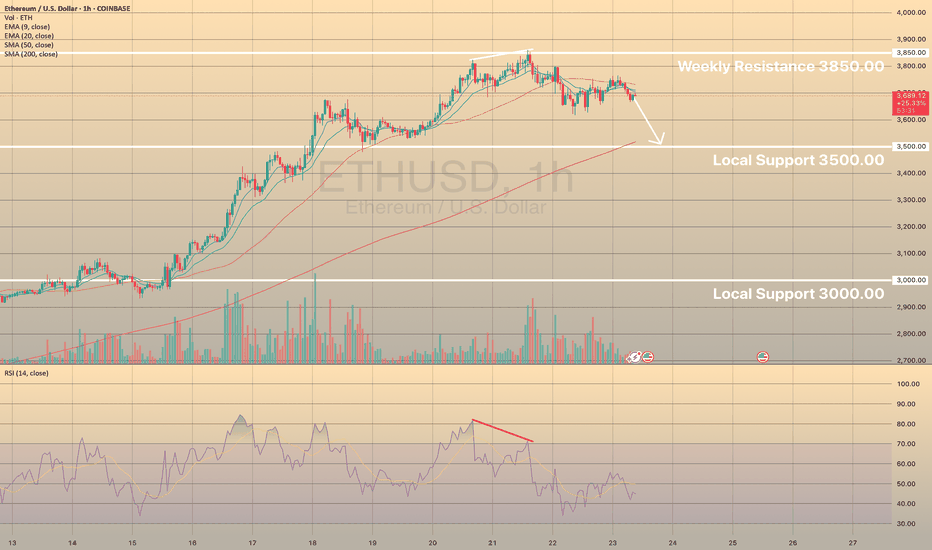

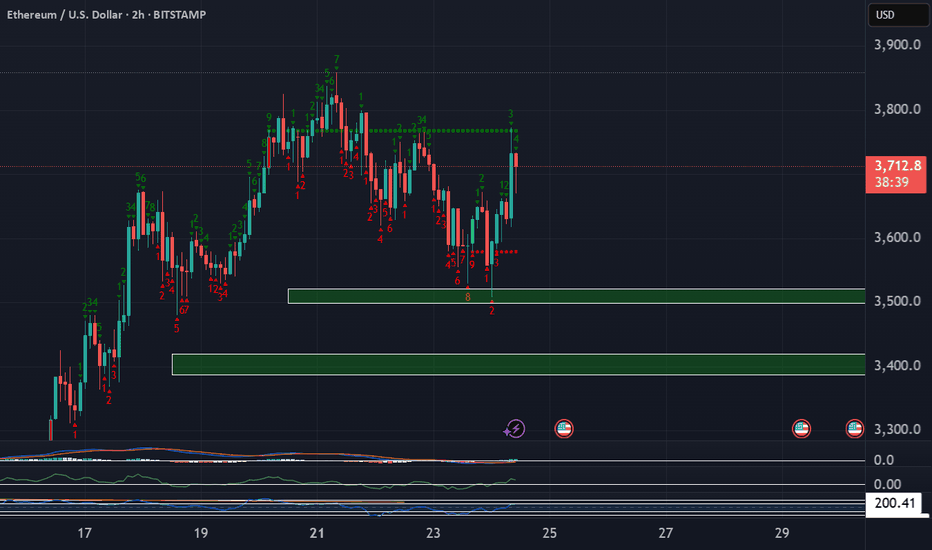

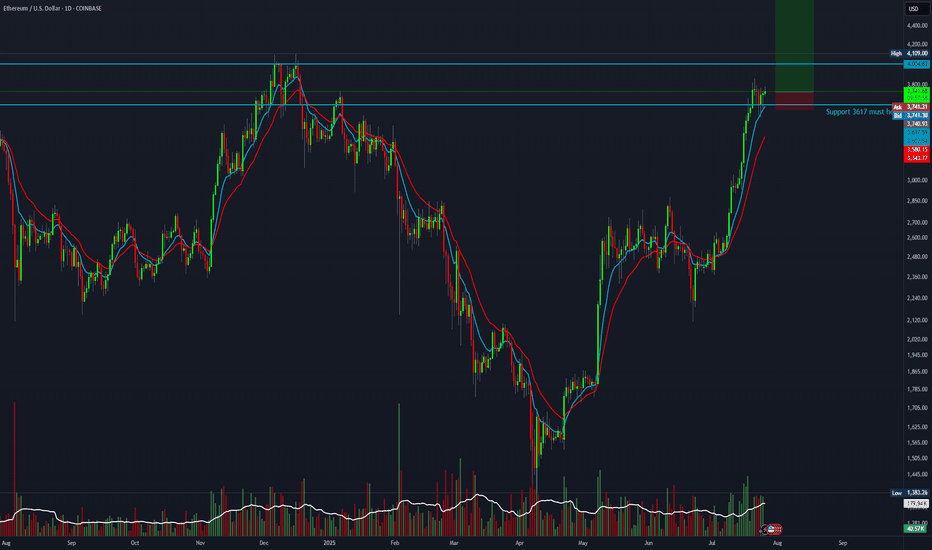

ETHUSD SEEMS TO RETEST SUPPORT LEVEL OF 3,500.00ETHUSD SEEMS TO RETEST SUPPORT LEVEL OF 3,500.00

The ETHUSD has hit some resistance at around 3,850.00 this week. But it's since pulled back from that level, which might be a sign of a cooling trend. That's backed up by the RSI going bearish.

Right now, the price is below the 50 SMA on the 1-hour chart, indicating a mid-term downtrend.

We could see the price find some support at 3500.00 or so. Additionally the SMA 200 lays nearby, providing extra support here.

