ETHEUR trade ideas

Handling Cup Formation on ETH daily chartCup and Handle formation is building up on ETH daily chart. It seems that current price drop is a part of Handle curve. Volume levels confirm the Cup formation declining along with the price, keeping it low on the base of the bowl and subsequently increasing. Only weak point here is the fact that begging of the formation doesn't correspond to price peak, nevertheless this is not mandatory is Cup and Handle technically can be produced at lower levels as well.

Currently handle is dipping into what previously was confirmed support zone.

If support will hold one more time we will see handle completed and potentially successful breakout that could send us as high as 200 euro resistance level, passing by heavy resistance around at 135-145 euro and 155-165 euro. If current support level will fail the we are falling back to test previously unconfirmed support level around 90 euro.

This information is provided for education purposes only.

Indicator set test - Let's predict the futureHeya,

I'm testing a set of indicators which I explained in this idea (click the bitch):

2h Chart:

MACD: Price is increasing but MACD builds lower lows -> Divergence -> bearish

StochRSI: positioned in the end of an upswing -> slighty bearish

RSI: in neutral zone -> neutral

CCI: upwards trend persists -> bullish

Ichimoku Cloud: bullish

Bears 1,5 : 2 Bulls

-> Bulls win this time

4h chart:

MACD: Price increasing, MACD Histogram building lower highs -> divergence -> bearish (also the 26MACD line (red) got cut from the 12MACD from above and it's already at a high level)

StochRSI: building lower lows while price is increasing -> Divergence -> bearish

RSI: going towards the overbought zone -> slightly bearish

CCI: neutral zone, but moving towards uptrend mark -> neutral

Ichimoku Cloud: Bullish

Bears 2,5 : 1 Bulls

The Bears win this time.

(Note: Price bounced off nicely at the pink trendline which could work as a further support)

1d Chart:

MACD: 12MACD crossed 26MACD from below and below the 0-line; Histogram is mot likely at it's current wave peak - hard to tell -> neutral

StochRSI: at a very high level in the overbought zone, will drop most likely -> slightly bearish

RSI: in neutral zone, but increasing -> slightly bullish

CCI: in neutral zone -> downward trend finished -> neutral

Ichimoku Cloud: Bearish

Bears 1,5 : 0,5 Bulls

The Bears win this time.

Additional Info:

In the 4h chart is saw that the volume dropped which could support the bears because the bulls have no support.

Result: It's quite hard to tell. According to the indicators set and the dropping volume I'd say the price will drop over the next few days.

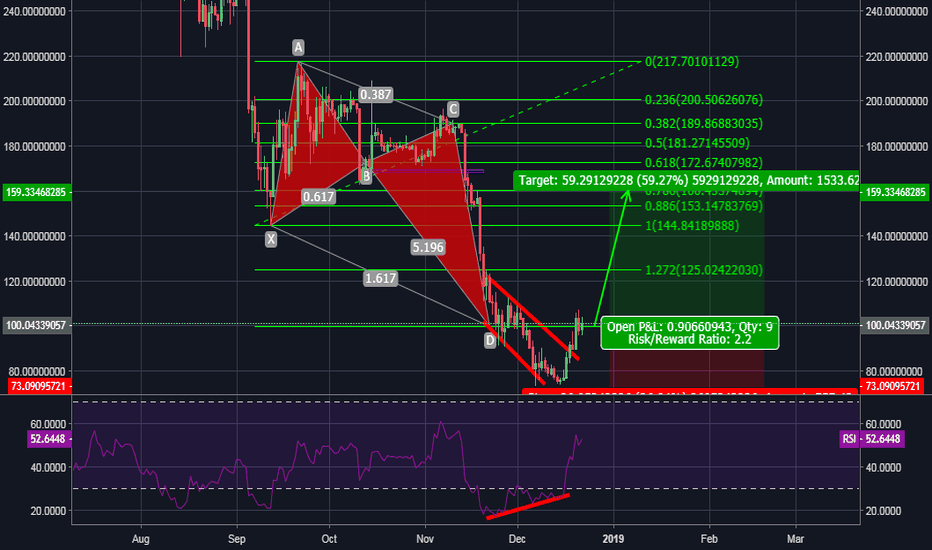

ETHEUR expectation Daily chartPrice shows a bullish Crab pattern and a clear RSI divergence showing a weakening bearish trend. for a Buy at actual price 100 euro , Take profit at 160 EUR and SL at 73 EUR you get a RR ratio of 2.2 .

Disclaimer This post is for educational purpose only and does not represent any solliciation to invest , buy or sell.

