#ETH Update #5 – July 27, 2025#ETH Update #5 – July 27, 2025

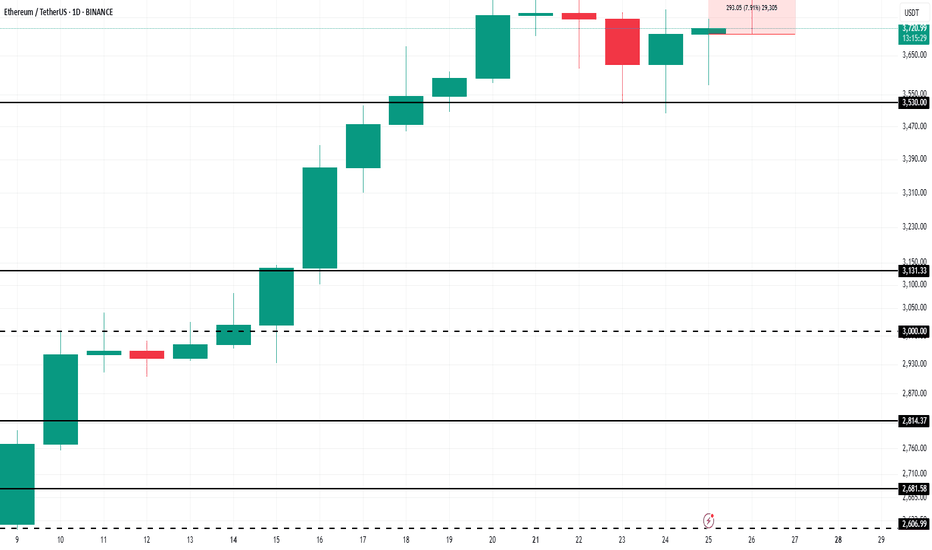

Ethereum is attempting to revisit the levels of its previous impulsive move without having completed a proper correction. The fact that Ethereum has not made a retracement around 3280 and is instead pushing toward a new ATH does not seem very healthy to me. If it had completed the correction, it would have also balanced an existing imbalance in the structure.

When we look at the recent candles, we observe a lack of volume. This volume weakness is not sufficient to break the resistance at the previous high. If Ethereum breaks the 3900 dollar resistance level with a strong candle, it could move toward the 4335 dollar zone.

However, it should not be forgotten that there is still an imbalance and a correction zone around 3280 dollars. If the price decides to return to that level, it would mean an approximately 15% pullback from here. This could pose significant risk for altcoins, and we might see corrections of up to 40% in some.

Ethereum is currently one of the riskier assets for either taking a long or short position. Therefore, I do not recommend opening any position at this stage.

ETHUSDT trade ideas

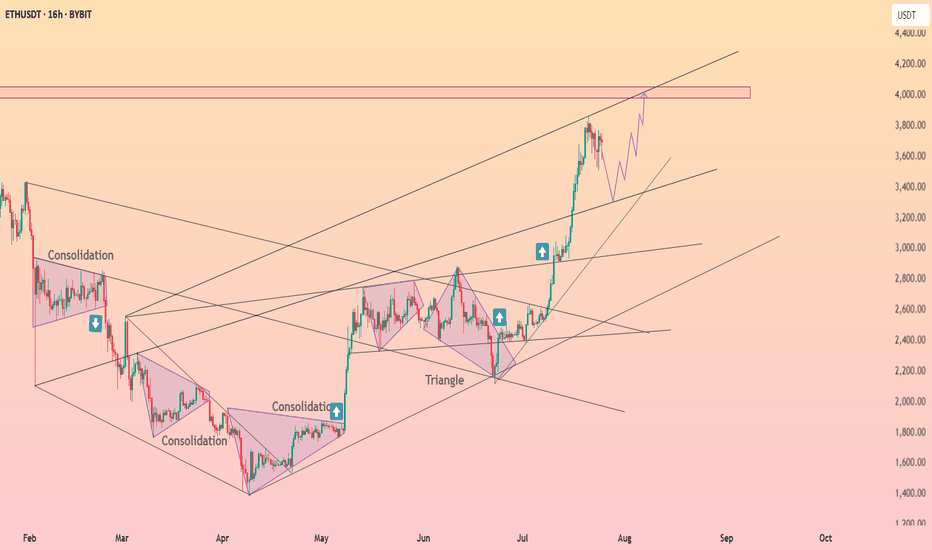

ETH Daily – Triple Rejection Zone Back in PlayEthereum’s pushing back into one of the most important resistance zones on the chart — the same level that’s caused three major rejections in the past year.

Now we’re testing it again, but this time momentum’s different. Daily structure is stronger, volume’s climbing, and bulls are showing no hesitation.

Here’s what matters:

– Triple top? If rejected again, this zone holds the trend hostage

– Break + retest? That’s the setup bulls have been waiting for

– Either way, this is a high-stakes level — and price won’t stay here long

Eyes on ETH. This zone will decide the next leg.

