ETHUSD trade ideas

Ethereum - Short Term Buy IdeaH1 - Strong bullish move.

No opposite signs.

Currently it looks like a pullback is happening.

Expecting further continuation higher until the two Fibonacci support zones hold.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Etherium..... Resisting at 50 % Fib RT.Though in an upward mood, the 50 % Fib RT seems a tuff nut to crack.

Expecting it to hold the 38.2 % Fib RT level of 2424, where the 200 DEMA too holds.

Lets see. Woukd love to add more at 2424 levels, with a strict SL if it daily closes below 2400.

Lots to learn from the markets.....

ETHUSD: First red day, day 2 on the backsideHello traders and welcome back on my profile, here is Gianni, and I hope you can enjoy this detailed analysis on ETHUSD.

As always, I don't use technical analysis for market prediction, because predicting is 50/50, but I use it to calculate my risk reward in case I would position myself in the market.

My general thesis for the day is pretty short, and following, the logic behind this thesis.

Monday, opening range of the week, established the current monthly high, breaking into the low of Friday (lower low) at the end of the day. Other time frames/big players might be in play and potentially the week can setup for a pump and dump.

Tuesday performed a strong pumping day, breaking through the Monday high and expanding the range higher, closing as well in breakout long.

Wednesday the market pretty much consolidated for the whole day, coming back inside the opening range high, and closing as first red day.

First red day is only a bearish signal, it doesn't mean that the market will drop certainly, but it gives you a signal the potentially long might be trapped in the wrong direction, increasing the chances of reversal, the day later or few more days later.

Today, Thursday, the market kept breaking lower, and it looks like coiling into the yesterday low of day, definitely a sign of weakness which I will keep in consideration.

8:30am and 8:40am NYT major red news are on schedule, I would not touch this market before that time, avoiding any possibility to be stuck in the trade.

How would I take this trade?

Simply I will be looking for any sell high opportunity after the news, reinforced with bearish price action, as triple tops, double tops and any kind of reversal patterns into the most recent high in place.

What about a long view?

Actually I'm not interested today, it can go higher, it can retest the weekly high, it can consolidate, it can do EVERYTHING, I don't care, my only focus is aligning my bearish thesis with a bearish setup.

I won't take in consideration any long opportunity for the day.

Overall, the market strongly pumped up during the previous week, I do not expect any crazy move, I do not think that this market trapped volume enough for a huge bearish collapse.

The potential opportunity of today, if presented, will be targeting the current weekly low (Monday low).

Stay tuned for further update during the NY session

Pectra Breakout to Unleash a New All-Time High? Ethereum’s Breakout Moment – Pectra to Unleash a New All-Time High?

Post with Emojis:

💎🚀 Ethereum’s Breakout Moment – Pectra to Unleash a New All-Time High? 🚀💎

Hey Traders!

Ethereum is standing at the gates of its next legendary move! With price holding strong above $2,531 and the Pectra upgrade just around the corner, all the stars are aligning for what could become one of the biggest rallies since The Merge. Are you ready for the breakout of the year?

📊 Key Levels to Watch:

📍 Support: $2,531 – Bulls holding the line perfectly.

🚀 Breakout Levels: $2,805 – $2,848 – The historic ‘Clashing Rocks’ resistance zone.

🎯 Immediate Targets: $3,200 – $3,500 🚀

🏆 Ultra Bullish Target: $4,000+ All-Time High Breakout Incoming!

📚 Why This Is NOT Just Another Pump:

🔧 Pectra Upgrade is a Game Changer:

💡 Smarter Wallets: No more annoying popups—seamless transactions!

⚡ Frictionless UX: Say goodbye to endless “approve + confirm” loops.

📉 Cheaper Transactions: Blobs scaling kicks in—lower fees, even in the craziest market conditions!

🌱 Staking Revolutionized: Bigger validator caps, faster deposits, smart contract withdrawals.

🔓 Unlocking $490B in Trapped Value: Capital flows freely—fueling the next bull run!

Ethereum is no longer just an asset—it’s transforming into the most efficient and user-friendly financial platform ever built.

💬 Question for You:

Are you already on board this rocket, or are you still watching from the sidelines? Which level will break first—$2,805 or $3,200?

Remember: When history and technology collide, markets explode. This is that moment.

One Love,

The FXPROFESSOR 💙

ps Trump bringing money from all over the place dominate news: for sure some ends up in Ethereum

ETH sub $1k coming soonCRYPTOCAP:ETH is rejecting resistance here. Unless we can flip it as support, then it looks like new lows are coming.

