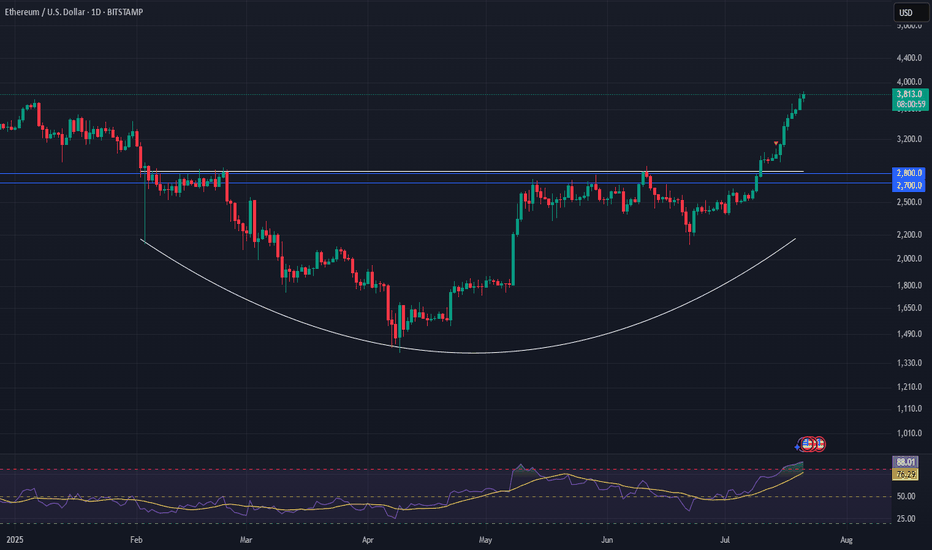

ETHUSD heading towards the top of the D1 frame✏️ CRYPTO:ETHUSD is in a strong uptrend towards the resistance zone of the 3800 daily frame. There are not many conditions for the sellers to jump in and reverse the current trend. Wait for the price reaction at the resistance of the D1 frame to consider the SELL strategy. Because currently if BUY is too Fomo.

📉 Key Levels

Sell trigger: Rejection from 3800

Target 3400, potentially 3,380

Leave your comments on the idea. I am happy to read your views.

ETHUSD trade ideas

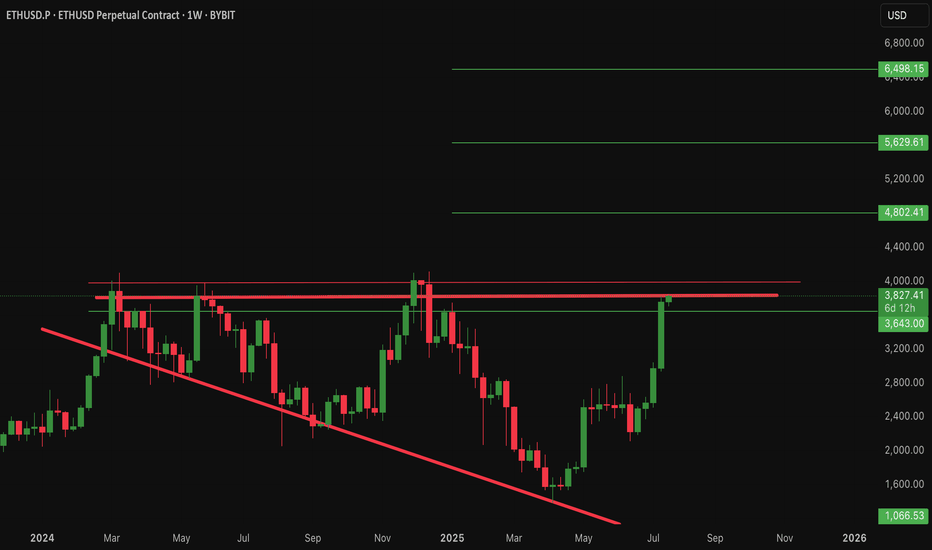

$Eth Ethereum nearing critical resistance....All Time High soon!This is a weekly candlestick chart of ETHUSD

Current price: 3800

CRYPTOCAP:ETH Ethereum recently broke out of a long-term downtrend, indicated by the red diagonal trendline. Price action has shifted from bearish to bullish. This is also a show of strong Momentum as recent candles are large and green, showing aggressive buying (strong bullish pressure).

If #eth continues in this uptrend then here are the resistance above to watch: 4000, 4800 and possibly new all time highs at 5600, 6400

Note worthy to know that the areas between 3800-4000 is very critical resistance.

