ETHEREUM Stock Chart Fibonacci Analysis 031125Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 1800/61.80%

Chart time frame: D

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress: C

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) 61.80% support

D) Hit the bottom

E) Hit the top

Stocks rise as they rise from support and fall from resistance. Our goal is to find a low support point and enter. It can be referred to as buying at the pullback point. The pullback point can be found with a Fibonacci extension of 61.80%. This is a step to find entry level. 1) Find a triangle (Fibonacci Speed Fan Line) that connects the high (resistance) and low (support) points of the stock in progress, where it is continuously expressed as a Slingshot, 2) and create a Fibonacci extension level for the first rising wave from the start point of slingshot pattern.

When the current price goes over 61.80% level , that can be a good entry point, especially if the SMA 100 and 200 curves are gathered together at 61.80%, it is a very good entry point.

As a great help, tradingview provides these Fibonacci speed fan lines and extension levels with ease. So if you use the Fibonacci fan line, the extension level, and the SMA 100/200 curve well, you can find an entry point for the stock market. At least you have to enter at this low point to avoid trading failure, and if you are skilled at entering this low point, with fibonacci6180 technique, your reading skill to chart will be greatly improved.

If you want to do day trading, please set the time frame to 5 minutes or 15 minutes, and you will see many of the low point of rising stocks.

If want to prefer long term range trading, you can set the time frame to 1 hr or 1 day.

ETHHEDGEUSD trade ideas

Ethereum $ETH Accumulation Analysis

🔸 Key Support Zone at $1,500 - $1,900:

Ethereum is currently testing a crucial support zone. Historically, this range has provided strong demand, making it an ideal area for long-term accumulation.

🔸 Upside Target: $3,500 - $4,500

If ETH holds this zone and reverses, a breakout above $2,200 could trigger a strong bullish move towards $3,500 and beyond.

🔸 Risk Level at $1,400:

A clean breakdown below $1,400 would invalidate the bullish setup and could lead to further downside.

🔸 Action Plan:

Start accumulating ETH between $1,900 - $1,500 using a DCA strategy.

Wait for a breakout above $2,200 for confirmation of strength.

A dip below $1,400 should prompt risk reassessment.

This setup offers a high-reward potential, but patience and risk management are key.

ETHEREUM CRASH TO $786! (UPDATE)Remember my Ethereum sell prediction from September 2024? Despite it pushing a little higher, price has remained within the trendlines & bearish channel, keeping its trend in a 'downtrend'.

We're still within a 3 Sub-Wave (A,B,C) corrective channel, with the current bearish move down being Wave C. Wave C target still remains around $786🩸

ETH - kiss of death repeating pattern confirmed - now what?Fact: Every time in history that we have closed a breakthrough candle on the monthly chart through the 21 SMA on ETHUSD, we have entered a bear market.

Fact: We did just that with February's monthly candle.

The same exact pattern has repeated 3x already.

Will this be any different this time?

ETH Bullish in the short term, bearish in the medium termThe five upward steps were completed some time ago and we entered three downward steps. The first downward step is over and we must wait for the price to grow to 2730, which is a heavy resistance, and then enter the third step, which is a decline to 1055, which is a strong support.

ETH(based on NEo wave)This supercycle is a nice nature triangle which E wave is ending and its look like a diamon diametrical.

so I will update it for the confirmation, I think ALTseason is so close and we can see that happening soon but this season take about 400 to 450 days and after that there is a huge CRASH!

