Ethereum’s 1H Chart Screams Breakout — Next Stop $3,941?Ethereum has recently broken above a short-term descending trendline that had been guiding the market lower over the past sessions. This breakout occurred after price formed a strong base around the $3,357 support zone, indicating that sellers were losing momentum. The “B” buy signals printed near these lows further strengthen the bullish outlook.

The immediate resistance lies around $3,559, which is the level price is currently approaching. If buyers can maintain momentum above this area, the next upside targets are $3,576, $3,680, $3,717, and $3,773. The major resistance and projected take-profit area is near $3,941.

From a structural standpoint, the shift from lower lows to higher lows suggests that the short-term trend may be reversing in favor of buyers. This aligns with the increased buying volume observed after the breakout, hinting at potential follow-through in the next London or New York session.

Trading Setup

• Entry: Around $3,553 after breakout confirmation

• Stop-loss: Below $3,357

• Take-profit 1: $3,680

• Take-profit 2: $3,773

• Final Target: $3,941

• Risk-Reward: Approximately 1.89:1

ETHEREUM trade ideas

ETH 4H Mid-Zone BounceETH on the 4H

ETH found support right at the midpoint between the 0.382 and 0.236 Fib levels — exactly at yesterday’s close.

Price closed above the BB center, and the SMA is also holding above it — early signs of recovery.

RSI formed a double bottom in the oversold zone and has now crossed above its moving average.

MACD is about to flip bullish.

I remain bullish and still holding my long, but with tight risk management.

Always take profits and manage risk.

Interaction is welcome.

Ethereum (ETH/USD) Analysis - Aug 01, 2025ETH is showing a strong uptrend on the 1D chart, recently hitting $3,639.37 after a -1.59% dip. A key support zone around $3,500 is in sight, which I’m eyeing as a potential buy opportunity. The chart suggests a solid base here, with historical price action holding firm.

Watch for a bounce or consolidation around $3,500-$3,600 before the next leg up.

Target: $4,000+ if momentum holds.

Risk: A break below $3,300 could invalidate this setup.

Bearish revrsal?The Ethereum (ETH/USD) is rising towards the pivot and could reverse to the 1st support.

Pivot: 3,760.94

1st Suport: 3,372.83

1st Resistance: 3,936.31

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

ETH/USDT – Bullish Reversal Potential from Fibonacci Confluence 💡 Idea:

Ethereum is showing signs of demand absorption at a critical Fibonacci support cluster (0.5 – 0.618 retracement). VSA patterns confirm that selling pressure is being absorbed, hinting at a possible markup toward previous swing highs.

📍 Trade Setup:

Entry: Current levels near 3,551

Target: 3,937 (+10.82%)

Stop Loss: 3,338 (below last absorption zone)

R:R Ratio: ~1.79:1

📊 Technical Reasoning (VSA)

1. Stopping Volume at Fibonacci Support

ETH tested the 0.5–0.618 retracement zone from its prior bullish impulse.

Wide spread down-bars on high volume failed to produce significant downside progress, signaling professional buying.

2. No Supply Confirmation

Following the stopping volume, the market printed narrow range candles on decreasing volume, indicating supply exhaustion.

3. Demand Emergence

The recent push above short-term resistance came with increasing volume and wider up-bar spreads, suggesting the start of an accumulation-to-markup transition.

4. Structure & Fibonacci Confluence

Current rally aligns with the Fibonacci golden zone and past structural support.

📌 Trading Plan:

Enter on confirmed breakout above minor resistance with volume expansion.

Scale out partial profits near 3,800 and let remainder ride toward 3,937.

Keep stop below 3,338 to avoid being shaken out by false breakouts.