#ETH #Ethereum #TripleTop #ResistanceTest #CryptoTrading #DailyChart #TechnicalAnalysis #QuantTradingPro

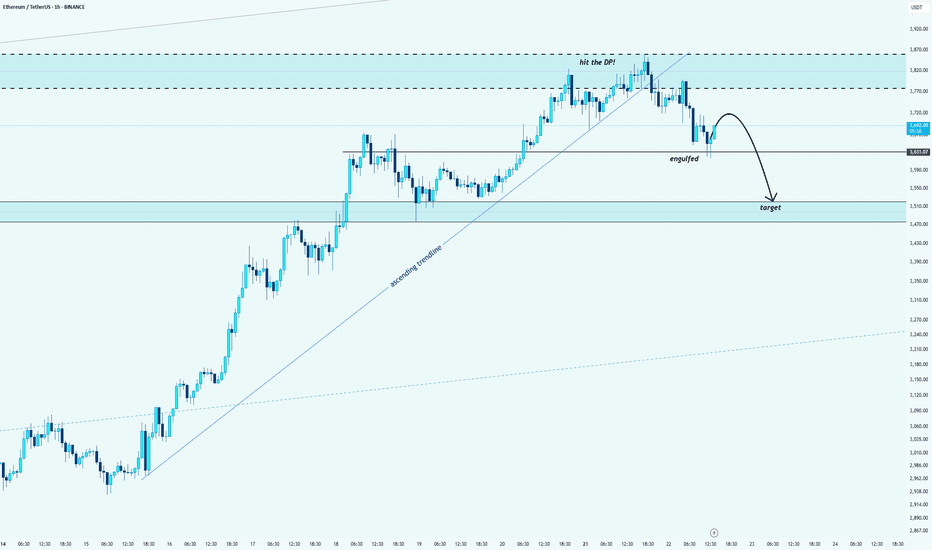

ETH/USDT: Bearish Reversal After Hitting the Decision PointHello guys!

After a strong rally, ETH finally hit the Decision Point (DP) zone marked above. Like what I said:

And we’ve already seen signs of rejection from that level.

🔹 The ascending trendline is broken

🔹 A key support got engulfed

🔹 Price is now forming a bearish structure

The target zone is mapped out around $3,500 – $3,470, where previous demand sits.

We might see a small pullback before continuation, but overall momentum is shifting downward.

Wait for confirmations and protect your capital

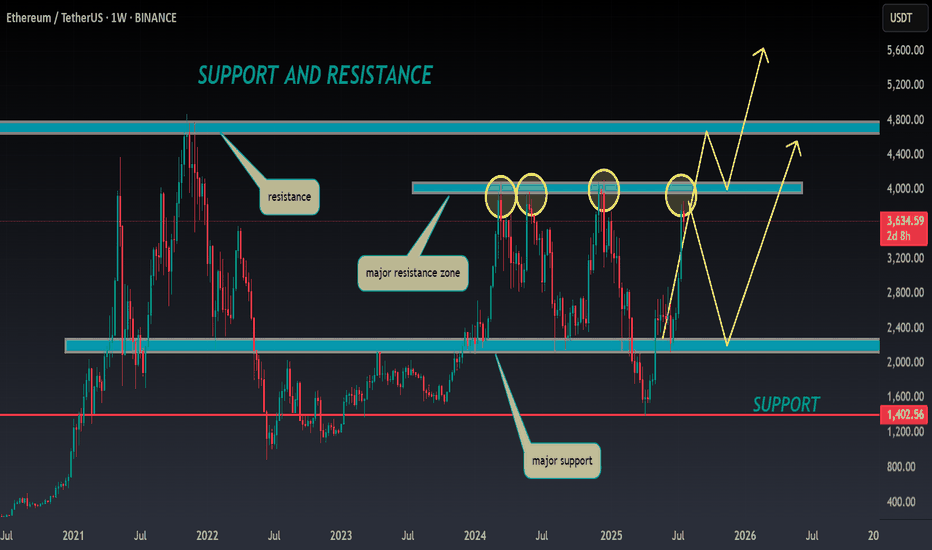

ETH ANALYSIS🔮 #ETH Analysis 🚀🚀

💲💲 #ETH is trading between support and resistance area. There is a potential rejection again from its resistance zone and pullback from support zone. If #ETH breaks the major resistance zone then we would see a bullish move

💸Current Price -- $3634

⁉️ What to do?

- We have marked crucial levels in the chart . We can trade according to the chart and make some profits. 🚀💸

#ETH #Cryptocurrency #DYOR

Ethereum is likely to retrace before continuing its bullish moveEthereum's technicals are highly bullish, supported by strong fundamentals. According to the market structure, it may retrace to the level shown in the chart above to collect liquidity and fill orders before moving forward to All time high near 4800.