ETHUSD.P trade ideas

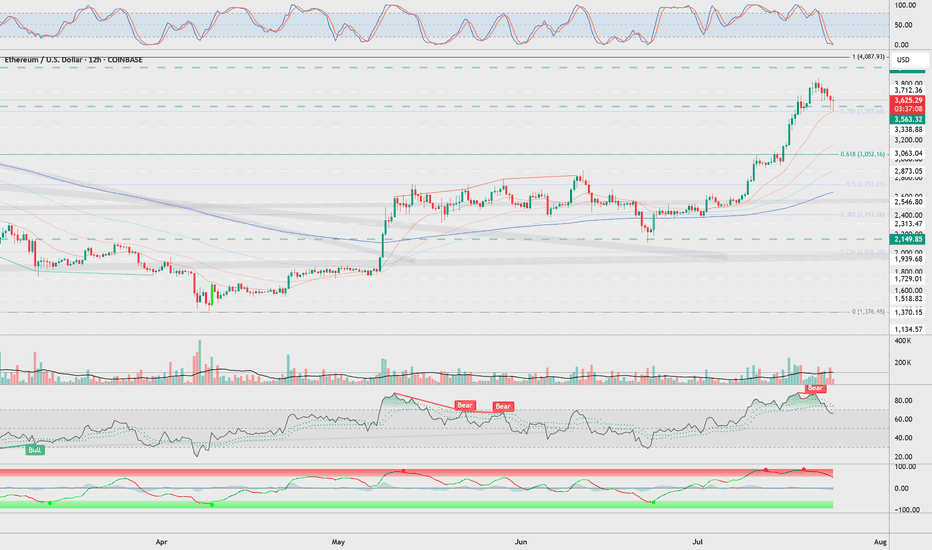

Will ETH stall at $3,800 like BTC did at $120K?Ethereum is firmly in breakout mode. The ETH/BTC ratio , a closely watched measure of altcoin strength, has surged close to a year-to-date high.

ETH has now gained over 25% in the past week, fueled by institutional flows into ETH ETFs and tech investor Peter Thiel reportedly taking a major stake in BitMine.

RSI is at 84.82 , showing extremely strong momentum, though short-term consolidation near the $3,800–$4,000 resistance zone is possible. This is a zone that capped previous rallies in 2024.

Bitcoin, in contrast, is holding flat near $118,000 , down slightly from its recent highs above $120,000 . Small-bodied candles and minor intraday sell-offs have formed a tight consolidation block, indicating profit-taking and indecision.

The question now is whether Ethereum will follow BTC’s recent behaviour and stall near local highs, or whether the breakout will carry it decisively through $4,000 .

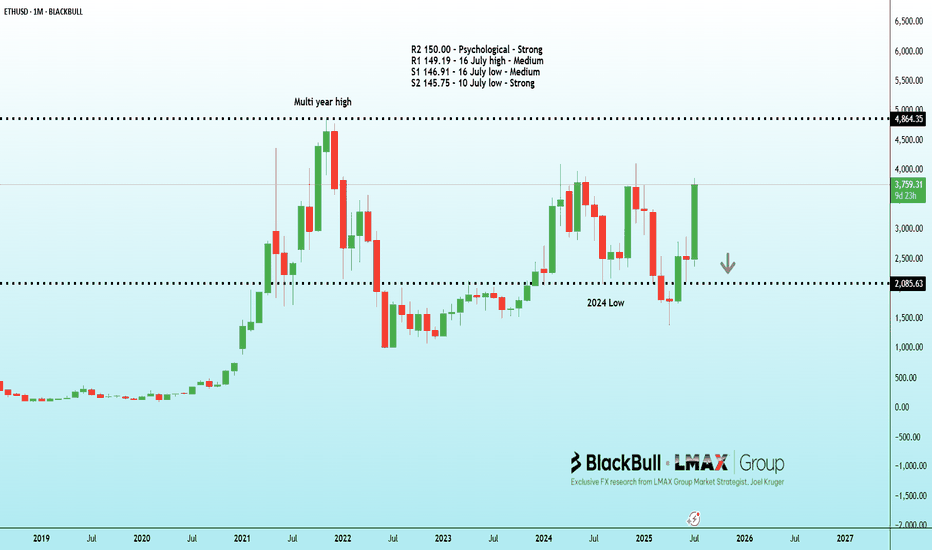

Dollar softens, Yen soars on BOJ normalization bets | FX ResearcThe US dollar got off to a soft start to the week, though thinner summer trading conditions have restrained activity across G10 and emerging markets. The Japanese yen stole the spotlight in G10 after the Ishiba coalition lost its upper house majority, fueling speculation about potential Bank of Japan policy normalization and political instability, which likely drove yen demand.

Meanwhile, positive market sentiment tied to a possible Trump–Putin meeting was overshadowed by skepticism about the sustainability of equity and Bitcoin rallies, given the sharp rise in US equity futures and bond market trends.

Political pressure on the Federal Reserve is intensifying, with Treasury Secretary Bessant questioning the Fed's credibility while also advocating for US–China trade talks and hinting at tougher terms for Europe. Despite calls from the administration and GOP figures for lower interest rates, the Fed anticipates price increases in August data.

In Canada, the Bank of Canada survey pointed to trade uncertainties and weak demand curbing inflation, with tariffs impacting corporate margins rather than consumers. On the fiscal side, the CBO estimates Trump’s tax cuts will add $3.44 trillion to the US deficit over the next decade—a significant but slightly reduced figure compared to earlier projections.