Assuming a retracement from this resistance, Ethereum remain bullish above 2900

Invalidation of this idea is under 2900

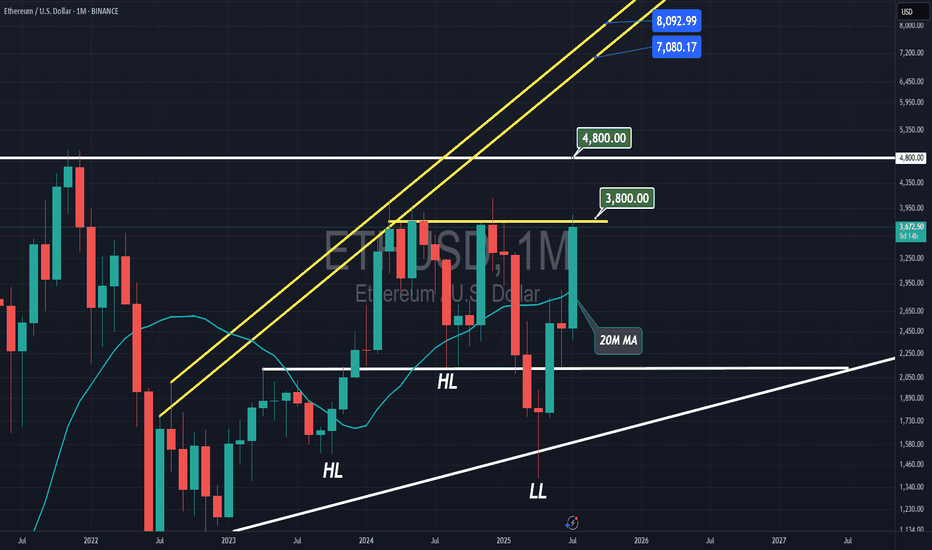

Ethereum: Breakout Holds Strong | Next Targets $4K, $7K+Last week, three major crypto bills cleared the U.S. House of Representatives—and Ethereum (ETH) is emerging as the biggest winner from this legislative momentum.

ETH recently broke out of a rounding bottom pattern and hasn’t looked back. Momentum continues to build, and it’s now outperforming most other major assets.

📈 Technical Highlights:

✅ Short-term target: $4,000

✅ Long-term potential: $7,000–$8,000

🛡️ Key support: $2,700–$2,800 (bullish as long as this holds)

📣 Takeaway:

Ethereum’s breakout remains intact. Pullbacks into support could offer high-probability setups for swing traders and long-term investors.

#Ethereum #ETHUSD #Crypto #Trading #TechnicalAnalysis #CryptoTrading #EthereumPrice #Altcoins #Bullish #Breakout

Ethereum Ready for New All Time HighEthereum's protracted consolidation between $2,000 and $4,000 over the past four years appears to be reaching a critical juncture. This extended period of sideways movement has built significant potential energy, suggesting that the market is coiling for a substantial breakout. Technical indicators are hinting at an imminent end to this consolidation phase, with increasing bullish momentum. Should Ethereum decisively break through key resistance levels, a rapid ascent towards the $10,000 mark by the end of the year becomes a distinct possibility. The duration of this consolidation underscores the magnitude of the anticipated move, making Ethereum a key asset to watch for substantial gains.

Anticipation is building for a potential surge towards the $10,000 mark by the end of the year. Several factors underpin this bullish outlook, including increasing institutional interest, the ongoing development and adoption of Ethereum's Layer-2 scaling solutions, and the continued growth of the decentralized finance (DeFi) ecosystem. The upcoming Fusaka upgrade, expected in late 2025, which aims to significantly reduce Layer-2 costs through Peer Data Availability Sampling (PeerDAS), is also contributing to optimistic price predictions. If Ethereum can maintain its current momentum and break through key resistance levels, the $10,000 target remains a distinct possibility.

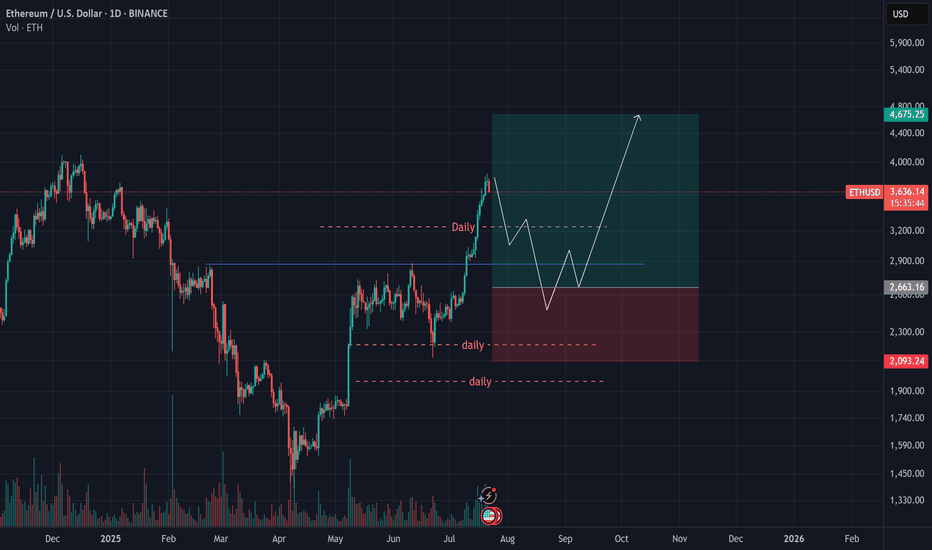

Ethereum (ETH) Analysis – July 21, 2025Ethereum has decisively broken through the key $3,000 level, pushing toward $4,000 with strong bullish momentum.

📉 While a short-term correction is likely in the coming weeks, ETH — much like Bitcoin — tends to attract increased investor interest with each dip.

As such, a continued rally toward $5,000 by the end of September remains well within reach, given the current structure and sentiment.

✅ Personally, I’m waiting for a pullback to around $2,700 as a more optimal re-entry point.

