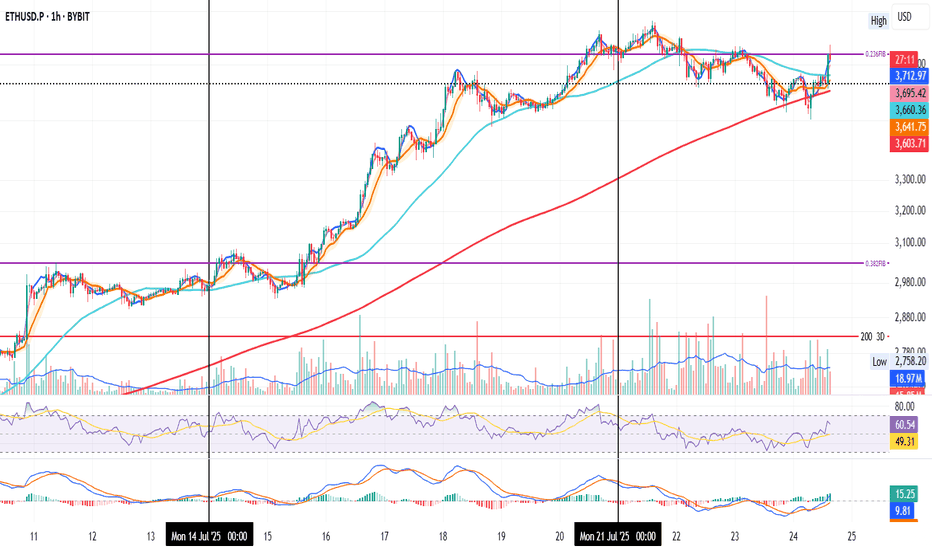

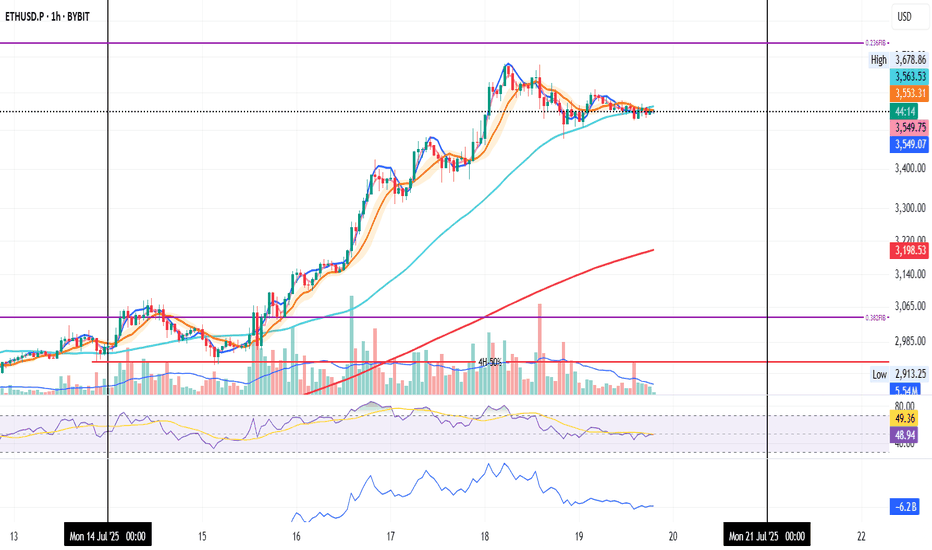

ETH 1H — Decision Point Ahead

ETH just confirmed a bullish RSI divergence, with price finding support at the 200MA.

MACD supports the move, and the trend structure is clean: MLR > SMA > BB Center.

Now, price is hovering at the 0.236 Fib level.

A few strong closes above it could open the door for more upside.

If rejected, we might revisit the 200MA for another test.

Either way — we’ll find out soon.

Always take profits and manage risk.

Interaction is welcome.