Exclusive FX research from LMAX Group Market Strategist, Joel Kruger

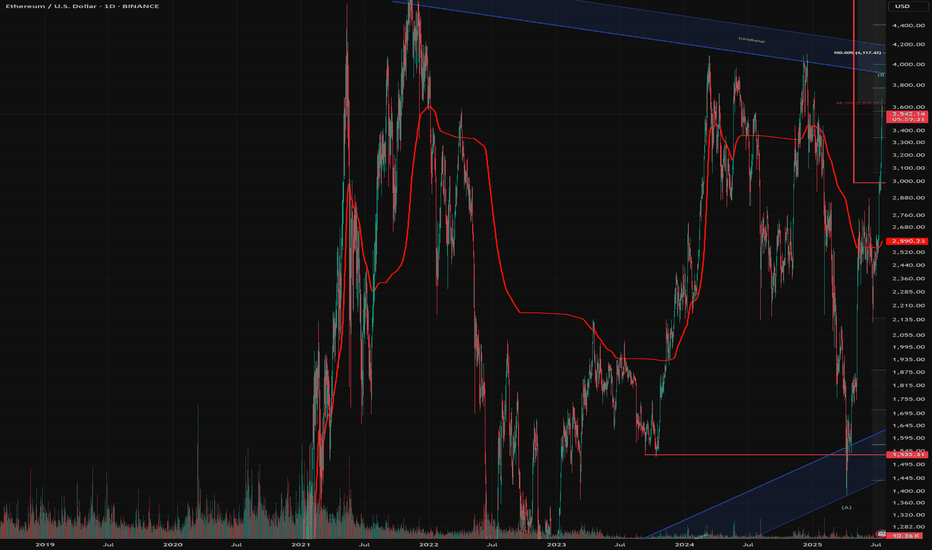

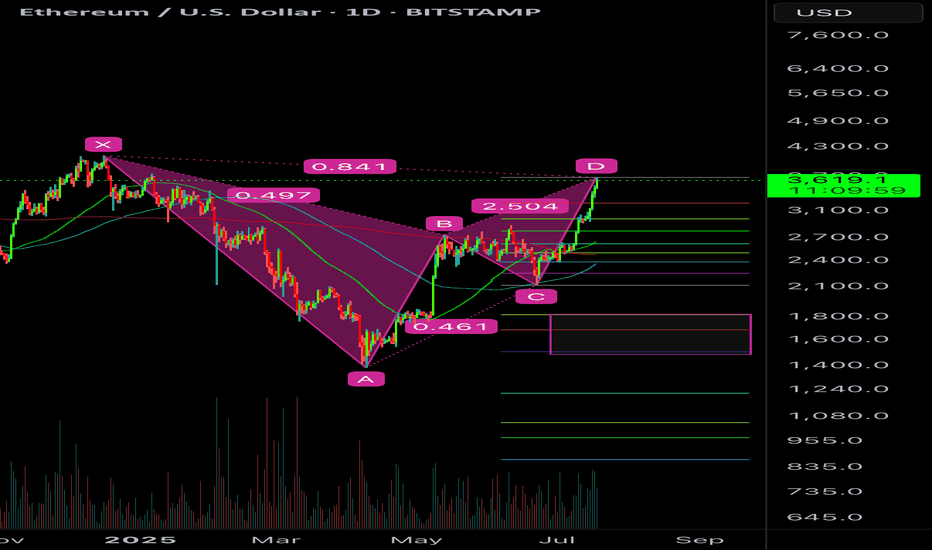

MY VIEW ON ETH - BULLISH & BEARISHMy analysis of Ethereum (ETH): Bullish and bearish scenario

The analysis of Ethereum is currently quite complex. The price structure does not show clear impulses in the form of classic wave movements, but frequently overlapping patterns that indicate ABC correction waves.

I therefore present both my primary and an alternative scenario for a bullish (rising) and a bearish (falling) trend.

Primary bullish scenario:

Wave 2 seems to be completed at the lower end of the blue trend channel and at the 70.70-% FiB. We could currently be in red wave 3. However, the structure of this movement is more reminiscent of an ABC formation, which could indicate a weaker impulse.

Should the price break through the upper edge of the blue trend channel and exceed the 100% Fibonacci level at around USD 4,424, several important Fibonacci zones would converge in the “profit area” marked in red. In this case, a setback as part of the red wave 4 could not be ruled out.

Alternative (bearish) scenario:

It is possible that the blue V-wave could turn into a white ABC structure. In this case, an additional wave 4 would be omitted, which could result in a stronger sell-off.

Secondary scenario - bearish:

If Ethereum fails to play out the primary bullish count scenario, I expect that we will continue to be in an overarching correction phase. This assessment also fits in with the typical market slowdown during the summer months.

In this case, a green ABC correction could form, whereby wave C could theoretically still rise to the 100% Fibonacci level at USD 4,416. However, this would be an overextended wave B.

In addition, we are already in the area of the sales or profit zone, which indicates that only a limited rise is possible.

Subsequently, I expect a stronger downward movement towards the green buy area between the 1.618 Fibonacci level and around USD 1,866.

