ETHFIUSDT 1D#ETHFI has formed a bull flag on the daily chart, and we expect an upside move soon as it approaches the daily SMA100.

In case of a breakout above the flag, the potential targets are:

🎯 $1.507

🎯 $1.701

🎯 $1.948

🎯 $2.262

🎯 $2.426

⚠️ As always, use a tight stop-loss and apply proper risk management.

ETHFIUSDT trade ideas

ETHFI/USDT — Symmetric Triangle at the Decision Point!The chart shows a symmetric triangle pattern (descending resistance + ascending support) approaching its apex. Price is currently testing the descending resistance area around 1.25 (red label) — a major decision point. Key horizontal targets/support levels are already marked on the chart (yellow).

---

Pattern Description

* Pair: ETHFI / USDT, 2-Day timeframe.

* Previous long-term trend: bearish (descending resistance line from the left).

* After bottoming near \~0.32–0.40, price formed higher lows (rising support) and lower highs (falling resistance) → creating a symmetric triangle / wedge.

* Volume typically contracts as the pattern nears the apex — this is a neutral-to-continuation pattern: often continues in the prior trend (bearish) but can also break upward strongly if there’s a catalyst.

---

Key Levels

Resistance / Upside targets:

* 1.250 — near-term resistance (↑ +6.4%).

* 1.784 — next major (↑ +51.8%).

* 2.390 (↑ +103.4%).

* 2.959 (↑ +151.8%).

* 5.024 (↑ +327.6%).

* 7.001 (↑ +495.8%).

* 8.660 (High, ↑ +637.0%).

Support / Downside levels:

* 0.850 (↓ −27.7%).

* 0.650 (↓ −44.7%).

* 0.500 (↓ −57.4%).

* 0.400 (↓ −66.0%).

* 0.320 (↓ −72.8%).

---

BULLISH Scenario (if breakout occurs):

* Breakout confirmation: 2D candle close above the descending resistance line + above 1.250, with increased volume. Ideally, a retest as support after the breakout.

* First target: 1.784 (conservative TP). If momentum is strong: 2.39 → 2.959.

* Risk management: stop loss below breakout candle or below the rising support line (e.g., entry at 1.30, stop \~1.00–1.05). Use position sizing to keep per-trade risk small (1–3% of capital).

* Significance: a break above will signal a potential *trend reversal* from long-term downtrend to accumulation/uptrend.

BEARISH Scenario (if breakdown occurs):

* Breakdown confirmation: 2D candle close below the rising support line with increased sell volume; failed retest confirms weakness.

* First target: 0.850. If selling pressure continues: 0.65 → 0.50 → 0.32.

* Risk management: if shorting, stop above retest/resistance (or above 1.25 if a failed breakout).

* Significance: since the prior long-term trend is bearish, a breakdown has high probability of trend continuation to the downside.

---

Trade Ideas

* Conservative: set alerts for 2D close > 1.25 + higher volume; partial entry, partial TP at 1.78, trail the rest.

* Aggressive: enter on breakout & retest of resistance as support.

* Bear setup: short after confirmed close below rising support & failed retest; target 0.85 first.

---

Technical & Psychological Notes:

* Pattern is very close to the apex → large move likely within the next few weeks on the 2D chart.

* Volume & candle close are key to avoid chasing fake breakouts.

* Also watch general crypto sentiment & news catalysts as they can trigger breakouts against the technical bias.

#ETHFI #Crypto #TechnicalAnalysis #Triangle #Breakout #SupportResistance #Altcoins #CryptoTrading #BullBear

ETHFI Bullish DivergenceBINANCE:ETHFIUSDT

Trade Setup:

Target 1: 1.054 (0.786 Fibonnaci Golden Zone).

Target 2: 1.130 (0.618 Fibonnaci Golden Zone).

Target 3: 1.184 (0.786 Fibonnaci Golden Zone).

Target 4: 1.410 (0 Fibonnaci).