Ethereum Analysis + Market Overview 🚀 Ethereum Analysis + Market Overview 🚀

Before diving into Ethereum, let’s quickly review the overall market conditions 👇👇👇

(For a more detailed market analysis, you can check my previous post, I’ll link it below.)

---

🔹 Analysis style:

Reviewing previous highs/lows breakouts in the mid-term (MWC - 4H).

Entries based on momentum & volume.

---

♦️ USDT.D

Support: 4.22

Max expected correction: 4.51

If 4.51 breaks upward, this could push us toward short positions.

---

♦️ BTC.D

Yesterday’s levels & analysis still remain valid.

Remember, on HWC (1D), after the recent downtrend, there’s only been one bullish candle.

For altcoins to rally: BTC.D must drop below 61.6 → 60.83 → 60.42.

Otherwise, if BTC.D grows (bearish for alts), 62.17 is the key resistance to watch.

---

♦️ TOTAL (Crypto Market Cap)

Must break 3.91 to confirm a bullish trend.

Early signal: 3.85 (1H timeframe).

---

♦️ TOTAL2 (Altcoin Market Cap)

Early bullish signal: 1.48

Confirmation level: 1.55

---

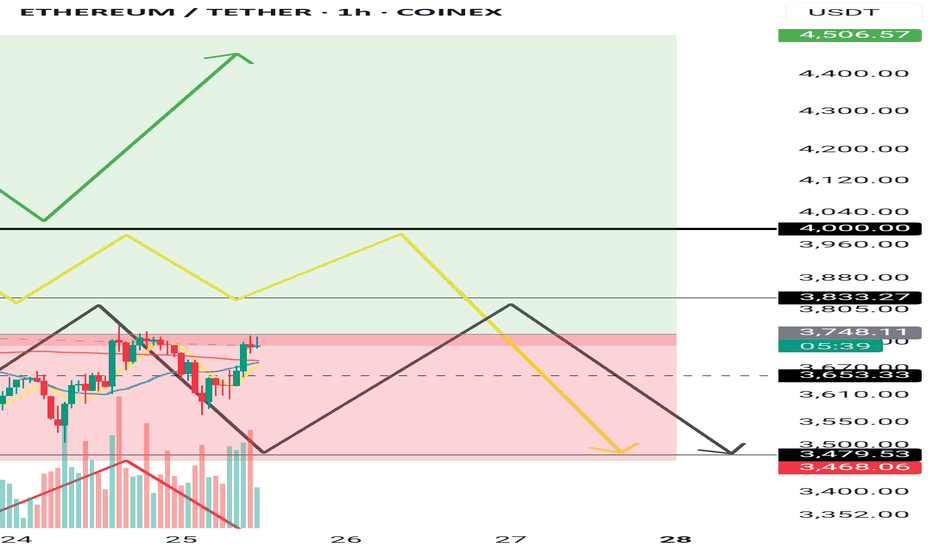

♦️ ETH (Ethereum)

Ethereum has shown strong support around 3500, despite the 48-hour drop, which reflects solid buying activity.

Additionally, positive whale news is increasing.

Early & risky trigger: 3653 (1H) – already broken.

Next potential entries:

3750 (1H)

3833 (4H)

Preferred entry: 3750, as it allows a tighter & safer stop-loss.

Beware: Fake breakout probability around 3833 is high.

Stop-loss for all 3 levels: 3455.

---

🔸 Entry Strategy:

If volume & momentum increase → place a stop-buy order on the exchange.

If volume is weak → wait for confirmed breakout above 3750.

---

♦️ ETH.D

The chart is fully bullish.

If ETH hits 3750, an early long position could be taken.

---

💎 Follow me & hit 🚀 for more real-time updates and setups!

---

ETH/USDT – Altseason Confirmation in Sight?Ethereum's recent breakout at 1900$ is showing strong momentum and may be signaling the long-awaited start of altseason. A daily close above the red resistance box will act as a key confirmation of this shift and could trigger a parabolic move across many altcoins.

For ETH, the next upside targets are:

$3,500

$4,000

$4,700

Stay alert — a confirmed breakout here could light the fuse for the broader altcoin market.

Ethereum’s $4,000 Target Alive as Historic Rally Signs EmergeBINANCE:ETHUSDT is currently trading at $3,680, just 9% away from the critical $4,000 resistance that many investors have been waiting for over the past seven months. The altcoin is expected to continue its upward momentum despite the recent consolidation, with the potential to breach the $4,000 mark soon.

Looking at broader technical indicators, the NUPL (Net Unrealized Profit/Loss) suggests that BINANCE:ETHUSDT is poised for a significant rally . The NUPL indicator, when reaching a threshold of 0.5, traditionally signals a pause in the uptrend, followed by a sharp rally.

$ BINANCE:ETHUSDT is currently nearing this threshold , which, in the past, has marked the beginning of powerful upward price action.

As long as BINANCE:ETHUSDT remains above its key support levels, the price is likely to surge toward $4,000 . If Ethereum can maintain its momentum, a breach of $4,000 could act as a catalyst for further gains.