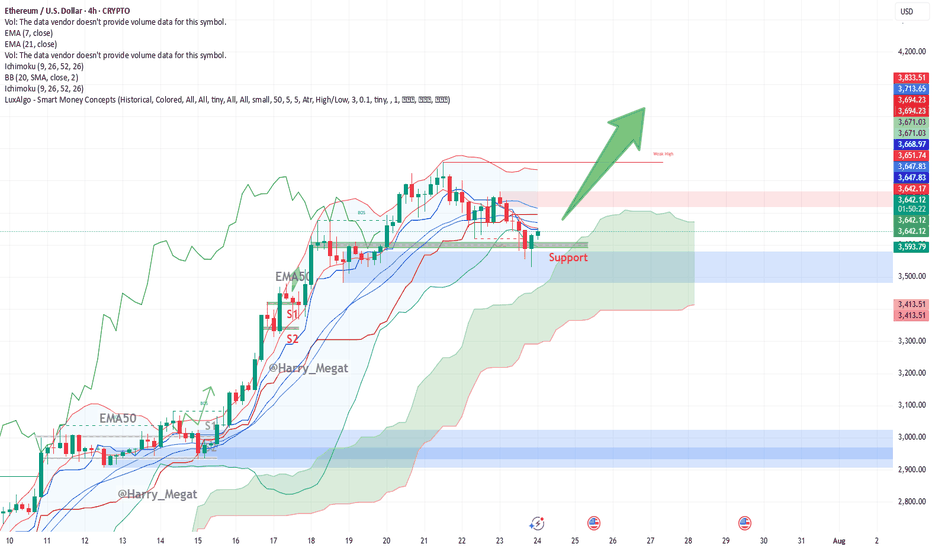

Ethereum (ETH/USD) 4-hour chart Technical AnalysisThis Ethereum (ETH/USD) 4-hour chart presents a **bullish setup**. Let’s break it down:

**Chart Overview:**

* **Price at the time of chart:** \~\$3,650

* **Support Zone:** \~\$3,615–3,630 (highlighted in green box)

* **Indicators:**

* **EMA 7 (Red):** \~\$3,653.87

* **EMA 21 (Blue):** \~\$3,669.75

* **Bullish Signal:** Large upward green arrow suggests expectation of a breakout rally from current support.

**Technical Analysis:**

**1. Bullish Bounce at Support**

* ETH tested the **horizontal support zone** multiple times, showing strong demand.

* The recent candle shows a **wick rejection** from the support zone — indicating buyer strength.

**2. Moving Averages**

* Price is trying to reclaim above the **EMA7**, with EMA21 nearby (\~\$3,670).

* A **bullish crossover** or strong candle close above both EMAs could confirm upside continuation.

**3. Structure**

* Previous resistance (\~\$3,615) has turned into **new support** — a classic bullish flip.

* The large green arrow projects a **potential breakout move**, targeting higher highs possibly above **\$3,750+**, then **\$3,900+**.

**Trade Setup Idea:**

| Type | Entry | Stop Loss | Take Profit 1 | Take Profit 2 |

| Long | \$3,655–3,660 | Below \$3,600 | \$3,750 | \$3,900+ |

**Watch Out For:**

* Rejection near EMA21 (\$3,670)

* False breakout if volume is weak

* Macro risk or sudden BTC movement dragging ETH

**Conclusion:**

The chart signals a **bullish bias** if ETH maintains above the support zone and reclaims both EMAs. A clean break above \~\$3,670–3,700 could spark further upside toward \$3,900+.