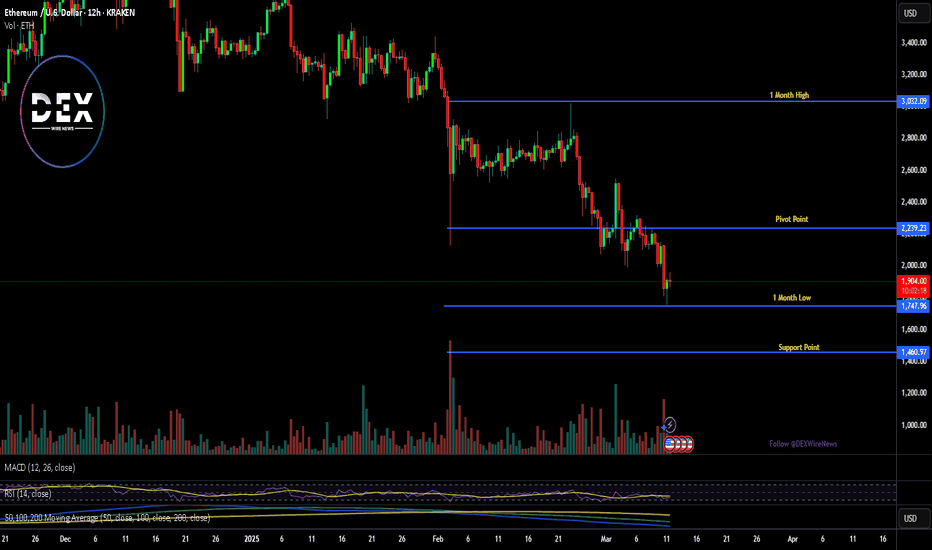

Breaking: Ethereum Dips 9% Today losing the $2k Price LevelEthereum today saw a noteworthy downtick with the asset dipping below the $2000 pivot zone. currently trading around the $1900 - $1700 price zones.

Ethereum is currently oversold as depicted by the Relative Strength Index (RSI) at 36. The 1-month low is acting as support point for Ethereum. Should selling pressure continue, CRYPTOCAP:ETH might tanked to $1000- 1400 price levels.

However, in the case of a price reversal, a break above the 65% Fibonacci retracement level could placed CRYPTOCAP:ETH on the cusp of a bullish spree.

Despite the bloodbath facing Ethereum albeit the general crypto landscape facing same, data from DefiLlama hints at a growing Defi landscape in the Ethereum blockchain with about $45.43 billion locked in Total Value Lock (TVL) and the volume growing in tandem with the TVL locked.

Presently up 2% trading at $1905 price point all eyes are set on the major pivots we mentioned above.

Bullish ETHUSD Long (long term) PennantBack in 2017 during the bull run we saw ETH break out of the Pennant to form a new ATH after rising ~300% from the point of break out of the pennant.

This is not a financial advice, but my view is that all market conditions allowing (since ETH isn't likely to soar up alone when BTC and other major top 10 coins are falling), that Eth will do a similar 300% rise to $12,000~$13,000 USD in the next coming years.

This was formulated based on Weekly chart pattern so this is going to be far out in the future but I just wanted to share my thoughts and call it out to see if I'm right or wrong in the future.

TP $12,000 (I would personally would break down TPs into 2-4 points, taking profit each levels, most of the time based on fibonacci retracement levels)

SL $1800

----

P.S. to my future self:

RSI, MACD, Volume not carefully taken into account.

You think that the price would reach around 2026 Sep.

You think we're at the spring of Wyckoff accumulation/Distribution cycle.

You are also weary about the little break out to the bottom which might be already signaling a bearish breakout, you are also worried about the lack of volume in the past year during these price action which also indicates a bearish, but you decided to set a stop loss and see it as a mega bullish trend on its way and banking on 2017 pattern to repeat in the coming years, trumping the bearish sentiment

Ethereum at Key Support: Will it bounce to 2,800$?COINBASE:ETHUSD price is moving inside a clear ascending channel , with the upper boundary acting as long-term resistance and the lower boundary providing dynamic support. After a steady climb, the price started showing weakness, confirmed by a head and shoulders pattern, a common sign that the trend might reverse. This led to a strong drop, bringing the price down to a key support zone around $2,000.

This support area is important because it meets with a major trendline, making it a likely spot where buyers could step in. The volume profile also shows a lot of activity in this zone, meaning traders have been interested in these levels before. If the price holds above this support, there’s a good chance it could bounce towards $2,800, which lines up with a previous resistance.

A breakdown below the trendline shifts the bias bearish toward 1,414. For now, as long as Ethereum stays above the support zone, a recovery toward $2,800 is on the table. But if it falls below, the bearish trend is likely to continue.

Just my take on support and resistance zones, not financial advice. Always confirm your setups and trade with solid risk management.

Ethereum will move to the upside1. Current Price and Context

The current price of ETHUSD is $1,848.22, as indicated by the red label at the bottom right of the chart.

This price represents a significant decline from earlier highs, suggesting a corrective phase following a prior uptrend.

2. Price Movement and Trend

The chart shows a sharp upward movement starting in early 2024, with the price reaching a high near $4,000 (orange horizontal line).