Stop Loss: 0.835 (1.272 Fibonnaci).

RSI Analysis: The RSI is showing a bullish divergence, suggesting potential bullish momentum. The current RSI is around 22.36, approaching oversold territory, so caution is advised.

ETHFI ANALYSIS🔮#ETHFI Analysis 💰💰

#ETHFI is trading in a symmetrical triangle in a weekly time frame and if it breakouts with high volume then we can see a bullish momentum in #ETHFI. Before that we will see little bit bearish movement towards its support zone and that a bullish movement.

🔖 Current Price: 1.218

⏳ Target Price: $1.608

⁉️ What to do?

- We can trade according to the chart and make some profits in #ETHFI. Keep your eyes on the chart, observe trading volume and stay accustom to market moves.💲💲

🏷Remember, the crypto market is dynamic in nature and changes rapidly, so always use stop loss and take proper knowledge before investments.

#ETHFI #Cryptocurrency #Pump #DYOR

ETHFI/USDT Chart Analysis - Bullish Breakout Potential

Looking at the ETHFI /USDT chart, we’re seeing a potential bullish breakout forming. After a strong downtrend, price has recently broken the resistance trendline, indicating a possible upward movement. A target of $1.60 (approx. 24% upside) is in sight if the price holds above the trendline.

Key Points:

Breakout above resistance: A strong push above the trendline could signal further upside.

Target Level: $1.60 (24.26% increase).

Momentum: ETH has been showing strength, so keep an eye on confirmation for entry points.

As always, manage your risk and consider the broader market conditions before entering.

ETHFI Coil Tightens Above Key SupportThis is ETHFI on the daily.

It’s currently consolidating above four major support levels:

• The black line at $1.097

• The 200-day MA

• The 50-day MA

• Bollinger Band center

A golden cross is approaching, and if price pushes higher, it could confirm soon. RSI is holding strong above both the 50 level and the signal line, suggesting bullish momentum is intact.

There’s also a bullish triangle forming between the series of lower highs and the $1.097 black line. Volume is decreasing, just as expected before a breakout. While breakouts can technically go either way, my bias remains bullish here.

From a fundamental standpoint, ETHFI benefits from the rising trend of restaking staked ETH, now regulated and attracting serious institutional interest.

Holding this support and completing the golden cross could be a volatile process, especially with ETHFI’s small $424M market cap and big macro events this week (like CPI and potential tariff news) on the radar.

Always take profits and manage risk.

Interaction is welcome.

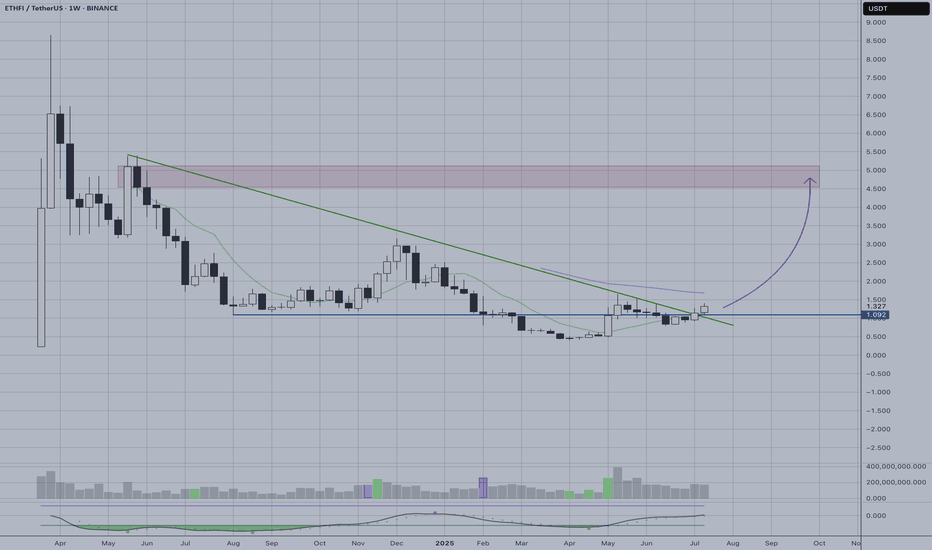

ETHFI | Trendline BreakoutETHFI on the weekly timeframe shows a significant bullish breakout after successfully breaking above the long-term descending trendline resistance that had been capping price action for months. This breakout represents a major shift in market structure and suggests the extended downtrend may be ending.