ETHUSD.P trade ideas

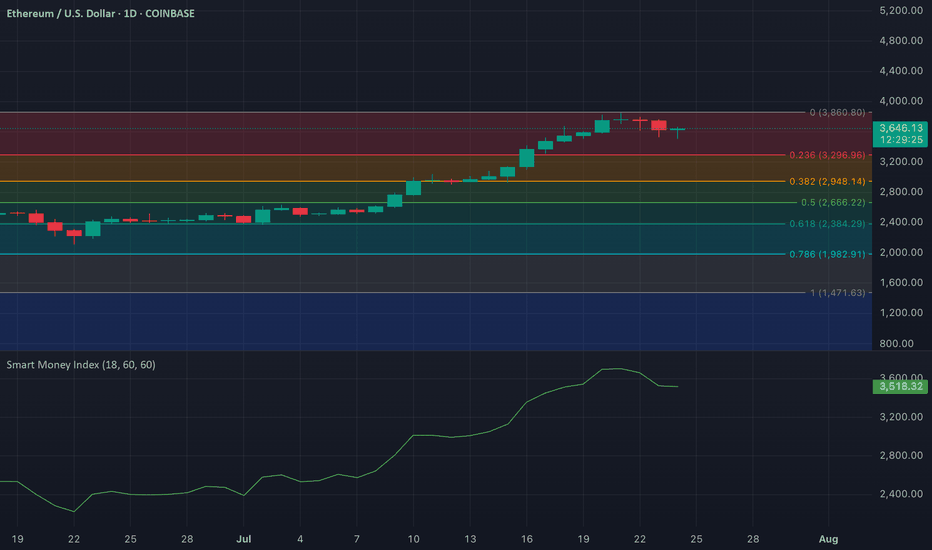

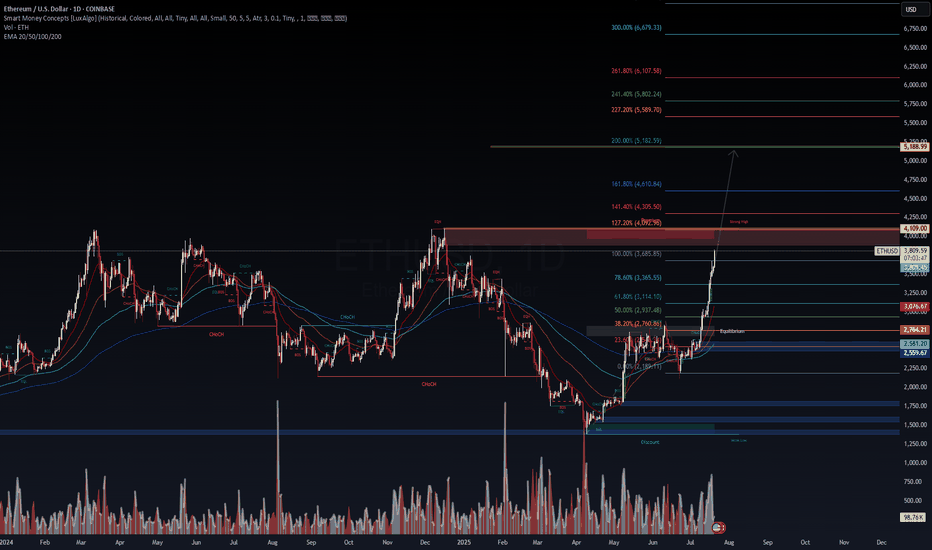

ETH/USD: Smart Money Index Signals Distribution Post-RallyOn the ETH/USD daily chart, a notable drop in the Smart Money Index (SMI) is confirming bearish sentiment among key market players. Since July 20, the SMI has declined by 7%, signaling increased selling activity from institutional investors and seasoned traders—often referred to as "smart money."

The SMI works by contrasting intraday trading behavior: it gauges retail-driven morning trades against institutional-dominated afternoon moves. A falling SMI, like the one seen on Ethereum, suggests that smart money is quietly exiting positions. In this case, it points to profit-taking after ETH’s recent price rally, reinforcing the idea that the current pullback may be more than just noise. Traders should monitor further declines in the SMI as a sign of continued distribution.