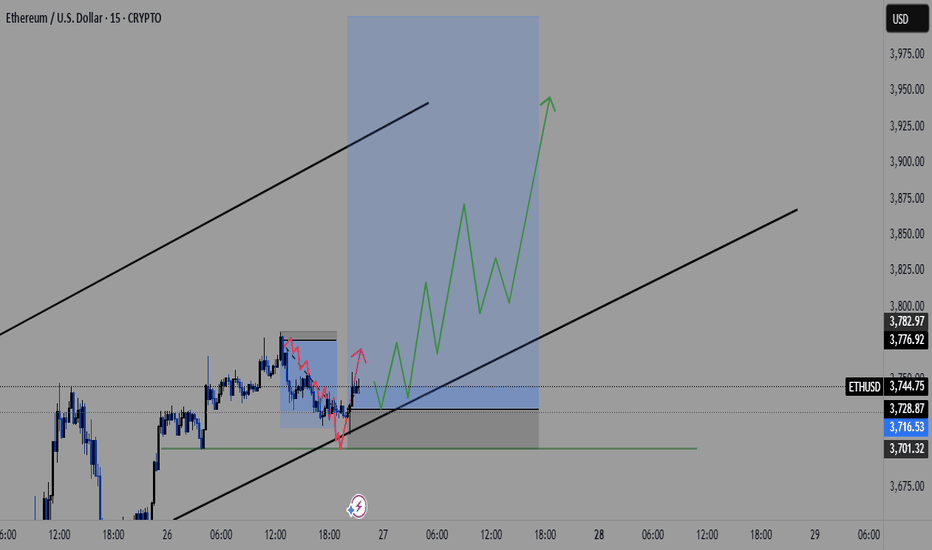

ETHUSD: How I see 15 min chart. Technical Context

Price completed a 5-wave decline into Wave 4 support at $3,246 (1.236 Fib extension of Wave 3) within a rising pitchfork channel

Expect a multi-leg accumulation between the orange lower pitchfork line and the red median line before resuming the up-trend

Accumulation Trajectory

Initial Leg: Bounce off $3,246 → rally to $3,563 (0.618 Fib of the entire drop)

Secondary Pullback: Retrace toward the orange trendline (~$3,400)

Subsequent Rallies: Series of higher lows along orange support, testing channel median at ~$3,600–3,650

Final Shakeout: Quick flush toward $3,300–3,350 to clear weak hands before impulsive leg

Intraday Trade Plan

Entry Zones

Tier 1: Near $3,260–3,280 (first swing low)

Tier 2: Along orange rising support (~$3,350 on strength)

Targets

Partial at $3,563 (0.618 retracement)

Full exit near red median line (~$3,625–3,650)

Stop-Loss

Below $3,230 (just under accumulation low)

Position Sizing

Risk ≤ 0.5% of account per leg; scale in on confirmation candles

“Fear in China might prompt a sell-off; use these dips to accumulate for the next impulsive wave.”

References

Murphy, J. J. (1999). Technical analysis of the financial markets. New York, NY: New York Institute of Finance.

Prechter, R. R., & Frost, A. J. (2005). Elliott wave principle: Key to market behavior (10th ed.). New Classics Library.

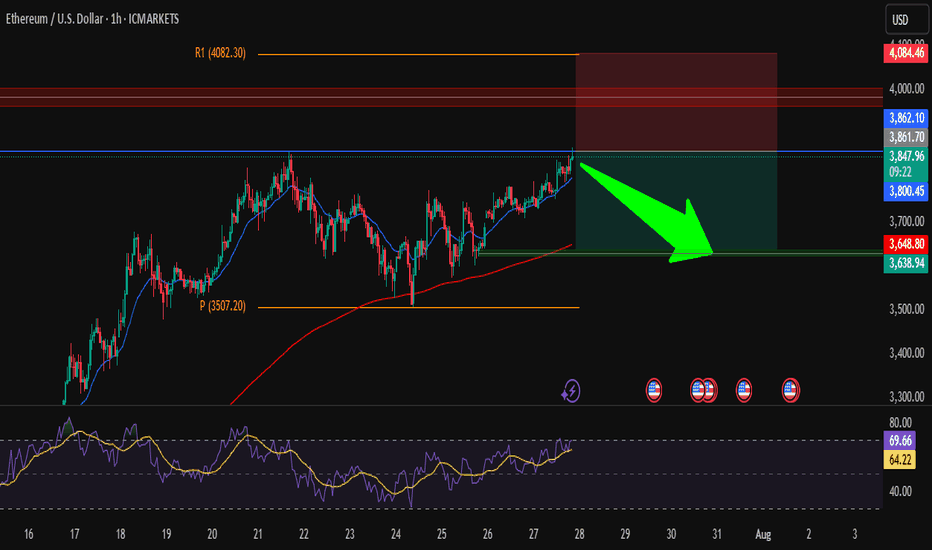

ETH/USD – Short from ResistanceHi traders ! , I opened a short position on ETH/USD as price is hitting a strong resistance zone.

Entry: 3850

SL: 4084.46

TP: 3638.94

📌 Why I took this trade:

Price is testing a strong resistance zone around 3860, RSI is overbought, and we could see a pullback toward the support area around 3640.