Short ethereum assuming parallelity and Impulse wave completionEthEur completed five Elliot waves with bearish RSI divergence. Volume spike during the ending fifth wave. Upper channel border was hit at the top of the move. Assuming channel parallelity and utilizing Fibonacci retracement our short target is between 91.02 and 95.57 EUR.

Are we bottomed yet? Don´t think so But. But... EURWell we need to noticed the volume on COINBASE:ETHEUR since 14th november.

So personally as a newbie i think we didn't found the bottom yet regards how markets works. Well but my thoughts are that big short need a better price to reload so lets restore the people confidence to load shorts at higher price.

It's important to notice that the herd (myself included) need to believe in a long bull run put savings and move funds so the market can turn..

For now that are my COINBASE:ETHEUR targets..

So never forget DYOD... Peace..

OwlTraders always awake on the markets movements.

Are we bottomed yet? Don´t think so But. But... EURWell we need to noticed the volume on COINBASE:ETHEUR since 14th november.

So personally as a newbie i think we didn't found the bottom yet regards how markets works. Well but my thoughts are that big short need a better price to reload so lets restore the people confidence to load shorts at higher price.

It's important to notice that the herd (myself included) need to believe in a long bull run put savings and move funds so the market can turn..

For now that are my COINBASE:ETHEUR targets..

So never forget DYOD... Peace..

OwlTraders always awake on the markets movements.

Are we bottomed yet? Don´t think so But. But... EURWell we need to noticed the volume on COINBASE:ETHEUR since 14th november.

So personally as a newbie i think we didn't found the bottom yet regards how markets works. Well but my thoughts are that big short need a better price to reload so lets restore the people confidence to load shorts at higher price.

It's important to notice that the herd (myself included) need to believe in a long bull run put savings and move funds so the market can turn..

For now that are my COINBASE:ETHEUR targets..

So never forget DYOD... Peace..

OwlTraders always awake on the markets movements.

Head and Shoulders coming?Potential Head and Shoulders reversal formation... I'm waiting for the right shoulder for confirm the pattern and enjoy it ;D! If you want take a little risk buy now and put a Stop Loss under the Head... you have a lot of chanche to win a big trade in the next months (possible Target 300 EUR).

Merry Christmas.

Maybe double bottom, breakout or big shout out.We can have the 5th end wave from fibonnaci and possible double top. But if the bulls it will be in action we can also break out.

A good key level to be sure on which direction we can go.

From my point of view the volume it's down, we will see the next couple of hours the sentiment.

Thanks!

Ethereum - Perfect Harmony [reversal in time and space]Experimental Chart

- The Bottom -

The bottom here is measured with the fibonacci retracement tool as well as other factors such as historical support zones, measured distances for bearish targets and fibonacci time - they all coincide.

A Fibonacci retracement is a term used in technical analysis that refers to areas of support (stops going lower) or resistance (stops going higher). Fibonacci retracement levels use horizontal lines to indicate areas of support or resistance at the key Fibonacci levels before the trend continues in the original direction.

The measured bottom has two levels:

115-107€ and 72-67€ which is less likely but still possible.

- The Confluence -

If the 'falling wedge' plays out and respect the mesurements for the 'predicted bottom' - which coincidentally also is very close to the the 'fibonacci retracement' and the 'fibonacci arc'.

Then this zone will meet the bullish sinus and intersect with the respective resistances in this fibonacci time.

This gives us two plausible targets of:

1491€ high and 1220€ low

ETH Divergence building upAs my previous major analysis still stands:

We are now approaching the pivot for the reversal,

immediate drop to the major support, i'm expecting a swift move down straight to 85€ with a weak bullish response that will push us further down the drain, the final target from my previous analysis still remains valid, and is projected here on this chart.

Mid 70 to low 60 euro is where i expect a angry bull to step in and give the bears bit of smacking.

Another thing i noticed is that the trendline of my experimental chart high frequency 2.0 where we got the initial bounce off, is interestingly enough aligning at the very same target range if we would get a aggressive drop, around 73€.

In my wyckoff analysis i came to the conclusion:

Comment: Just FYI as i mentioned earlier, the recent low of 88€ could be one of the secondary tests, which means it's possible that we will have another dip. We need to see more followthrough here.

All clues, including my fractal analysis on the pennants in this bear markets are solidifying my conclusion.

Any attempt to rally of here will be stopped out at either triangular trendlines (98-101€) , if we happen go sideways outside of the triangle then expect a later break to the downside, we have seen this happen and people gets baited in.

As we continue to build up the divergence we will pop off when we hit my downside target and have a change in momentum with a larger upside.

First of we need to see how the price responds at the trendlines and my bottom that i have drawn out.