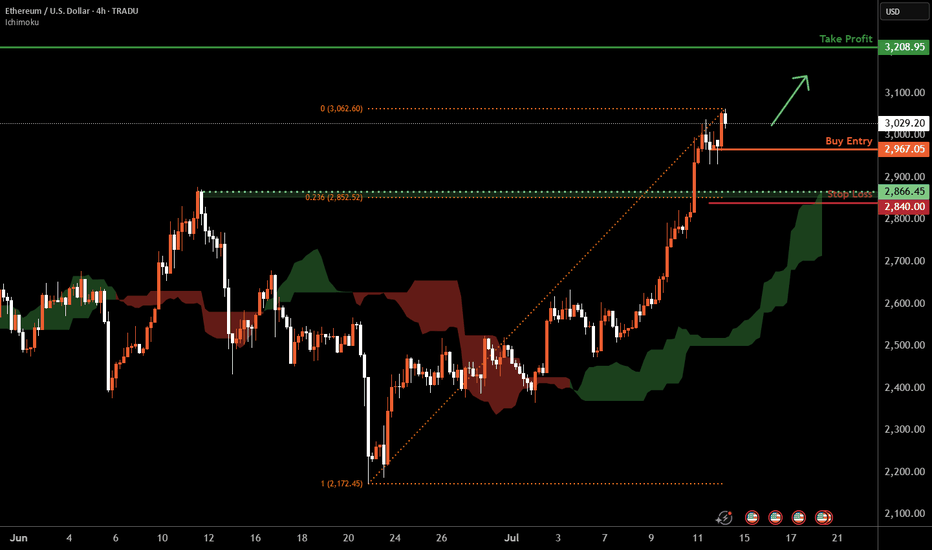

Ethereum H4 | Bullish uptrend to extend higher?Ethereum (ETH/USD) is falling towards a swing-low support and could potentially bounce off this level to climb higher.

Buy entry is at 2,967.05 which is a swing-low support.

Stop loss is at 2,840.00 which is a level that lies underneath a pullback support and the 23.6% Fibonacci retracement.

Take profit is at 3,208.95 which is an overlap resistance.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

People Don't Eth Enough Most people aren't aware of the opportunities taking place. Here I am soaked with more insight than I can carry. It runs off of me continuously like a waterfall. In all honesty I am truly alone...always in my own thoughts because the world seems impossible to hold a conversation with...a conversation that actually matters...but here, at tradingview, there is a sense of relief. To me, it is important to know where to place money, that it may grow with interest. People don't believe me. They never did and I never cared. I only cared to warn them but who am I?

Bullish bounce?Ethereum (ETH/USD) is falling towards the pivot and could bounce to the 1st resistance.

Pivot: 2,810.19

1st Support: 2,361.23

1st Resistance: 3,481.42

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

ETH/USD Setup | Thief Trading Blueprint for Profit.🔥🚨THE ETHEREUM HEIST PLAN: Thief-Style Trading Blueprint for Maximum Gains🚨🔥

💰Thief Mode: Activated | Time to Rob the Bulls 💰

📢🌍 Hello Money Makers, Crypto Crooks & Chart-Breaking Bandits! 🐱👤🤑💸

Welcome to the “Thief Trading Style” breakdown — a high-stakes, high-reward crypto market blueprint built on deep technical & fundamental intel. This isn’t your average strategy… it’s a full-blown heist on the ETH/USD market!

🧠 THE MASTER PLAN (ETH/USD – Day & Swing Trade)

🔎 Based on our Thief Mode analysis — blending market sentiment, trend psychology, and price action — Ethereum is ripe for a bullish robbery. We’re setting up shop at high-risk liquidity traps and targeting bearish overconfidence.

💥ENTRY STRATEGY – "The Vault Is Open, Time to Strike!" 💥

🟢 Go Long:

Swipe in on bullish momentum.

🕒 Set Buy Limit Orders at key pullback zones (swing highs/lows from 15m or 30m timeframes).

💼 Use DCA (Layered Orders) for multiple precision entries. The more layers, the stronger the loot stack.

🛑STOP LOSS – "Thief Rule: Don’t Get Caught"

📍Place SLs at logical swing highs/lows using the 1H timeframe

💡 Adjust according to lot size & how many entries you're stacking

Risk smart, steal smarter!

🎯TARGET – "Make the Escape at 2850.0 or Jump Early if Cops Close In!"