Nice risk/reward setup, keeping it simple.

This is just my analysis, not financial advice.

What’s your view — drop or breakout?

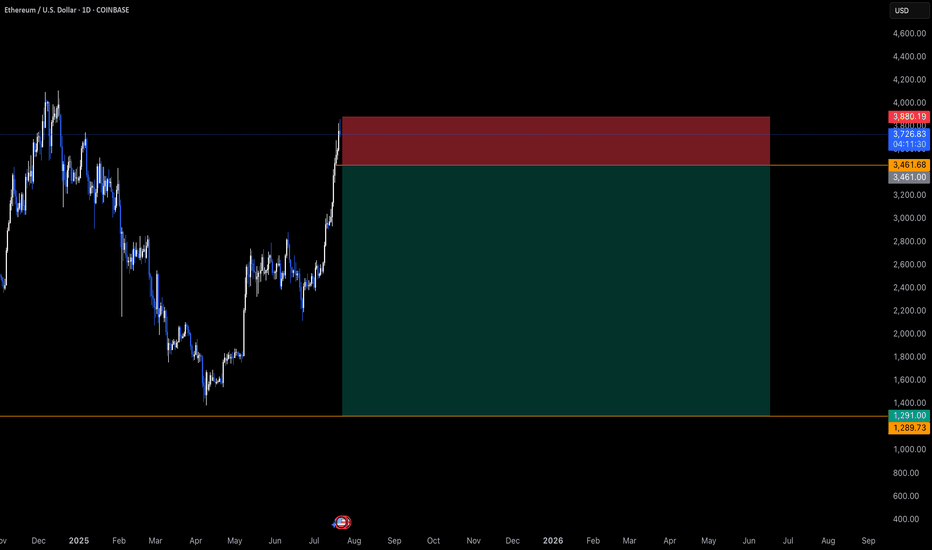

ETHUSD BROKE THE LOWER BORDER OF THE WEDGE. PRICE IS MOVING TOWAETHUSD BROKE THE LOWER BORDER OF THE WEDGE. PRICE IS MOVING TOWARDS THE LOCAL SUPPORT.

Yesterday, Ethereum saw its largest monthly increase since July 2022, thanks to strong inflows into exchange-traded funds and increased activity in the Ethereum treasury. US exchanges are working to obtain regulatory approval for a standardized framework for listing crypto funds. Coinbase and JPMorgan have joined forces to provide Chase customers with access to crypto products.

Despite these positive developments, the short-term outlook does not indicate a bullish setup. It appears that all the information has already been factored into the price. The pair moves towards the local support of 3,500.00. However, in the long term, these developments are favorable for investment.

Here is how Eth compares to top ISO coinsHere is an overview of Eth's price action compared to other top alt coins.

I used the same method for anticipating the "WT" target for each asset.

Xlm, Sui and Xrp all hit my WT targets somewhat precisely. But NOT Eth.

Eth is hold up surprising well compared to top ISO coins. This doesn't mean Eth can't

hit my WT target at a later date. But if Eth's breakout isn't a fakeout, this current price action may invalidate any previous bearish targets for Eth. I hope so for the Bulls sake.

May the trends be with you.

ETH Gears Up Again

ETH on the 4H is confirming the uptrend

MLR > SMA > BB Center — trend structure is bullish

PSAR has flipped bullish

RSI has plenty of room to run

MACD has turned green

Next resistance: 0.236 Fib and the 50MA.

On the macro side:

• Fed chair replacement talks

• Slower job numbers

• CFTC launching “Crypto Sprint”

Momentum is building. We’ll be here to watch it unfold.

Always take profits and manage risk.

Interaction is welcome.

Multi-Timeframe Market Analysis – Bullish Opportunity Setting U🔍 Multi-Timeframe Market Analysis – Bullish Opportunity Setting Up?

I’ve been closely tracking a potential bullish setup using a multi-timeframe approach. Here’s a quick breakdown:

📅 Weekly Timeframe:

Price is currently trading inside a Weekly Type 2 Bullish Fair Value Gap (FVG) — a key higher timeframe support zone.

No bearish break on weekly structure yet, so bullish bias remains valid unless this FVG fails.

📉 Daily Timeframe:

We’re seeing a bearish orderflow leg, but this is unfolding within the weekly bullish FVG, reducing confidence in downside continuation.