After this peak, the price entered a correction phase, dropping steadily. The downward movement is marked by a descending triangle pattern, a bearish continuation pattern characterized by lower highs and a flat or slightly declining lower trendline.

The upper trendline of the descending triangle slopes downward, while the lower support level was initially around $2,100 (orange horizontal line labeled "Correction").

3. Breakdown and Support Levels

The price has recently broken below the $2,100 support level, which could indicate a continuation of the bearish trend or a potential exhaustion point.

The current price of $1,848.22 is near a significant low, with the chart suggesting this as an "Opportunity to go for long" (yellow annotation). This implies that some traders might see this as a potential reversal point to enter a long position, anticipating an upward move.

4. Potential Targets and Resistance

The chart projects a potential upside target near the previous high of $4,000 if the price reverses and breaks out of the descending triangle pattern.

The vertical orange line at $4,071 suggests a psychological or technical resistance level that the price approached earlier in the trend.

5. Technical Observations

Descending Triangle: This pattern often signals a continuation of a downtrend unless a strong bullish reversal occurs. The breakdown below $2,100 supports the bearish case, but the current low at $1,848.22 could act as a support zone if buying interest emerges.

Volume (not shown): Without volume data, it’s hard to confirm the strength of the breakdown or potential reversal. Typically, a breakout with high volume would carry more significance.

Timeframe: The 12-hour chart suggests this is a medium-term analysis, suitable for swing traders looking for opportunities over days or weeks.

6. Possible Scenarios

Bullish Scenario: If the price holds above $1,848.22 and starts to recover, it could test the $2,100 level again. A break above $2,100 with strong momentum might signal a return to the $4,000 range, aligning with the "Opportunity to go for long" annotation.

Bearish Scenario: If the price fails to hold $1,848.22 and continues to decline, it could test lower support levels (e.g., $1,500 or below), indicating further correction.

ETHEREUM CRASH TO $786! (UPDATE)Remember my ETH short bias from last September? Despite it pushing up a little, price has remained within the trendlines & bearish channel, keeping its main trend in a 'downtrend'.

We are still within a 3 Sub-Wave (A,B,C) corrective channel, with the current bearish move down being Wave C. Wave C target still remains around $786🩸

Short Trade at Ethereum executed Strong signal received on ETH which shows a Profit Factor of 4.00 in Short Trading at the 15min timeframe. The trade was open for 45min and the Exit was placed at a very nice spot.

Would you like to receive such sort of signals in realtime? Tell me in the comments and follow for more!

Ethereum's Potential Bottom: Could $5000 Be Next?Ethereum has experienced a significant 56% drop over the last 84 days. Has ETH found its bottom, or is more downside ahead? Let's break it down.

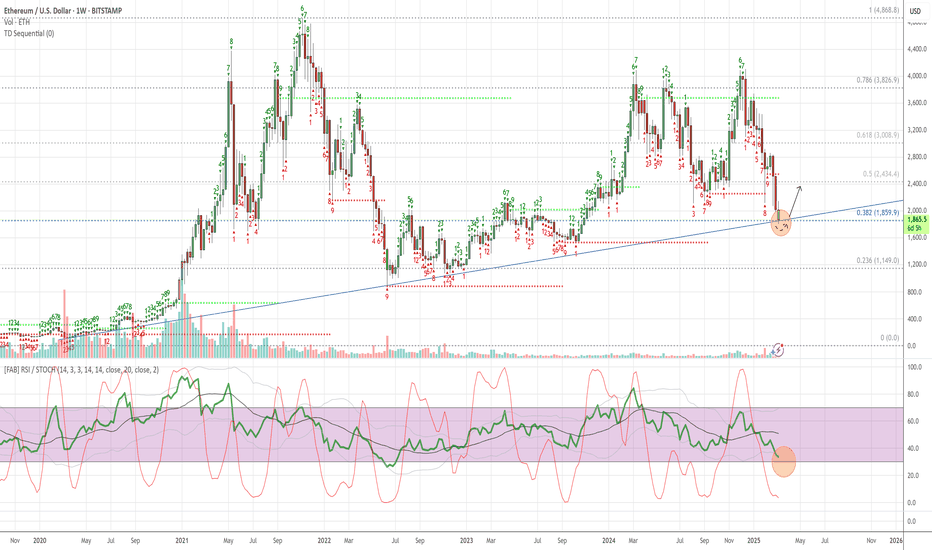

🔹 Fibonacci Retracement from October Low (2023) to December High (2024)

Starting with the Fibonacci retracement from the low of $1520.85 on 12th October 2023 to the high of $4109 on 16th December 2024, ETH recently hit the 0.886 Fib retracement at $1815.9 and saw a bounce. This area aligns with the Point of Control (POC) from previous price action, a potential signal that this could be a major support zone.