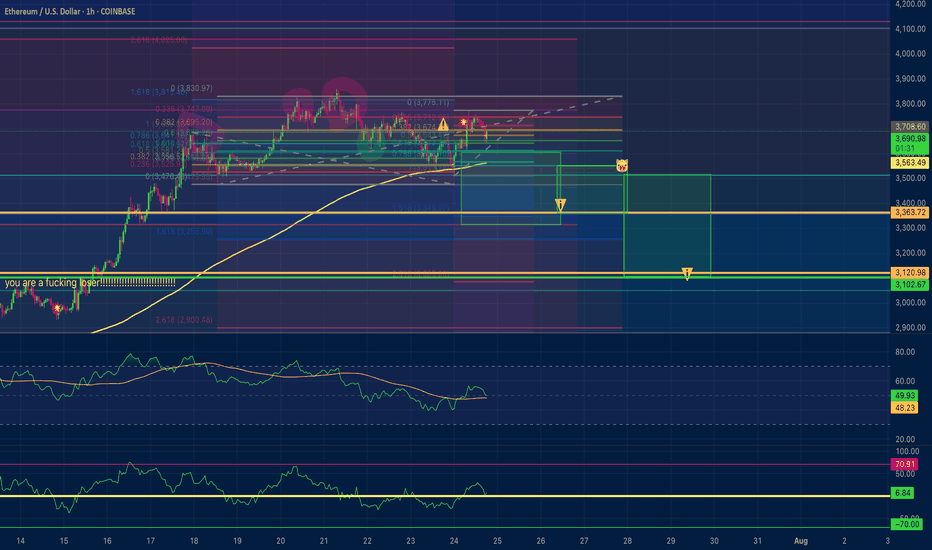

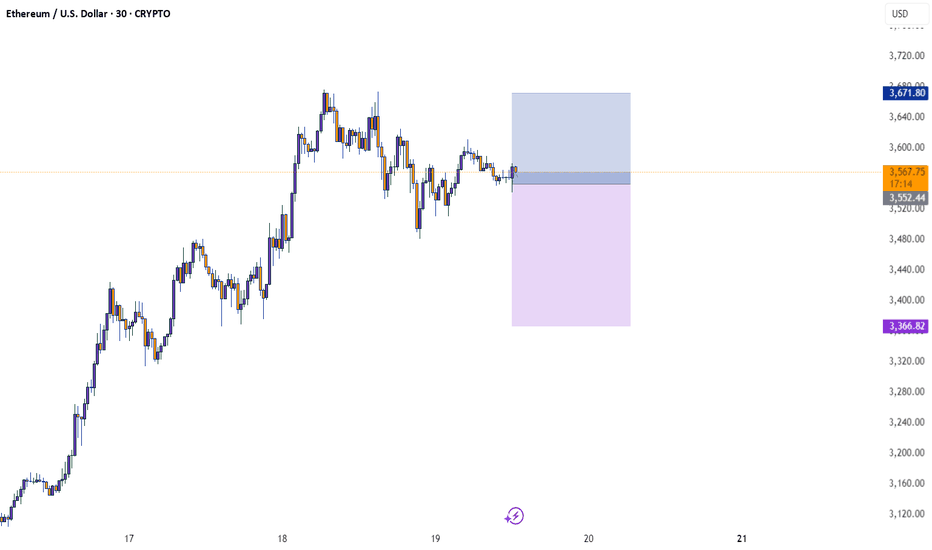

Ethereum Price Target $3,120 by Sunday?Ethereum short position Price Target $3,120 by Sunday ? Negative divergence on the hrly RSI.

Exhausted the 15 minute positive divergence when bouncing off the EMA 200 on the 1 Hour chart. First profit target is $3,350 second is $3,120. I am usually wrong with my estimations... I would recommend the opposite. So go long!

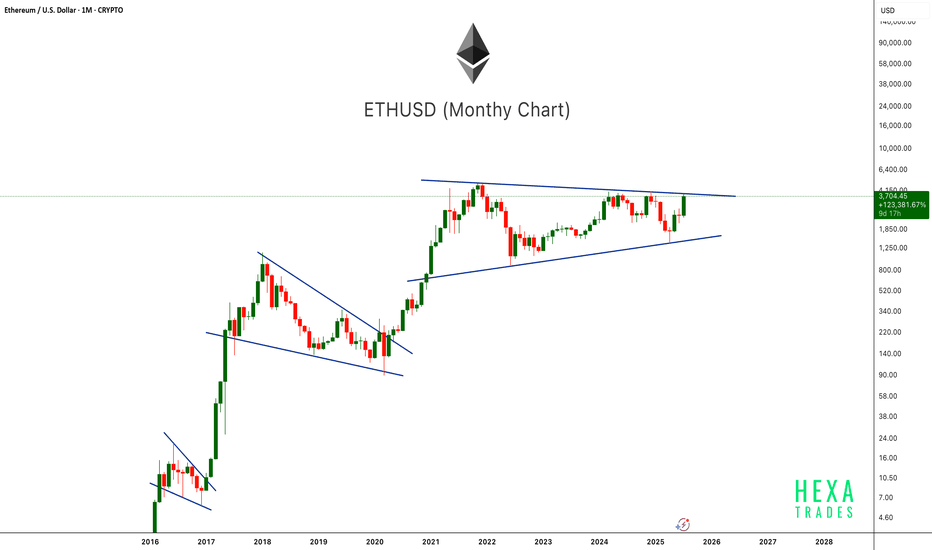

ETH Ready to Pop!ETHUSD is once again testing the upper boundary of a long-term symmetrical triangle on the monthly chart. This pattern has been forming since the 2021 peak, showing consistently higher lows and lower highs. Previous breakouts from similar consolidation patterns (2017 and 2020) led to massive rallies. With the current monthly candle showing strong bullish momentum, a confirmed breakout above this structure could mark the beginning of Ethereum's next major bull run. Keep an eye on the breakout level for confirmation.

Cheers

Hexa

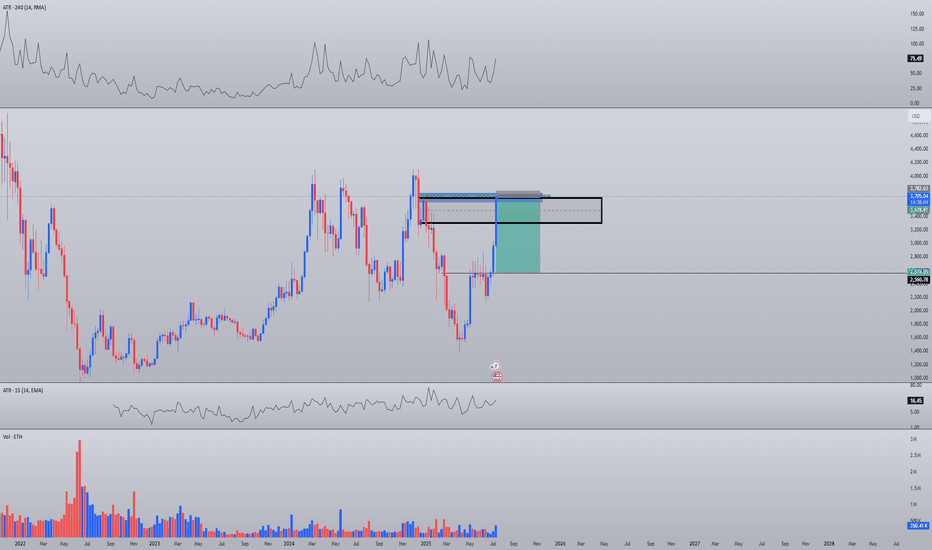

make or break for ethEthereum is currently trading at a make-or-break level. If we fail to break above this key resistance area before or during tomorrow’s U.S. market open, there’s a high likelihood of a sharp downside move. The most compelling bull case recently—BlackRock’s involvement in ETH staking through ETFs—has already played out. At this point, I struggle to see any near-term catalysts that could surpass that narrative in bullish impact.