However, should unforeseen selling pressure arise, $BINANCE:ETHUSDTprice could slip below the $3,530 support level. In such a scenario, Ethereum may fall to $3,131, invalidating the current bullish outlook. The key will be maintaining support and capitalizing on the retail-driven surge.

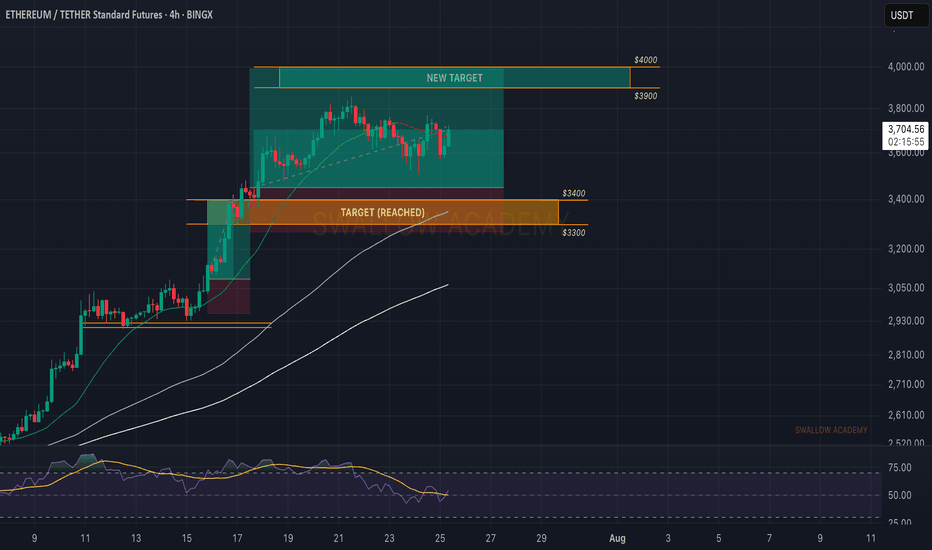

Ethereum (ETH): Buyers Accumulated | Time For Boune & BreakoutEthereum had its fun this week, and now we are already seeing some signs of buyer dominance forming here.

Based on our overall target and bigger timeframes, TAs, the $4000 is the target and 4hour candels are showing that buyers have not given away anything yet but rather have just been accumulating.

As long as we are above our entry area, we are bullish, and so should you be ...

Swallow Academy

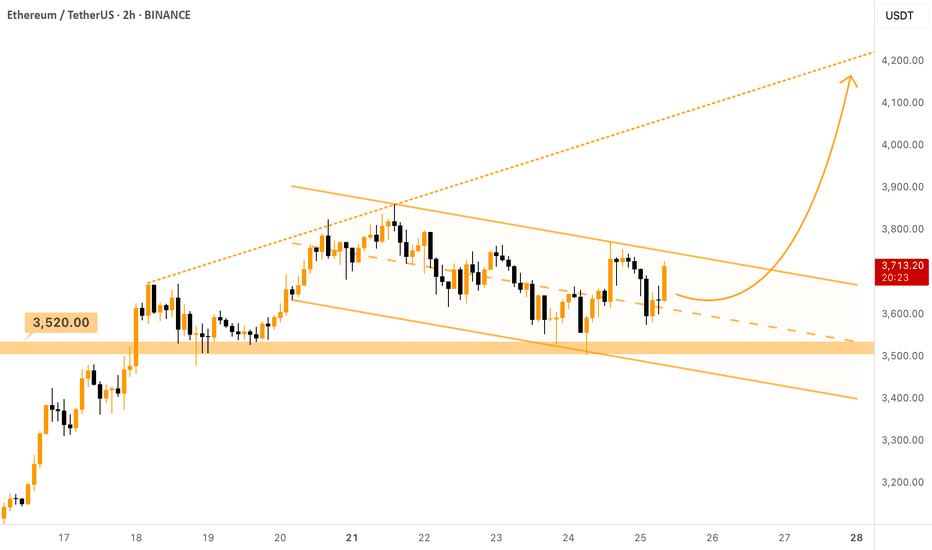

$ETH - Taking Lead Over $BTC (again)Ethereum is strong as ever here. Despite Bitcoin dumped due to the FUD of Galaxy Digital selling CRYPTOCAP:BTC worth of $3.5B, Ethereum managed not stay above the support and even umped!

It is currently forming a Descending Channel (bullish pattern) above the $3520 support level. Local setup. Once this channel is broken upwards, we can expect the price to move towards the ascending resistance that was set a week ago, target is $4100 - $4200 .

You can either enter a trade here or wait for the breakout of the descending channel, the second option is safer.