However, the real question is whether this is the final bottom, or if ETH will retest lower levels.

🔹 Further Fibonacci Retracement Analysis

Next, we take a larger Fibonacci retracement, from the low of $879.8 on 18th June 2022 to the high of $4109. The 0.786 Fib retracement at $1570.85 appears to be a critical support zone, as it also coincides with the POC in the volume profile of the entire market structure. This indicates that the $1570-$1600 region is a significant area of interest for buyers to step in.

🔹 Log Scale Fibonacci Confluence

To further strengthen this analysis, applying the same Fibonacci retracement on a log scale shows the 0.618 Fib retracement at $1585.17, very close to the POC and 0.786 Fib level, reinforcing this region as a major support zone.

🔹 High-Probability Long Setup

If ETH revisits the $1570-$1600 zone, this forms an ideal high-probability long setup with excellent risk/reward potential. A potential R:R ratio of more than 20:1 could materialise if this setup plays out and price targets $5000 as a take-profit level. The stop loss placement will determine the exact risk-to-reward, but the reward could be massive if this level holds.

💬 What are your thoughts? Will Ethereum find its bottom around these key levels? Excited to see how this develops! 🚀

(ETH) ethereum "nft land"I was recently looking into NFTs on Opensea and while doing so I noticed there are far more NFTs from people based on the Ethereum blockchain compared to the other offerings on Opensea. Even though Solana (SOL) is on the forefront of popularity with Meme projects Opensea does not offer an exclusive Solana chain to provide NFT ideas. Hence, there is not an easy way to compare to amount of Solana projects to Ethereum projects being built, developed and/or offered. It would be interesting to see the comparison of NFTs on Solana versus Ethereum. Ethereum reduced their transactions with a transition to Proof-Of-Stake and since then the number of Ethereum NFTs must be growing. While the news is on a constant watch for new meme projects, tokens, the Opensea network for many other blockchains is not growing as nearly rapidly as Ethereum.

ETH may Get to $1,537 Dear Traders,

I decide do a monthly review/analysis of ETH away from the noise in Lower timeframe to help you see the bigger picture and the higher timeframe market structure and price action without getting things too complicated.

We say ETH hit its All-Time-High of $4,869 in November 2021 which was immediately followed by a 7-month low of $869 in June 2022 representing about 82% drop in price before a bullish run that ended in March 2024 creating a high of $4,091 representing a 465% increase in the price of the crypto asset over the 21-month period before dropping to its low of $2,067 which represent an approximate 50% drop in price over a 5-month period ending in August 2024 before hitting a new Lower High (LH) of $4,091 in December 2024.

Since December 2024, every subsequent monthly candle has been closing lower than the previous whilst currently trading below February, 2025 low.

If the downtrend continues over the next couple of days or weeks, my immediate prediction for ETH will be the next support at around $1,537 with possible extension to $1,175. If we don’t get to see a pullback within the zone referenced here, we may just see ETH do a free fall to $315.

Remember, as a trader, your job is to focus on price action and trade in the direction of price irrespective of your opinion. Also note that this is strictly on the basis of Technical analysis and fundamentals can change predictions and this is why price action should remain our focus so we can know when our bias is changing and we can adjust.

Having said all that also note that #ETH has fallen more than 21% in the week to March 9, marking its biggest weekly decline since November 2022.

A break of the bullish trend line that began in June 2022 suggests a possible end to Ethereum's three-year bull run unless we see a shift in market structure sooner than expected.

A new opportunity to attempt a pullback on the quarterly candleToday, a new opportunity for market growth has emerged, and I want to consider it. First of all, I want to emphasize the discrepancy in fundamental factors. The crypt was brought down against the background of a trigger that I paid attention to first of all – wti oil went below 71 and at the opening of the new week, the crypt immediately reacted, in anticipation of a drawdown of the foreign exchange market and the growth of the dollar following oil. However, the subsequent mass of negative statistics on the United States completely offset the impact of oil and the euro went above 1.050 and even 75, which so far strengthens purchases. As a result, the crypto market remains in an oversold position relative to other markets.