I think the most likely level to find support is at $753, however I marked off other levels that are important incase we find support there.

You'll want to bid these levels because they'll be the buy of the decade, should we get down there.

I'm calling for $10,000 per Ethereum.I think Ethereum could reach $10,000 or even $20,000 if we really go parabolic in wave 5.

We are potentially gearing up for the biggest crypto bull market in human history, and Ethereum should be a major player in this move.

As always, stay profitable.

– Dalin Anderson

ETH short than longLooking at Ethereum right now, $2760 is showing solid resistance. I’ve taken a short position there, expecting a pullback as momentum fades.

If price drops significantly, I’ve got a buy order waiting at $1870 — a key level from previous structure and a potential bounce zone if the market overreacts.

No emotions, just levels. Manage your risk and let the trade come to you. 👇

Short: $2760

Buy Limit: $1870

Ethereum - Bull run over Ethereum Weekly Chart Analysis (as of May 14, 2025)

1. Breakdown of M-Pattern:

Ethereum has clearly formed and broken down from a large M-pattern, indicating a bearish double-top structure.

This breakdown suggests weakness and the potential for a deeper correction if critical support levels fail.

2. Retest of Triangle Pattern:

After the breakdown, ETH has retested the lower boundary of a previously broken ascending triangle.

This retest aligns with the $2,746–$2,370 zone, which is now acting as a strong resistance cluster.

3. Current Price Zone – No Trading Zone:

Ethereum is currently trading around $2,587, right in a no-trading zone (highlighted in the chart box).

This zone represents indecision — neither a clear breakout nor breakdown — suggesting traders should wait for confirmation.

4. Bearish Scenario – Pin Zone Break:

A break below $2,370, the key horizontal support (also the neckline of the M-pattern), would likely confirm renewed bearish momentum.

If this level is decisively broken, expect a strong downward move.

5. Downside Targets:

First major support: $1,410 – previous swing low.

Final bearish target (highlighted in purple): $1,000–$1,004 — a psychological and historical support level.

6. Upside Scenario (less probable currently):

ETH would need to reclaim $2,746 and break back into the triangle to invalidate the bearish setup.

Only then could the long-term target of $5,391 be reconsidered.

Conclusion:

Ethereum is in a critical decision zone. While the macro pattern signals bearish continuation, confirmation will come on a break below $2,370. If that happens, a drop toward $1,000 is highly likely. Traders should remain cautious and avoid new positions until a decisive move occurs.

FXAN & Heikin Ashi Trade IdeaBINANCE:ETHUSD

In this video, I’ll be sharing my analysis of ETHUSD, using FXAN's proprietary algo indicators with my unique Heikin Ashi strategy. I’ll walk you through the reasoning behind my trade setup and highlight key areas where I’m anticipating potential opportunities.

I’m always happy to receive any feedback.

Like, share and comment! ❤️

Thank you for watching my videos! 🙏

Ethereum H4 | Overlap support at 23.6% Fibonacci retracementEthereum (ETH/USD) is falling towards an overlap support and could potentially bounce off this level to climb higher.

Buy entry is at 2,455.05 which is an overlap support that aligns close to the 23.6% Fibonacci retracement.

Stop loss is at 2,250.00 which is a level that lies underneath an overlap support.

Take profit is at 2,846.25 which is a multi-swing-high resistance.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