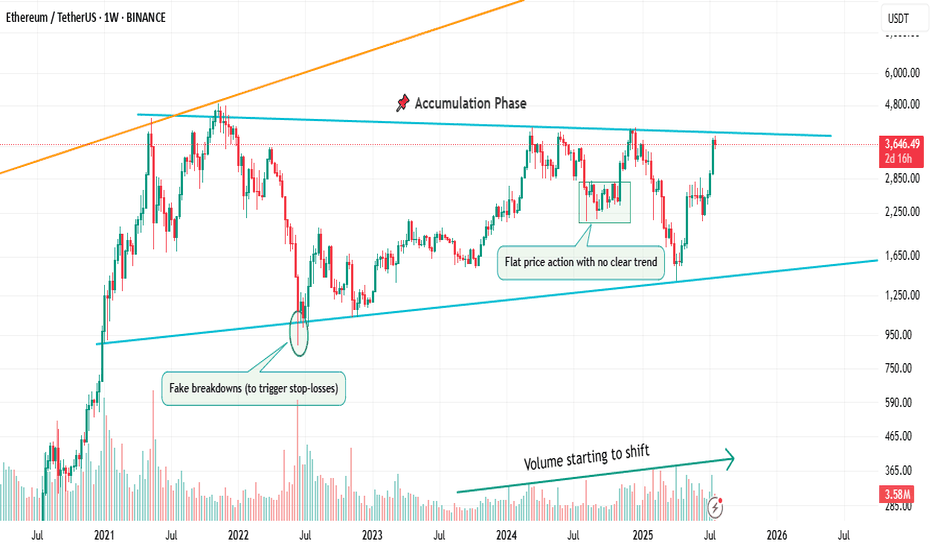

Flat, Quiet… and Full of Clues .Most traders only see the middle.

The acceleration. The “trend”. The movement.

But that’s just one-third of the story.

If you really want to understand the market’s rhythm,

you need to study how moves begin, evolve, and die.

Let’s break down the 3 key phases every market goes through —

again, and again, and again.

📌 1. Accumulation Phase

This is the part no one talks about.

Why? Because it’s boring. Choppy. Range-bound. Confusing.

Most traders get shaken out here.

But smart money? They’re quietly buying.

You’ll often see:

Flat price action with no clear trend

Fake breakdowns (to trigger stop-losses)

Volume starting to shift

Long wicks — both directions

This phase is a test of patience, not prediction.

And if you learn to read it well, you’ll start catching moves before they go parabolic.

🚀 2. Markup / Acceleration Phase

Here’s where everyone wakes up.

Momentum kicks in.

News gets bullish.

Breakouts start working.

Pullbacks are shallow.

And suddenly, everyone’s calling it a bull market.

But don’t be fooled.

This is not where smart money enters — this is where they ride the wave they already created.

Learn to:

Ride trends, not chase them

Add on pullbacks

Avoid FOMO entries

This is the fastest and most emotional part of the cycle — which means it rewards discipline, not excitement.

🧯 3. Distribution Phase

The party’s still on… but the hosts are quietly leaving.

Price starts to stall.

Breakouts stop working.

Volume gets heavy at the top.

And the same excitement that brought everyone in?

It’s now being used to sell into.

Distribution is sneaky.

It’s not an obvious top.

It’s a process — just like accumulation.

You’ll often see:

Lower highs forming quietly

False breakouts to trap buyers

Increasing volatility

Bullish news… with no follow-through

If you’re not paying attention, you’ll keep buying strength —

right before the rug gets pulled.

So what’s the lesson here?

Markets don’t just “go up or down.”

They prepare, move, then exhaust.

And if you learn to spot these transitions —

you’ll stop reacting late

and start positioning early.

That’s the real edge.

currently we are on the accumulation phase so in this idea I tried to show you the real story behind it and as well talk about the two others to beware of them also in the right moment I will talk about them , but for now let's focous on the current phase because we want to be part of the smart money and enjoy the next phase which is 🚀Markup / Acceleration Phase .

—

🧠 Save this post.

🔁 Revisit it when you’re confused.

📊 Because the chart isn’t random — it’s just cycling

And also remember our golden rule :