Despite that, broader market sentiment remains highly irrational. Across equities and crypto alike, we’re seeing strength that, in my view, isn’t fundamentally justified. I personally don’t believe the market deserves new all-time highs given current macro and liquidity conditions.

Technically speaking, I’ll consider entering a short position if ETH closes within the 0.5 monthly order block without a clean breakout. On top of that, the Ethereum futures weekly chart also looks bearish—Friday’s close reinforced that weakness. However, it’s possible we gap up and invalidate the current futures order block, which would require a reassessment of the short setup.

Right now, caution and discipline are key. We're at a technical and psychological inflection point—and what happens next could shape the trend for weeks.

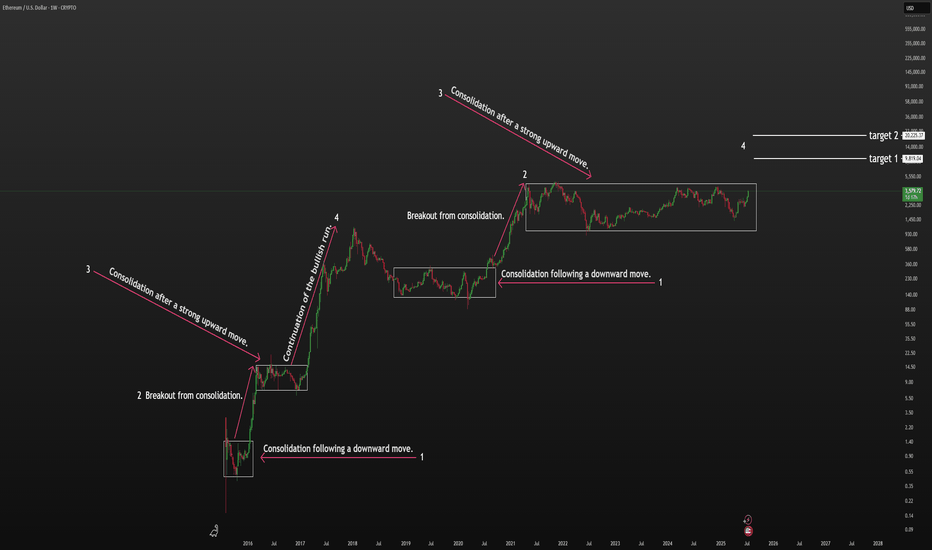

ETH - consolidation breakout - BULLRUN 2025 CONFIRMEDHistorically, Ethereum tends to make very strong impulsive moves after long periods of accumulation.

Right now, we've been consolidating for over 1,500 days — and while no one expects it, a move to $10K or even $20K is not off the table. The chart structure suggests it's possible.

Take a look at the historical price action I marked: after long consolidations came powerful bullish rallies.

And yes — those consolidation phases occurred during bear markets,

while the breakouts and bull runs happened in 2017 and 2021, right when the major BULL RUNS started!

Will 2025 be the same? LET’S SEE! 🚀

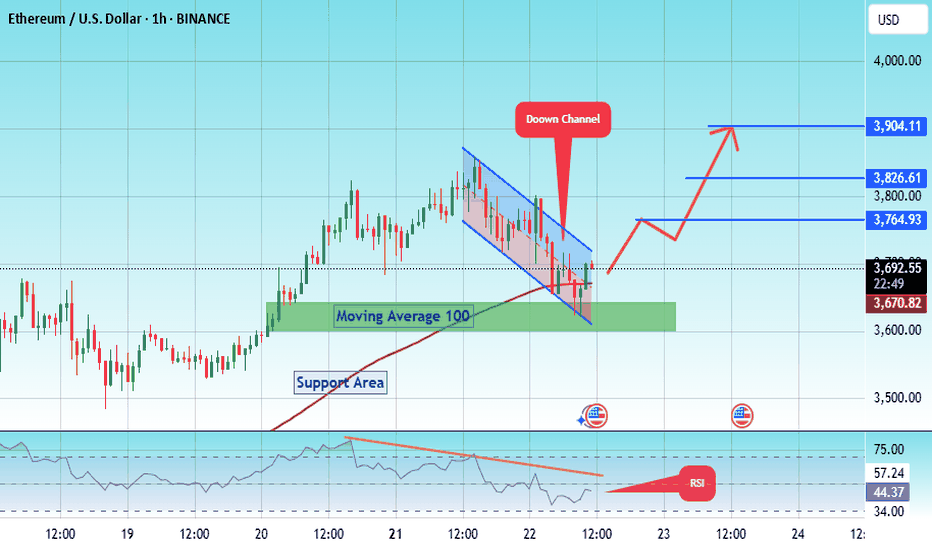

#ETH/USDT SETUP ,Bought From $3696#ETH

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking strongly upwards and retesting it.