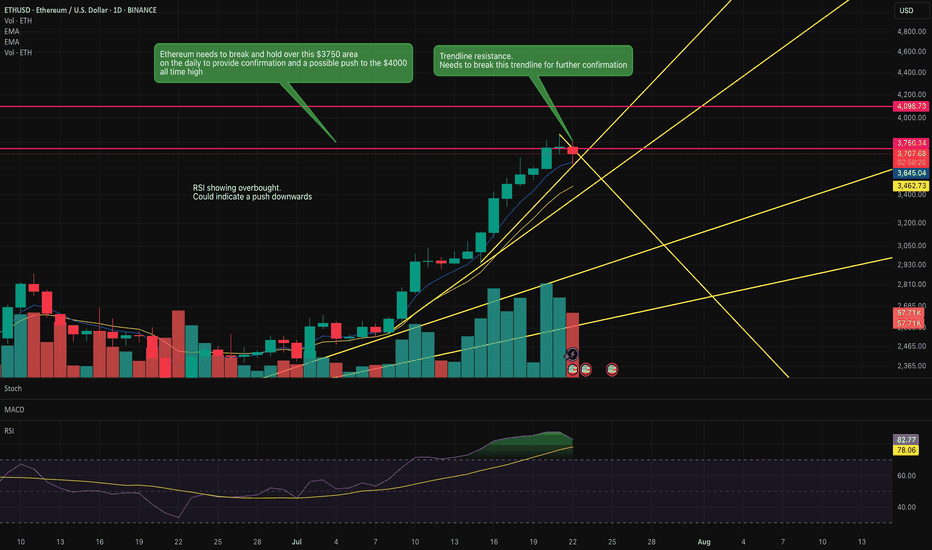

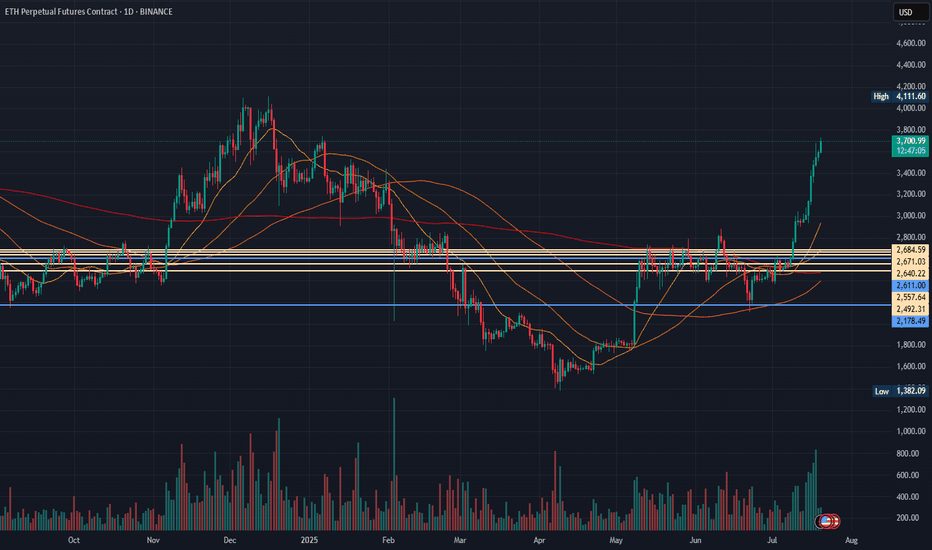

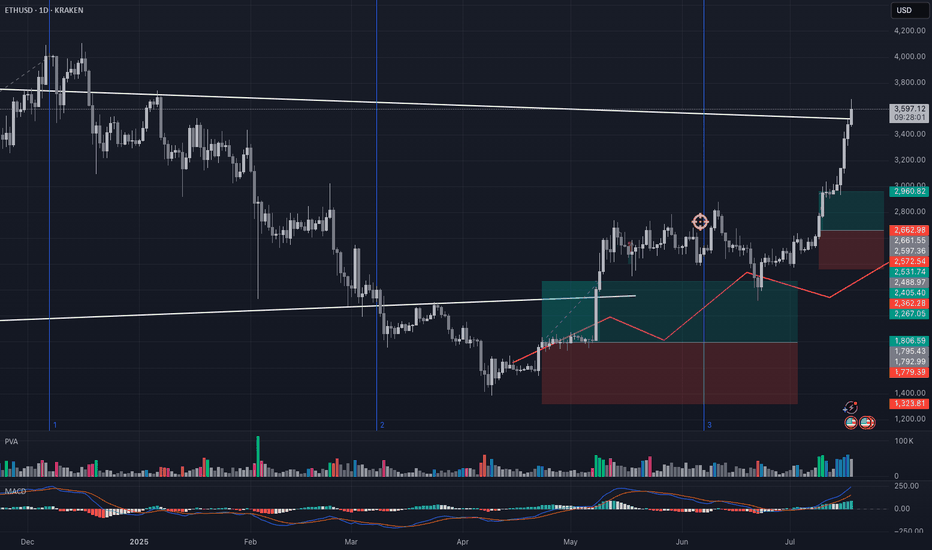

Is Ethereum going to push above this key resistance?Ethereum is knowcking against this key resistance area.

If it pushes above this $3750 area then it has a clear run to the previous all time highs of $4000.

RSI indicates overbought so it could indicate a reversal to the downside.

Key trendline is being honoured currently. However, a break of this trendline may indicate the move upwards to the previous all time high.

Watch this space over the next couple of days.

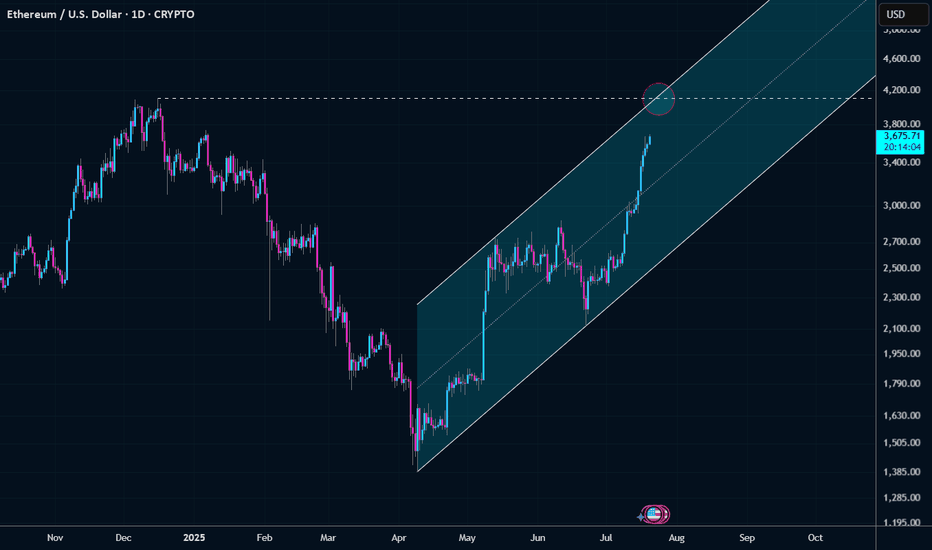

Ethereum Bullish Rally IncomingIf Ethereum can break above that point and clear $2,840, this level will turn into a major support, where fresh supply waits. However, a drop below the 200-EMA could lead the price to retest $2,400. A break below this level would shift momentum negative and risk a slide toward the April low near $1,500.