🐺 Discipline is rarely enjoyable , but almost always profitable. 🐺

🐺 KIU_COIN 🐺

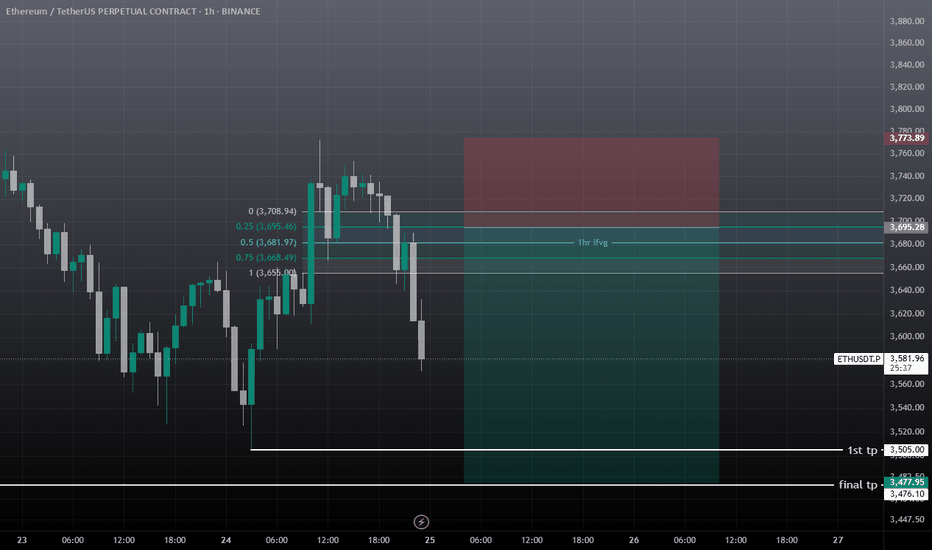

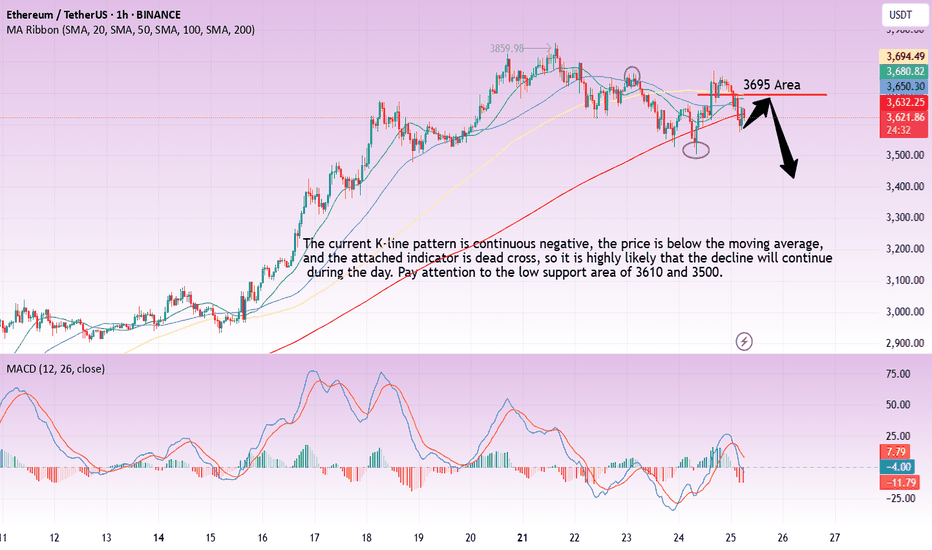

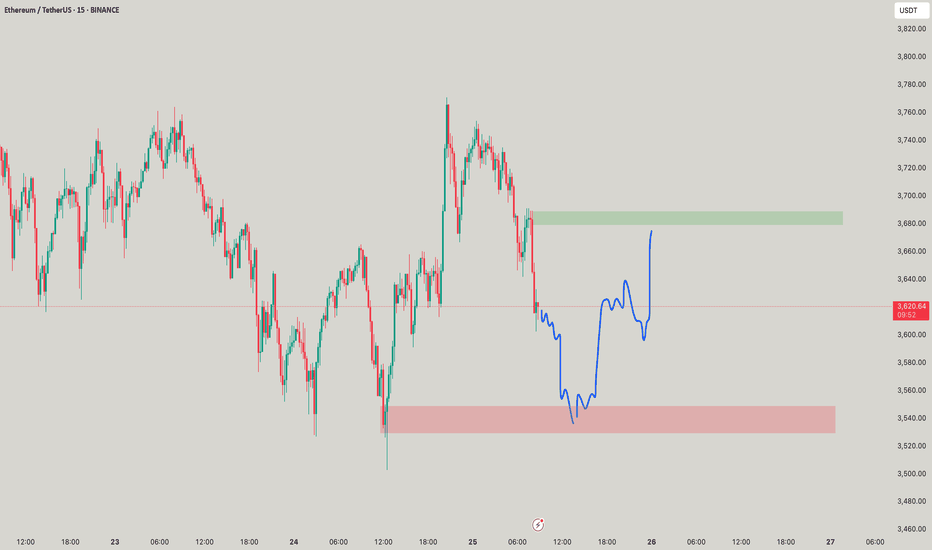

ETH-----Sell around 3690, target 3615 areaTechnical analysis of ETH contract on July 25:

Today, the large-cycle daily level closed with a small positive line yesterday, the K-line pattern was single negative and single positive, the price was at a high level, and the attached indicator was golden cross and running with shrinking volume. From the big trend, the current trend is in a weak trend, the price rebound is not strong and has not continued, the trend is prone to fall under pressure and test the low point downward, so the trend has changed; the short-cycle hourly chart yesterday hit a high in the US market and fell under pressure in the Asian morning. The current K-line pattern is continuous negative, the price is at a low level, and the attached indicator is dead cross running. It is highly likely that the decline will continue during the day. Yesterday's low point of 3500 is the position that needs to be paid attention to today. The current hourly chart resistance is near the 3695 area.