We have support from the lower boundary of the descending channel at 3640.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upside.

There is a major support area in green at 3600, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the Moving Average 100.

Entry price: 3696.

First target: 3764.

Second target: 3826.

Third target: 3904.

Don't forget a simple thing: ease and capital.

When you reach your first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

MY VIEW ON ETH - BULLISH & BEARISHMy analysis of Ethereum (ETH): Bullish and bearish scenario

The analysis of Ethereum is currently quite complex. The price structure does not show clear impulses in the form of classic wave movements, but frequently overlapping patterns that indicate ABC correction waves.

I therefore present both my primary and an alternative scenario for a bullish (rising) and a bearish (falling) trend.

Primary bullish scenario:

Wave 2 seems to be completed at the lower end of the blue trend channel and at the 70.70-% FiB. We could currently be in red wave 3. However, the structure of this movement is more reminiscent of an ABC formation, which could indicate a weaker impulse.

Should the price break through the upper edge of the blue trend channel and exceed the 100% Fibonacci level at around USD 4,424, several important Fibonacci zones would converge in the “profit area” marked in red. In this case, a setback as part of the red wave 4 could not be ruled out.

Alternative (bearish) scenario:

It is possible that the blue V-wave could turn into a white ABC structure. In this case, an additional wave 4 would be omitted, which could result in a stronger sell-off.

Secondary scenario - bearish:

If Ethereum fails to play out the primary bullish count scenario, I expect that we will continue to be in an overarching correction phase. This assessment also fits in with the typical market slowdown during the summer months.

In this case, a green ABC correction could form, whereby wave C could theoretically still rise to the 100% Fibonacci level at USD 4,416. However, this would be an overextended wave B.

In addition, we are already in the area of the sales or profit zone, which indicates that only a limited rise is possible.

Subsequently, I expect a stronger downward movement towards the green buy area between the 1.618 Fibonacci level and around USD 1,866.

LEAVE YOUR COMMENTS AND ASSESSMENT

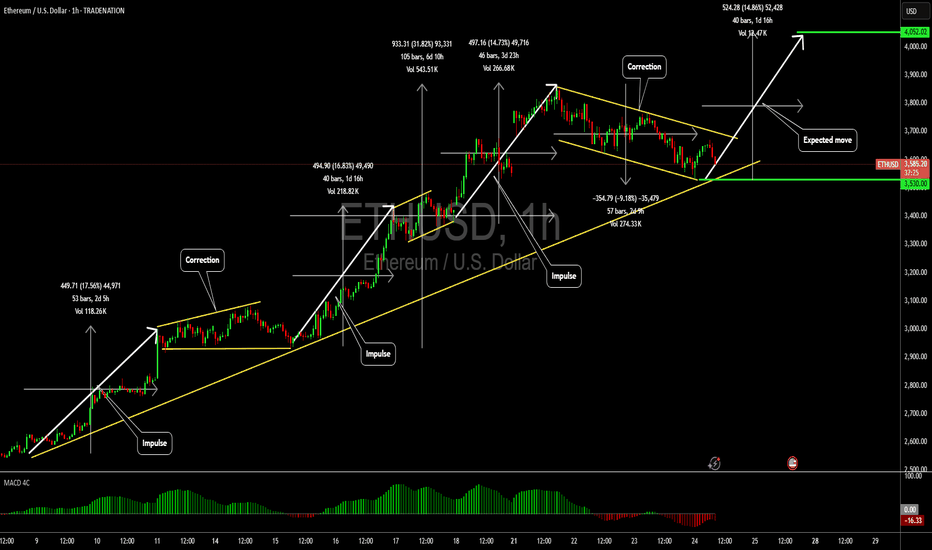

ETHUSD: A potential short term trade setting upHello,

The ETHUSD pair is currently forming a well-defined bullish flag pattern, a reliable indicator of a potential continuation of the upward trend. Risk-tolerant investors may consider entering at the lower boundary of the flag, while risk-averse investors might prefer to wait for a confirmed breakout to the upside before entering a position.

The MACD is showing a bullish zero-line crossover, further supporting our bullish outlook. Additionally, the cryptocurrency market has experienced significant growth recently, with Bitcoin trading at all-time highs. While Ethereum has underperformed Bitcoin, this lag presents a compelling buying opportunity, as investors who missed Bitcoin's rally may turn to Ethereum to capitalize on its potential catch-up