Key Technical Points:

Clean break above descending trendline resistance

Volume appears supportive of the breakout move

Potential Targets:

Initial resistance zone around $4.5 (red shaded area)

Higher targets possible if momentum sustains

Risk Considerations:

Weekly timeframe moves take time to develop

A false breakout could see price return below trendline

Overall crypto market sentiment remains crucial

The breakout setup offers favorable risk-to-reward for longer-term positioning, though traders should monitor for sustained momentum above the trendline to confirm the reversal.

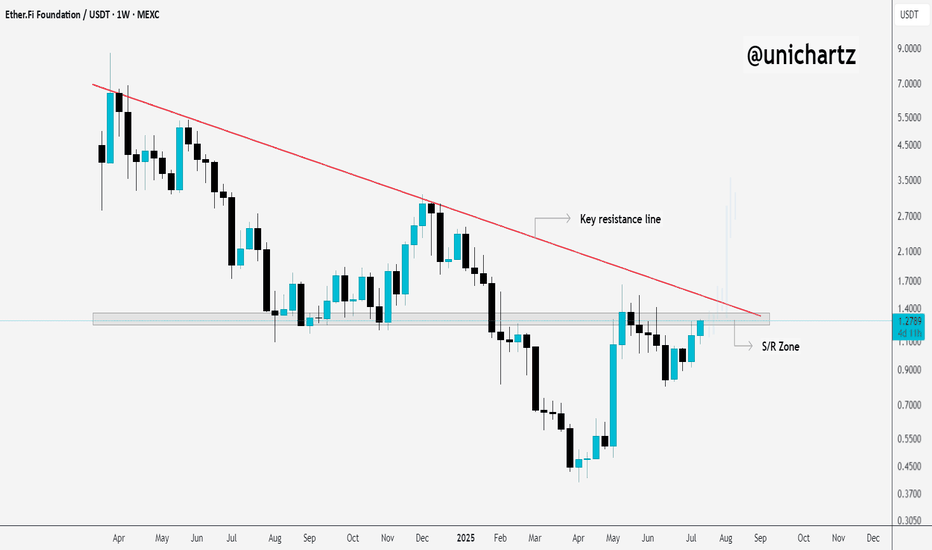

ETHFI Bulls Need to Flip This Level for Upside ContinuationCRYPTOCAP:ETHFI is still hovering around the key S/R zone and trading just below the major trendline resistance on the weekly timeframe.

This area has been a strong rejection point in the past, so it’s a crucial level to watch.

If we get a clean breakout and weekly close above this zone, it could trigger a breakout from the long-term downtrend, potentially kicking off a fresh bullish move.

Keep a close eye. A decisive move is coming.

DYOR, NFA

ETHFI Key Reclaim Watch — Only Long Above $1.09 Confirmation✅ Price currently below major 1D S/R — no bullish bias yet

✅ Only looking for a long entry after confirmed reclaim of $1.09

✅ Structure remains bearish until then

Primary Scenario (Bullish):

Enter long only after confirmed reclaim/close above $1.09

Targets: Move to upper range ($2.76) on strength

Bearish/Flat Scenario:

If price fails to reclaim $1.09, no position — stay sidelined

🔔 Triggers & Confirmations:

Only long above $1.09 with confirmation (candle close, volume spike, or strong reclaim)

No trade below $1.09

🚨 Risk Warning:

Structure remains bearish below $1.09 — avoid bottom picking or forced trades

ETHFI/USDT – BREAKOUT ALERT! Descending Trendline Under Pressure

After over a year of relentless bearish pressure, ETHFI is now approaching a critical technical juncture that could mark the beginning of a major trend reversal. The chart displays a long-term descending trendline, and bulls are now challenging it with growing strength. This setup could lead to a powerful breakout and a potential trend shift.