LEAVE YOUR COMMENTS AND ASSESSMENT

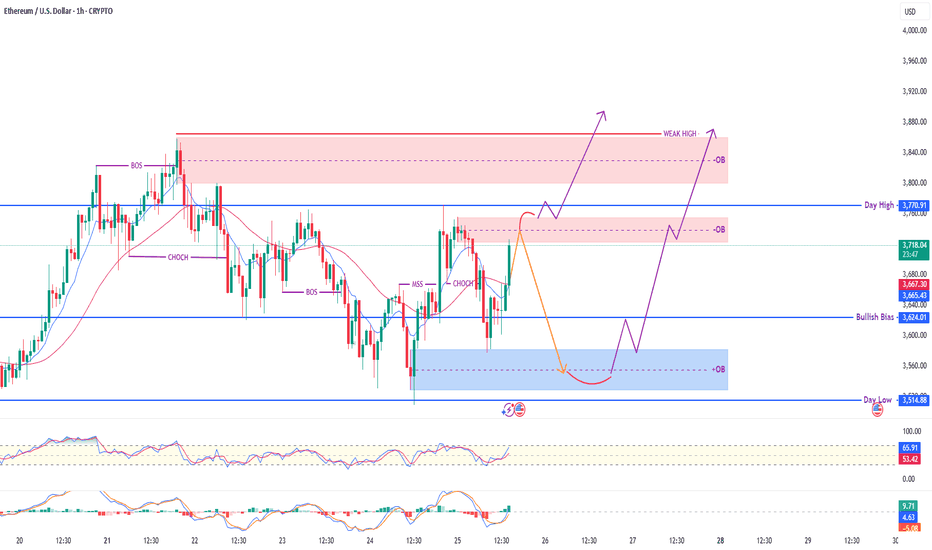

Ethereum / USD – 1H Smart Money Outlook🔹 Current Price: $3,718

🔹 Key Zones:

🔴 Supply Zone (OB): $3,770 – $3,850 (Weak High)

🔵 Demand Zone (OB): $3,540 – $3,600

⚠️ Bullish Bias Level: $3,624

🔹 Day High / Low: $3,770.91 / $3,514.88

🧠 Market Structure Overview:

✅ CHoCH → MSS confirmed bullish intent

✅ Price reclaimed structure above EMA

🔁 Price may react at supply zone, retrace to demand, then rally

📈 Scenario Outlook:

Bearish Rejection from OB Zone:

🔸 Price taps OB → drops to demand (blue zone)

🔸 Bullish reaction expected at deep discount zone

Direct Bullish Breakout:

🔸 Clean breakout above weak high → potential for trend continuation

🧠 Smart Money Notes:

BOS + CHoCH + MSS confirms internal liquidity shifts

OB zones respected repeatedly = high reaction probability

RSI overbought → short-term pullback likely

📊 Indicators:

RSI: 65.99 (Approaching overbought)

MACD: Bullish crossover

EMA Crossover: Bullish

✅ Bias: Bullish

🕰️ Timeframe: 1H

🔍 Strategy: Wait for discount entry or bullish breakout

Ethereum Long These zones are significant because they represent areas where large institutions and professional traders are likely to be active, potentially causing strong price movements when those orders are triggered. We want to enter trades that have minimal drawdown to maximize our buying power.

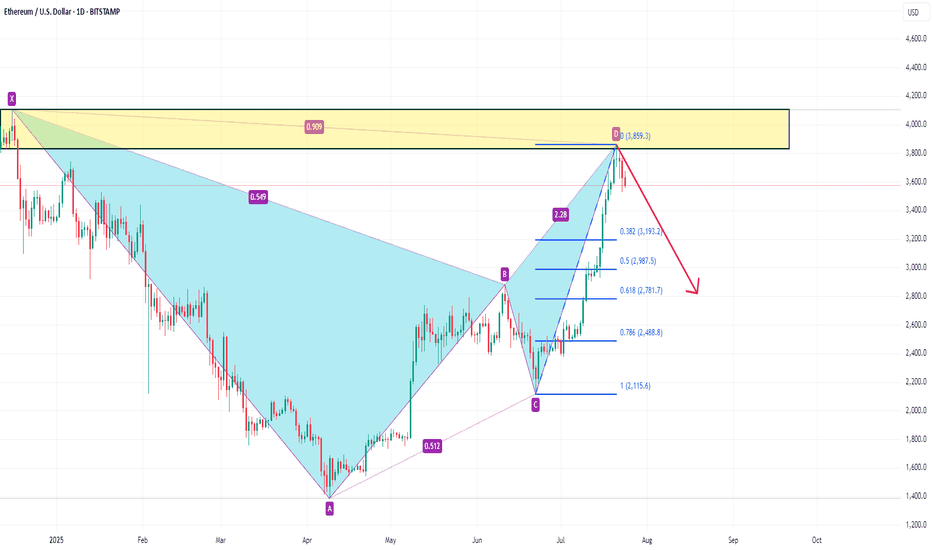

ETH BEARISH BAT POTENTIALETH can go slightly higher but it’s at/near the .886 retracement and meets a valid bearish bat pattern.

I would be targeting a full move if it is unable to break above the .886.

Too many euphoric here. The move has been really scammy off the hype news of Genius Act which everyone saw coming. Expect a sell the news event and BTC.D bounce would destroy alts for one last capitulation most alts may drop 40-50% from here. Then the real bull will start.