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

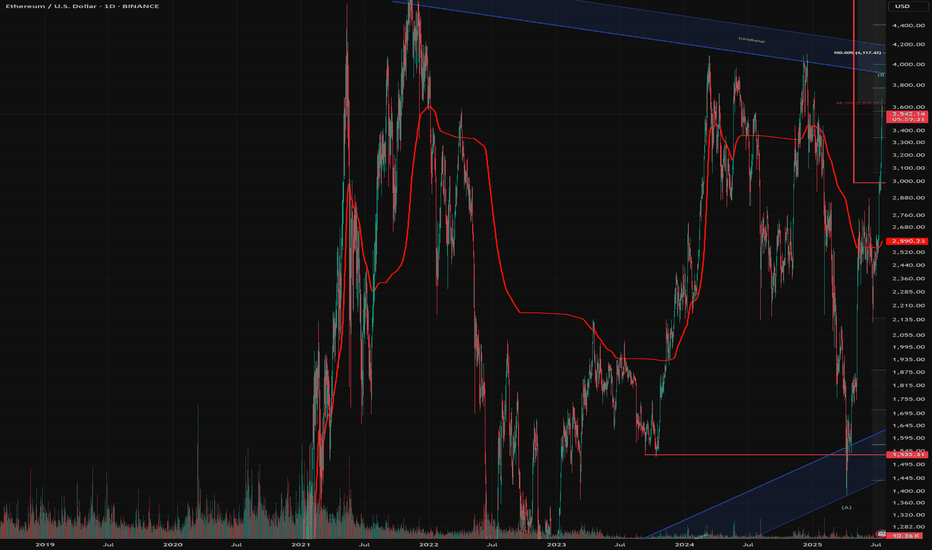

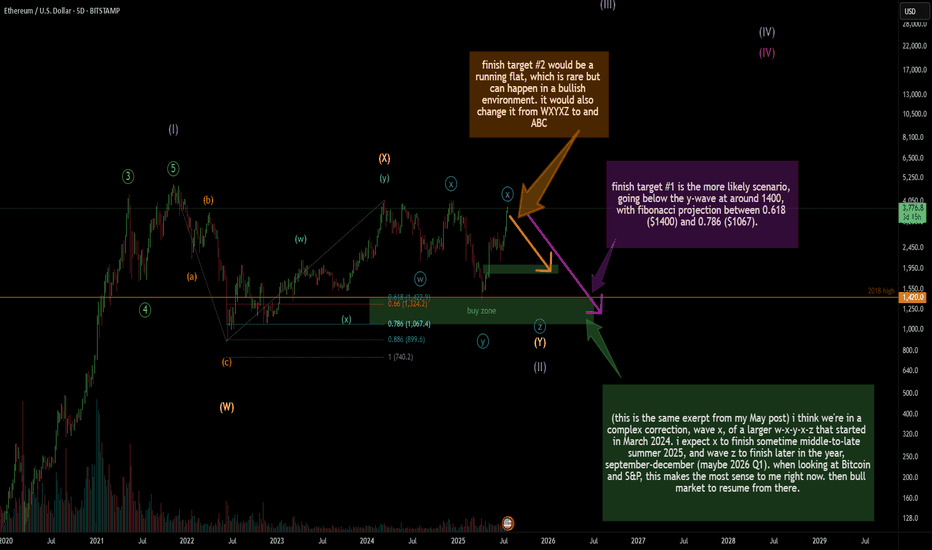

MTF bearish macro outlook on Ethereum, wave X finishedMini altcoin season over? I think we are about to see a record high amount of liquidation within the next few months.

This is not going to sit well with a lot of people I suspect.. Even if the count is technically correct, I suspect many will not see it as probable.

This is a bias based on not just Elliott waves, but internals of S&P and NQ looking week despite crawling higher this past few days. Ethereum and even Bitcoin having massive open interest (OI). Each time Ethereum has reached close to 4k area (2024 March, May, Dec, 2025 July), OI has increased significantly with high-ish positive funding rate. Almost all indicators for Bitcoin are red hot with bearish divergences. Momentum has stalled. Sentiment is ridiculously bullish.. after Bitcoin has had a 8x?

Having said that, from the last post, I was expecting somewhere around 3500-3600 region to finish the X wave. 1400 to 1800 run is impressive. But, so were the S&P, NQ, Bitcoin, and gold. I still see the recent April to July run as a 3-wave in Ethereum.

Invalidation is simple: it needs to break 4k. That would mean there are multiple 1-2's stacked in the April-to-July run..

I see 1900 as a very strong level. I suspect that's not the final destination but I expect to see a good reaction/bounce from that area. My primary target is just below 1400, the April 2025 low. Anywhere between around 1050 and 1400 should suffice, forming a massive running flat as a corrective wave 2 since 2022.

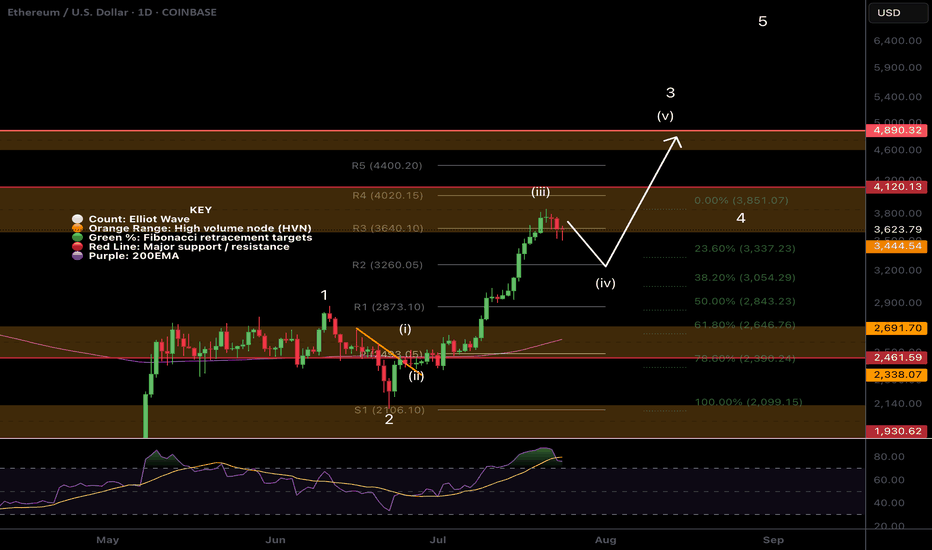

$ETH Hit Our Targets and was rejectedCRYPTOCAP:ETH hit our signal take profit target at $3820 and was rejected at the High Volume Node EQ to the penny.