Today's ETH short-term contract trading strategy:

Sell in the 3690 area after the rebound, stop loss in the 3720 area, and target the 3615 area;

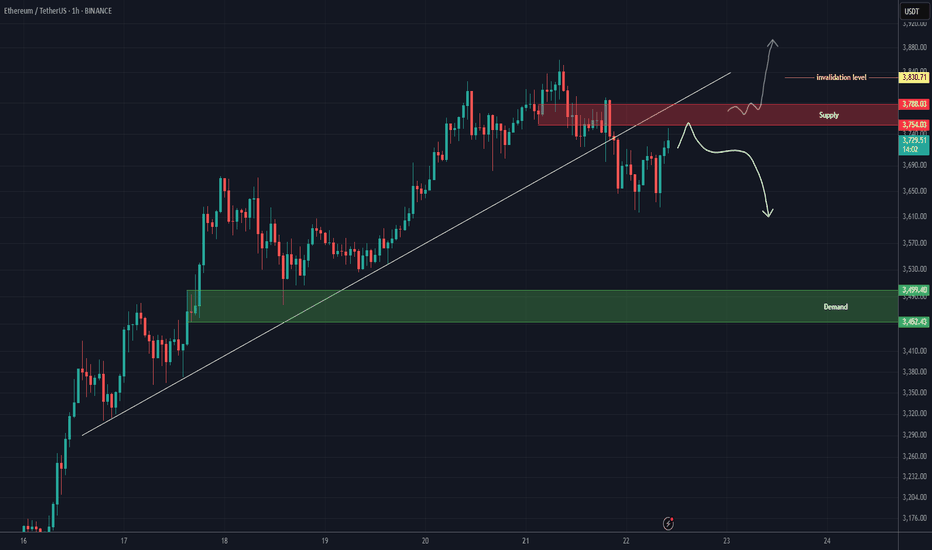

ETH analysis (1H)A trendline has been broken, and a resistance zone has formed on the chart. As long as Ethereum fails to hold above the red zone, the price may experience a drop.

The green box can be considered the target.

If the price stabilizes above the red zone and a daily candle closes above the invalidation level, this analysis will be invalidated.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

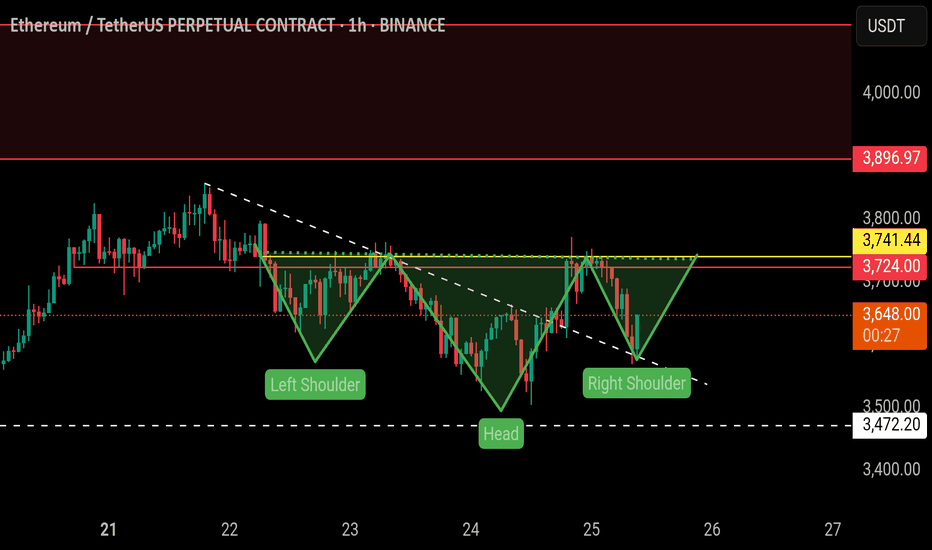

$ETH | Ready to fly (Inverted head and shoulders)BINANCE:ETHUSDT.P

On 1H TF, the price is forming inverted head and shoulders pattern, which is a strong bullish pattern.

The price has retested the trendline support and bounced back.

Expecting it to breakout above yellow line soon.

A breakout above the yellow line will be a bullish and pattern confirmation.

We can initiate a long entry from here.

Please do proper risk management and must use stop loss.