📌Set TP at 2960.0, or

📌Exit early if the market starts turning shady (exit before reversal signs appear)

⚔️SCALPER'S CODE – "Fast Hands Only!"

🧲Only scalp Long-side plays

🧠Use trailing SLs to protect stolen profits

💼Big wallets? Front-run the move

🪙Smaller bags? Team up with swing traders and follow the blueprint.

🚨MARKET CONTEXT – Why This Heist is Bulletproof

💥ETH/USD is showing bullish energy due to:

Macro & Fundamental Drivers

On-Chain Metrics showing accumulation

Sentiment Analysis leaning toward over-leveraged bears

Intermarket Correlation signaling rotation into altcoins

🔗Stay sharp, keep updated with: COT Reports, Macro Calendar, Crypto News Feeds

⚠️NEWS RELEASE WARNING – "Robbers Hate Surprises"

📛Avoid new entries during major news releases

📈Use Trailing Stop Losses to lock in profits

⛔Don’t leave positions unmanaged during volatility spikes

💖LOVE THE PLAN? THEN BOOST THE GANG!

🎯Tap the 🔥 Boost Button 🔥 and show support for the Thief Trading Style!

The more boosts, the more plans drop — let’s build a community of smart traders robbing the market legally (😉).

✍️DISCLAIMERS

📌This analysis is for educational purposes only — not financial advice.

📌Always trade within your own risk management rules.

📌Market conditions change fast — adapt, evolve, and don’t trade blindfolded.

🚀Stick around for more blueprints — the next heist is always just around the corner.

Until then… Lock. Load. Loot. 🐱👤🤑💰

ETHUSD: Bulls Are Winning! Long!

My dear friends,

Today we will analyse ETHUSD together☺️

The price is near a wide key level

and the pair is approaching a significant decision level of 2,980.5 Therefore, a strong bullish reaction here could determine the next move up.We will watch for a confirmation candle, and then target the next key level of 3,001.1.Recommend Stop-loss is beyond the current level.

❤️Sending you lots of Love and Hugs❤️

ETH / USDC Liquidity Pool RangeEthereum is climbing alongside Bitcoin, but it’s clearly outperforming. In many ways, ETH is the Microsoft of the crypto space—serving as a foundational platform on which countless networks and tokens are built, much like Windows supports a broad software ecosystem. In contrast to Bitcoin’s role as a digital currency, Ethereum functions more like a software operating system.

We broke out of the previous range for strong profits. The new range is tighter, with the lower boundary set just above the current ETH spot price at $2,995.91 and the upper boundary at $3,340.90, as marked by the horizontal yellow lines. On the 3-hour chart, momentum is beginning to turn upward. To enter the liquidity pool within this range, we must be fully allocated in ETH.

ETH/USD ROBBERY IN PROGRESS! Long Now, Exit Before Bears Attack!🚨 ETH/USD HEIST ALERT: Bullish Loot Before the Trap! 🚨

Thief Trading Style: Steal Profits & Escape Before the Cops Arrive!

🌟 Greetings, Market Pirates & Profit Bandits! 🌟

(Hola! Oi! Bonjour! Hallo! Marhaba!)

🔥 The Ethereum vault is WIDE OPEN! Time to execute the Thief Trading Strategy—bullish momentum is primed for a heist. Long entries only! Target the highs, then vanish before the overbought trap snaps shut.

🔑 Heist Plan (Day/Swing Trade)

🎯 Entry: "The vault is unguarded—swipe bullish loot at any price!"

Pro Tip: Use buy limits within 15-30min for pullback entries (recent swing lows/highs).

🛑 Stop Loss:

Thief SL (4H): 2240.0 (Nearest swing low)

Adjust SL based on risk, lot size & multiple orders.

🏴☠️ Target: 2800.0 (or escape earlier if bears ambush!)

⚡ Scalpers’ Quick Loot:

Only scalp LONG!

Big wallets? Charge in! Small wallets? Join swing traders & rob smart.

Trailing SL = Your Escape Rope!

📢 Why Ethereum?

🐂 Bullish momentum + strong fundamentals = Perfect heist conditions!

(Check COT reports, macro trends & sentiment— check 👉🔗!)

⚠️ WARNING: Cops (Bears) Are Setting Traps!

Avoid fresh trades during news!

Trailing SL = Lock profits & run!

💥 BOOST THIS HEIST!

🔥 More boosts = Faster profits!