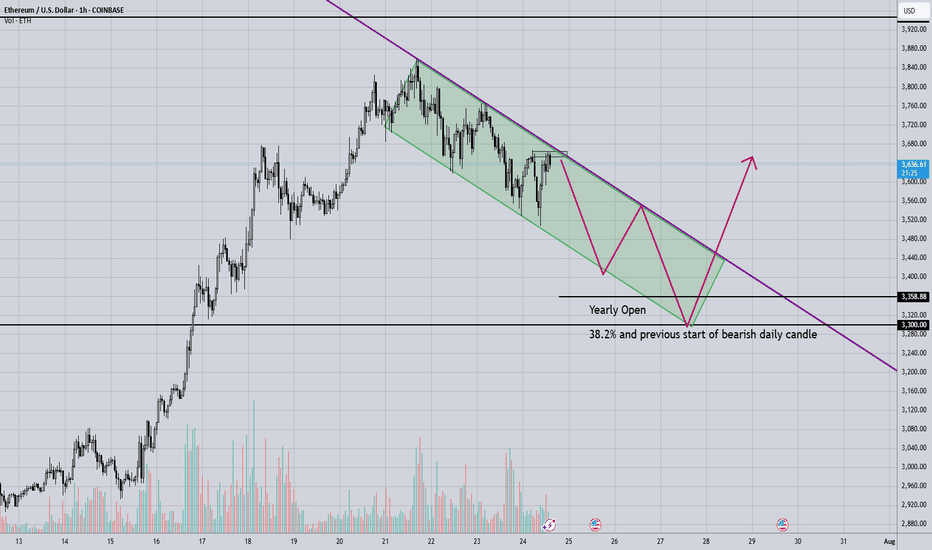

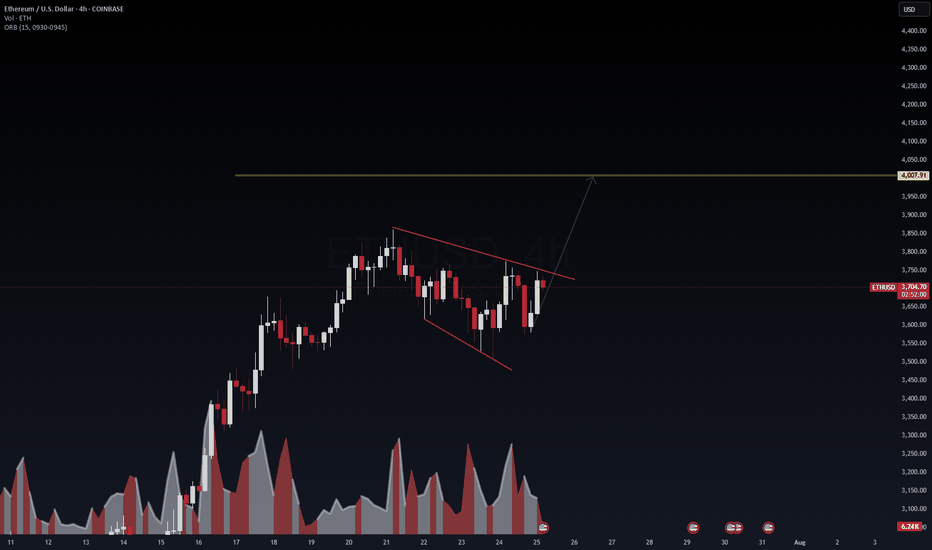

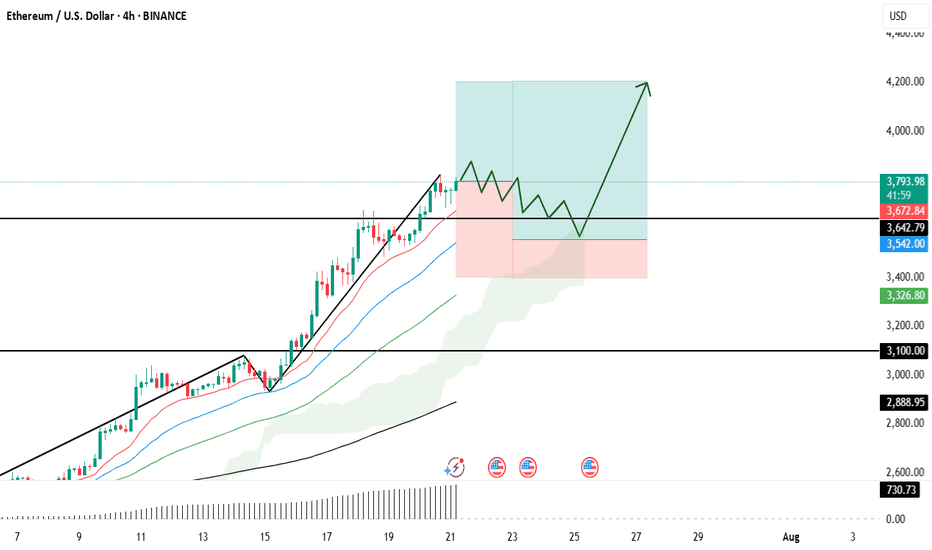

ETHUSD: Road to 4K today after a breakout. ETH/USD – 4H Outlook: Targeting $4,000+

Ethereum is coiling within a descending wedge, signaling potential breakout momentum. Volume compression indicates that once ETH breaks above the wedge resistance (~$3,750), it could accelerate toward the $4,000–$4,050 supply zone.

Key Levels:

Resistance: $3,750 → $4,000

Support: $3,650 → $3,550

Breakout Target: $4,007 (mid-term)

VolanX Protocol Insight:

Institutional liquidity clusters sit above $3,800. A clean breakout with strong volume could trigger stop runs and a swift rally to 4K.

Risk Management:

Entry after breakout retest above $3,750.

Stop-loss: Below $3,640.

Take-profit: $3,980–$4,050.

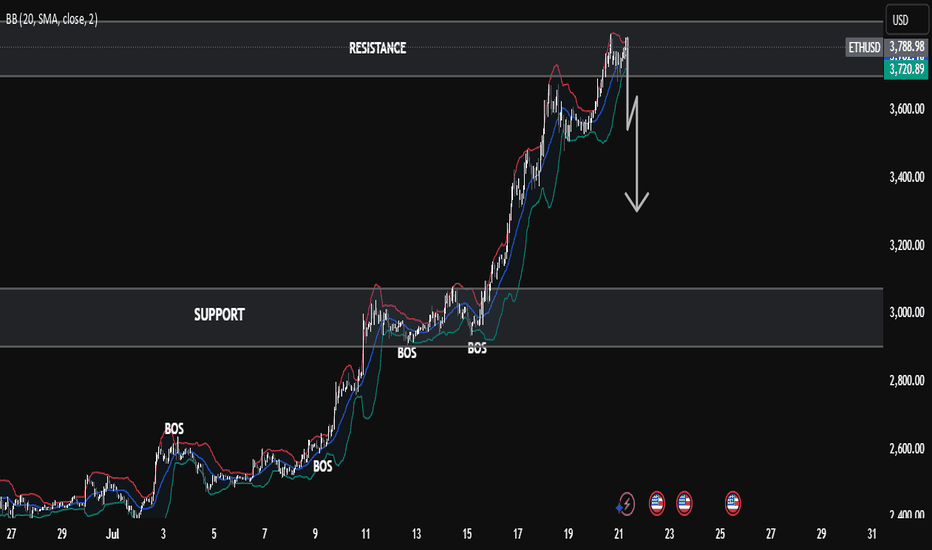

Ethereum at Crucial Resistance – Will the Bulls Hold or Fade?Ethereum at Crucial Resistance – Will the Bulls Hold or Fade?”