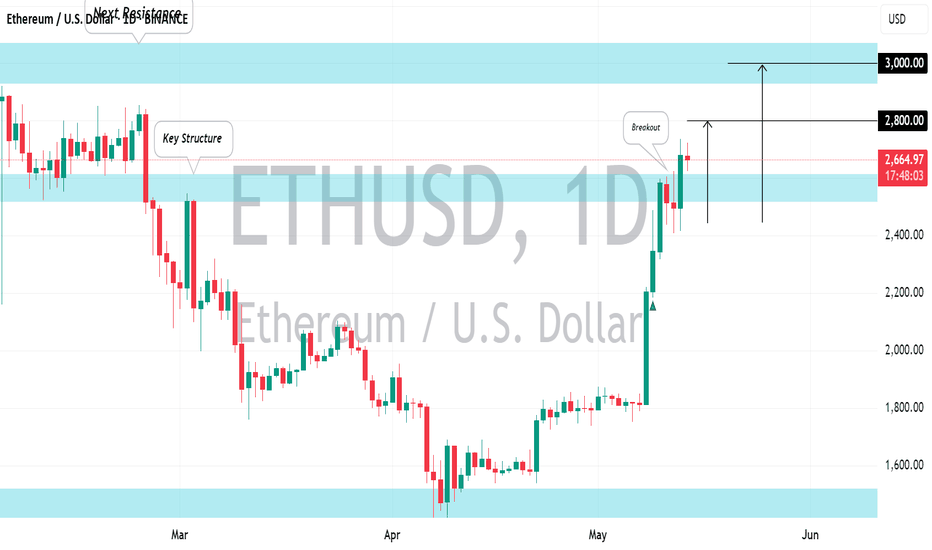

ETHEREUM (ETHUSD): Retest of $3000 Soon!Ethereum has successfully violated and closed above a significant daily horizontal resistance level.

The bullish momentum appears to be ongoing, and the price is likely to soon test the psychological level of $3000 mark.

Following this test, a breakout is expected, potentially driving prices to new heights.

ETHEREUM, the big catch-up has finally begun!Introduction: In our previous TradingView analyses, we defended the bullish recovery of the crypto market since the beginning of April, particularly for the bitcoin price. The latter seems to be positively correlated with the global liquidity trend (you can reread all our latest crypto analyses in our analysis history directly from the main page of our TradingView profile).

In this new analysis, we discuss the return of Ethereum's outperformance of Bitcoin.

1) ETH/USD bullish cycle: what are the theoretical price targets highlighted by technical analysis of the financial markets?

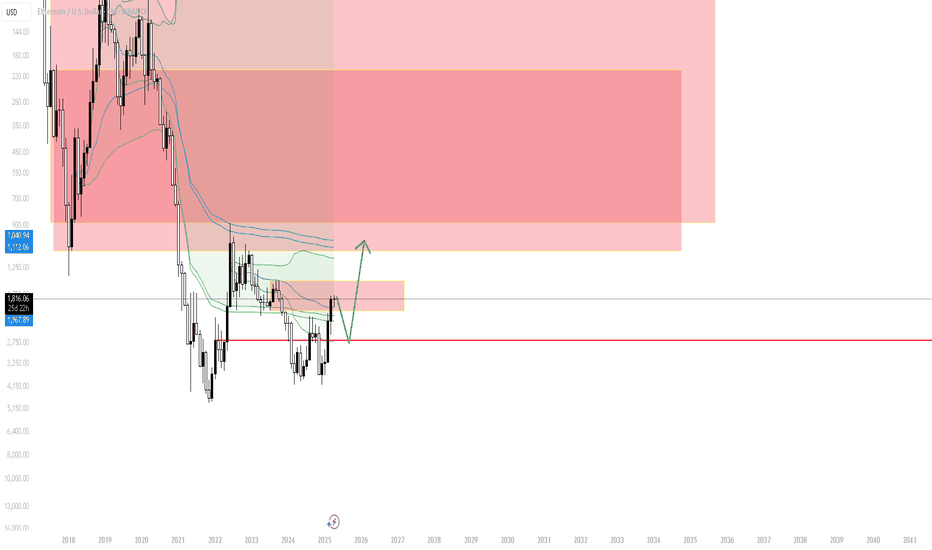

The current bullish cycle for ETH/USD began in the summer of 2022, with prices rebounding from the all-time high of the penultimate cycle, which peaked at $1150 in January 2018. A chartist base for a bullish reversal had developed between July and November 2022, before the uptrend began shortly after the FTX bankruptcy.

A well-constructed uptrend then took place until March 2024, with an intermediate high reached at $4,000, a resistance that three times produced a bearish rejection effect. The ETH/USD rate finally rallied back above major support at $1150/1350 and now appears to have resumed a bullish bottom trajectory in alignment with the bitcoin price.

2) Ethereum VS Bitcoin, the great catch-up may have begun

The question investors are now asking is whether or not Ethereum is in a position to outperform bitcoin in the coming weeks. To answer this question, we need to look at both fundamental and technical aspects.

On the fundamental level, the very recent “Pectra” update considerably improves the functioning of the Ethereum blockchain, notably by reducing transaction costs. This update could be the fundamental element underpinning a return to Ethereum's outperformance of Bitcoin.

In terms of technical analysis, it is the ETH/BTC ratio that helps determine Ethereum's cycles of outperformance and underperformance against Bitcoin. Technical analysis of the ETH/BTC ratio highlights the presence of long-term chart support, which seems to have enabled a clear rebound in the ETH/BTC rate.