🧩 Technical Pattern Overview:

🔸 Descending Trendline Resistance – Established since April 2024, acting as a dominant resistance across multiple retests.

🔸 Base Accumulation – Price has formed a strong base between $0.80–$1.00, indicating declining selling pressure and potential accumulation.

🔸 Volatility Squeeze – Price action is tightening near the apex of the descending triangle, suggesting that a breakout (up or down) is imminent.

🔸 Breakout Watch – A confirmed breakout above $1.25 would be a major bullish signal.

🐂 Bullish Scenario (Confirmed Breakout):

If the price breaks and closes above $1.25 with strong volume:

🎯 Potential Upside Targets:

Target 1: $1.784 – Previous local resistance

Target 2: $2.390 – Former consolidation zone

Target 3: $2.959 – Key psychological resistance

Extended Targets: $5.024 and $7.001 if a sustained rally unfolds

Ultimate ATH: $8.660 – If the broader crypto market enters full bullish mode

💡 Catalysts to Watch: Altseason, project news, favorable macro sentiment, or exchange listings.

🐻 Bearish Scenario (Rejection at Resistance):

If ETHFI fails to break out and gets rejected at the descending trendline:

🔻 Potential Downside Levels:

$1.088 – Immediate support

$0.88 – Minor support

$0.70 – Historical support zone

$0.50 to $0.35 – Deeper bearish targets if selling resumes

⚠️ Fakeouts are common during volatile phases — always wait for confirmation with volume.

📌 Conclusion & Strategy:

ETHFI is at a make-or-break level. A confirmed breakout could trigger a strong upward rally with high risk/reward potential. However, failure to break resistance could lead to continued consolidation or even downside.

🔍 Traders should watch for a clean breakout above $1.25, preferably with high volume. Risk management is key — define your invalidation levels and stick to your plan.

🧠 Trading Recommendations:

🟢 Breakout traders: Wait for confirmation > $1.25

🟡 Accumulate: Between $0.90–$1.00

🔴 Stop-loss: Below $0.85 for conservative risk

📈 Risk/Reward after breakout: Attractive (1:3 or better)

#ETHFI #ETHFIUSDT #CryptoBreakout #DescendingTrendline #AltcoinAnalysis #TechnicalAnalysis #BreakoutTrading #CryptoSignals #BullishReversal

Buy Trade Strategy for ETHFI: Tapping Into the Future of ETH Title:

Buy Trade Strategy for ETHFI: Tapping Into the Future of Ethereum Restaking

Description:

This trading idea is centered on ETHFI, the governance token of the EtherFi protocol, a rising player in the Ethereum liquid restaking ecosystem. ETHFI empowers users to participate in the decentralized governance of EtherFi while benefiting from innovative staking models that unlock liquidity for staked ETH. As Ethereum continues to evolve post-merge, protocols like EtherFi aim to maximize staking efficiency and accessibility, making ETHFI an integral part of the Ethereum restaking narrative. Its unique position in this emerging sector, coupled with increasing adoption and ecosystem development, suggests strong long-term potential.

Nevertheless, the crypto market remains highly volatile, and investments in tokens like ETHFI carry inherent risks influenced by regulatory decisions, protocol upgrades, and broader market dynamics. Prudent risk management and informed decision-making are crucial when engaging with early-stage governance assets.

Disclaimer:

This trading idea is for educational purposes only and should not be considered financial advice. Cryptocurrencies, including ETHFI, involve a high degree of risk and may result in total loss of capital. Always conduct your own research, consider your financial situation, and consult a licensed financial advisor before making any investment decisions. Past performance is not a reliable indicator of future results.