Ethereum is currently trading near a key resistance zone around $3,800, as marked on the chart. After a strong bullish rally with clear Break of Structures (BOS) along the way, ETH has now reached an extended point where price may face selling pressure.

The Bollinger Bands are stretched, showing overextension, and the marked arrow suggests a possible correction or pullback from this level. A retest of previous support zones (~$3,400–$3,200) could be expected if the resistance holds.

⸻

Key Levels:

• 🔼 Resistance: ~$3,800

• 🔽 Support: ~$3,400 / ~$3,000

• 🔄 Price Action: Watching for rejection or breakout confirmation

This is a textbook case of price approaching a strong resistance level after a bullish wave, where caution and confirmation are key for the next move.

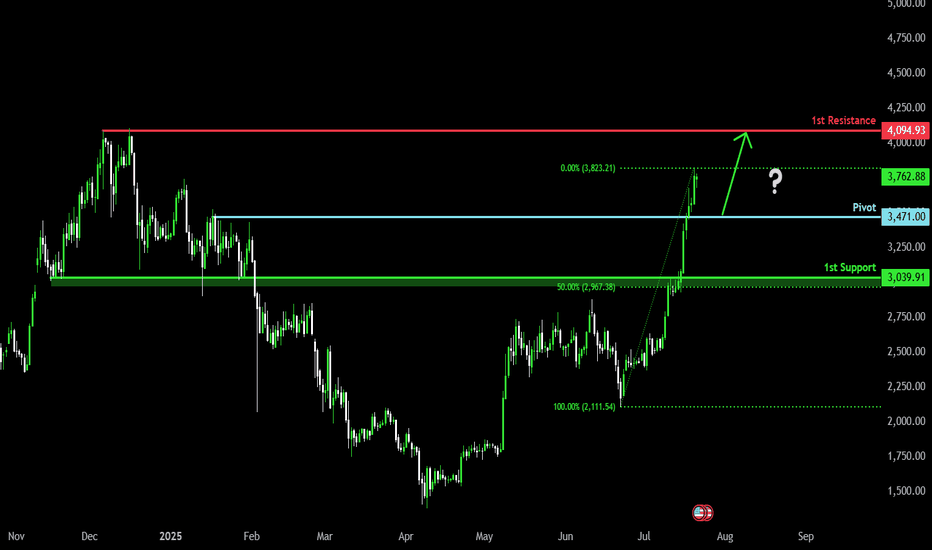

Bullish continuation?The Ethereum (ETH/USD) is falling towards the pivot and could bounce to the 1st resistance.

Pivot: 3,471.00

1st Support: 3,039.91

1st Resistance: 4,094.93

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

ETHUSD – Long Setup Activated | VolanX Protocol AlertEthereum (ETHUSD) is displaying strong bullish intent after reclaiming the VolanX Alert Line (~$3,659). Price action is forming higher lows with BOS (Break of Structure) signals, indicating that smart money is accumulating before a potential continuation rally toward the premium zones.

Key Levels & Zones:

Entry Zone: $3,660 – $3,680 (retest of equilibrium/alert line)

Target 1: $3,767 (weak high zone)

Target 2: $3,875 (premium zone)

Target 3: $4,000+ (extended bullish target)

Invalidation: Close below $3,620 (discount zone breach)

Rationale:

CHoCH → BOS → Retest Pattern: Multiple change-of-character moves followed by a BOS above $3,705 signal bullish market structure.

Liquidity Hunt Completed: Price swept the $3,540 discount zone and rebounded sharply, confirming smart money entry.

OPEX Volatility Catalyst: With options expiration tomorrow, volatility could drive ETH toward key liquidity zones. Favoring long bias as buy-side liquidity builds above $3,750.

Volume Surge: Breakout volume on 15m and 1H charts suggests institutional participation.

Trade Plan:

Long Entry: On a successful retest of $3,660–$3,680 zone with strong bullish candle confirmation.

Stop-Loss: Below $3,620 (structure invalidation).

Targets: Scale out at 3,767 → 3,875 → trail above $3,900.

Risk-Reward: ~1:3 or better, depending on execution and trailing strategy.

Disclaimer:

This analysis is for educational purposes only and not financial advice. Trade responsibly and use proper risk management.