Read More at: www.cointrust.com

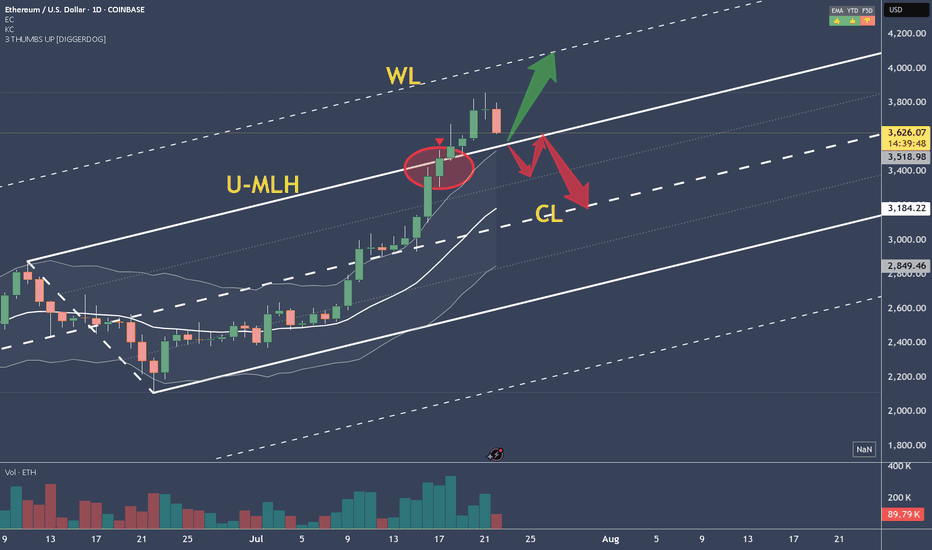

ETHUSD - Decision TimeWhat do make of the current situation?

What if you are long?

Here's what to expect:

a) support at the U-MLH, further advancing up to the WL

b) open & close within the Fork. If so, there's a 95% Chance of price dumping down to the Centerline.

Taking 50% off the table is never bad.

50% money in the pocket if price falls down to the Centerline.

Or if it advances up to the WL, you still have 50% that generates profits.

Either way, you have a winner on your hands.

Don't let it dig into a Looser!

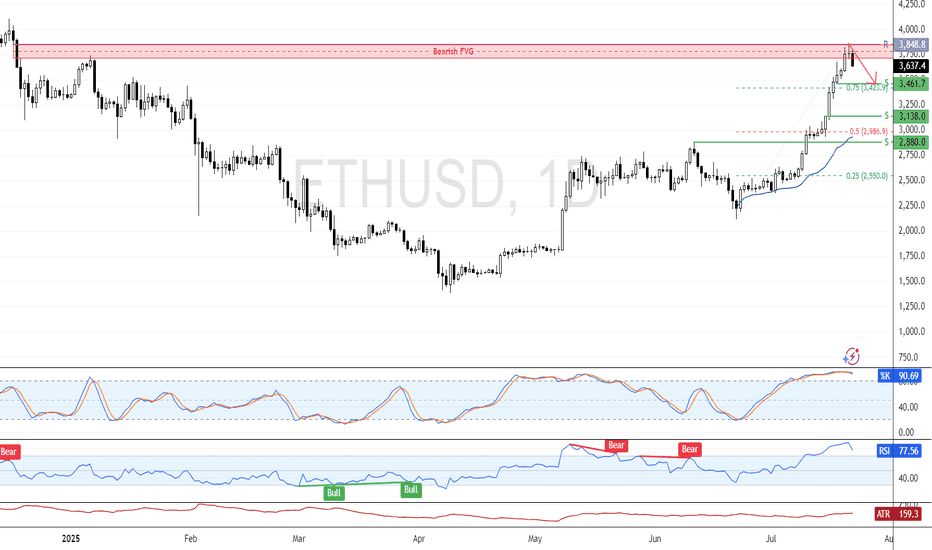

ETH Eyes Consolidation from Overbought ZoneFenzoFx—Ethereum pulled back from the daily bearish FVG. The recent candle closed with a long wick and flat body, reflecting market uncertainty. Momentum indicators remain in overbought territory, signaling a possible consolidation phase.

If resistance at $3,848.0 holds, the price may decline toward support at $3,461. However, the bullish outlook stays valid as long as ETH/USD holds above $3,848.0.

Ethereum D1 | Potential bullish bounceEthereum (ETH/USD) is falling towards a pullback support and could potentially bounce off this level to climb higher.

Buy entry is at 3,470.65 which is a pullback support that aligns with the 23.6% Fibonacci retracement.

Stop loss is at 2,980.00 which is a level that lies underneath a a pullback support and the 50% Fibonacci retracement.

Take profit is at 4,027.15 which is a multi-swing-high resistance.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

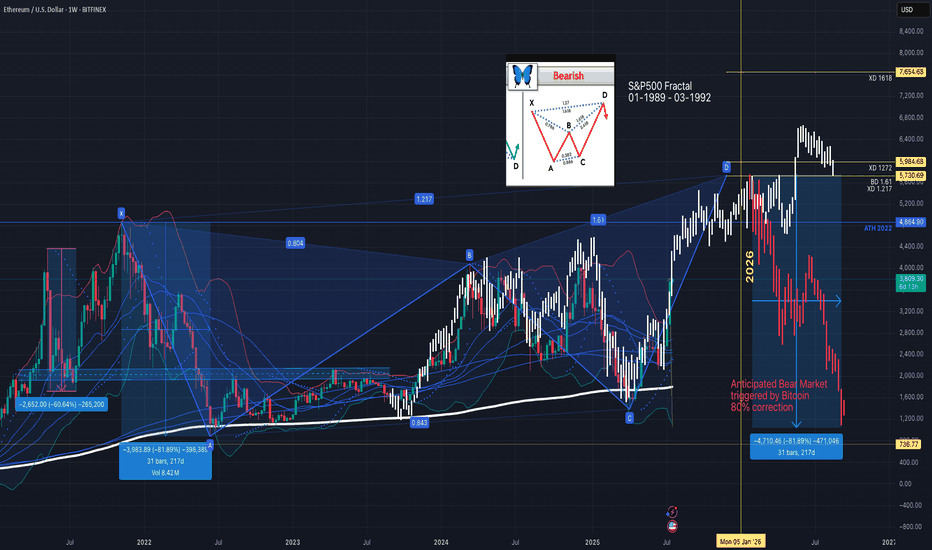

Ethereum Metric Projections for $5,700-$7,500 RangeEthereum (ETH/USD) - Integrating Cowen's Cycle Top Insights: Butterfly Pattern & S&P Fractal in One Chart, Plus Risk Metric Projections for $5,700-$7,500 Range