That appears to have completed wave 3 of this motif wave. Wave 4 has an expected target of the R2 daily pivot and 0.236-0.382 Fibonacci retracement, $3260 before continuing to the upside in wave 5 with a target of the all time high.

This aligns with my views of a significant pullback at the end of August and September which is typical after a summer rally.

No divergences yet in daily RSI.

Safe trading

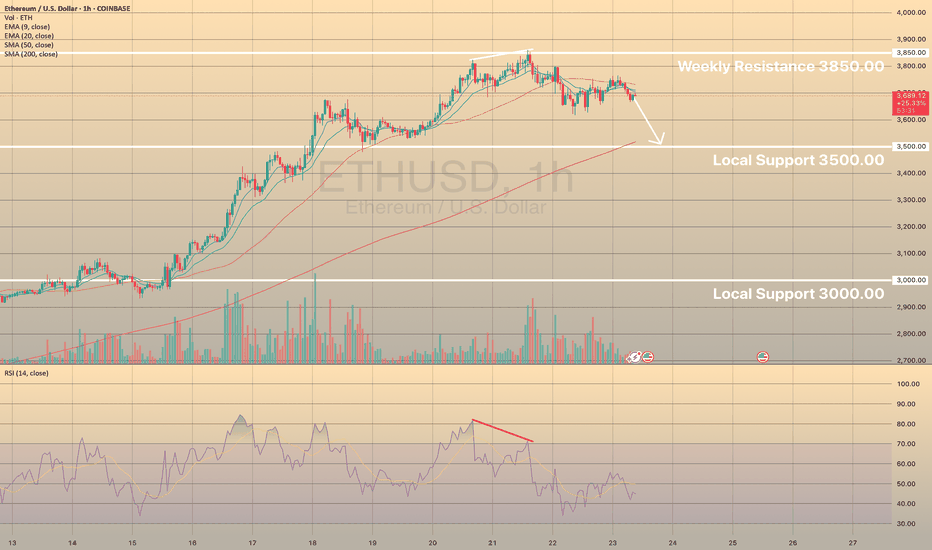

ETHUSD, XRPUSD - BEARISH DIVERGENCE SUCCESSFULLY WORKED OUT

ETHUSD, XRPUSD - BEARISH DIVERGENCE SUCCESSFULLY WORKED OUT

On these 2 graphs you may observe ethereum and ripple declining after strong bearish divergence showed up on both of these instruments. Here, the bearish divergence proved to be a success. In both cases the price has almost reached first targets: 3,500.00 for ETHUSD and 3.00000 for XRPUSD.

What will be next?

It looks like downwards correction still persists and we may observe some deeper than now decline with possible targets of 3,000.00 for the ETHUSD and 2.60000 for the XRPUSD.

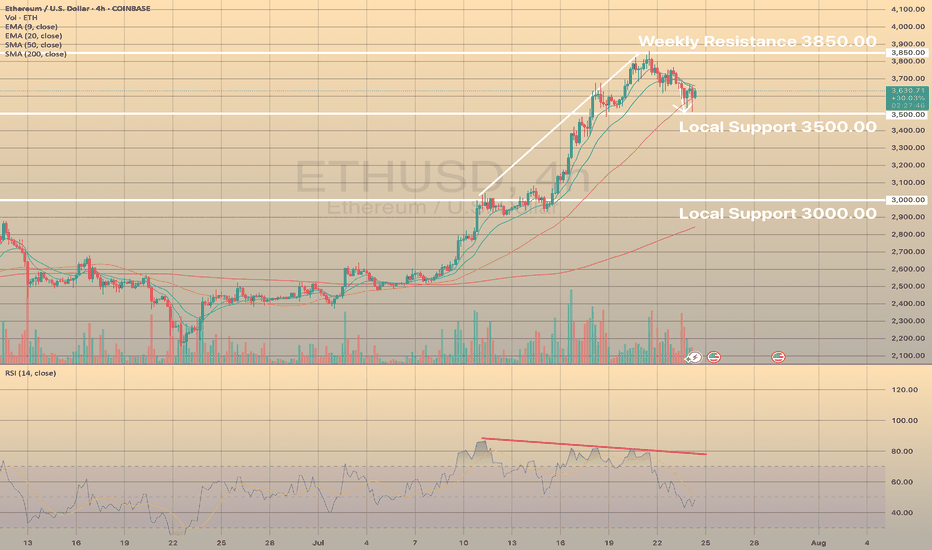

ETHUSD SEEMS TO RETEST SUPPORT LEVEL OF 3,500.00ETHUSD SEEMS TO RETEST SUPPORT LEVEL OF 3,500.00

The ETHUSD has hit some resistance at around 3,850.00 this week. But it's since pulled back from that level, which might be a sign of a cooling trend. That's backed up by the RSI going bearish.

Right now, the price is below the 50 SMA on the 1-hour chart, indicating a mid-term downtrend.

We could see the price find some support at 3500.00 or so. Additionally the SMA 200 lays nearby, providing extra support here.