ETHFI _ just went Long reading the waves and Speed IndexReading the recent history of the waves (annotations in sync with the chart):

1. Support

2. Huge volume on PVR indicator at the bottom (buyers)

3. Abnormal Speed Index 55.7 on the down wave , that's Hard to Move Down , more buyers

4. Finally the Entry on a PRL signal.

Enjoy!

PS. I have no idea what this ETHFI crypto is, I just analyzed the chart and it looked like a high probability trade.

ETHFIUSDT Breakout Loading!CRYPTOCAP:ETHFI is consolidating within a symmetrical triangle on the 4H chart, with price tightening between descending resistance and rising support. A breakout or breakdown is likely soon. Watch for volume confirmation. Key levels to watch: $1.35 (resistance) and $1.00 (support). Breakout could lead to $1.50+, while breakdown risks a drop toward $0.95.

ETHFI/USDT10 hours ago

Key Level Zone: 1.1560 - 1.1630

LMT v1.0 detected.

The setup looks promising—price previously trended upward with rising volume and momentum, then retested this zone cleanly. This presents an excellent reward-to-risk opportunity if momentum continues to align.

Introducing LMT (Levels & Momentum Trading)

- Over the past 3 years, I’ve refined my approach to focus more sharply on the single most important element in any trade: the KEY LEVEL.

- While HMT (High Momentum Trading) served me well—combining trend, momentum, volume, and structure across multiple timeframes—I realized that consistently identifying and respecting these critical price zones is what truly separates good trades from great ones.

- That insight led to the evolution of HMT into LMT – Levels & Momentum Trading.

Why the Change? (From HMT to LMT)

Switching from High Momentum Trading (HMT) to Levels & Momentum Trading (LMT) improves precision, risk control, and confidence by:

- Clearer Entries & Stops: Defined key levels make it easier to plan entries, stop-losses, and position sizing—no more guesswork.

- Better Signal Quality: Momentum is now always checked against a support or resistance zone—if it aligns, it's a stronger setup.

- Improved Reward-to-Risk: All trades are anchored to key levels, making it easier to calculate and manage risk effectively.

- Stronger Confidence: With clear invalidation points beyond key levels, it's easier to trust the plan and stay disciplined—even in tough markets.

Whenever I share a signal, it’s because:

- A high‐probability key level has been identified on a higher timeframe.

- Lower‐timeframe momentum, market structure and volume suggest continuation or reversal is imminent.

- The reward‐to‐risk (based on that key level) meets my criteria for a disciplined entry.

***Please note that conducting a comprehensive analysis on a single timeframe chart can be quite challenging and sometimes confusing. I appreciate your understanding of the effort involved.

Important Note: The Role of Key Levels

- Holding a key level zone: If price respects the key level zone, momentum often carries the trend in the expected direction. That’s when we look to enter, with stop-loss placed just beyond the zone with some buffer.

- Breaking a key level zone: A definitive break signals a potential stop‐out for trend traders. For reversal traders, it’s a cue to consider switching direction—price often retests broken zones as new support or resistance.

My Trading Rules (Unchanged)

Risk Management

- Maximum risk per trade: 2.5%

- Leverage: 5x

Exit Strategy / Profit Taking

- Sell at least 70% on the 3rd wave up (LTF Wave 5).

- Typically sell 50% during a high‐volume spike.

- Move stop‐loss to breakeven once the trade achieves a 1.5:1 R:R.

- Exit at breakeven if momentum fades or divergence appears.

The market is highly dynamic and constantly changing. LMT signals and target profit (TP) levels are based on the current price and movement, but market conditions can shift instantly, so it is crucial to remain adaptable and follow the market's movement.

If you find this signal/analysis meaningful, kindly like and share it.

Thank you for your support~

Sharing this with love!