I've consolidated key ideas from quantitative analyst Benjamin Cowen's recent analysis into a single visual framework for Ethereum (ETH/USD) on the weekly timeframe, as of July 21, 2025, with ETH hovering around $3,500 following its rebound from the "going home" phase earlier this year. By overlaying Cowen's bearish butterfly harmonic pattern and the S&P 500 fractal (1989-1992) directly onto the chart, I've made his structural predictions accessible in one cohesive view, highlighting potential cycle tops without needing separate tools for those elements. For the risk metric bands, which aren't plotted here, I've pulled in Cowen's dynamic projections below as a complementary layer. His base case dovetails with the chart's signals, pointing to a realistic top between $5,700 and $7,500 ahead of a possible 2026 bear market, barring significant economic shocks. Let's dive in.

1. Bearish Butterfly Harmonic Pattern: Core Structure and Targets (Integrated on Chart)

Drawing from Cowen's "butterfly effect" video, I've labeled the pattern (points X, A, B, C, D) right on the chart to show its Elliott Wave roots and reversal potential at highs.

X to A: The foundational low-to-high move from the early 2020s.

A to B: Culminating at the ~$4,850 peak (2021 ATH).

B to C: The pullback to ~$900 (2022 low), nailing the 0.786 Fibonacci precisely.

C to D: The ongoing rally, with C spanning the 0.382-0.886 range—Ethereum pivoted at ~0.382 first, then probed lower.

Minimum target per Cowen: A 1.618 extension from B lands at ~$5,700, a spot to consider lightening up.

Bolder projections: Extending to 2.24 from B (~$7,500) or 1.272-1.618 from X (~$6,000-$7,300).

This setup, triggered post-ETH's "home" drop in Q2 2025 (which floored ETH/BTC), remains intact on the chart and forecasts rejection at D, ushering in the marked "anticipated bear market."

2. S&P 500 Fractal Comparison (1989-1992): Historical Roadmap (Overlaid on Chart)

I've directly superimposed Cowen's favored fractal onto the ETH price action for easy comparison, capturing its "perfect" alignment down to small dips and surges.

Parallels: ETH's post-halving trajectory echoes the S&P's extended climb before peaking.

Outlook: Projecting to January 2026 (factoring in ~6 months of remaining bull phase per 4-year crypto rhythms), the fractal hints at a low-end top around $5,300.

Fuller extension: Should the uptrend stretch (mirroring ETH's delayed 2018 top relative to BTC), it could hit ~$7,500 pre-bear phase.

Cowen ties this to BTC's recurring bears in 2014, 2018, and 2022 (post-halving), suggesting ETH aligns similarly—expect ATH breaches (~$4,850) but tempered by fading cycle intensity.

3. Ethereum Risk Metric: Quantifying Overheating and Diminishing Returns (Separate Projections)

Cowen's proprietary 0-1 scale (0 low risk, 1 high) adds data-backed context, sitting at ~0.672 currently (0.6-0.7 band, signaling room for gains before excess heat).

Recurring setup:

ETH "homes" at 0.3-0.4 risk across cycles (Q4 2016, Q4 2019, Q2 2025), syncing with ETH/BTC lows and ATH-bound rallies.

Past peaks:

Touched 0.4-0.5 and 0.5-0.6 in 2017/2020; highs at ~0.7-0.9, with 2017 grazing 0.9-1 fleetingly and 2021 at ~0.8-0.9 before faltering.

Dynamic targets (evolving with price; assuming no 2020-like crash from unemployment jumps):

0.7 risk: ~$4,100 (close to range ceilings and ATH entry).

0.8 risk: ~$5,600 (cautious peak aligner with butterfly mins; limited historical dwell time).

0.85 risk: ~$6,600 (momentum-fueled midpoint if post-ATH strength holds).

0.9 risk: ~$7,700 (stretch goal; brief past visits, adjusted for cycle fade).

0.95 risk: ~$9,000 (euphoria territory; Cowen flags as exit signal, improbable baseline).

1.0 risk: ~$10,000 (absolute cap; theoretical, not expected amid history's ~4% time over 0.8).

This bolsters the $5,700-$7,500 as grounded, per Cowen: "Realistic because folks crave $10,000"—rooted in data sans overreach.

4. Key Chart Annotations Supporting the Outlook

Momentum/Volume: Carp Momentum showing divergence; declining volume on upswings (e.g., Vol 8.42M labeled).

Other Annotations: Recent drop: -2,652 (-60.64%) over 265-200d; projected declines: -3,983.89 (-81.89%) over 351 bars/274d, and -4,527.68 (-80.01%) over 31 bars/21d, -4,710.46 (-81.99%) over 31 bars/274d.

Core view: Momentum for $4,000-$4,850 breaks, but with potential consolidations or 20% dips en route (e.g., daily RSI heating up, possible August-September correction like 2017).