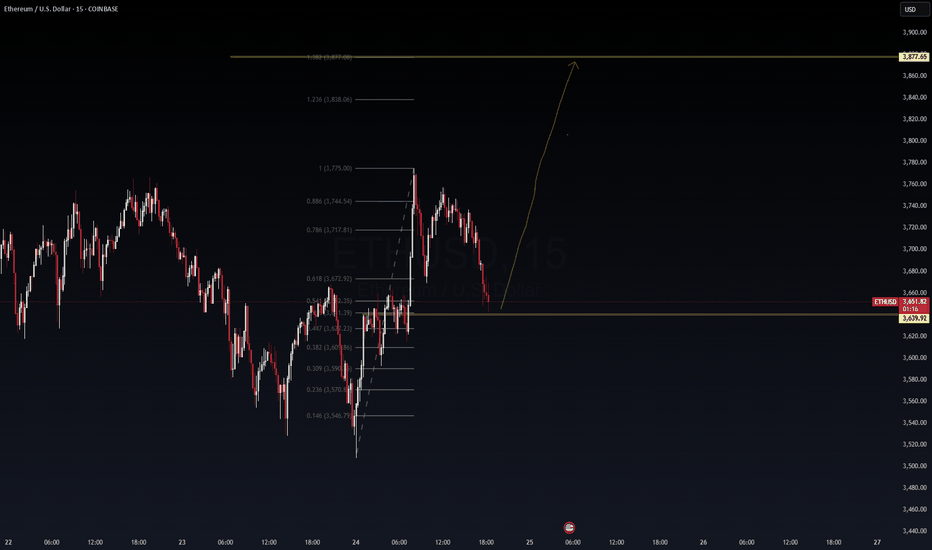

ETHUSD: [VolanX ETHUSD SMC Outlook] — Compression → Expansion📈 — Compression → Expansion Setup Brewing

Chart Context (15m):

We're in a descending channel compression zone, rejecting from discount demand after BOS (Break of Structure) & CHoCH (Change of Character) confirmations. Volume spiked at the low, signaling potential accumulation. Current price is coiling just under the equilibrium zone.

🔍 Technical Setup:

🟢 Weak Low Sweep into high-volume demand zone

🔴 EQH (Equal Highs) + Liquidity resting near $3,754

🟣 Premium Supply Zones above $3,700 — final liquidity targets

🔻 Still under bearish internal structure (lower highs intact)

🟠 Equilibrium retest holding as micro support (watch for impulse)

🎯 VolanX Execution Path:

Break above $3,667 trendline = early long trigger 🚀

Target 1: $3,700 zone reclaim = confirmation of strength

Target 2: $3,754 liquidity hunt 🧲

Rejection from $3,754–$3,775 = potential short setup

🔻 Invalid Below:

Close below $3,600 with volume = bearish continuation

Retest of $3,523 “Discount” zone or liquidity void

📊 Volume Profile:

Highest reactive node: $3,623–$3,646

Spike near low = trap or base?

📡 VolanX Signal Protocol:

Accumulation + Compression = Expect Expansion.

ETHUSD may be rotating toward premium liquidity unless invalidated. Watch for breakout confirmation above descending trendline + EQH run.

🧠 Narrative Bias:

Markets are pricing in ETH's role in upcoming ETF decisions & regulatory clarity. VolanX AI aligns this structure as "coiling before institutional deployment."

#ETH #VolanX #SmartMoney #LiquiditySweep #CryptoTrading #OrderFlow #VolumeProfile #ETHUSD #TradingView #AlphaSignals #VolanXProtocol #SMC #PriceAction

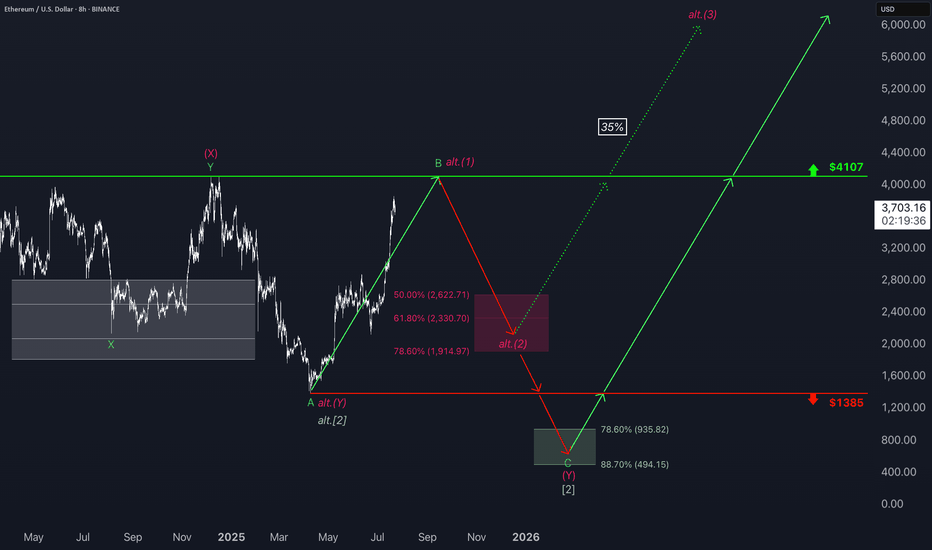

ETH: Eyes Resistance, But Correction Still LoomsEthereum has also seen a modest pullback since yesterday morning, but here too, it’s too soon to confirm a high for turquoise wave B. Accordingly, we anticipate further gains in this corrective rally—potentially up to resistance at $4,107—before the subsequent turquoise wave C takes over and drives the price down into the green long Target Zone ($935.82–$494.15). Within this range, we primarily expect the low of the wave- correction, which has now lasted more than four years, setting the stage for a long-term trend reversal to the upside. According to to our alternative scneario, magenta wave alt.(1) would complete with the next high. The following pullback, attributed to wave alt.(2), would then only extend into the slightly adjusted magenta Target Zone ($2,622–$1,914) before a move to new all-time highs (probability: 35%).

📈 Over 190 precise analyses, clear entry points, and defined Target Zones - that's what we do (for more: look to the right).