My bias here: Neutral to bullish, watching lower timeframes for confirmation.

⏳ H4 Timeframe:

A dealing range is forming, hinting at potential accumulation or reversal.

Since this is happening after price tapped the weekly FVG, I suspect smart money is accumulating long positions.

I’ll be watching for bullish FVG formation within this range to confirm the setup.

⏱ Lower Timeframes (H1–M15):

Looking for internal liquidity sweeps followed by bullish FVGs.

These will be my entry triggers, with targets at external liquidity levels like daily swing highs.

🎯 My Trading Plan:

Favoring buy setups unless weekly FVG is invalidated.

Focused on H4 breakout and lower timeframe confirmation.

Risk managed entries only, with clear invalidation and targets.

💬 How do you approach multi-timeframe confluence in your trades? Drop your thoughts below!

#Trading #Forex #TechnicalAnalysis #SmartMoney #FVG #MarketStructure #Liquidity #MultiTimeframe #PriceAction #TraderMindset #SwingTrading

ETH VS AI?Hi

Asked AI on the next movement ETH

Predicted Target = 4 847

Time Projection 20 days → 15 Aug 2025

Probability (%) Attenuation × 100 = 183.6 %

Variance vs. Today (Target) 4 847 − 3 507 = 1 340

Projected Retracement Price 3 886 − 599 = 3 287

Variance vs. Today (Retrace) 3 287 − 3 507 = −220

All the best

Caveat emptor

Not a guru

ETH/USD Rebounds, Faces Key ResistanceFenzoFx—Ethereum rebounded from the previous day's low, now trading near $3,639.0. This level contains an order block that triggered bearish reactions earlier this week.

The trend remains bullish as price holds above the VWAP from July 1st. A close above $3,724.0 is needed to confirm continuation.

If bullish momentum holds, ETH may target $3,818.0 and $3,941.0. However, a drop below $3,546.0 would invalidate the bullish outlook. In that case, ETH/USD could revisit $3,410.0 and $3,354.0.

Ethereum Breakdown Imminent: Bearish Triple Tops confirmedEthereum has fired off multiple bearish signals that traders and investors cannot ignore. A confirmed triple top on the daily chart suggests exhaustion at resistance, while the appearance of a hanging man candlestick pattern adds weight to the reversal thesis.

The daily RSI has confirmed a bearish divergence, and the MACD has officially crossed below the zero line—marking a shift in momentum and confirming bearish control.

In this video, I’ll break down:

• The triple top formation and its implications

• Why the 200 EMA is the next major support target

• The significance of RSI and MACD confirmations

• What traders should watch for in the coming sessions

This isn’t just noise—Ethereum’s technicals are flashing red. Make sure you’re prepared.

ALT season is here - this is huge, hugeETH is in an enormous symmetrical triangle on the weekly chart and its crossing upper line.

If the week finishes above 4000, nobody can stop this. Running to 6000 without stopping is almost certain.

After it needs to relax and the alt season will explode. This seems to be just a new life opportunity.

ETHUSD Long Setup: Targeting $4,000 After Bullish Reversal from ETH just swept the previous lows near $3,650–$3,700, clearing liquidity and flipping that zone into fresh support. This classic price action move often precedes expansion, and ETH looks primed for a continuation toward $4,000 in the coming sessions.

🧠 Technical Analysis

Previous Highs Swept: ETH took out the prior highs around $3,650–$3,700, trapping late shorts and grabbing liquidity.

Break of Structure: We've seen a clear bullish market structure form on the 4H and daily TFs, with higher highs and higher lows intact.

Support Zones:

$3,650–$3,700 (former resistance, now flipped support)

$3,550 (consolidation base before breakout)

Resistance Zones:

$3,950–$4,000 (psychological level + previous 2024 highs)

$4,100+ (weekly imbalance and potential extension zone)

Now that ETH has cleared short-term liquidity and confirmed demand on the retest, the path of least resistance appears to be up.

🔍 Fundamental Outlook

ETH ETF Narrative: Market anticipation for spot ETH ETF approval is heating up, boosting demand and institutional interest.

Reduced Sell Pressure: With the Shanghai upgrade long behind us, staking continues to increase, reducing circulating supply.

Macro Tailwinds: Risk-on sentiment in the broader market is aiding crypto momentum, especially for large-cap assets like ETH.