5. Cycle Top Predictions and Navigation Strategy

Confluence Range: $5,700 (safe, 0.8 risk/butterfly floor) to $7,500 (bold, 0.9 risk/fractal ceiling)—Cowen's "realistic" span, screaming sensibility over $10K hype.

Upside outliers: $9,000-$10,000 at 0.95-1 risk, but Cowen urges bailing there.

Horizon: Late 2025/early 2026 crest, then bear (regression retest like priors).

Cowen's Dynamic DCA Out: Sidestep top-guessing by scaling sales at bands—off original stack:

0.6-0.7 (~$3,500-$4,100 now): 1/10th.

0.7-0.8 (~$4,800 ATH): 2/10ths (30% total).

0.8-0.9 (~$5,700-$7,500): 3/10ths (60% total).

0.9-1 ($9,000+): Rest (4/10ths).

Strength-selling yields dip-buy cash, hodl remnant for surprises.

6. Trade Setup (Bearish Long-Term, Bullish Near-Term)

Long Entry: Buy dips to $3,000-$3,200 support, eyeing ATH push.

Short Entry: At $5,700+ on cues (bear engulf, >0.8 risk).

Stop Loss: Over $4,850 (bull) or $8,000 (bear void).

Take Profits: Layered—$4,800, $5,700, $7,500; bear lows $2,000-$1,500.

Risk: 1-2% trades; crypto vol demands caution. Cowen: No certainties, but patterns favor ATHs pre-drop.

Void: Volume-backed $8,000+ surge eyes $10,000+, scrapping bear case.

Not advice—DYOR on macros/ETH shifts. Cowen sees pattern repeats with softer peaks. Your ETH thoughts? Comment!

#ETH #Ethereum #CryptoCycle #BearishButterfly #PricePrediction

Likes/follows if valuable!