NFA, DYOR

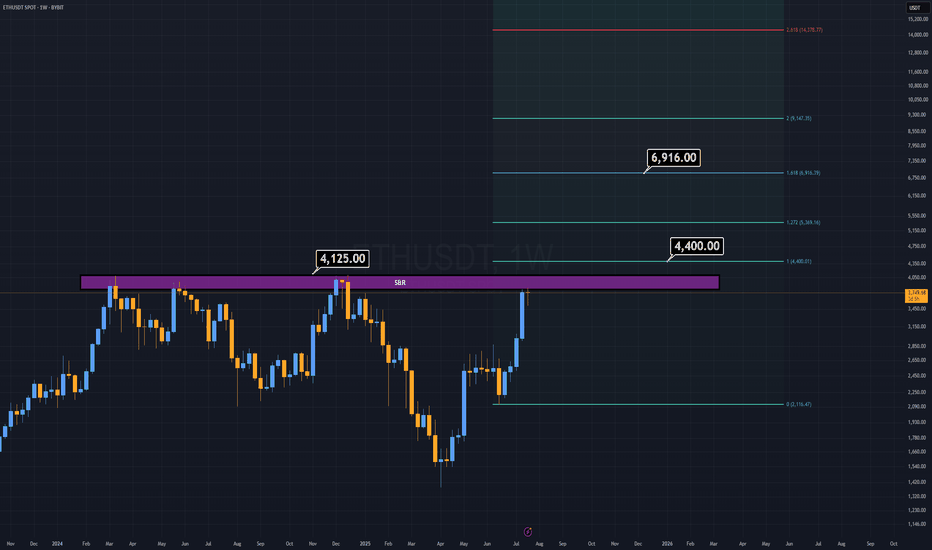

ETH Analysis (1W)Here I am, presenting the asset I personally dislike the most — ETH.

But the chart doesn’t care about feelings. ETH looks ultra bullish, but only if it breaks above the $4,125 level.

Why this level?

The $3,800–$4,100 range has historically acted as a major distribution zone — a place where market participants have consistently taken profit for years.

If this resistance is finally broken, we could see ETH rally toward $6,900 as a minimum target.

This level is based on the breakout projection of the long-standing macro structure.

Honestly, the target looks even better than the asset itself :)

Good Luck.

Ethereum vs SolanaIn 2025, the competition between Ethereum and Solana is no longer just a rivalry — it’s a pivotal chapter in blockchain evolution.

We are witnessing a clash of two philosophies:

Ethereum — maturity, security, and deep ecosystem

vs.

Solana — speed, efficiency, and adaptability.

📈 Price Resilience vs. Market Legacy

While Ethereum still holds the crown in market cap and institutional trust, Solana is rewriting the rules with superior transaction speed and cost-effectiveness.

The question is no longer "Who is better?"

It’s "Who is evolving faster?"

⚡ Key Drivers Shaping the Ethereum-Solana Rivalry

1️⃣ Scalability vs. Stability

Solana leads with up to 65,000 TPS, attracting high-frequency traders, NFT creators, and DeFi innovators.

Ethereum, relying on its Layer-2 solutions, tries to balance security with scalability.

2️⃣ Institutional Shifts

Funds like Galaxy Digital and Ark Invest are reallocating capital towards Solana, betting on efficiency and growth.

Ethereum, meanwhile, is waiting on ETF approvals to regain momentum.

3️⃣ Technological Innovation

Ethereum focuses on sharding and Layer-2 expansion.

Solana pushes aggressive ecosystem growth but pays the price with occasional network instability.

📊 Market Performance Snapshot — 2025

Ethereum: ▼ 56% YTD | ~$1,600

Solana: ▼ 40% YTD | ~$135

Solana’s DEX market share jumped to 39.6% in Q1, driven by meme coins and retail traders.

Ethereum’s dominance continues to erode under macro pressures and rising competition.

But don’t be fooled — Ethereum's foundation remains strong. Institutional adoption and infrastructure upgrades still offer potential for a rebound.

📉 ETH/BTC Looks Like a Meme

ETH/BTC:

SOL/BTC: Potential -50% in next 160 weeks ➡️

ETH/SOL:

⚡ Where Did the Liquidity Go?

The real question isn’t why ETH is dropping —

It’s why no one cares.

Layer 2 solutions — Arbitrum, Optimism, Base — have drained liquidity from Ethereum’s mainnet.

DeFi activity? → Migrated to L2

Users? → Choosing lower fees and speed

Ethereum L1? → A blockchain for whales and archives

No liquidity = No rally

No narrative = No attention

Funds are betting on Solana and L2, not Ethereum’s base layer.

🎯 When Could ETH Take Off?

Only if we see:

A strong “Liquidity Returns to L1” narrative (RWA could be a trigger)

Spot ETH ETFs launching with institutional accumulation

A new DeFi wave on L1 (unlikely with current gas fees)

Or simply — when the market decides to pump forgotten assets

For now, Ethereum is about patience.

Smart money is flowing into L2, Solana, and high-risk narratives.

🕒 But Time Will Tell...

Today, we debate ETH vs. SOL.

Tomorrow — the bull market ends, and we’ll be discussing entirely different narratives.

Are you SOL or ETH?

As always, stay one step ahead.

Best regards,

EXCAVO

______________________________

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.