🚀 Daily robberies = Easy money!

Stay tuned—next heist coming soon! 🤑💎 (Like & Follow for more loot!)

Ethereum (ETH/USD) on the 2-hour timeframe.Ethereum (ETH/USD) on the 2-hour timeframe, here's the analysis and target level:

---

🟦 Chart Observations:

ETH is in a rising channel.

Price is respecting Ichimoku Cloud support.

A bullish breakout pattern is forming (consolidation above the cloud).

My clearly marked "TARGET 3300" at the top.

---

🎯 Target Level:

Primary Target: $3,300

This is the next major resistance and aligns with the top of the projected ascending channel.

Confirmed by your chart annotation.

---

📍 Current Price:

$2,964.3 (Sell) / $2,964.5 (Buy) — as shown in the screenshot.

---

📈 Strategy Suggestion:

Entry: On break above local consolidation / wedge (~$2,980–3,000).

Target: $3,300

Stop-Loss: Below Ichimoku cloud or lower channel (~$2,850 or tighter).

Support Levels to watch:

$2,815 (highlighted on the chart)

$2,700 (lower channel zone)

---

Would you like me to prepare a full trade plan or backtest this setup?

ETH : I'm not in yet and why ?Hello, good ?

Me yes or no.

I'm not in ETH move yet, because for the moment, we are in a retest of the bulltrend.

The wave C is a perfection if we look Elliot wave.

But now, if we look the actual move in BTC, we can easily imagine a breakout of ETH.

And we can see an elliot wave configuration for the new uptrend. Wave 3 can be between 4500 and 5000.. But more if we have a brutal move on BTC.

The best case for the wave 3 is above the ATH, then ATH retest, then discovering price.

Which target final target ? Best case 15-17k

Worst case : 5-7k

You have the intermediates levels (orange) to help you to enter.

Ether is a buy between 1300-1500!!This price point is significant as it aligns with Ethereum's previous highs from 2018, suggesting a potential support level. The occurrence of a monthly divergence indicates that selling pressure may be diminishing, potentially paving the way for a bullish reversal.

Looking ahead, industry projections are optimistic about Ethereum's future performance. Analysts anticipate that Ethereum could reach new all-time highs, with some forecasts suggesting prices exceeding $5,000 in the coming year.

From a fundamental perspective, Ethereum's transition to a proof-of-stake consensus mechanism has significantly reduced its energy consumption and introduced deflationary pressures on its supply. This shift, along with ongoing network upgrades, enhances Ethereum's scalability and security, reinforcing its position as a leading platform for decentralized applications and finance.

Furthermore, the approval of Ethereum-focused exchange-traded funds (ETFs) has opened new avenues for institutional investment, contributing to increased demand and potential price appreciation.

In summary, the current price dip presents a favorable buying opportunity, supported by technical indicators and robust economic fundamentals. With continued network enhancements and growing institutional interest, Ethereum's outlook remains positive.

Please note alot of these things can take time to reflect in price. So although some of these news are a few years long it does not make it any less impactful! Buy when there is blood on the street.

Wajani Investments: ETHUSD Analysis

ETHUSD has currently formed a triangle with a resistance broken to the upside. In most circumstances, I’ll like to wait for a retest of that resistance, i.e. resistance-becomes support to be sure that the breakout was not false. Once that level is tested and held, I’ll take a trade assuming Leg2 would have a similar move like Leg1. This is a very good trade with a 1:4 RR.

If you have any questions, feel free to ask. You can add or subtract from this idea.

Remember, trading always carries risks, and this is for EDUCATIONAL PURPOSES only.

Ethereum Stalls at $3,101.0FenzoFx—Ethereum broke past $2,880.0 but stalled near a bearish fair value gap. The daily chart shows a longwick bearish candlestick, signaling increased selling pressure.

With Stochastic at 90.0, ETH is short-term overbought. Resistance is at $3,101.0—if it holds, ETH may retreat to $2,880.0 or $2,638.0.

A close above $3,101.0 would invalidate the bearish outlook and pave the way toward $3,330.0.

ETH Update 25-7-11so I know this is a bit of a weird view but I like to zoom out sometimes and I like this blue corridor. Personally, I think the demand for ETH speaks for itself so eventually it will see new highs and everything. This is just a way to gauge the next moves. It will probably mimic BTC with its head and shoulders pattern but be more amplified even though it’s lagging behind still and has been for years.