From HMT to LMT: A Brief Version History

HM Signal :

Date: 17/08/2023

- Early concept identifying high momentum pullbacks within strong uptrends

- Triggered after a prior wave up with rising volume and momentum

- Focused on healthy retracements into support for optimal reward-to-risk setups

HMT v1.0:

Date: 18/10/2024

- Initial release of the High Momentum Trading framework

- Combined multi-timeframe trend, volume, and momentum analysis.

- Focused on identifying strong trending moves high momentum

HMT v2.0:

Date: 17/12/2024

- Major update to the Momentum indicator

- Reduced false signals from inaccurate momentum detection

- New screener with improved accuracy and fewer signals

HMT v3.0:

Date: 23/12/2024

- Added liquidity factor to enhance trend continuation

- Improved potential for momentum-based plays

- Increased winning probability by reducing entries during peaks

HMT v3.1:

Date: 31/12/2024

- Enhanced entry confirmation for improved reward-to-risk ratios

HMT v4.0:

Date: 05/01/2025

- Incorporated buying and selling pressure in lower timeframes to enhance the probability of trending moves while optimizing entry timing and scaling

HMT v4.1:

Date: 06/01/2025

- Enhanced take-profit (TP) target by incorporating market structure analysis

HMT v5 :

Date: 23/01/2025

- Refined wave analysis for trending conditions

- Incorporated lower timeframe (LTF) momentum to strengthen trend reliability

- Re-aligned and re-balanced entry conditions for improved accuracy

HMT v6 :

Date : 15/02/2025

- Integrated strong accumulation activity into in-depth wave analysis

HMT v7 :

Date : 20/03/2025

- Refined wave analysis along with accumulation and market sentiment

HMT v8 :

Date : 16/04/2025

- Fully restructured strategy logic

HMT v8.1 :

Date : 18/04/2025

- Refined Take Profit (TP) logic to be more conservative for improved win consistency

LMT v1.0 :

Date : 06/06/2025

- Rebranded to emphasize key levels + momentum as the core framework

ETHFI last dip buyBINANCE:ETHFIUSDT remains one of the strongest ETH beta plays since the April bottom. After a clear impulse move and consolidation, price swept into a key 1D order block cluster, now acting as support.

Setup:

🟩 Key Support: $1.09–1.24 (1D OB cluster)

• Structure remains bullish above this zone

• Recent sweep confirmed as a last dip buy opportunity

• Higher lows and clean defense → continuation likely

📌 Wave Structure Suggests Ongoing Expansion

• Wave (4) completed on OB retest

• Next move (wave 5) targets new local highs if $1.24 holds

🎯 Targets:

• First resistance: $1.60

• Extension: $2.50–3.00+ (mid-range of former distribution zone)

Plan:

• Long bias above $1.09

• Accumulate dips on intraday structure above the OB

• Exit bias only on daily close below $1.09

ETHFIUSDT breakdown alertETHFIUSDT breakdown alert

ETHFIUSDT has broken down from a triangle pattern and appears to have completed a retest of the breakdown zone. If the price fails to reclaim this level and continues to reject it, we could see further downside pressure in the coming sessions.

Key levels to monitor:

– Breakdown zone now acting as resistance

– Immediate support below

– Volume confirmation to validate the move

Watch ETHFI closely — if the retest holds, it may lead to continued bearish momentum.

ETHFI (swing setup) — Retest in Progress Eyes on Sweep & ReclaimBINANCE:ETHFIUSDT is retesting a key breakout zone after a strong rally. Current structure suggests a possible swing long setup forming, contingent on a liquidity sweep below $0.97 and a clean reclaim.

Entry Criteria:

🟩 Retest Zone: $0.97–1.02

Looking for a sweep below $0.97 followed by a reclaim and bullish confirmation for entry.

❗ Invalidation: Close below $0.75 cancels the setup — indicates structural breakdown.

🎯 Target: $3.12+

Aiming for the top of the previous range — a 200%+ move if the reclaim holds.

📌 Big moves come from big levels — timing the reclaim is key.