Ethereum (ETH): Buyers Losing Dominance....Might Fall To $1,400Ethereum might see one nasty fall pretty soon with the current dominance that sellers are showing on the markets.

Despite having a HUGE CME gap, we do not see any signs of recovery after yesterday's choppy movement, where price got rejected from 100EMA.

If we see further pressure from sellers just like that, we will see $1400 pretty soon, leaving the CME gap for later.

Swallow Academy

ETHUSDT.P trade ideas

DeGRAM | ETHUSD Breakout of the Downward Wedge📊 Technical Analysis

ETH broke out of a falling wedge and is testing resistance at $1 685. A breakout confirms bullish momentum.

💡 Fundamental Analysis

Staking yields are projected to exceed U.S. interest rates by mid-2025, attracting more investors.

✨ Summary

Technical breakout + rising staking yields = strong upside potential. Watch $1 685 for confirmation.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

ETH Analysis: Bearish Outlook ETH Analysis: Bearish Outlook

From previous price movements, ETH has shown strong reactions after retesting key structural areas. It tested 1943 before pulling back, and after breaking 1770, the decline accelerated.

Currently, ETH tested 1685 and is expected to move lower again. If it manages to rise slightly, it should not surpass 1770, which serves as a major resistance level. If it reaches this zone, the bearish wave could begin under a second scenario.

Overall, this reversal is taking place within a tight reversal zone, with price shifts limited to about 5% between key levels.

The bearish movement is anticipated to unfold as shown in the chart.

You may find more details in the chart!

Thank you and Good Luck!

❤️PS: Please support with a like or comment if you find this analysis useful for your trading day❤️

ETHUSDT: No Bottom yet, Bears still in control?Hey Realistic Traders, is ETHUSDT just a dead cat bounce, or are we looking at an actual reversal? Let’s dive in...

Since March 26, 2025, ETHUSDT has struggled to break above the EMA100 line, signaling a bearish trend. Additionally, a symmetrical triangle pattern has broken to the downside, further confirming bearish momentum.

The Stochastic indicator has crossed and is moving downward within the neutral zone, confirming that selling pressure may continue.

These signals indicate that Ethereum could drop toward our first target at $1,403. After hitting this level, a short pullback is likely as traders take profits, before the price potentially continues its descent toward a new low around $1,239.

These targets were identified using a combination of Fibonacci ratios and classic support/resistance levels, as shown in the chart.

This outlook remains valid as long as the price moves below the stop-loss level at 1,754.

Support the channel by engaging with the content, using the rocket button, and sharing your opinions in the comments below.

Disclaimer: "Please note that this analysis is solely for educational purposes and should not be considered a recommendation to take a long or short position on Ethereum.

ETH | Position SetupNew safe setup based on fundamentals & market structure.

🧠 Ethereum is still the market’s tech locomotive — accumulating capital, awaiting major updates (ETF, staking, etc.).

Entry: $1,600

DCA: $1,155

Estimated liquidation: ~$790

⚙️ Execution:

30% at market

50% limit buy

20% margin addition

🎯 Take-Profit Strategy:

TP1: $2,066 (+78%) → 20%

TP2: $2,486 (+156%) → 30%

TP3: $3,050 (+263%) → 40%

TP4: open → 10%

⭐️ High R/R setup with max drawdown control and clean 3.3x potential.

ETH Possible breakout pendingIf BTC doesnt screw this up we have a solid chance of breaking out on 4hr TF of ETH/USDT based on:

- Previous retest of the 1680 - 1690 resistance leading to continued higher lows, &

- RSI trending upwards.

- Another retest is coming

Invalidated if:

- We fall off directly from the structure being formed here.

- Retest at resistance (1680) & being unable to penetrate, which imo will lead to accelerated bottom retest.

Important: ETH/BTC is still on command breathing with not many signs of flipping the trend.

Interesting to see how this plays out.

Ethereum (ETH): Seeing Buying Pressure | Buy Entry ActivatedEthereum has broken our buy entry zone and retested it properly, and now we are looking to see further movement to upper zones here, which would lead the price to the 200EMA line.

If all goes as planned, we should see a target of 25% reached; liquidity of BTC has to flow now into ETH.

Swallow Academy

ETHUSDT soon above 2200$AFter huge fall in previous months now the whales are ready to buy back tokens and market and let it rise once again this time pump can continue or it may be short-term but no worries we are opening buy here and set target to close to decrease the risk and even short-term range can hit our target near 2200$.

DISCLAIMER: ((trade based on your own decision))

<<press like👍 if you enjoy💚

ETH Daily AnalysisEthereum Technical Outlook 🧠

ETH is currently in a downtrend on both the daily and 4-hour timeframes 📉.

The $2100–$2150 range, which previously acted as a major support level, has now turned into a key resistance zone 🔄.

Price is moving within an ascending channel 📈 and approaching a supply zone located between $1790–$1820 🟥.

For a confirmed trend reversal, Ethereum must break above the red descending trendline 🔻 and flip the key resistance zone (marked on the chart) into support ✅.

Until then, bearish momentum remains dominant.

ETH/USDT Breaks Uptrend – Key Retracement Zone in PlayETH/USDT has broken its recent uptrend and is now entering a correction phase, approaching a key retracement zone around the $1,630 level. This area has acted as strong support in the past and could become a critical decision point for price action. If the level holds, it may trigger a continuation of the broader bullish trend. However, a breakdown below this zone could open the door for a deeper pullback. Monitoring closely for confirmation and market reaction.