🎯 Target: $4,000

📉 Invalidated Below: $3,550 (if reclaimed by bears, invalidates bullish thesis)

The Unicorn Breakout – Regression, Madness & Meme Math🦄 The Unicorn Breakout – Regression, Madness & Meme Math

FX_Professor | July 14, 2025

🎨 Welcome to my world…

Some draw straight lines.

I draw quadratic regression channels, alien spirals, and unicorns.

Because sometimes, the market is not just math — it’s emotion, storytelling, and madness therapy.

This chart isn’t just analysis. It’s a prophecy. It’s a canvas.

It’s for the traders who still feel.

📈 What are we looking at?

🧠 The Setup:

- Quadratic Regression Channel: Anchored from the 2018 top, respected for over 7 years. ETH is bouncing off the midline like it heard destiny calling.

- Major Resistance: The $2,900–$3,100 zone is our historic ceiling. Marked as 1 – X – 2… and next, not maybe but SURELY the decisive number3? 🚨 (X stands for 'no touch' ie 'close but no cigar' - Look at my recent BTC 1-2-3 breakout posts!)

- My Golden Cross: Quietly forming support. Check that xx/Xxx Secret EMA crossover. Setup reserved as a little family secret destined to be passed on to my sons (and some of you!).

- Alien Spiral (not Fib 😉 ): A colorful vortex leading us toward areas of re-accumulation and expansion. ETH is now riding the 0.382 arc — and you know what that means...

🚀 Targets:

- $4,000 — First milestone and zone of psychological resistance

- $6,034 — Mid-regression line + historical extension

- $8,674 — Unicorn Target Zone. Meme ATH + Euphoric breakout + Regression logic

👽 The Floor:

$1,067 – $1,492 — Alien Support Range™. If we nuke, that’s where we land, in pain. That's when we apply for jobs at Taco Bell (at least i love the food there, i am prepared for that scenario too).

🦇✨ Ethereum Community — this might be your time.

Dear ETH fam...

This isn't hopium.

This is regression math meeting Breakout Structure.

ETH has reclaimed key levels, rotated capital is flowing, and Bitcoin dominance is peaking. . WAIT FOR MY ETHBTC ANALYSIS (ON SUPPORT AND REBOUNDING)

The Unicorn doesn't knock twice.

If Ethereum Season is real — this chart might age beautifully.

🤹 Why the chaos?

Because markets are art.

Because crypto is culture. (and yes it's also 90% shit, you will hear a lot about that when that time comes).

Because every emoji here has meaning:

🦄 = Imagination

👀 = Momentum watchers

👽 = Alternative thinking

🏈 = Painful resistances, mental and physical toughness builds champions. Patience Wins!

🥶 = Cold accumulation

🧑💻 = Professor mode

🐧❤️🔥🐤🦩 = Read below…

🧊 The Penguin Message

Bottom right, you’ll see a penguin family :

A penguin, a flamingo, a baby chick, and a blue heart.

That’s not just decoration — it’s the real alpha.

💙 The best blockchain is YOU.

👶 The best altcoins are your CHILDREN.

🧊 The best staking is your FAMILY.

Trade smart. Build cool stuff. But don’t forget to be a good human.

The charts will wait. But your people won’t.

Spend time wisely: Learn skills, invest in YOURSELF, enjoy moments with loved ones, make others smile, be that change in the world.... and if you don't have kids then what on earth are you doing?? Go get laid, now! You are ready, stop thinking, just Do It (disclaimer: unless you have 5 already, in that case pls invest in condoms)

Share this with someone who needs to see this. Or just save it as 'ETH season'.

FX Professor — out.

🦄📈👁️

#ETH #Ethereum #UnicornBreakout #CryptoArt #QuadraticRegression #Altseason #TradingView #ChartTherapy #BeAGoodHuman

$Eth Bearish Divergence Alert – Correction Ahead?#ETHUSDT is approaching the $4000 zone, but momentum indicators signal caution 🧨

🔸 Bearish divergence spotted on RSI – price making higher highs, while RSI makes lower highs

🔸 MACD is showing signs of weakening bullish momentum

🔸 Stochastic RSI reflects fading buyer strength, hinting at possible seller dominance

If correction plays out, key support zones to watch are $3000 – $3200 👀

That range may offer a bounce opportunity, but if broken, deeper downside is possible ⚠️

Trade wisely and always manage risk 🎯

#Ethereum #CryptoAnalysis #BearishDivergence #CryptoSignals