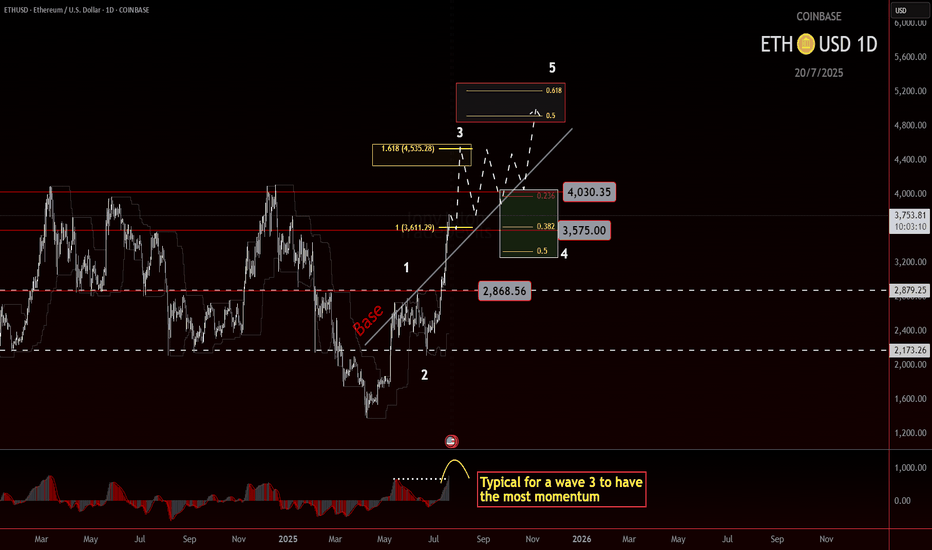

ETH roadmap to 5000!Ethereum Wave 3 in Play? Eyes on the $4500 Target

Ethereum may currently be progressing through a wave 3, which is often the strongest leg of an impulse. The structure so far supports that idea, and based on standard projections, the most likely target sits near $4500.

If price can break and hold above the 4k level, we could see a consolidation forming above the previous high. That would be a constructive sign and might set up the next leg higher.

But there’s still a chance ETH struggles to clear that level. If that happens, consolidation could form just underneath, which would still be acceptable within a wave 3 framework. What matters next is the shape and depth of the pullback.

Wave 4 will be the key. A shallow or sideways correction would keep bullish momentum intact. A deeper pullback doesn't ruin the structure, but it does mean we’ll need to watch support zones more closely.

If wave 4 behaves well and broader market conditions stay supportive, then a final wave 5 could bring ETH into the $5000 region. That’s the upper edge of this current roadmap, based on conservative assumptions.

Stay flexible. Let the structure guide the bias.

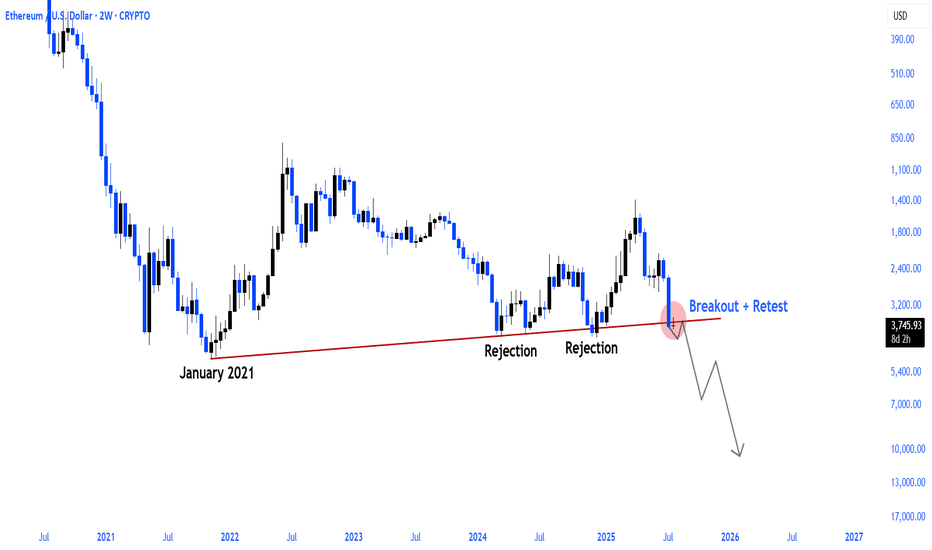

Ethereum is going to 2000 then new ATH

Alright, let's talk about what I see coming for Ethereum. I’ve been deep-diving into these charts, especially that weekly one where I’ve highlighted the past moves and percentages. I'm using these patterns as a guide to try and anticipate where Ethereum is heading next. I'm going to set aside any kind of trading advice, and focus on what I see the market doing next.

Key Observations From Past Cycles

Looking at Ethereum's history, I’m seeing a pretty clear cycle of large price swings:

Massive Rallies: Ethereum has a history of powerful bull runs, where the price can surge by hundreds, or even thousands of percent. I need to be aware of these to understand the potential of the coin.

Substantial Corrections: These rallies are always followed by substantial corrections, which range from about 30%, to upwards of 80%. This is important to see as any retracement can be devastating to a trader.

My Prediction For The Next Move:

Based on those historical patterns, here’s what I see as the most probable outcome for Ethereum's next move:

Anticipated Retracement: I’m expecting a retracement, or a pullback following the recent gains. Ethereum tends to make large retracements after a period of growth, and I am anticipating this will happen again soon. I want to see the price find a solid level of support, as this will be important to the next move up. Based on historical price action, I expect the next support levels to be somewhere around $2000 to $2500.

The Next Upside Move: After that pullback, I anticipate a strong upside move.

The magnitude of this move is unclear, but the data on the chart shows we could be looking at a move upwards of 100%, and maybe even more. I want to be watching that very carefully when it happens.

Strategic Long Position on Ethereum (ETH)

Ethereum's funding rates have spiked, reflecting an overcrowded long side. Such conditions often precede a long squeeze, as the market seeks to shake out overleveraged traders.

Despite this risk, the current bullish momentum justifies a tiered entry approach:

First Entry (Market Order): 3,790

Second Entry (Limit Order): 3,550

🛑 Stop Loss (for both entries): 3,400

🎯 Take Profit Target: 4,200

This setup allows participation in the upward trend while leaving room