Trade safe, Joe.

ETH is fighting in the support zoneHello everyone, I invite you to review the current situation on ETH. When we enter the one-day interval, we can see how the ETH price moved in a strong downtrend channel. What's more, we can see that the price fell below the main uptrend line.

As we can see, the price is currently fighting to break out on top in the support zone from $ 1690 to $ 1350, in a situation if this zone was broken, we could see another strong drop to the support area at $ 884 at the previous low after the bull run.

On the other hand, if ETH gets wind in its sails again, it must first pass through the resistance zone from $ 1952 to $ 2100, while further on there is a very strong zone from $ 2500 to $ 2740.

However, here, taking into account the one-day interval, the RSI indicator shows a breakout above the top of the border, which may affect the potential end of the current uptrend.

$ETHUSDT Bearish downtrend Analysis:Join our community and start your crypto journey today for:

In-depth market analysis

Accurate trade setups

Early access to trending altcoins

Life-changing profit potential

Let' analyse ETHUSDT:

Ethereum has been consistently respecting a strong descending channel and 21-day EMA since its peak earlier this year. Each lower high has led to a significant drop, creating a pattern of bearish rallies followed by sharp corrections. Let’s break it down:

Bearish Wave Structure:

ETH has seen four major drops off this trendline:

-28.55%

-34.03%

-30.56%

Each time price approached the trendline, it faced heavy resistance, leading to these sharp declines — forming a repeating structure of lower highs and lower lows.

Current Setup:

ETH is now again testing the descending channel and 21 day EMA, mirroring previous price behavior. This is a key decision point.

Technical Observations:

Price is approaching horizontal resistance, 21D EMA, and the channel upper line.

Rejections from this area have historically triggered steep drops.

The downtrend remains intact unless a clean breakout occurs.

What to Watch For:

Rejection Zone: ~$1,750–$1,730 (previous horizontal rejection zones + channel).

Confirmation of Breakout: Daily close outside channel and above 21D EMA with follow-through volume.

Breakdown: Failure to break and bearish engulfing near resistance could signal another wave down.

Conclusion:

ETH is at a critical resistance confluence. While a breakout would be a significant technical shift, the current trend favors caution. Watch closely for confirmation signals before positioning.

If you find this analysis helpful, please hit the like button to support my content! Share your thoughts in the comments, and feel free to request any specific chart analysis you’d like to see.

Happy Trading!!

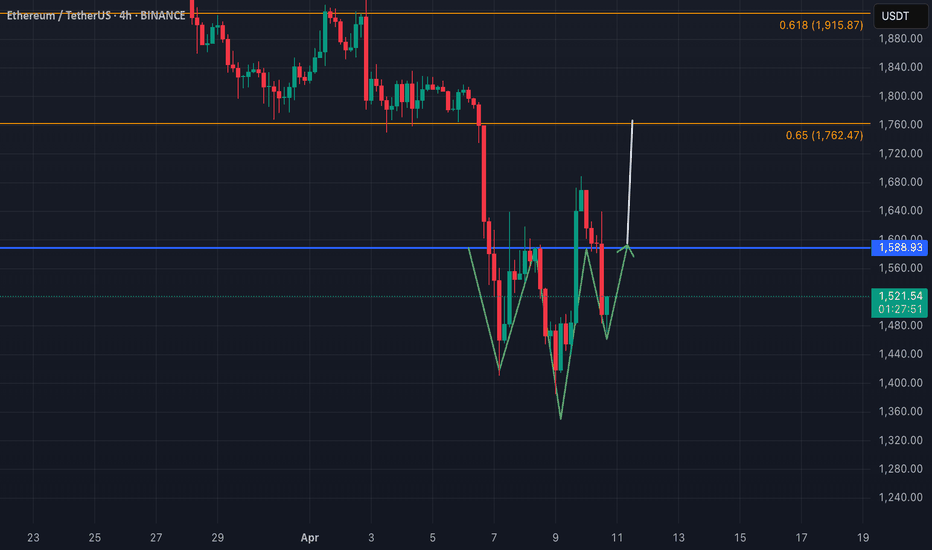

Head and shoulders on eth?🕰️ Timeframe: 4H

📈 Pattern: Inverse Head & Shoulders (Bullish Reversal Setup)

📍 Current Price: $1,518

📏 Neckline: ~$1,589 (marked in blue)

🧠 Pattern Structure:

Left Shoulder: ~$1,475

Head: ~$1,420

Right Shoulder: ~$1,470

Neckline: ~$1,589

Measured Target: Neckline to bottom = ~$1,589 - $1,420 = $169

→ Breakout Target = $1,589 + 169 = $1,758** — aligns with Fib 0.65 ($1,762)**

🧩 Confluence Factors:

🔹 Fibonacci 0.65 @ $1762 = Target zone of the pattern

🔹 Fibonacci 0.618 @ $1915 = Secondary resistance zone

🔹 Clean neckline retest idea → breakout & retest of $1589 = ideal entry trigger

🔹 RSI divergence (if any) & volume confirmation on breakout = final confidence boost

✅ Strategy Plan:

Entry Idea: Break & retest of $1589

Take-Profit: $1758–1766

Stop-Loss: Below right shoulder ($1465–1470 zone)

Risk/Reward: ~2.5R depending on entry accuracy

Probability: 65/35 bullish continuation if neckline breaks with strong volume