Consequently, if this major support remains preserved over the coming weeks, then yes, it's becoming increasingly likely that ETH/USD will do better than BTC/USD over the next few weeks on the crypto-currency market. This market view would be invalidated in the event of a breakout of the major support mentioned and which is represented on the chart below.

DISCLAIMER:

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only. The presented idea (including market commentary, market data and observations) is not a work product of any research department of Swissquote or its affiliates. This material is intended to highlight market action and does not constitute investment, legal or tax advice. If you are a retail investor or lack experience in trading complex financial products, it is advisable to seek professional advice from licensed advisor before making any financial decisions.

This content is not intended to manipulate the market or encourage any specific financial behavior.

Swissquote makes no representation or warranty as to the quality, completeness, accuracy, comprehensiveness or non-infringement of such content. The views expressed are those of the consultant and are provided for educational purposes only. Any information provided relating to a product or market should not be construed as recommending an investment strategy or transaction. Past performance is not a guarantee of future results.

Swissquote and its employees and representatives shall in no event be held liable for any damages or losses arising directly or indirectly from decisions made on the basis of this content.

The use of any third-party brands or trademarks is for information only and does not imply endorsement by Swissquote, or that the trademark owner has authorised Swissquote to promote its products or services.

Swissquote is the marketing brand for the activities of Swissquote Bank Ltd (Switzerland) regulated by FINMA, Swissquote Capital Markets Limited regulated by CySEC (Cyprus), Swissquote Bank Europe SA (Luxembourg) regulated by the CSSF, Swissquote Ltd (UK) regulated by the FCA, Swissquote Financial Services (Malta) Ltd regulated by the Malta Financial Services Authority, Swissquote MEA Ltd. (UAE) regulated by the Dubai Financial Services Authority, Swissquote Pte Ltd (Singapore) regulated by the Monetary Authority of Singapore, Swissquote Asia Limited (Hong Kong) licensed by the Hong Kong Securities and Futures Commission (SFC) and Swissquote South Africa (Pty) Ltd supervised by the FSCA.

Products and services of Swissquote are only intended for those permitted to receive them under local law.

All investments carry a degree of risk. The risk of loss in trading or holding financial instruments can be substantial. The value of financial instruments, including but not limited to stocks, bonds, cryptocurrencies, and other assets, can fluctuate both upwards and downwards. There is a significant risk of financial loss when buying, selling, holding, staking, or investing in these instruments. SQBE makes no recommendations regarding any specific investment, transaction, or the use of any particular investment strategy.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. The vast majority of retail client accounts suffer capital losses when trading in CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Digital Assets are unregulated in most countries and consumer protection rules may not apply. As highly volatile speculative investments, Digital Assets are not suitable for investors without a high-risk tolerance. Make sure you understand each Digital Asset before you trade.

Cryptocurrencies are not considered legal tender in some jurisdictions and are subject to regulatory uncertainties.

The use of Internet-based systems can involve high risks, including, but not limited to, fraud, cyber-attacks, network and communication failures, as well as identity theft and phishing attacks related to crypto-assets.

ETHEREUM SWING SHORT|

✅ETHERUM went up by 76%

In just 3 weeks so the coin is

Overbought, therefore, despite

Or overall very bullish bias on

Crypto mid-term we will be

Expecting a local correction

From the wide horizontal

Resistance above around 2900$

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Long-term Perspective on ETH/USDHello,

The ETH/USD pair has recently caught my attention as the price has been forming within an ascending triangle setup. This pattern is usually considered a bullish signal, however, it's crucial to pay attention to the resistance and immediate support of the pattern to anticipate where the breakout may occur.

The ascending triangle's resistance and support are the two main areas to watch. If the price breaks above the resistance (the flat top of the triangle), we could see a significant bullish move, with the major supply zone being the crucial resistance to look out for. Conversely, the immediate support is the upwardly sloping line formed by rising troughs. If price breaks this trendline, it would indicate that bears have gained control.

It's worth noting the significance of Support Level 3. I consider this a 'dangerous' level of support, as a break below could potentially trigger a drop towards the $360 price point, a strong demand zone. However, I'm skeptical about this bearish scenario happening soon.

Please remember that the targets for both bullish and bearish scenarios are shown on the chart and these scenarios are based on the assumption of the price breaking out of the triangle.

While my analysis is currently leaning towards a bullish breakout given the ascending triangle pattern, I will be providing intermediate updates as the market develops. It's important to remember that this is a long-term market perspective and that crypto markets can be highly volatile and unpredictable.

As always, please consider this analysis as part of your own research and trading strategy. Stay tuned for updates and remember, trade smartly!