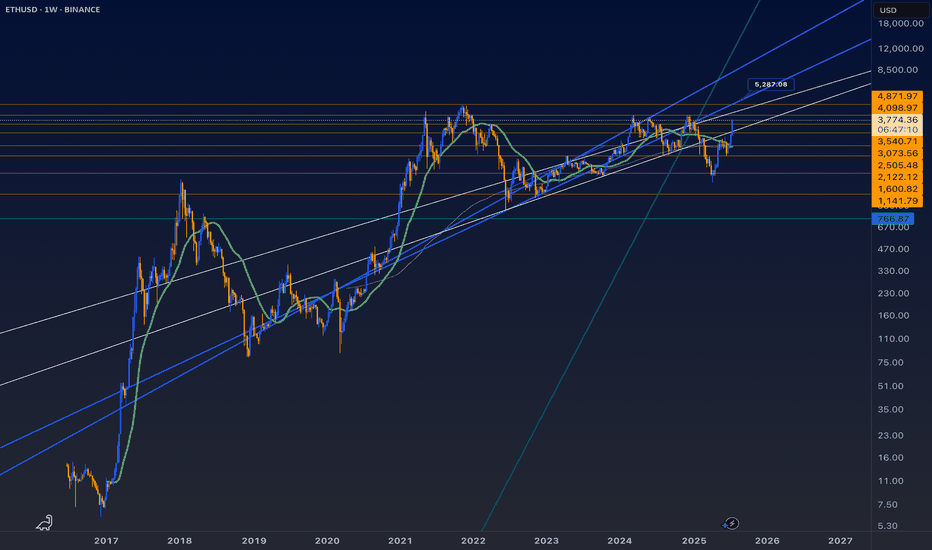

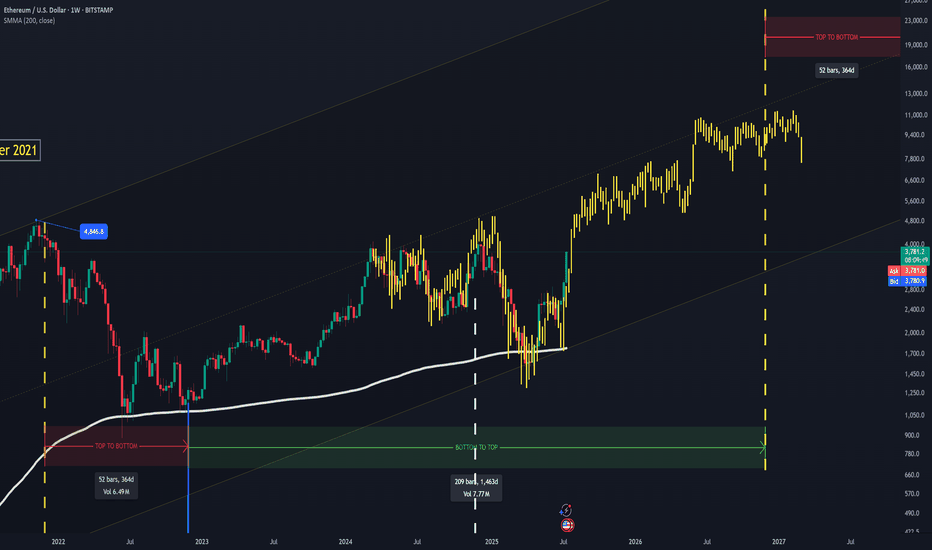

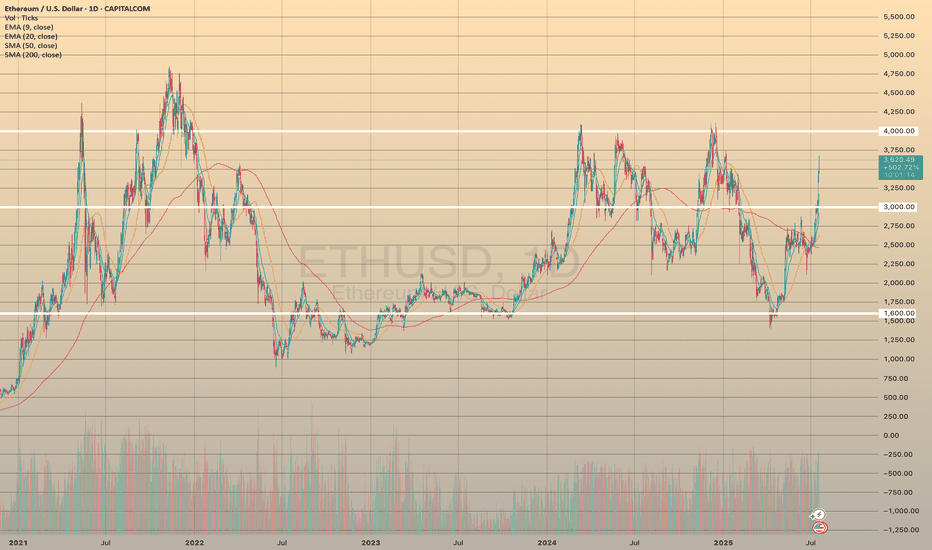

ETH Season?Well, in all of its history Ethereum’s recent lows remind me the most of December 2019 while the recovery after reminds me the most of the bull rally after March 2020. Either way I think the time for ETH and crypto as a whole is very near. Here’s my charted roadmap. If BTC hit a new high and then some over a whole year already since it hit a new high, then how do we not expect ETH to do the same and probably amplified as well as certain alt coins too. Curious to see how this thesis plays out. Not financial advice

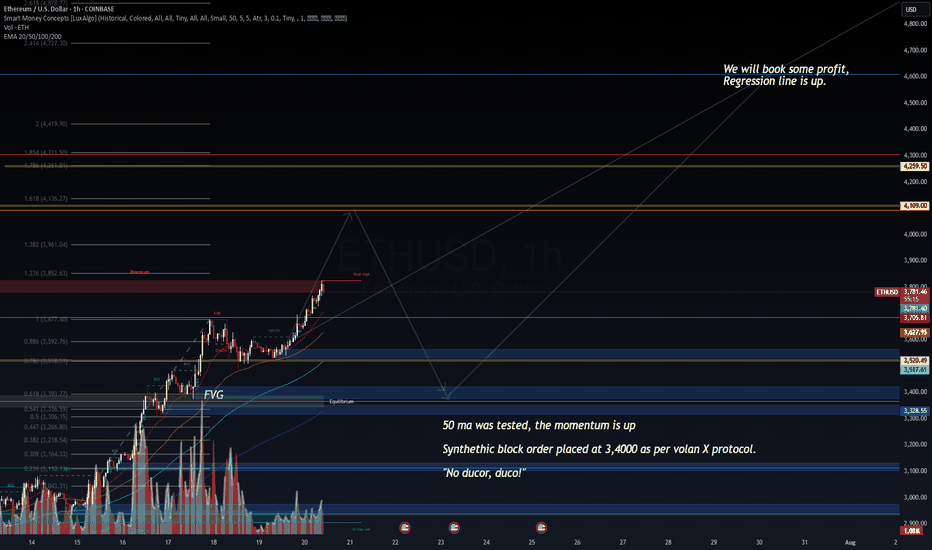

ETHUSD – Deploying Synthetic Capital as per VolanX Protocol📈 ETHUSD – Deploying Synthetic Capital as per VolanX Protocol

1H Chart | July 20, 2025

"No ducor, duco!"

(“I am not led, I lead.”)

🧠 Market Context:

Price is holding above the 50 MA, confirming upward momentum. Liquidity has been taken from prior internal highs, and price continues pushing into the premium zone above the 1.0 Fibonacci level.

🔧 VolanX Protocol Deployment Update:

✔️ Synthetic Block Order: Placed at $3,400, with precision according to Volan X synthetic injection model.

✔️ Regression Line: Sloping upward – momentum remains in favor of bulls.

✔️ Weak High Targeted: $3,850 zone approached with clear aggression.

✔️ Volume Uptick: Observed near FVG and mitigation zones – ideal for synthetic deployment timing.

📍 Key Zones:

🚩 Block Order Zone: $3,400

🎯 First Profit Target: $3,852 – $3,961 (Premium zone)

🟡 Ultimate Target: $4,259 – $4,419

🔵 Equilibrium Support: $3,328

💬 Narrative:

"We will book some profit, Regression line is up."

Price is behaving according to expectations. The 50 MA retest confirms the continuation bias, and we now monitor for the next volatility compression before expansion. Expect smart money to aim for the inefficiencies left near the $4,100–$4,250 level.