Given the picture and binance's aggressive measures to keep the market at the bottom, the situation looks like another giveaway game. The Amers tried to bring down the market by selling oil. Against this background, ether opened the month below 2250, which gives a technical signal for sales up to 1900. At the same time, binance was not against helping to delay the pullback of the quarterly candle as close as possible to its close, which would open a new quarter above 2250 or 2500, giving a signal to maintain purchases. Such a picture and the negative opening of the month reduce the goals that we can achieve from above this quarter, we are no longer talking about 3,500 on the air. However, if the altcoin index goes from 8.5% to 10-11, according to my expectations, the ground will be sufficient for coin breakouts.

And so, after the sales in the first half of the month, against the background of the bearish last candle and the opening of this month below 2250, this week it is worth preparing for a new attempt to roll back the quarter, which will begin with the reversal of the month as it passes its middle. This week, there is a high probability of breakouts of similar rare pros or burger on many oversold coins.

First of all, it is worth noting uft vidt alpaca, which binance artificially pushed below the technically relevant market levels by assigning the tag monitoring. Given the assignment of the tag, it is worth calculating the upper limit of the flat at 0.25 for uft, 0.025 for vidt and 0.15 for alpaca. From attempts to test these levels, it is more reliable to reduce positions and move lower on the next market drawdown. There is a high probability that, under the pressure of the new tag, these instruments will flatten from marked loyalties to these resistances until the fall and reach higher targets only by the end of the year. In my opinion, there is also a high probability that the monitoring tag was added temporarily to create profitable entry points for large investors and reset the hamsters, since the tokens were trading with fairly good dynamics and futures were added to them at the end of the year for a specific purpose. The picture resembles manipulations with pros. These tokens are now in the most oversold position and are very interesting to work with, because in case of rollbacks they will give up to 50-100%+ growth.

Among the coins with the monitoring tag, I also consider troy and cream to work, but they are now inferior in growth potential by up to 50%. It should be borne in mind that, depending on the activity of buyers, troy can test the left technical signal at 0.0032-35 and repeat the pros pattern. There is no such goal for cream. The combo can also show up to 30-50% growth, but it is in a less oversold position and there is a possibility of testing supports at 0.100-125 and subsequent growth with the main resistance at 0.25. I am not considering other coins with the monitoring tag in the current market picture yet. I would like to remind you that there has been no delisting so far this month, and in the first half of the week before lunch, it is worth keeping a short stop at the current coin price with the tag monitoring in case of delisting.

After changing the frequency of operations with the monitoring tag from quarterly to monthly, coins without the tag are in danger of a double collapse. First on tag assignment, then in the case of delisting. We were finally prevented from identifying more reliable instruments among those that were oversold and had accumulated great potential for a rebound. After assigning a tag to more than fifty coins over the summer at such a pace, I think binance will start removing the tag for over-traded coins at the bottom, where we again lose the opportunity to determine which coins can fail in this case. However, based on indirect signs of past volatility and the addition of futures, I suspect that the tag may be removed from coins such as alpaca uft vidt pros ctxc combo troy aergo.

Among coins without the monitoring tag, vib still stands out strongly, according to which there is a high probability of an exit attempt to 0.1+. Until next month and the new assignment of the tag, the monitoring token is reliable, which can lead to a sharp influx of buyers at the turn of the quarter. Relative to the market, it is also in the zone of extreme oversold conditions, and at the current price of ether, the range of 0.075-90 is more appropriate for vib. Purchases are still rather sluggish under the pressure of indicators and a pullback after the breakdown of last month, but in the near future there is a high probability of leveling off into the specified range at least. In a negative scenario, without steady growth under market pressure this month and the assignment of monitoring in the new one, the token has nowhere to fall, which also makes investments from the current position quite reliable.

In addition to vib, among coins without the monitoring tag that are reliable until the new month, pda stands out strongly with a growth potential of up to 80%+. In case of general market growth, I also consider voxel farm og wing to scalping. For voxel and farm, there is a probability of a drawdown of up to 25-30% in the event of a negative market and the departure of ether to 1900, but with market growth, impulses of up to 30-40% are likely from current levels. According to wing and og, emission data from different sources began to diverge, which could lead to a drawdown to 1.5 and 2.5, respectively, with a negative market and falling ether. If the market grows from current levels, growth waves of up to 30-40% are also likely.