📊 Deployment Signal: LIVE

🧬 VolanX Engine: Active

📍 Next Review: Upon 1.382 fib reaction or volatility compression

#ETHUSD #VolanX #SyntheticCapital #SmartMoney #MomentumTrading #TradingStrategy #FVG #PriceAction #CryptoAnalysis

ETH is up about 50% Since June 2025Relying on the absolute intraday low from June to claim that ETH is “up 70%” is a textbook data‑skewing mistake often found in AI‑generated headlines. A more robust approach is to average prices over several days (or even a full week). On that basis, ETH has risen roughly 50% since June— not 70%. Don’t let a distorted headline push you into adding leverage through perpetuals just because your strategy’s returns lag spot performance; that reaction only compounds impermanent‑loss risk.

Inspired my Benjamin CowenWhilst this is also high speculation and to not be used to predict the market, using Benjamin Cowen's idea of using the SPX Index's 1990's timeframes and extending them to match the potential ETHUSD cycle.

You'll see how the early parts to the moves are near 1/1 of each other. Looking into the future, you'll also see that the SPX's moves interact with the middle part of the channel multiple times, and begins to decline in the potential bear market (yellow dashing lines). This also looks pretty convincing. Charts are so fascinating.

the Inverse Golden BullrunJust a joke maybe but here some considerations...

each peak is reached in 1/0.606 * previous cycle length, which is oddly close to the inverse of the golden ratio. The Q1 peak in 2024 seems to have occurred oddly in advance.

Resistance of bear markets can be found at a common focal points and all have an angle of approx 20° on the linear scale.

this inverse golden bullrun will produce a very turbolent market with a new local top in 2025. This seems reasonable considering the whole global situation, crypto narrative, oversaturation and how we got rejection before breaking the past ATH.

the overall superstructure could break out or be confirmed after next "inverse golden bullrun"

oddly again, should the breakout occurr, it would happen around 1/3rd of the triangle, which is typical for those structures.

overall, not bullish nor bearish, don't hate.

most certainly mostly wrong ;)

not a financial advice, just for fun.

ETH on the 1H timeframe

Indicators are showing slight weakness:

MLR < SMA < BB Center

Price is trading below the 50MA

RSI is under the midpoint, and green volume is fading

This could just be a pause before the next leg up

but I’m curious whether the last high of $3,678.86 was this week’s top,

or if price will try to break it tomorrow.

Always take profits and manage risk.

Interaction is welcome.

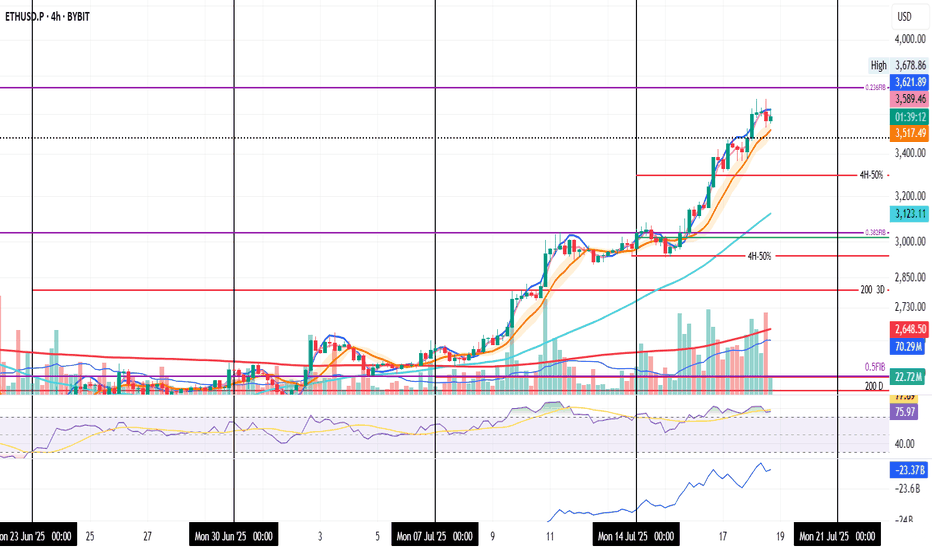

*ETH 4H — Charging the 0.236 @3700$ETH on the 4H is getting ready to charge the 0.236 Fib level.

MLR > SMA > BB Center — momentum is aligned.

Volume confirms the move.

Even though I don't enjoy it — and last time I sold just a part of the position too soon —

I placed a partial TP again. It needs to be done. The market can always turn.

We’ll be here to see it unfold.

Always take profits and manage risk.

Interaction is welcome.

#ETHEREUM - 900 POINTS MOVE ON THE RADARDate: 19-05-2025

#ETHEREUM - The last time we posted an update on this scrip was on 24th April. In fact, we did have had a run-up for about 900+ points move and we are expecting the same this time around also. I am making it very clear that the number of points it can move but not a direction. The chart says so.

Current Price: $2469

Mid-Point: $2571.73

Upside Targets: $2991.35, $3232.17, $3479.84 and $3727.50

Downside Targets: $2152.94, $1911.29, $1663.63 and $1415.96

Support: $2394.59

Resistance: $2750.52

ETHUSD - ANOTHER GROWING WEEK

ETHUSD - ANOTHER GROWING WEEK✅

ETHUSD has been growing all these days together with a bitcoin. All the news, listed in my previous post for the BTCUSD are also valuable here. Really nice fundamental support, people are purchasing the asset.

But what's with technicals? 📊

Compared to the bitcoin, ETHUSD hasn't reached ATH. According to a daily chart (pic 1), the price has been moving sideways since 2021 and a strong resistance is waiting ahead at 4,000.00. However, for now we are good. I bet that during upcoming days the asset will reach this level and rebound from it. Will it break the resistance? I think it is too early to make any conclusions.